We have all come across the term Stagflation in our economics textbooks, but what does it really mean? We have been studying it as a theoretical concept, but can it really occur on a large scale for a sustained period of time in the modern economy?

Before we dive into that, let us understand what stagflation really means. Stagflation can be understood as a period of slowing economic growth that is accompanied by increasing prices and a relatively high level of unemployment. Or more simply put, a period of high inflation and lower GDP growth.

Now this definition itself may seem paradoxical.

If the economic activity in a region is slowing down, accompanying unemployment is understandable, but inflation too should be slowing down. With lower demand and investments general level of prices of goods and services in an economy would trend lower. Well the idea itself may not be as far-fetched as it initially seems.

Imagine this: A country is suffering from recession, as growth is slowing. In response to this, the central bank cuts rates. This enables higher borrowing and investments. This increased investment is quickly reflected in the prices, but demand in the economy is slow to pick up. Hence in a way, the country was in a period of stagflation till demand plays catch-up. However, for this article, we are not concerned with a temporary period of stagflation. We are trying to assess if we are currently facing this phenomenon on a much larger scale.

The Indian economy has been slowing down long before the pandemic hit, since Q1 FY 20. The pandemic has only made matters worse. With negative growth expected for the year FY 21, economic recovery prospects seem grim in the near future. With this sustained period of low/negative growth prevalent, we meet the first condition of stagflation.

Coming to the next parameter – Unemployment. With unemployment being relatively steady since the start of 2019, most variations can largely be attributed to seasonal factors. The onset of the pandemic, however, has caused a huge surge in unemployment. Unemployment rates have risen from 7.2% in Jan 2020 to a whopping 23.5% in April and May 2020. While this sharp jump did taper off significantly in June, at 11%, the unemployment was still much higher than the long term average rate. As growth prospects look grim, return to long term average levels of unemployment look uncertain in the near term. Meeting our second criteria for stagflation.

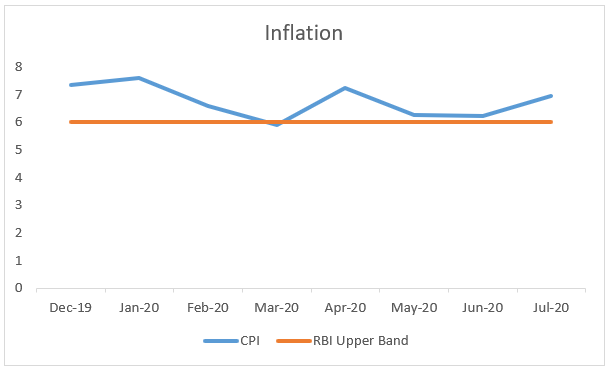

Lastly, we come to the most interesting factor – Inflation. India’s monetary authority has set a long term inflation target of 4% (to fluctuate within a +/- 2% band). While inflation has been on the rise since September 2019, it has breached RBI’s upper target band of 6% in Dec 2019 and has continued to be above 6% since then, except March 2020. Now with the pandemic striking one would expect inflation to taper off, as a substantial portion of demand was completely wiped off. However, this has not happened. In fact, inflation levels have been higher since March 2020. The reason behind the anomaly can be explained. The pandemic caused massive supply chain disruptions due to the large scale movement restrictions and lockdowns. The supply-side pressures in turn caused a large uptick in prices. Food prices were one of the largest contributors to this. While this was expected to ease with a helping hand from the monsoon, July inflation numbers came in higher than most expectations. Leaving the outlook for the future uncertain.

As Dr. Dholokia, a MPC member put it,

“This would imply that the economy is not caught up in recession with deflation but in a deep stagflation, which occurs when the adverse supply shock is more severe than the demand shock.”

Are we looking at a period of stagflation in the country or are we likely to see a quick reversal as inflation falls? The inflation trajectory over the next few months will play a key role in determining this, as growth and inflation are unlikely to reverse trends in the near future.

Until then, Stay safe.

Follow Us @

How can economies come out of Stagflation or such a situation? Are there any strategies or methodologies which the consumers/govt /regulatory authorities implement to avoid such a situation?

Hi Adithya,

To answer your second question first, since stagflation is usually caused to due cost push inflation, it is difficult to predict and therefore prevent against. These period of low growth are usually accompanied with black swan events such as the current pandemic, which are difficult to predict to avoid in advance.

Once an economy is already facing Stagflation, the most effective way to deal with it would be to use all tools available to restore the supply shocks without letting unemployment rise. This would help control prices, and leave policy space to fight low growth. However this may not always be practically possible. In such cases where inflation and unemployment pose a long term threat to the a, economy going through a period of slowing growth, the government/central bank must first control inflation by using appropriate monetary policy tools. Meanwhile reforms and other measures can be used to restore supply chain disruptions and get growth back on track. Such policy action/reforms should focus on supply side policies that boost productivity i.e. growth without giving rise to higher inflation.