About the Suez Canal

The Suez Canal is located in Egypt, which connects Port Said on the Mediterranean Sea to the Indian Ocean via the Egyptian city of Suez on the Red Sea. It is an artificial sea-level waterway running north to south across the Isthmus of Suez in Egypt, to connect the Mediterranean Sea and the Red Sea.

Between 10% and 12% of all global trade flows (including 7% of the world’s oil) through the 193-kilometer-long canal. It enables more direct shipping between Europe and Asia, eliminating the need to circumnavigate Africa and cutting voyage times by days or weeks.

What happened?

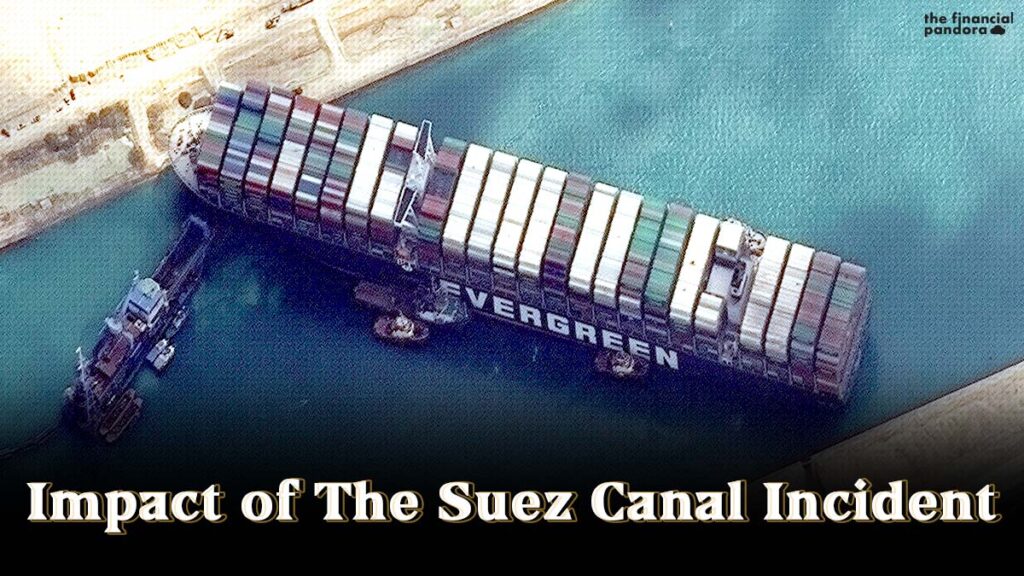

A container ship called the ‘Ever Given’ was stuck between March 23rd and 29th, 2021, blocking other vessels from transiting one of the world’s most important waterways. The ship was travelling from the Yantian district of China, to the Port of Rotterdam, Netherlands.

Due to a sandstorm, the all Indian crew on board lost the ability to steer the ship, causing the hull to deviate. The Panama-flagged, Japanese-owned ship was lodged in a single-lane stretch of the canal for six days, causing a large percentage of global trade to halt and resulting in a loss of close to $10 billion every day. At least 300 ships carrying goods across a number of industries were stuck in the gridlock.

The ship was finally dislodged on 29th March at 9 AM ET, with the collective effort of at least ten tugboats, paired with specialized dredging equipment and expert salvage teams and high tide.

Economic Impact

Ships which were scheduled to pass through the route were forced to take a detour around the Cape of Good Hope in South Africa to avoid being trapped. The route generally takes upto two additional weeks. This caused major delays in the arrival of goods, resulting in driving up costs. These ships had to cross an additional unplanned 6,000 miles and up to $400,000 in fuel costs, varying across ship sizes.

Production facilities at many units worldwide were seriously impacted due to non availability of materials, thus leading to losses in billions and idle time for manpower.

The 12 major ports in India have been undergoing a significant dip in cargo traffic every month since the start of the Covid-19 pandemic. According to Secretary-General of the Federation of Indian MSMEs (FISME), Anil Bhardwaj, since August 2020, freight charges have risen from $800 to $2500. The blockage in the Canal furthered an already critical demand-supply imbalance, leading to an escalation in existing freight rates.

Oil prices were heavily impacted, witnessing a sudden but unsurprising jump. This was because authorities had given a timeline stating weeks or even months for clearing of the ship. Fortunately it only took six days, but approximately 13 million barrels of crude were affected.

The top three exporting countries of crude oil and oil products through the route in the past month have been Russia, Saudi Arabia and Iraq. Top importing countries include India, China and South Korea. A large percentage of these oil and LNG tankers which were scheduled to pass through the route were diverted, costing billions. Needless to say, these countries were affected the most. Refining operations were immediately altered to suit the change in circumstances, which were tough to reverse.

A slightly overlooked matter was the impact on livestock. 130,000 sheep were being transported to Romania alone, resulting in growing concerns surrounding growth in fatality rate since the food on board was not enough. In response to this, Romania temporarily suspended all live exports.

Russia used this incident to promote their Arctic shipping routes as a shorter alternative to carrying goods around Africa.

What next?

There are talks in place for further Expansion of the Suez Canal so as to avoid another blockage of this level. However, that will take years to implement. In the meantime, companies which regularly route their cargo through the Suez Canal have now started going back to the drawing board to account for a recurrence. This includes increased inventories, reduction of reliance on Just-in-Time inventory, and additional financial provisions while budgeting.

This post was written in collaboration with Asif Yahiya Sukri LLP. Asif Yahiya Sukri LLP provides unparalleled personalized financial services to a broad range of clients across different geographical locations. With a presence in the USA, India and the MENA region, they ensure that all of your financial decisions are made carefully and with your best interests in mind. They are innovators who understand what goes into building companies.

You can also reach out to them on info@aysasia.com

Follow Us @