In the gush of Covid-19, various reforms have been taken by the govt. One of the major reforms is upliftment of the slogan आत्म निर्भर meaning self-reliant by promoting “MAKE IN INDIA”.

This was done by opening the gates for many businesses to take shelter beneath the umbrella of MSME’s Act.

Let's Understand What Is An MSME!

The MSME’s governed by Micro, Small & Medium Enterprises Development (MSMED) Act, 2006 are small scale businesses in India which contribute to a major part of Indian economy.

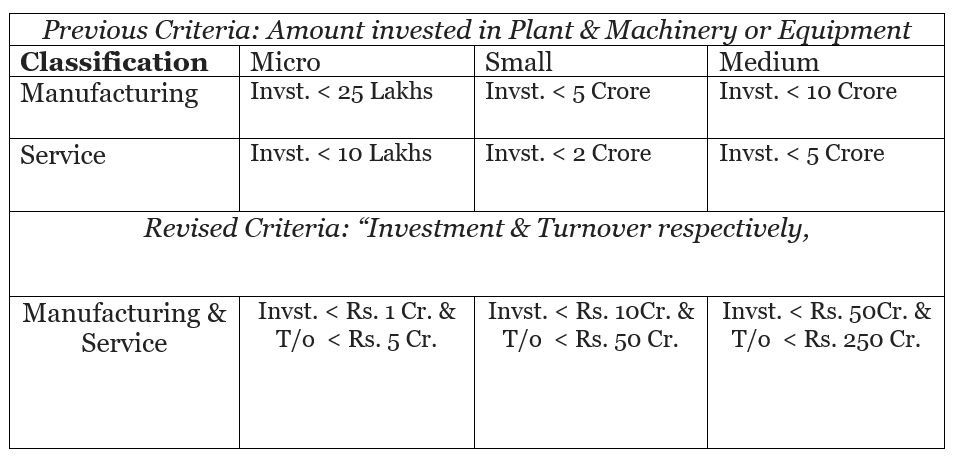

The earlier definition was quite restrictive as compared to the revised definition as tabulated below:

*Note: MSMED act is not applicable to Traders.

Revision here means that the definition of MSME firms has been changed and the amounts which specify whether a firm is a MSME or not has been increased so that more firms can come under the purview of MSMED Act.

Why The Revision?

The MSME’s enjoy a handful of existing benefits compared to similar units which aren’t registered under MSMED Act like

1. Credit facilities; better availability of loans.

2. Lower rate of interest on the loans.

3. Collateral free bank loans, meaning firms don’t need put a ‘security’ with a bank to take a loan.

4. Government grants for promotion & development

5. Tax payments at lower rates

Since Indian economy is built up on so many of these small enterprises, be it a kirana store in your locality or a HUF business or a Pvt ltd Co., it was the need of the era to extend these benefits available for MSME’s to bigger players too.

What was the need at this time?

Everything comes to a common conclusion i.e Liquidity.

Liquidity means free flow of cash for day-to-day business operations or for paying off the expenses like interest on loans etc.

The lockdown has affected many business and public in general, especially the daily wagers, labourers, workers, artisans etc. How?

If your business is not building products in factories or not able to sell products, how will you pay your employees or pay rent or pay interest or pay creditors? You need cash or in other words! ‘liquidity’.

It is predicted that this ‘economical strike’ may take businesses years to bounce back which has affected the survival of MSME’s to a massive extent as they are generally small in size and require extensive labour to conduct business.

In order to lend a helping hand, the GOI has launched various measures to support these sectors. (some of them given below)

1. A collateral-free loan upto Rs. 3,00,000 Crores with a 4-year tenure.

2. The moratorium period which was generally 3 months have been increased to 12 months for principal which effectively means that the firms can pay the principal value of their loans after the 12 months now!

A “moratorium period” is a waiting period after which you, as a borrower can start paying back the loan. (For Moratorium on Personal Loans, click here)

3. Extension of various due dates for income-tax compliance will help the business to invest more time in development than in compliance.

4. In order to meet the extensive liquidity requirements, the govt has also introduced Partial Credit Guarantee Scheme 2.0 for NBFC’s, of which first 20% of loss will be borne by the GOI encouraging the NBFC’s to fund MSME’s.

What this means that if NBFCs provide loans to MSMEs and firms are not able to pay back then first 20% of the loss (arising from the default) will be taken care of by the government.

Why? To help boost much needed credit in this sector so that the firms can invest more and provide more employment.

Okay! Now, that’s a good amount of information, how is this change bringing in betterment, to know more stay tuned…

Follow Us @

Very informative and in short….

Great ……