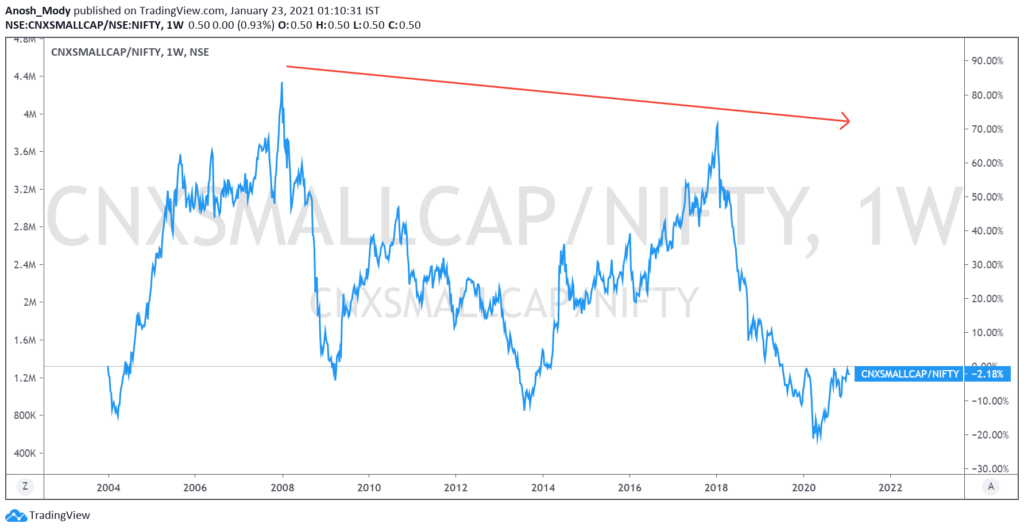

Legend has it that the smallcap universe of the stock market is just like Lord Kuber’s treasure chest; i.e., no matter when or where you dive in, you are bound to strike gold. But is that true? Well, smallcaps as a category have underperformed the Nifty50 by a wide margin over the long run. Don’t believe me? Here is a ratio chart comparing the Nifty Smallcap Index to the Nifty50.

We see how smallcaps have clearly been weak, relative to India’s flagship stock market index over a ~15-year period!

Despite this huge underperformance, the hype regarding smallcaps is very strong. “Wish I had bought Symphony Ltd in 2003 “, or “I missed Avanti Feeds at 20 bucks!” are common statements among many others that one would hear in a room full of stock market aficionados. Why? Because the shares of these companies eventually surged multi-fold, rewarding patient investors handsomely! Now, this is in absolute contrast with the smallcaps underperforming large caps conclusion that we draw from the above chart! How is it that a category that is relatively so weak, has managed to produce these multi-bagger opportunities? After all, Symphony’s share price surged from Rs. 0.2 in 2003 to over Rs. 1800 in 2018. Avanti surged from Rs. 2 in 2010 to Rs. 940 in 2017 (yes, you read that correctly). And these are but 2 names selected at random. Bajaj Finance, Alkyl Amines, Titan, and many others have seen an incredible surge in market value over long periods of time.

It is success stories like these which entice investors to buy smallcaps. Everyone wants to “catch-em-early”. Everyone is eager to find and own the “NEXT Bajaj Finance/HDFC Bank/TCS/HUL” in its early stages.

Now while this sounds just like Kuber’s treasure chest, it certainly isn’t that simple.

While considering investing in smallcaps, we must understand Why, When and What to buy!

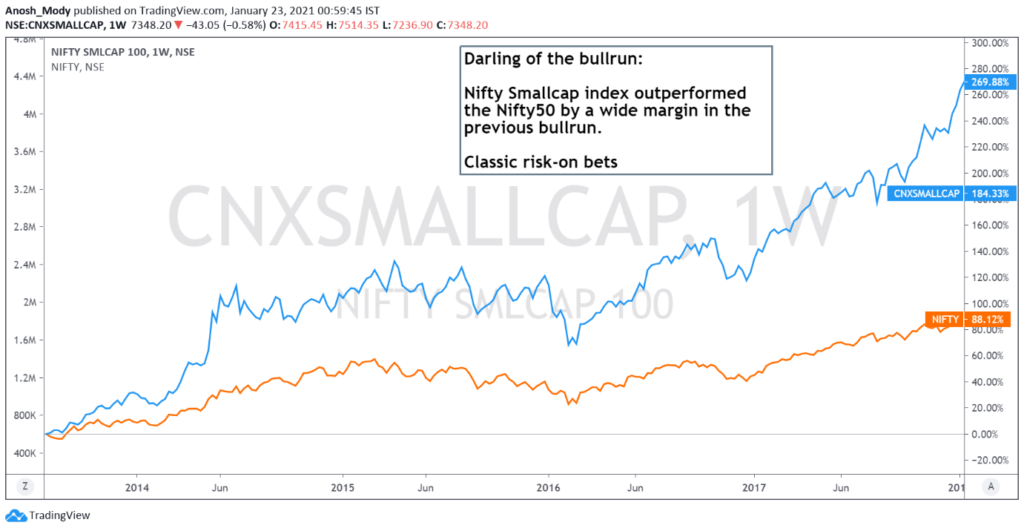

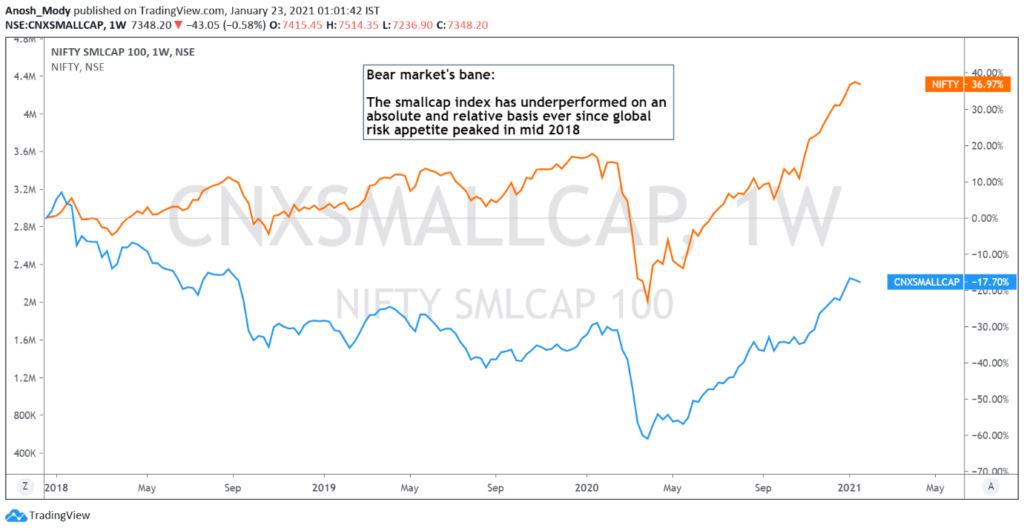

Since we have already established the WHY, let’s move to the WHEN. Unlike most large cap companies, where buying at almost any price eventually leads to profit, timing entries and exits is very crucial when it comes to smallcaps. To illustrate this, we have 2 charts:

We see how participating aggressively in smallcaps in the bull-run of 2013-2018 was wildly profitable, and led to disproportionate gains for risk loving investors. At the same time, we see how the smallcap index has still not managed to recover from the correction after its 2018 peak, which means a lot of investors are probably still stuck with stocks that they bought in euphoria, and were unable to sell, even though the Nifty50 went on to make new highs over the next 3 years.

Hence, it is important to identify what part of the market cycle we are in, while making smallcap investing decisions.

That’s the when, now let’s talk about the WHAT. Smallcap investing requires strict fundamental filters. I believe in buying growth at reasonable valuations, after carefully analysing the key growth drivers, while trying capitalise on large macro trends. Companies should be filtered out based on visibility of earnings, ability to generate free cashflow, low leverage, sustainable return ratios and last but not the least, management quality and corporate governance.

Despite all of this, there are a few issues that deal smallcap investing a bad name:

- Liquidity:

The shares of smallcap companies are often illiquid, with very shallow trading volumes. This makes them easy targets for price manipulation, and can adversely affect serious long-term investors, as the share price in the short run can be incredibly volatile.

- Need for patience:

There are quotes that one often reads in financial media, such as: “If you had invested Rs. 1 lakh in Havells in 1996, it would be worth more than Rs. xx crores today!” Well, they forget to add the assumption: “assuming you didn’t cash out at 5, 10, 15 or even 100 lakhs”. In reality, holding on to a winner long enough, and allowing it to compound over years is not easy.

- Performance:

Expecting a smallcap portfolio to perform like a largecap one by consistently beating a benchmark is a naïve habit, and more often than not, leads to investors selling their diamonds while they are still in coal form. Value unlocking takes time, and that is something every smallcap investor must come to terms with before venturing into this territory.

The path for smallcaps going forward, from a technical viewpoint:

The charts below show that the smallcap index is considerably away from its All Time High, while the relative strength chart with the Nifty50 is ready to breakout from an inverted head and shoulders pattern. This means that going froward, we are likely to see a period of serious outperformance by smallcaps, similar to what we saw in the golden period for stock markets, i.e., late 2013 to early 2018, when the smallcap index nearly tripled.

Conclusive remarks

I hope to have adequately highlighted the pros and cons of smallcap investing via this article. I would like to end with 3 famous thoughts, between which smallcap investors must strike balance to consistently generate alpha:

1) Fortune favours the bold.

2) Fools rush in where angels fear to tread.

3) Stocks are never cheap and popular at the same time.

Happy investing! 🙂

This post was written in collaboration with Asif Yahiya Sukri LLP. Asif Yahiya Sukri LLP provides unparalleled personalized financial services to a broad range of clients across different geographical locations. With a presence in the USA, India and the MENA region, they ensure that all of your financial decisions are made carefully and with your best interests in mind. They are innovators who understand what goes into building companies.

You can also reach out to them on info@aysasia.com

Disclaimer:

I, Anosh Mody shall take no responsibility for any profit or losses occurring out of investment/trading decisions you make based on the contents of this article.

I am not a SEBI registered investment advisor. This article is meant for educational purposes only, please consult your investment advisor before acting upon any information you see here.

I may or may not have open positions in the securities or asset classes discussed in this article, kindly assume that I am biased.

Anosh Mody is an MBA student from SBM, NMIMS Mumbai. However, the views reflected in this article are strictly his own, and in no way reflect upon the B-School in any manner.

Follow Us @

Thanks Anoosh. as always, a pleasure to read