Human beings are said to be the greatest gift arising out of the big bang. However, over the years of civilization, there are still a few equations or questions that remain unsolved and unanswered.

To name a few:

What happens after we die?

Why does time always walk in one direction? (the future) AND :

How did an old man who used to save $100 at the end of every month for almost 40 years @8 p.a. earned a total sum of $3,49,100 for his grandchildren as an inheritance?

The math behind the last example is magical, isn’t it?

Time is a dilating subject. Humans live in the present but can predict the future by assuming different possibilities.

Interest rates, therefore, is one of the greatest outcomes which did not evolve or was discovered but is present and can predict a ‘financial future’ by assuming some possibilities (of course!)

What is an Interest Rate?

There are mainly three types of Interest rates – Nominal rate, effective rate, and real interest rates.

i. Nominal interest rate: The nominal interest of an investment or loan is simply the stated rate by which interest payments are calculated. Suppose a bond has been issued at $100 with a coupon rate of 6% p.a. for 10 years. Here, a coupon rate is a nominal rate on the bond. As the amount of interest rate will be calculated by undertaking 6%.

ii. Effective interest rate: The effective rate of return is the total rate of interest realized on an investment that has been compounded throughout the year. Let’s take an example of an old man who invested $100 every month for 40 years by investing 8% p.a. to an effective rate of 0.67224% compounded monthly.

How is it possible? Question churning in your mind right? Hold unto that thought!

Well, the old man invested $100 for 12 months and that too for 40 years i.e. N=12*40=480 with a nominal rate of 8%per annum i.e. 8/12 = 0.67% per month (approx.) and never withdrew the amount. This led to an extra income of interest on interest which in finance lingo, is well known as Compound interest. The effective rate of interest can also be calculated quarterly, semi-annually or even daily.

iii. Real interest rate: This is the return that does not take into account the inflation rate in nominal return. Thus, it removes the effect of Inflation on the Nominal Interest Rate to realize the actual interest rate.

Expected Real interest rate = Nominal rate – Expected Inflation rate

If the lender assumes that the nominal rate of the bond is 7% with a 5% expected inflation rate over the year. The expected real interest rate is 2%. The real interest rate is realized after the impact of inflation on the nominal rate is known.

Factors affecting Interest rates

Interest rates are the yardsticks of money flows in an economy. There are various factors affecting interest rates offered such as the credit rating of the borrower, currency flow in the economy, bond liquidity, international trade concerns, change in monetary/fiscal policies and so on.

Estimation of the current pandemic on Interest Rates

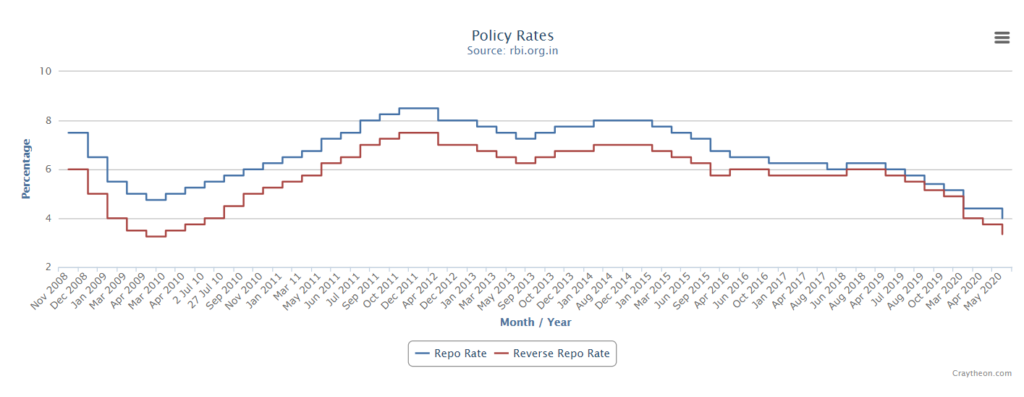

The current pandemic has led many countries devastated due to the disturbed demand-supply equilibrium of which India has too faced disruptive consequences. Reserve bank of India who controls the monetary policy of the country had reduced the repo rate further from 4.40% to 4% in this lockdown on May 22nd. The repo rates have been reduced for the last two consecutive times. But, wait, what is a repo rate?

Simply saying, it is an interest charged by RBI to the bank. In case RBI was to lend money to the banks, it would do so at the Repo Rate. Repo rates act as a benchmark rate for the banks providing and charging interest on loans to the common public/businesses.

During a liquidity crisis in the market, RBI reduces the repo rate to allow banks to make more loans at lower interest rates which indirectly leads to higher loans, credit availability in the market.

Whereas, a reverse repo rate is an inversion of the repo rate. Reverse repo rate is charged to the RBI by commercial banks for lending money to the former. RBI may charge a higher reverse repo rate to pull liquidity and control inflation in the economy. (since RBI has full authority to change the reverse repo rate)

Conclusion

Interest rates are the causal sequence of a country’s economies – diseconomies of scale, serving as a base for possible future economic events. Furthermore, it can also be used as a strong lagging economic indicator which might give us a confirmation regarding a lot of other indicators like CPI, purchasing power, potential growth, etc. in a developing economy.

Follow Us @

Subcribe to Our Mailing List!

Some Unrelated Stories!

Great Article! It helped me clear my concept on Interest rate & understand RBI policy. Keep up the good work waiting for more article from you.