Last year at this time, SoftBank was all over the news for a record-breaking amount of loss of $17 billion in a single quarter after the troubles at WeWork degraded its value by $40 billion. In fact, we wrote an article about it that you can check out here where we explored the history of SoftBank and its founder Masayoshi Son.

This year the story is quite reversed and for good. The Japanese investment giant generated $45.88 billion after-tax profits for the fiscal year 2020. To put that number in some context, Berkshire Hathaway made a profit of $44.28 billion, Microsoft made $42.5 billion, and Alphabet made $40 billion in profits in the same period.

And, just like last year, there is more to it than meets the eye here.

Deeper dive in numbers:

The partial sale of investments like Guardant Health, Uber, OSIsoft, and others yielded around $3.9 billion which forms part of ‘realized’ gains.

The major portion of the recorded gain is ‘unrealized’ or ‘notional’ meaning that the only reason for recording the gain is the increase in the value of the investments and not the actual sale of such holdings.

Such unrealized gains amounted to $39.4 billion from listed companies in the Vision Fund 1 (SVF 1) portfolio. The major portion of this gain was from the listing of a South Korean e-commerce company Coupang and an online food delivery platform DoorDash based in San Francisco.

The net unrealized gain from the unlisted portion of SVF 1 was recorded at around $11 billion. While, unrealized gains from SVF 2 portfolio were $4.5 billion.

The gain from the partial sale of T-Mobile shares was $3.8 billion while unrealized gains from the merger of Sprint and T-Mobile were recorded at $4.45 billion.

Out of a total portfolio of 81 companies in SVF 1, 11 of them including AUTO1, Coupang, and View are listed. 6 such listings were completed in this fiscal year. In the case of SVF 2, 3 out of 44 companies in the portfolio are listed, the latest one being Qualtrics.

During the fourth quarter, 7 Special Purpose Acquisition Companies (SPACs) were listed bringing the total listed SPACs to 9.

SoftBank’s IRR (from inception to March 31st, 2021) for both vision funds combined was 43%

The listing hype:

The listing of Coupang and DoorDash looked very promising on the day of the listing. SoftBank’s investment was worth more than 10X after Coupang’s IPO but, the price began to tumble soon after. Both stocks are currently trading at less than the listing price. And, with the fall in the share price, SoftBank’s profits decline.

$41 Billion monetization plan:

SoftBank announced on March 23rd, 2020 a program to monetize its assets worth around $41 billion in order to fund its shares repurchase and improving its financial position by reducing debt by bond buy-backs and improving cash reserves.

As against the initial plan of monetizing assets worth $41 billion, it was able to monetize close to $50 billion by partially selling shares of T-Mobile and Alibaba in six months from April to September 2020.

SoftBank also launched a share repurchase program to buy-back its shares of up to $18.4 billion out of which it has already repurchased a cumulative of $17.94 billion. The buy-back program generally helps to propel the price of the share upwards. SoftBank has been running this program for some time now and announced the closure of buy-back with the release of its annual results.

The tale of golden eggs:

Son regards SoftBank as the company that lays “golden eggs”. But, eggs have to hatch one day with profitable exits for him as well as the investors and shareholders. If the gains remain unrealized and the companies find it hard to increase or at least maintain the current value, it wouldn’t be a good scenario for Son.

Investors recognized this and SoftBank’s shares dropped 14% from their peak in March 2021.

In a statement released with its annual earnings, it said that “there is no guarantee that the current positive impact will be sustained in light of uncertainties associated with the pandemic.”

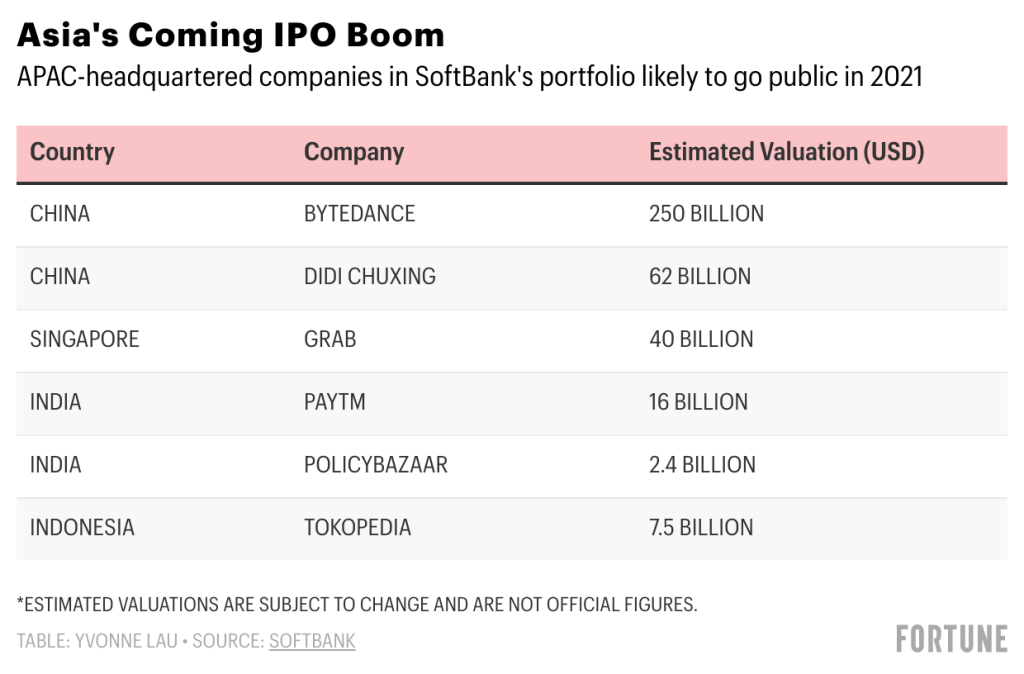

SoftBank has some of the most anticipated IPOs in its pipeline like ByteDance, Didi, Grab, Tokopedia, and India’s own Paytm and Policybazar.

Navneet Govil, CFO of Vision Fund told Reuters that SoftBank has raised an additional capital commitment in Vision Fund 2 of $20 billion bringing its total to $30 billion indicating bullishness for upcoming investment opportunities.

The closure of buy-back program, ARM-Nvidia deal not going through, along with uncertainty relating to the state and effects of the pandemic on huge bets made by Son in tech companies, have all made its shareholders of SoftBank skittish towards the future.

Will the bets go down as the biggest mistakes like WeWork in the wake of the new normal in the post-pandemic world or will it hold the test of time and be the smartest bets that could have been placed will indeed be very interesting to watch as it unfolds.

This post was written in collaboration with Asif Yahiya Sukri LLP. Asif Yahiya Sukri LLP provides unparalleled personalized financial services to a broad range of clients across different geographical locations. With a presence in the USA, India and the MENA region, they ensure that all of your financial decisions are made carefully and with your best interests in mind. They are innovators who understand what goes into building companies.

You can also reach out to them on info@aysasia.com

Follow Us @