In my previous article, “6 lethal impediments to financial freedom”, we discussed some of the psychological barriers to planning, that keep individuals from attaining their financial goals. We also looked at the elusive concept of “ideal financial plan”, and all that it should (ideally) encompass.

Broadly, I categorize personal finance in 3 niches, viz Investment, Protection and Legacy. (yes, you can call it IPL :P)

Today, we shall discuss the WHY, HOW, WHERE, and WHEN of the first niche, INVESTMENT.

Let’s start out by asking a very fundamental question: Investment entails risk.

So WHY bother?

What’s wrong with bank deposits or saving accounts? I may not earn much there, but at least I don’t bear the risk of losing any of my hard-earned money!

Well, yes and no. Investment certainly entails risk. And the more risk we take on, the higher our potential return. But we are wrong in assuming that we won’t lose money by leaving it lying around in our bank account. Enter: Inflation, the silent killer. Here’s a chart of inflation in India over the long run. Inflation, put simply, is the loss in purchasing power of your money over time. To illustrate: You have a $100 bill. Inflation is 5%. At the end of the year, you still have the same $100 bill. But do you? Were you to spend that $100 to purchase grocery for your home at the end of the year, you’d be able to purchase grocery worth $95, vs $100 earlier, as the purchasing power of your $100 bill has shrunk by 5% due to the rise in the price of the groceries!

Long-term averages of inflation in India: 40-year average =7.9%; 20-year average =6.4%; 10-year average =7.3%1

Hence, on average, in any randomly chosen year, you lose 6.4-8.0% of your purchasing power by leaving your funds idle, and that is certainly not what we would call “risk-free”.

This clearly illustrates the “WHY” of investment, and how the fear of risk can be riskier than an intelligent and calculated risk in preserving and growing your wealth!

Now let’s talk about the “HOW”

It is impossible to address investment without speaking of savings, i.e. the amount of income you manage to tuck away, after meeting all your expenses.

To invest, one must first save. These savings when invested intelligently, compound over time to generate huge wealth. So, the more we save, the wealthier we are likely to be in the long-run.

No, this does not mean we must be stingy and deny ourselves a comfortable life. Rather, it is a hint at “Frugality”, i.e. living within one’s means and curtailing avoidable expenses. Getting enamoured by the flashy lifestyle of the super-rich and famous, and even worse, trying to imitate them can often break the backbone of our financial future, as it will make us over-spend. To spend money we don’t have, we must borrow. Large credit card spend is a classic example of how we get sucked into over-spending.

We must always keep in mind that when it comes to personal finance: CASH IS KING, DEBT IS DEATH.

To cut a long story short, SAVE. And save, not just to save, but to INVEST.

After the HOW, we talk of the “WHERE”

Let’s pin the most important factor right at the start of this section: HIGH POTENTIAL REWARD COMES WITH HIGH RISK.

So, where do I invest my savings?

In a world, where there are new investment solutions popping-up every fortnight, this sure becomes a dodgy question to answer.

A few famous investment options are:

Equity – Variable return class – relatively risky; but the upside potential is infinite

Debt – Fixed return class – relatively safe (conditions apply); but limited upside

Physical Property – Hybrid returns – Risk of high opportunity cost – Very illiquid

Gold – A good hedge against almost everything, including depreciation of the home currency

And a few new-age investment options like cryptocurrency, equity derivatives, hybrid insurance-investment solutions, financial instruments linked to physical property, start-up financing and many, many others!

Let’s look at each asset class in brief:

i. Equity:

An absolutely essential portfolio component. From legendary tech investor and podcast host Naval Ravikant: “You’re not going to get rich renting out your time. You must own equity – a piece of a business – to gain your financial freedom.” 2

By “renting out your time”, Naval means employment. You cannot get rich working for someone else. You MUST own a piece of business with infinite growth potential to be financially independent!

Equity markets are very misunderstood and often equated to a casino. While it is true that it’s a risky asset class, no other asset class contains the potential that equity shares do. A few examples of massive compounders over the past ~20 years in India are Eicher, Symphony, Motherson, Bajaj Finance, HDFC Bank among scores of others. Even small amounts invested in these scrips during their initial growing days have made a lot of people very rich, assuming they could handle the drawdowns during tough times, and let their profits run!

This is a very interesting graph of Symphony ltd which shows clearly both the sides of equity investment. Upside potential is huge, but you must be willing to accept the drawdown that comes with it.

You must also have a well-planned exit strategy. Catching the top, or the bottom is nearly impossible, hence having conviction in the business you own via the share is paramount.

Also, those who do not wish to risk being exposed to equity shares directly can choose the passive investment route via Index ETFs. They can play the equity upside by hugging on to index returns! This is a lazier form of participating in equity growth.

Bro-Tip

Timing the market is not easy. Accumulating equity in a staggered manner can help you optimize your average cost of purchase while ensuring you don’t miss out on the growth story.

iI. Debt:

Debt is an asset class which offers a fixed return on investment. In essence, you are lending money to the issuer of the debt instrument, for which they reward you with interest.

Examples include bonds, G-secs, FDs, debt MFs, among others.

Bro-Tips

The assumption that debt is a zero-risk investment avenue is highly incorrect. Default risk, ie the risk of the borrower defaulting on repayment of your capital is a very serious concern. Hence chasing high-risk debt instruments for better yield is foolhardy. After all, we risk losing our entire capital (in case of default), with fixed up-side potential! Hence, high-risk should be reserved for asset classes with infinite upside potential. Better (Reward : Risk) ratio.

Also, it is crucial to understand what stage of the interest rate cycle we enter fixed-return instruments. Entering near the peak of the cycle is advisable, as the subsequent fall in rates will result in an increase in the value of your debt investment.

III. Property:

Investing in property means locking your liquid cash in an illiquid physical asset. While property investment has proved lucrative for many, one must thoroughly understand the motives of purchasing property, and the constraints that come with it. Rental yield and appreciation in the value of the asset are guiding factors in property investing.

Rental yield is not assured. No tenant, no rent.

Appreciation in value is led by a rise in demand for the property, which is in turn influenced by location, development in the area, weather, administrative rigidities and others.

The biggest challenge in property investment is liquidity. If we need the money urgently, there is no way we can get it out on time. Sale of the property is a process that can take weeks, months or even years. Hence, we must understand that the amount of our capital that is locked in property is UNSPENDABLE.

IV. Gold:

Gold 3 is an asset class that is vastly debated. I believe gold is a great store of value. It can act as an effective hedge against equity market volatility and also serve as a hedge against home currency depreciation!

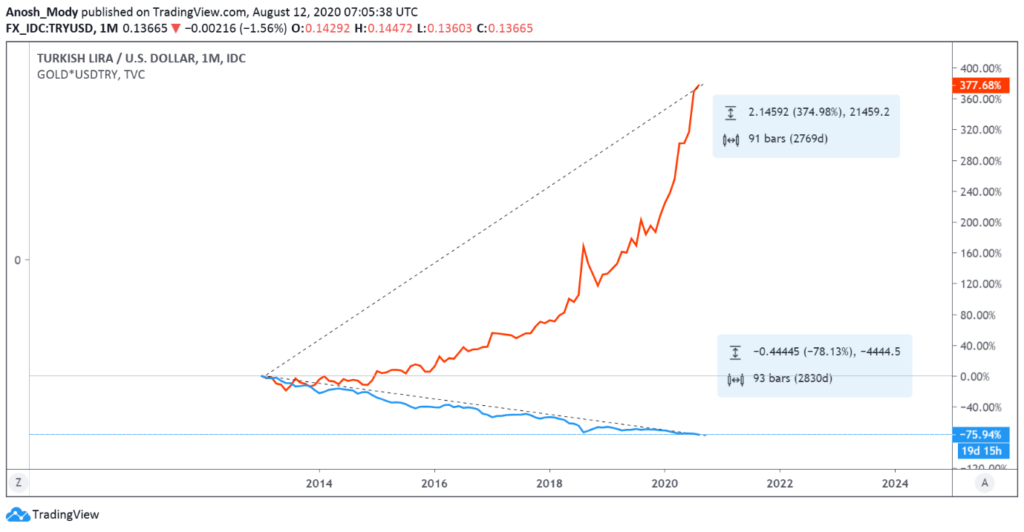

A recent example is the Turkish lira crash. Check how Gold investors were saved from the massive value destruction. The orange line is Gold in Lira, and the blue line is Lira vs USD. The chart speaks for itself.

So now that we’ve seen the whole buffet in front of us, the question is how much to eat of each dish to consume?!

This brings us to the concept of diversification and asset allocation. If we were to strip away all the jargons from this concept, it means “Don’t put all your eggs in one basket”

The first step is to identify our risk profile. Risk profile means how much risk we can afford to take on our incremental and existing investments, after considering our existing assets, liabilities, short-term and long-term goals and liquidity.

Put simply, an unmarried man with no dependent family members would have a higher risk-taking ability than a married man with 2 children and dependent parents, assuming they have similar income.

Clearly, risk profiles vary from person to person, and asset allocation is also subjective. There is no sure-shot formula for success.

We must thoroughly analyse our financial position and decide an optimal mix of the above illustrated asset classes, while also holding some liquid cash (or equivalents) as emergency funds. We must learn to accept that the only factor we can control and manage is RISK. Return is beyond our control.

Finally, let’s talk about “When”.

Am I too late to start investing? This is a question I always answer rather bluntly: NO.

There is no such thing as starting too late, or too early for that matter. Your money should ALWAYS be working for you, even when you sleep! So, start NOW, if you haven’t already.

To conclude, I would like reiterate my opinion from the previous article: it is always prudent for one see a certified professional to seek advice on investment decisions that they make. A surgeon would never operate on their own kin, because of the emotional connect they have. Similarly, one should seek external counsel regarding their financial planning to gain an unbiased, intelligently researched strategic advice that can help forge the path to financial freedom!

Follow Us @

Some Unrelated Stories!