In the previous post we discussed about :

1. What is an MSME ?

2. What are the benefits available to it? &

3. What are the new reforms favouring the MSME’s?

Link to the previous post- Lockdown, A Big Hit Or Boon To MSME’s Survival? Part:1

Let us now walk through the actual part.

How Is This Going To Be Helpful?

Liquidity can be roughly defined as availability of easy money on hand. The release of the govt. packages will help in movement of working capital for these businesses.

Working Capital denotes the amount of funds needed for meeting day-to-day operations of a business.

Working Capital Management will help regularize periodic payments for MSME’s like:

1. Payment of salary to employees.

2. Payments to suppliers can be cleared off which will re-build the trust in these businesses.

Not only that, this will help businesses to make payments towards committed/fixed costs which needs to be paid even if no goods or services are produced or sold, for ex.:

1. Factory/warehouse/office rent,

2. Insurance,

3. Leasehold payments,

4. Interest on loan & principal re-payments.

Additionally, usage/consumption-based payments like:

1. Electricity bill,

2. Water bill,

3. Labour costs and

4. Maintenance & cleaning costs etc can also be paid off.

Consumption based costs are costs which are incurred depending on the quantity of service/product used.

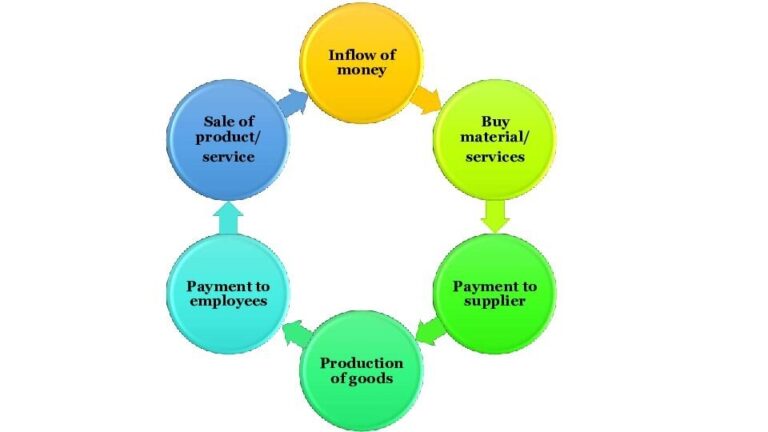

Basically, once a business takes off it will automatically start the other limbs of this cycle and will not only enable them to meet existing demands but will also create a buffer for short-term needs.

To ensure this govt. has also streamlined an important measure to ensure these small business get money flow on time, that is:

1. Payment to MSME’s needs to be done within 45 days of sale, post that interest @3 times the bank rate will be payable to them.

Bank rate – A bank rate is the interest rate at which RBI lends money to other domestic banks; current bank rate is 4.65%.

To sum up, as the money will flow in, the businesses will be able to run and the rest will flow as follows:

Also, the creation of e-platforms will help these businesses operate online.

There are start-ups like nukkadshops.com and ekasta.com which are helping Kirana stores to process online orders and platforms like Kheyti.com, are helping to create connectivity between farmers & vendors, as per an article published by Business Line.

Digitalization has proven to be a privilege in the time of such crises.

Though this lockdown has created a cavity in service sector as well, numerous technological advantages like providing remote access for services, and virtual meetings over zoom, google meets etc can be a start to a new phase of online businesses.

This cycle will never stop running and more funds will flow in demanding services and the need for delivering these will call out for workforce which will create employment opportunities.

As the govt. statistics predict that about 45 lakh units will be benefited from collateral free loans which in return will help in country’s growth, as MSME’s contribute to India’s GDP around 30% from manufacturing & service sector & provide employment to around 120 million people. Also 45% contribution of the overall exports from India is from MSME.

Around 2 lakhs Stressed MSME’s1 will be benefited by the sub-ordinated debt funds2 of 20000 cr. to be set-up by govt.

Govt’s view in pushing these MSME’s will be a ray of sunshine for those who are on daily wages to earn a livelihood. And also, a motivation to new talent to get down into this strive to live.

As a matter of fact, after the announcement of the “Aatma Nirbhar Bharat”, the govt and the country is trying to balance the loss caused to people at large by offering employment to those who lost their jobs in the Covid-19 rampant.

This sounds great but everything cannot be hunky-dory, so…

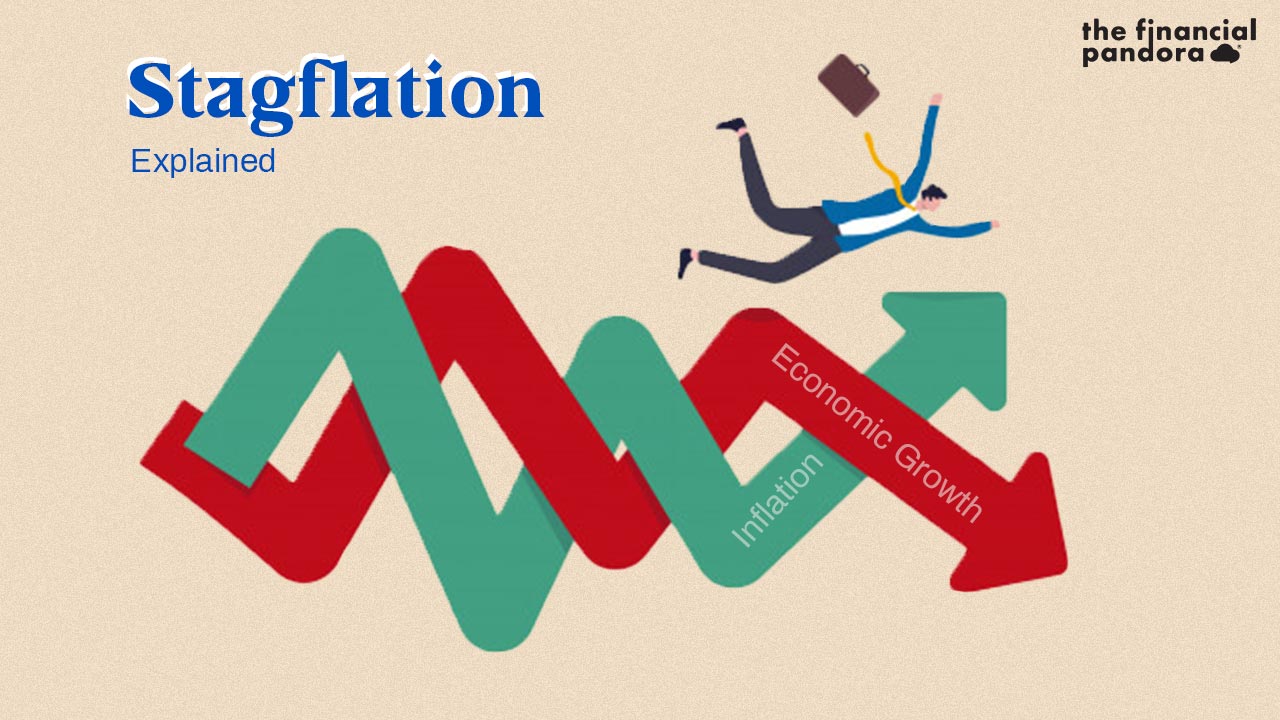

Can This Turn Upside Down?

There are two sides to every coin.

Undoubtedly, this is going to brace up our economy, but the extensive side-effects of this cannot be ignored!

Many sick industrial units may register as an MSME to claim these benefits, this might fall on those genuine units who needed that helping hand to lose this support.

Sick industrial units are companies in existence for more than 5 years having losses exceeding their total value of assets(-)liabilities.

The collateral free loans of 300000 cr. are for existing units who has already taken loan from banks and the amount payable is upto 25 crores.

Collateral free loans mean MSME’s don’t need to attach a ‘security’ with a bank to take a loan.

Time and again it has proved that the word FREE has its own trial of hidden meaning. This states that nothing ever comes free, the govt. is all hands-on deck providing collateral free loans, but someone else may have to pay for it.

Banks may happily grant these loans to MSMEs since these are fully backed by the government guarantee.

So, if an MSME fails to pay off the loans to the bank, the govt being the guarantor, will have to repay the loan amount to the bank.

This will lead to the burden of payment to fall on the govt’s shoulders.

Also, if the govt is unable to pay this loan, the bank’s portion of non-recoverable amount might increase resulting in liquidation (worst-case scenario)

This may in return hit govt. itself with a slingshot.

Personal Analysis

In order to avoid this the govt. needs to have a bird’s eye view towards the sanction & disbursements of loans.

In order to sanction a loan, a background check is already in place, to ensure it works smoothly, govt may filter out more based on few parameters for ex.

1. If any unit has recently registered as an MSME, its ability to pay off loans or

2. If it’s a sick unit it can be filtered out with similar background check via MSME tracking mechanism

This liquidity measure might turn to be a therapy for the loss caused to these MSME’s via short term vision, but if our economy does not revive, then will this be a painful journey in the long run? Let’s wait & watch!

All said & done, the idea here is to simply survive and band-aid the oozing economy.

Hopefully, this big step might be a leap to the other side by jumping over the economic trench drilled by Novel Corona Virus.

To know more, find out various info graphics related to AatmaNirbharBharat here.

Follow Us @

Subcribe to Our Mailing List!

1. Stressed MSME’s are those who are unable to pay interest & principal upto 90 days.

2. “Sub-ordinated debt funds” are high-yield, high-risk bonds where, in the event of liquidation/bankruptcy or the co. doesn’t have money to pay its creditors, these bonds will pay their investors in the end after everyone has been paid off (high risk, remember?)

Very useful information. Thanks !