All the people in the world want to look beautiful and smart. A decade ago, one would have to roam to several branded shops to get the best apparels to dress up in the most elegant way. With an exponential growth in digitization, everything is now available with a click. A company was founded with the simple motto “Your Beauty, Our Passion!”

Nykaa is one of the best examples of how digitization has given rise to an entire vertical. Falguni Nayar, former Managing Director of Kotak Mahindra Capital gave up on her post to become an entrepreneur at the age of 50. Her vision was fueled by her interest in fashion and stories of successful entrepreneurs like Ronnie Screwwala of UTV. She was inspired by Sephora, which is a personalized French retailer of beauty care products. India had a market ready to spend on guidance and products for their personal care and Nykaa did their best to convert them. Having born in a business family and studying from IIM Ahmedabad, her business acumen helped her beautify an untapped market.

A lot of consumer-facing companies such as Zomato, Flipkart, Grofers and Pepperfry are planning to go public soon. According to various sources, Nykaa is also planning an IPO at a $3 billion valuation by the end of 2021 or early 2022. The founder, Falguni Nayar was planning an IPO in 2020 but the pandemic might have disrupted the plans. It is leaning towards a domestic listing but an overseas share sale might also happen. In this article, we will see an overview of how Nykaa is doing and will it be one of the biggest IPOs of the year?

PRODUCT

In India, personal care is something everyone aspires of, but it is difficult to access everything from a single place. If someone wants to buy branded makeup accessories or skincare products, there are no platforms where it is easy to browse and buy. According to the founder Falguni Nayar, “beauty was an untapped market in India and was on the way to experiencing explosion”.

Enter in Nykaa!

Nykaa has all the brands ranging from Maybelline, Estee Lauder, MamaEarth to some of their own brands such as Nykaa Naturals and Nykaa Cosmetics. Nykaa is also exclusive to some brands such as Murad, Becca, Elf and Sigma. For selling products, it is also important to educate the people about beauty and skincare. There is a section called Nykaa TV where masterclasses of beauty experts and bloggers can be seen. Along with this, Nykaa has formed a forum called Nykaa Network where people can post questions and reviews about the products thus forming a mini-social network. This type of engagement is very good as it holds on to the consumers and develops a loyal customer base.

This is how the home page of Nykaa looks like.

With more than 50000+ products across 1000+ brands, Nykaa has grown a lot in the past few years. Initially, Nykaa focused on personal care products such as makeup and skin-care products but over the years, it has expanded to other items such as apparels (under the tag of Nykaa Fashion), handbags, footwear, jewellery and even gadgets.

Nykaa has no direct competitors as of now, but E-commerce giants such as Amazon and Walmart-owned Flipkart are increasing their inventory of personal-care products which gives them a stiff competition. With them, retail chains such as Shopper Stop or Pantaloons shifting to an online interface also gives a tough fight to Nykaa. Nykaa had the first-mover advantage and it has to up their game – from products to delivery and customer service to continue dominating the market.

For example: Expanding to other products apart from beauty has its own pros and cons. Products such as women’s and men’s apparel are dominated by E-commerce giants such as Myntra and Amazon – even for the same brands. Adding to that, Amazon and Myntra can deliver goods in 1-2 days but Nykaa takes 4-5 days on average for the delivery of a product. On the other hand, the positives include developing a wider reach and simplicity for the consumers as they can find all the things at a single place.

FINANCIALS

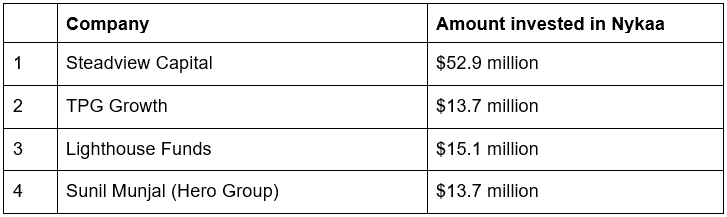

Nykaa has had 12 funding rounds and raised over $145 million. In April 2020, Nykaa gained Unicorn status (a startup which is valued over $1 billion) after receiving Series F investment from Steadview Capital. Some of the lead investors presently are:

Nykaa also attracted the attention of the Hindi-film industry. Katrina Kaif with her own beauty line – “Kay Beauty” invested an undisclosed amount in Nykaa in the year 2020. She said:

“Nykaa has opened new avenues for women to explore and celebrate their own unique idea of beauty.”

After her investment, it was Alia Bhatt who joined the bandwagon. She also invested an undisclosed amount in Nykaa in October 2020. With such influencers joining the brand, more people would definitely get to know about the brand. However, Nykaa does not only target the upper class people. One can find products between the range of ₹60 to ₹10000. It targets people across all the spectrums – from middle class people to someone such as a Bollywood star as well.

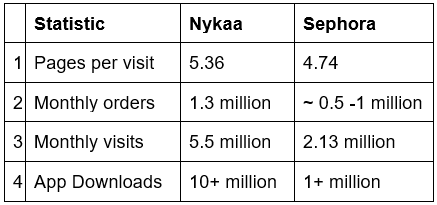

Below are some of the statistics of the Nykaa website in comparison to Sephora (a French retailer specializing in beauty and personal care products. Sephora is now acquired by Louis Vuitton.)

Note: (Pages per visit – Average number of pages visited a user visits on the website. As Nykaa expanded from cosmetics to other accessories, we can see that the pages per visit have increased more than Sephora, a French retailer which concentrates only on personal care products.)

We can see that the Indian market is enthusiastic about beauty and skincare products from the numbers of Nykaa. If we compare it to Amazon India (established in June 2013) or Myntra (established in 2008, now acquired by Flipkart) which have over 100+ million monthly visits, Nykaa is still in an infant stage. However, the parent organizations of the above two i.e Amazon.com and Flipkart) are two E-commerce giants whereas Nykaa is a standalone company. With the growth that it shows, there is a great potential in the future.

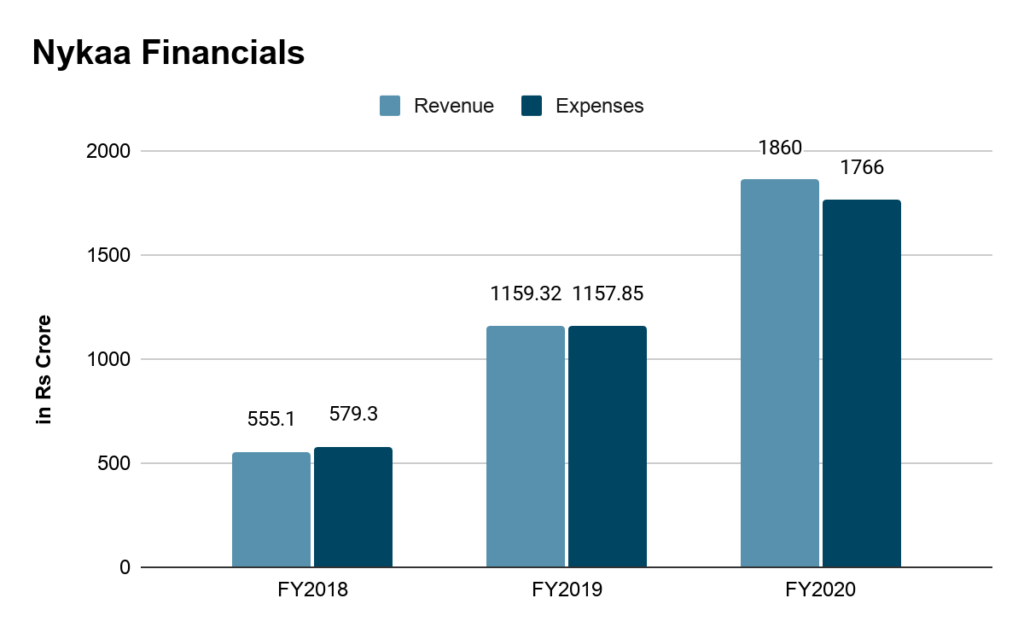

Nykaa became profitable for the first time in FY2019 with a profit of around ₹2 crore. The profit increased exponentially in FY2020 (₹94 crore). Nykaa is further estimated to grow 40% in revenues in FY2021 despite the COVID-19 pandemic. In addition to the primary E-commerce business, it also has around 68 brick-and-mortar stores consisting of its two main retail formats – Nykaa Luxe and Nykaa On Trend. Though online remains the main focus, around 10% to 15% of the revenue comes from the retail stores.

From this article, we can see that Nykaa clearly has been doing well over the years. With the COVID-19 pandemic, online shopping is gaining momentum as people do not prefer to go outside. Nykaa with its staggering growth and team have a long way to go and going public is an important step ahead. Nykaa might as well be one of the biggest IPOs of 2021!

This post was written in collaboration with Asif Yahiya Sukri LLP. Asif Yahiya Sukri LLP provides unparalleled personalized financial services to a broad range of clients across different geographical locations. With a presence in the USA, India and the MENA region, they ensure that all of your financial decisions are made carefully and with your best interests in mind. They are innovators who understand what goes into building companies.

You can also reach out to them at info@aysasia.com

Follow Us @