On 3rd November 2020, the U.S. held its Presidential elections. However, due to the ongoing pandemic, mail-in ballots have become the norm, potentially resulting in a delay in results.

In the past, the U.S. elections have been a major topic of discussion not only in the U.S. but across the world, owing to the fact that the country is a global superpower. In India, we have seen investors studying the potential impact of either a Republican or Democratic Government every four years in the weeks leading to the election and strategically alter their portfolios accordingly.

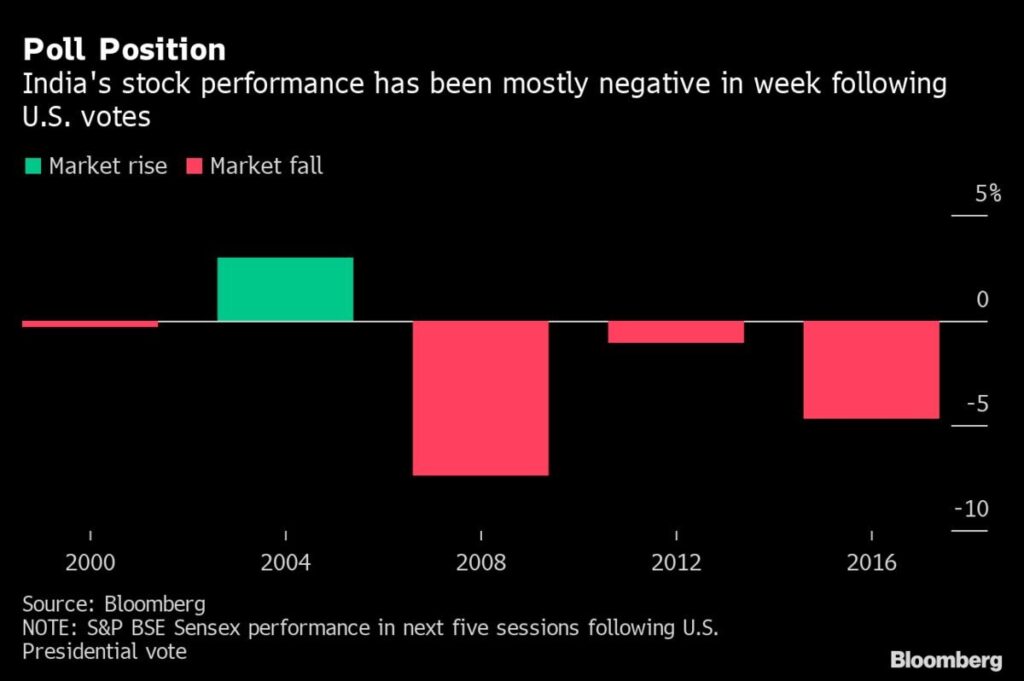

Historically, the U.S. Elections have had a varied impact on Indian markets. The uncertainty over the next U.S. President percolates to the markets through market sentiments.

This brings us to the question: historically how have U.S. elections impacted Indian markets?

An important factor to consider is that the impact of the U.S. elections on Indian markets is short term. In the long term, the structural trend in the market takes over.

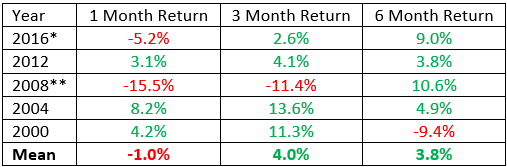

The chart below shows the movement of the Nifty 50 index after the U.S. election:

* Demonetisation, ** Global Financial Crisis

2016: Donald Trump vs Hillary Clinton

Before the results of the 2016 U.S. elections, polls put former Democratic nominee Hillary Clinton ahead of Donald Trump, which in turn boosted the confidence of investors globally. In India, stocks gained constantly in the days leading up to the election. The morning of 8th November 2016, Indian stocks rose for a second day with a high volatility. The BSE Sensex rose by 0.5% to a one-week high, while the Indian VIX rose to 1.6%, the highest figure recorded since 4th November 2012. Overall during the year, the Sensex was trading at 16.4 times projected 12-monthly earnings.

However, on the evening of 8th November, Prime Minister Narendra Modi announced the demonetisation of all ₹500 and ₹1,000 banknotes as well as the issuance of new ₹500 and ₹2,000 banknotes as a replacement for the same. The aftermath of the announcement was massive and lasted for a long time. This made it difficult to isolate the impact of the Republican victory on the Indian markets.

2012: Barack Obama vs Mitt Romney

In 2012, the Indian Rupee saw a steep decline after the central bank cut its growth forecast. In a study by Bloomberg where 25 emerging market currencies were tracked, India was the third-worst performer in the days leading up to the U.S. elections. This impacted the BSE Sensex 30, where more than half the stocks were declining. The day before the election, the INR lost 1.5% to 54.6075 per dollar, the most since 8th October 2012, consequently increasing the import bill as well as fuelling inflation.

When President Barack Obama was elected for a second term, the S&P 500 fell by 3.78% in the week after the election. In India, while the Sensex fell 1% in the week after the election, it recorded a gain of 3.5% in December, which was aided by foreign investor buying. However, the dollar rallied 0.5% in the same week, due to the fact that the USD is considered a safe haven. On the other hand, the Indian Rupee declined 0.55%.

2008: Barack Obama vs John McCain

2008 was the only recent election wherein Foreign Institutional Investment in the Indian Equity market was negative. This was caused by the 2008 Global Financial Crisis. This indicated that foreign investment is not impacted by U.S. elections. During the week after the election, the S&P 500 fell 10.6%, while the BSE Sensex saw a decline of 7%. The U.S. Dollar rallied 2.8% while the Indian Rupee fell 0.84%.

How will the U.S. elections this year affect India?

The COVID-19 pandemic is a black swan event. Markets globally are not at their usual state, which has resulted in abnormal profits and losses for people. It is possibly difficult to isolate the impact of the crisis from the outcome of the election.

Most economists have stated that a Democratic sweep will be beneficial towards China, Japan and South Korea. Joe Biden is expected to steer towards China.

On the other hand – India, Vietnam, the Philippines, and Taiwan will benefit from a Republican victory. President Donald Trump has constantly held China responsible for the Coronavirus, which will in turn give India a chance to emerge as a potential superpower.

A major concern of President Trump’s administration with India is the trade deficit, which stood at $28.8 bn last year. The figure rose by nearly three times since 2008, after former President Barack Obama was elected. The U.S. imposed tariffs on steel and aluminium imports to deal with the gap. In retaliation, duties for nearly 20 American products were raised by India.

Although the Trump administration has a friendly relationship with the Indian ruling party, the BJP as well as the Prime Minister Narendra Modi, such policies introduced by the former have made the economic environment unsettled. This is expected to change if the Democratic party wins this election, making Joe Biden President. Analysts state that while the mini trade deal which was expected late last year was abandoned, a second term for Trump shows little to no potential for the same. On the other hand, a Democratic victory could bring about a more nuanced policymaking process.

One of the biggest potential changes is the Iran nuclear deal, which was signed by President Obama but reversed after President Trump took office. Bringing back this policy could be a win for India, which would regain a vital export market, a source for cheaper oil and possibly a stake in a key port.

Another aspect of the Indian economy which could benefit from a Democratic win is Indian drug companies. Joe Biden has vowed to expand Obamacare which provides affordable healthcare in the U.S. “A new comprehensive health plan could be an opportunity for India’s generic drug manufacturers to further grow business in the U.S.,” states B Gopkumar, CEO of Axis Securities Ltd.

As the world has been affected by the Coronavirus, the U.S. is looking to detach itself from China. For the Republican party, India seems like an attractive ally. In February 2020 when Donald Trump visited India, he stated that the U.S. and India are “powerful defenders of peace and liberty”. Prime Minister Narendra Modi has presented India as an ideal destination for foreign investment as well as for foreign companies to set up business. However, it seems that most companies might not halt their operations in China in the near future. The ones that do may prefer – Vietnam or Laos to India, according to Anupam Manur, a research fellow at the Takshashila Institution. However, the present labour and land law reforms may make it easier for foreign businesses to bring their ventures to India.

Regardless of the U.S. election winner, analysts state that progress on a trade agreement will hinge on the U.S. securing even greater access to the massive, yet fragmented, agricultural market in India.

The S&P BSE IT Index rallied 36% this year. Indian software exporters obtain a majority of their business from the U.S. Donald Trump has been very supportive of ‘Make in America’, hence posing a threat to the export of software from India. Joe Biden too is vocal about the issue. His mention of subsidising the industry against WTO regulations indicates his support for the policy.

By taking into consideration the overvaluation of the U.S. Dollar paired with RBI policies to restore liquidity and demand, it is likely that investments into India will increase. Through this, the Indian Rupee could possibly appreciate, according to Amit Pabari, managing director of CR Forex Advisors.

David Chao, Invesco’s strategist states “I think that the U.S. presidential elections will have a positive impact on the Asia Pacific market inflows. I expect emerging market Asia equities to strengthen from current levels into the year-end as the election overhang is removed and investors refocus on fundamentals, such as an improving economy and likely Covid-19 vaccine in 2021.”

Either way, it is expected that the Federal Reserve will continue their low interest rate policy, especially in the short-term. This is a win for India as according to UBS Global Research’s report, Indonesia and India have the largest yield spread over U.S. treasuries today. The impact of these rates is visible through the increase in Foreign Institutional Investors. These FIIs have pumped $1.6bn into Indian Equities in August 2020 alone, the highest amount in ten years.

Follow Us @