Introduction

We, human beings, get distracted expeditiously, especially in the era of the internet and social media. We tend to miss the bigger picture, something we missed amid the novel Coronavirus Crisis. By solely focusing on Coronavirus, we missed looking at an equally grave problem — the Global Debt Crisis. COVID-19 can not be exclusively blamed for what may turn into an incessant market hiatus. The financial markets were already in deep turmoil long before the virus. Stocks were pumped up on boundless monetary and fiscal policy easing measures since 2008. (2)

Tackling the current situation has become more of an art than science. The overdue consequential complexities in the financial sector since the 2008 crisis are resurfacing. Also, the huge contractions in energy, aviation, retail trade industries, and others, pose significant threats to the global economy.

This essay argues how the global economy was already heading for a decline, despite the onset of COVID-19, which added to the impending crisis, being the scapegoat for reckless capitalism.

Global Debt Crisis

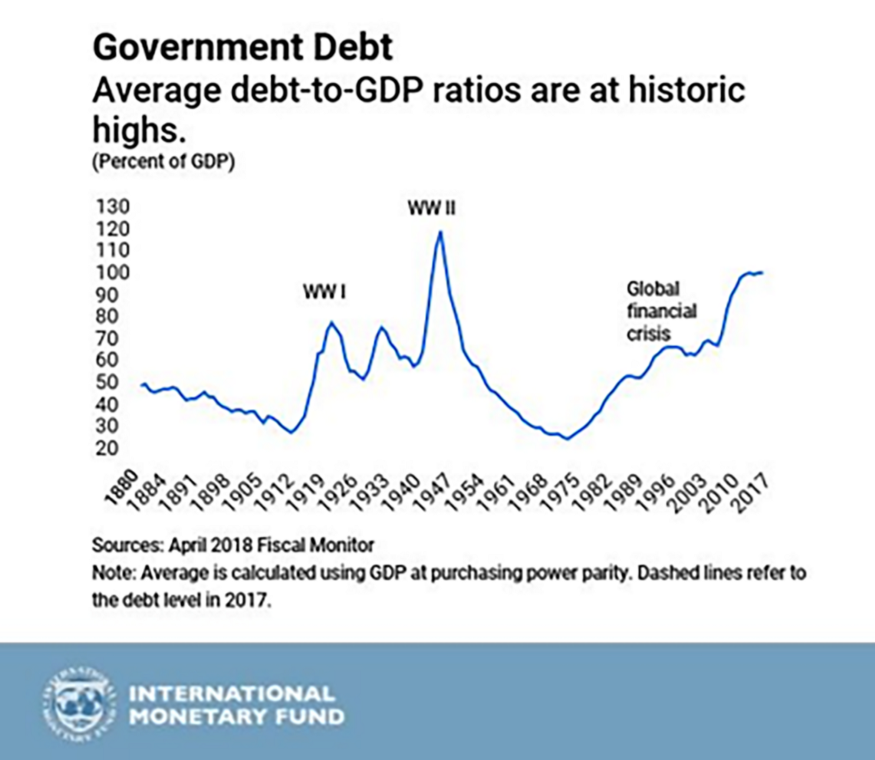

Now that the U.S. and the global economy are in an unparalleled downward spiral, the U.S. budget may quadruple to $4 trillion. (8) Projections from the Committee for a Responsible Federal Budget (CRFB) estimates that by 2023, U.S. public debt will exceed the record set in the post-World War II years. (7)

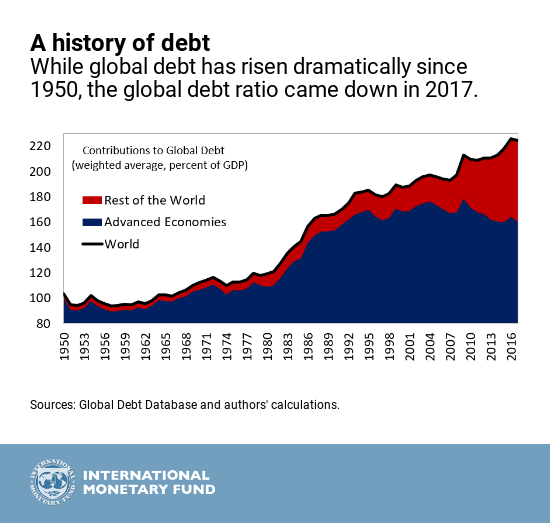

As people are quarantined to contain the novel coronavirus, the economy enfeebles further. Not only has the situation worsened, but realistically — the approaching recession would begin with $87 trillion more in global debt than at the onset of the 2008 financial crisis.

Using a simple top-down estimation, if net government borrowing doubles from 2019 levels — and there is a 3% contraction in global economic activity (nominal terms) — the world’s debt pile would surge from 322% of GDP to over 342% this year.

Global debt across all sectors rose by over $10 trillion in 2019, topping $255 trillion. At over 322% of GDP, global debt is now 40 percentage points ($87 trillion) higher than at the onset of the 2008 financial crisis. A sobering realization as governments worldwide gear up to fight the pandemic. (10, 11)

“The cumulative loss in global GDP this year and next could be about $9 trillion — bigger than the economies of Japan and Germany combined,” said IMF’s Chief Economist Gita Gopinath. (12)

So, why is debt bad? A majority of debt includes interest. Interest on debt must be paid, or else credit ratings decline. In terms of countries, governments must pay off the debt via their income (taxes). The Government must also spend on various other things such as; welfare, defense, public goods, infrastructure developments, and on its bureaucracy. When debt increases, interest payments grow larger. Larger interest payments reduce the government expenditure. The Government’s public spending is an economic stimulus. Due to the reduced public expenditure, the economy might lose its ability to grow. This might result in stagflation.

Over the past few decades, after every subsequent recession, economic growth rates have slowed, especially in the West. After the 2008 recession, growth rates in the US barely topped 3%. This contrasts pre-2008 global growth rates averaging 3–4%. This is much more of a dire situation in Europe, in particular the eurozone, where growth rates have decreased since 2008.

World Bank data shows a gradual decline in economic growth rates in the West. At the same time, debt levels have increased. Although other factors are involved, the opportunity costs involved with interest payments influence economic growth rates.

Thus, post-2020, debt levels have increased by unprecedented levels. We can inference that growth rates will continue to stall well into the 2020s if not well into the future with the onset of Climate Change.

FED Doing Things Differently

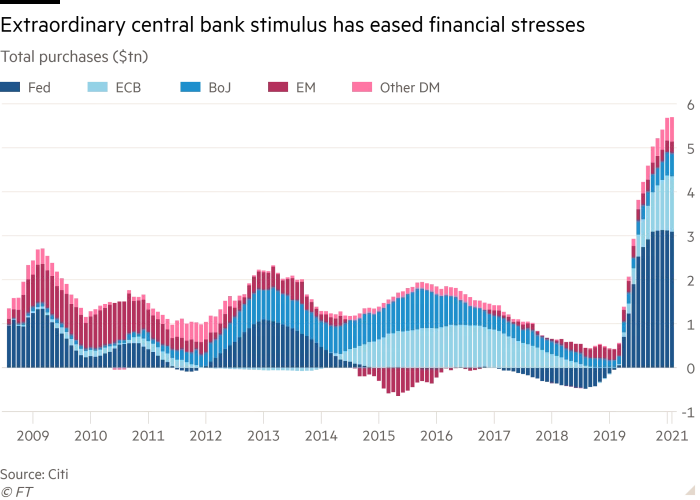

Previously, the central government as the issuers of the nation’s currency were presumed to have top-grade government obligations and gilt-edged assets on their balance sheets. There was an implicit rule against this arm of government associating itself with private companies, even as a creditor. This crunch passed after the financial crisis of 08’. The Federal Government bailed out the pre-eminent U.S. banks and other entities deemed ‘Too Big to Fail’ using an exorbitant sum of $700 billion. (1)

This Fed again overstepped by injecting trillions of dollars of bailout money in the form of grants with some strings attached (such as limits on executive compensation or stock buybacks) and loans. The ultimate purpose of these bailouts is to keep capital flowing, as the Covid-19 outbreak prompted a massive, indeterminate economic shutdown via nation-wide lockdowns.

What’s different from the Troubled Asset Relief Program (TARP) bailout of 2008 is that, unlike the banks and financial institutions whose negligence caused the mortgage collapse, the airlines’ and many other industries’ predicament wasn’t of their own making.

The U.S. government’s buying up of the private sector’s junk-bonds, which is beyond what has ever been done, even in the 2008 financial crisis, is arguably distorting asset values in the process. The vast expansion of the Fed’s activities in funding the private sector, in particular, it’s purchase of corporate debt, has led to more capital within corporations who have used this spare cash for stock buy-backs, increasing dividends for a smaller pool of investors, as well as massively inflating the price of their company stock. The Fed does this by buying up corporate bonds, which includes below-investment-grade credits (speculative class bonds), more popularly named; junk bonds.

The purchase of speculative classes, means passively investing in credits, by the Fed has caused the greatest outburst in the capital markets. The selective capital allocation of the Fed can either be looked at prudent investment or plain nepotism. In the ETF basket, the biggest debtors get the largest weight, and concurrently some of the worst credits also get lumped into the basket. Conclusively, the Fed is using public money to assist dicey debtors, such as the US shale industry.

Ultimately, this has led to deferring the loan cycles of an existing over-leveraged economy. Resulting in the ballooning of the liability sides of the balance sheet — eventually directing us back to an even more slippery Global Debt Crisis. This is because, for a balance sheet to balance, assets must be equal to liabilities. But not just the US but the global economy has been constrained by more debt, there is more debt than assets. For the debt-led system to work, you need to make money from debt. However, it seems that we are now creating more debt from debt, perpetuating the crisis.

Financial Markets

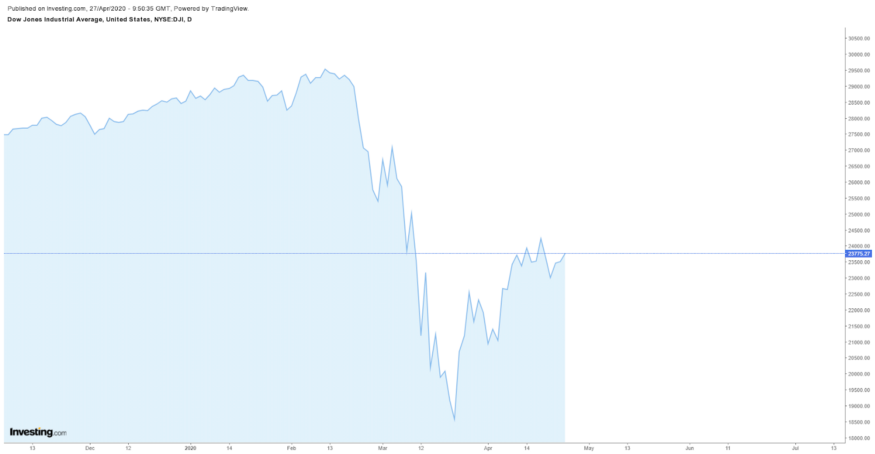

Since the Fed is interposing itself into the market, investors are grasping at straws to the true asset values. Their deception is definite after the market’s reset. Investors’ fundamental error is that they usually fixate on one dimension versus a multi-dimensional problem.

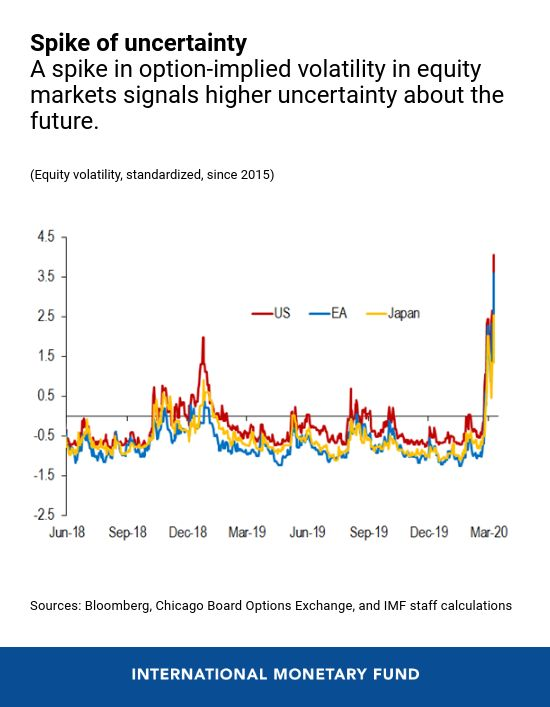

Instead of fear, investors are exhibiting signs of greed and discounted-price phenomena. High volatility subjected to prolonged uncertainty calls for increasing room of error. The markets are so deceived that we are officially in a bullish phase, despite the macroeconomic side-effects of the crisis. We are halfway-up the free-fall on the Dow Jones Industrial Average, which we witnessed in late February. It also brought the FTSE All-World Index back down to the US tax cut-fueled rally of 2017 summer. (6)

The continual fluctuations in Gold and Crude possess a very distorted image of US equities. For decades, oil has been sending decisive signals about the direction of the global economy, which has been bearish.

Some nervousness started creeping back into markets this week, caused by oil market ructions capped by an unprecedented sight of the US benchmark crude price falling below zero down to negative. Though partly a technical dislocation, it picturized the vulnerable state of the global economy. This characterized by the bullish outlook in the markets is a matter of pure hypocrisy. (9, 11)

Losing a decade’s worth of job creations within a timeframe of a few months simply symbolizes the market’s theory of Bulls climb up the stairs, whereas bears jump out of the window, but concerning job creation. Investors hence should be extremely precautionary and mindful of their investments.

Future

The Coronavirus along with the forecasted Global Debt Crisis holds an extremely elusive and volatile future. The uncertainty regarding remission and cure has not only brought psychological fear amongst the consumers but also a huge leakage in the circular flow of incomes.

The startup-spree that we witnessed in the last decade would be another potential disaster. There are as many start-ups that we could count globally, the government’s bailout scheme for small businesses and emerging start-ups will never be enough to save them all. Again, leading to nepotism and biases among crony-capital. Though a prolonged virus situation would be a huge setback, due to lack of economic activity and liquidity problems, the current handling of the crisis shows deep flaws within the system.

Earlier, we had assumed a ‘V-shaped recovery’ meant an abrupt and a quick readjustment. This no longer looks like a possibility because of the unrivaled combination of negatives with the crisis. Crucially, in a V-shaped recovery, there is a limited ‘psychological hangover’ effect when the lockdown ends. There is no lingering fear among the consumers, businesses are eager to reinvest and fearless travel internationally. Immediate exchange of goods and services after the reopening of the economy being fundamental for an agile recovery.

Even in the ‘U-shaped recovery,’ we are presuming GDP rebounding faster than The Great Recession and The Great Depression of 1929. The exogenous nature of the virus compared to the endogenous nature of The Financial Crisis of 2008, is one of the only positive aspects to look at.

Follow Us @

Some Unrelated Stories!