Dear readers,

A small recap before we begin with today’s article. In my first piece on personal finance, “6 lethal impediments to financial freedom”, we discussed some of the psychological barriers to financial planning, that keep individuals from attaining their financial goals. We also looked at the elusive concept of “ideal financial plan”, and all that it should (ideally) encompass.

In the 2nd article in the same series, “Investing 101: How, When And Where?”, we touched upon the “I” of “IPL” (Investment, Protection, Legacy: for those who missed it the last time).

Today we cover the most crucial (but most overlooked) aspect of any individual’s personal finance: Protection.

Any proponent of protection solutions is often looked down upon as a “salesman”. This stigma arises from the fact that Insurance companies have historically followed the product-push model of distributing their offerings to the general public. This model has also ensured that mis-selling, both intentional and uninformed is amply present in the insurance space!

The reason I write this article today is to sensitize the readers to the importance of being adequately protected and offering a few less heard of tips to help readers make informed decisions while formulating a consolidated financial plan.

As always, let’s begin with the most fundamental question of all.

WHY should I bother insuring myself?

While working in the personal finance space, I often faced push-back from clients when trying to get them to avail of protection solutions. Below is the most frequently used line of argument, (as quoted from my previous article)

“I’m fit as a horse, and not going to die or fall critically ill anytime soon. Why should I pay an insurance premium that I will never see again, I’d rather enjoy the money NOW!”

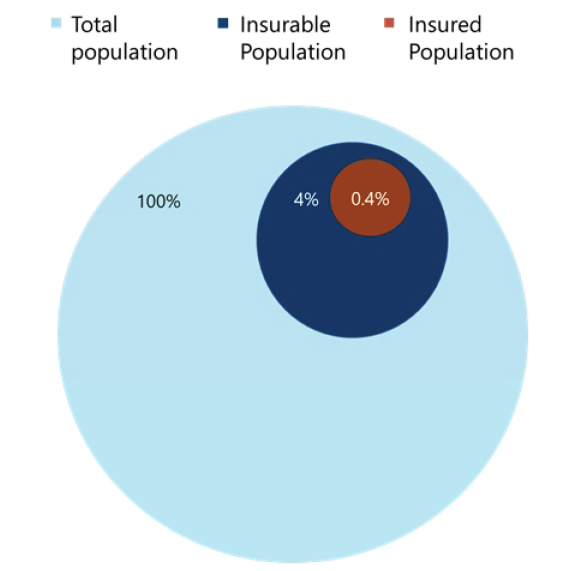

Here is a graphical representation showing how laid-back Indians are in insuring ourselves.

(Insurable population is defined as the number of I-T returns filed for income > 2.5 LPA)

A few instances where this kind of thought process could be a flying spin-kick to the face:

Walking down the street and getting run over by a truck, dying in an air-crash, being grievously injured in a car accident, the onset of a deadly disease that has no cure (ahem-covid19-ahem), going into indefinite coma and being unable to provide for dependents, unfortunate death of the bread-earner of the family who is indebted and the burden to repay that debt is now on the dependent family, dispute and litigation that can prevent the family of the deceased from gaining access to the deceased’s wealth and possessions and forcing them to alter their lifestyle…

…and the list is truly endless

Frightening these may sound, but as luck would have it, all of these are transferable risks (financially speaking)

Well, simply put, calamity doesn’t call before it visits home. It strikes its unsuspecting victims with extreme impunity and malice, often not even allowing time for the victim to respond. Hence, one must always plan for the worst, to ensure that when (if) calamity strikes, our firefighting mechanism is already in place to deal with it.

What insurance really does is transfer of risk from the individual to the insurance company. No, that does not make us immortal and immune to harm, rather what it means is that the insurance company assumes the responsibility of restoring us to the financial condition we were in before the uncertain incident (read as: calamity) took place.

In turn, the company charges a contribution from us every year. In insurance terms, this contribution is known as “premium”.

That pretty much sums up WHY we must get ourselves adequately insured. Now let’s look at the WHAT.

Protection solutions can largely be identified as:

- Life Insurance

- Health Insurance

- General Insurance

Life Insuarance

Life insurance means protecting your dependent family’s financial future in case of your untimely demise. Without getting too scientific about it, 20x our current net annual income is the amount of Sum Assured we should maintain and this cover should be valid till at least the intended age of retirement, i.e. it should cover the working life of the individual.

To put things in perspective: A 26-year-old man having a net annual salary of Rs. 20 lakhs should have life cover of at least Rs. 4 crores, valid till age 60 (typical retirement age). This would cost him just ~Rs. 32000 pa as premium, or ~1.6% of annual salary. (Premium quote from a private life insurance company)

He would pay this premium of Rs. 32000 for the next 35 years (a rough total of Rs. 1120000, not discounting for time value), but this would ensure that Rs. 4 crores would be received by his family in case of untimely death!

Health Insuarance

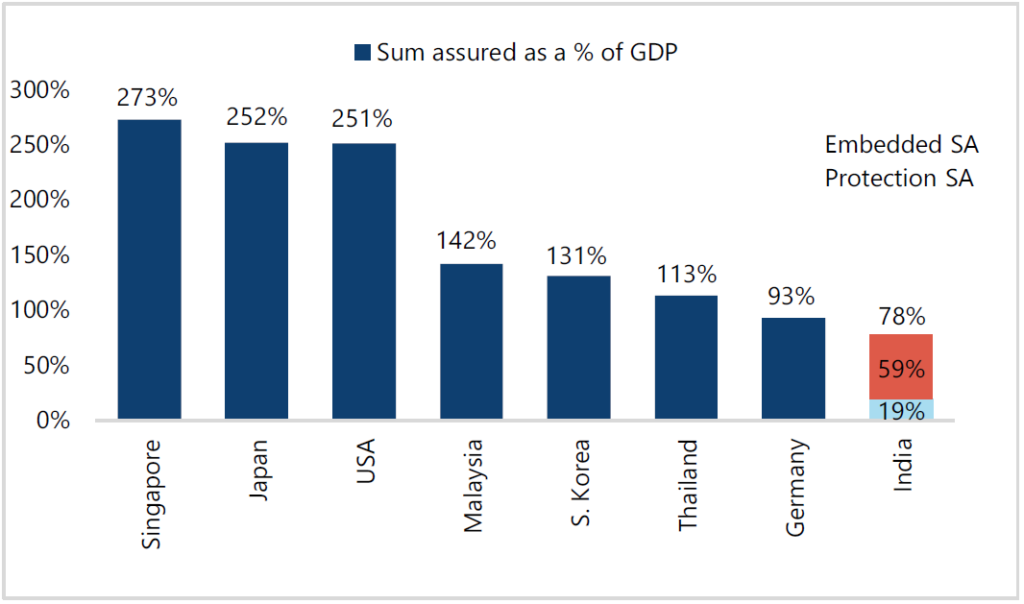

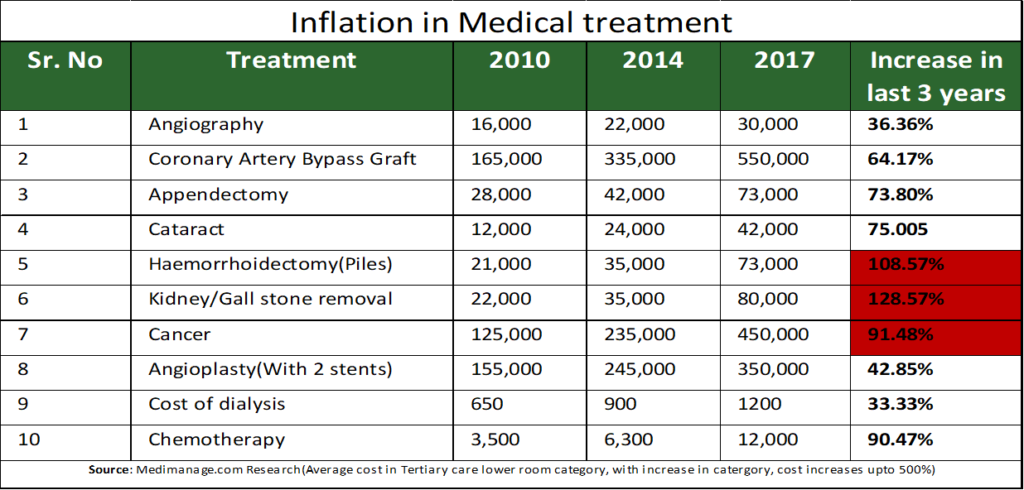

Having adequate health insurance means you don’t have to dip into your savings, liquidate investments or borrow money to pay medical bills in case of a sudden major illness. As seen in the tables below, medical costs are rising astronomically.

But, isn’t protection EXPENSIVE!?

While that may seem true, (it’s not), we are neglecting the fact that not having protection can turn out to be a lot more expensive. Here’s some common medical procedures, and their costs in India and the USA, and the inflation in these costs over the past decade. (all figures are approximations and the data is slightly old)

Let’s now look at the cost of insuring a typical family of 4:

The premium cost per year, for insuring a 30-year-old man, his wife and 2 children for Rs. 25 lakhs, is ~Rs. 32000. (Premium quote from a private health insurance company)

When we look at the premium amount relative to the enormous and rising threat of being unprotected, the premium amounts don’t seem so expensive after all. When we attach the threat of COVID to this list, the risk is even higher!

General Insuarance

General insurance encompasses insuring our house, vehicle, travel, goods in transit, factory/godown/office premise, housing society, etc. This all sounds ordinary, but a simple analysis reveals that the premium amounts are quite laughable vs the kind of protection they offer. Every individual must consider getting their physical assets insured.

If you’ve made it so far into this article, and think getting the right kind of insurance is an easy task, think again. The range of products offered by insurance companies is very vast, and convoluted with jargons and technical terms that can be easily used by miscreant sellers to mis-lead unaware buyers into making poor decisions.

Below are a few things to watch out for while planning your protection:

1. START EARLY. Unlike investing, where it is never too early or late to start, insurance is a different ball game. For both LIFE and HEALTH insurance, the earlier you begin, the lower your premium amount is. A simple illustration for a Rs. 5 cr term-plan for a 25-year-old vs a 40-year-old (up to age 60 for both) is shown below:

For perspective, a Rs. 5 cr term plan life cover up to age 60 years would cost a 25-year-old man Rs. 38000 per year as premium. The same would cost a 40-year-old man Rs. 74644!

So, insurance must be priority #1, especially for young individuals stepping into the workforce, even before investing.

2. NEVER LIE. THEY’LL FIND OUT. To quote my very knowledgeable professor Dr. Sunny Oswal, who’s words have stayed with me ever since: “Insurance companies are the best investigation agencies in the world”. Do NOT, under any circumstance, knowingly or unknowingly conceal any relevant information to your insurance company while applying for a policy. The company can and will reject the claim amount when calamity strikes, when they find out that you have lied about a certain relevant fact at the time of your application, and they are allowed to do so by LAW, given that by lying, you violate the principle of Uberrima Fides, which translates to Utmost Good Faith.

The last thing we’d want is a life insurance claim being rejected on death, and our dependent family being stranded in a tough financial condition, or a health insurance claim being rejected and we being forced into liquidating investments or borrowing money to pay the bills.

3. FEATURES: There is much I would love to share about the world of insurance with my lovely readers via this article. However, that would risk turning this article into a novel, because the subject is truly never ending. To state briefly, while choosing an insurance policy, we must not look at only the cover offered and premium charged. There have been immeasurable innovations in both life and health insurance over the years after private players entered the market. A reliable insurance company, features that match your needs and wants, and an adequate cover should be the primary area of focus.

For instance, several term plans now come with the option to pay off the premium liability in 5-15 years, while allowing the cover to run till a later date as chosen. This can be immensely useful if you wish to cover your life till, say age 80, but don’t want to be paying the premium every year till age 80, but would rather get done with the liability in 10 years of your working life. This is but one small instance. There are hundreds of other factors that one must evaluate while opting for a protection plan.

4. MARRIED WOMEN’S PROPERTY ACT OF 1882: A highly ignored but immensely powerful act that is valid till date. It acts as a ring-fence for life insurance proceeds for the married woman, in case of the unfortunate demise of the husband, who was under debt, and unable to repay it. To illustrate, a businessman who owed Rs. 10 crores to banks and other lenders passes away. At the time of passing, he had assets worth Rs. 10 crores. His wife, who is the rightful heir to these assets, will be faced with intense litigation, as the claimants (creditors) try and make good of their bad debts.

Now, consider the same situation, but with the caveat that the business man had insured his life for Rs. 5 crores, and also opted for the MWPA while applying. This Rs. 5 crores will be paid to his wife upon his demise, and no 3rd party can lay claim on the said amount, as the MWPA ring fences this amount from any litigation whatsoever! Hence, it is always advisable, even for the wealthy, to ensure their lives and ring fence the proceeds to ensure their successors are financially taken care of regardless of litigation or 3rd party claims upon their demise.

5. OLD POLICIES FROM NATIONALIZED COMPANIES: From personal experience, I can safely say that you are not realizing the entire value of the premium you pay if you hold insurance policies issued by nationalized companies. I cannot emphasize enough how crucial it is for you to assess your current plan if you are one such individual. You’ll be absolutely astounded by the value gap that you will discover, upon a simple comparative cash flow analysis.

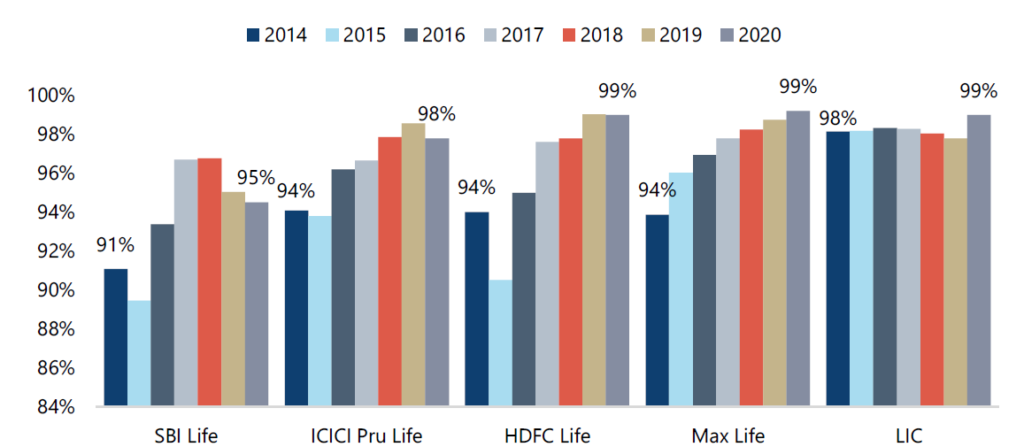

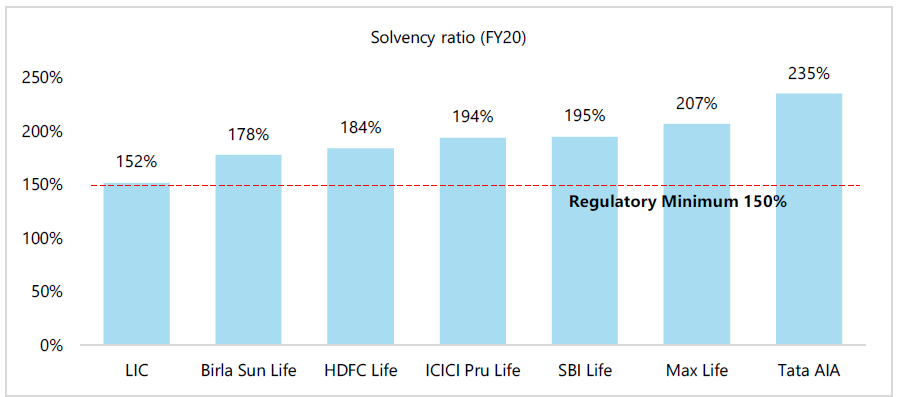

Also, “nationalized companies are safer bets for consumers” is a fallacy. Here are the facts:

Private life insurance companies have been consistently improving their claim settlement ratio:

6. DON’T TRY THIS AT HOME: As I mentioned before, this industry is fraught with dangers in the form of mis selling and misinformation on every corner. Do not get suckered into buying insurance based on the “Rs. 1 crore cover for Rs. 49 per day” ads by companies and aggregators. Consult a professional who can assess your goals and needs, and recommend an intelligently crafted solution tailored specially for you!

To conclude, I’d like to leave the readers with an analogy:

The most skilled warrior in the world, when steeping into battle, can choose not to wear his armor or carry a shield. He may even emerge victorious in battle. But one stray arrow to the heart could end his story in a jiffy. However, with the adequate protection of his shield and armor, he would be less prone to defeat!

Think of yourself as the warrior, and the battle as your path to financial freedom. The armor and shield are your financial protection solutions, while the stray arrow to the heart is untimely death or major illness.

The protection ensures that unpredictable and uncertain events do not defeat you in your battle, that is the path to financial freedom!

Do reflect upon all you have read here, and apologies for the brevity, but I would be more than glad to address any queries related to this topic on an individual basis, so please feel free to reach out.

Stay safe. Stay protected. 🙂

Follow Us @