What if I tell you that there’s an investment product which can give you all the upside of Equity while protecting or almost no downside?

These are very rare and scarce instruments called Convertible Bonds. (Preferred Bonds and Warrants are also somewhat similar instruments as well)

Convertible Bonds are not just one more boring fixed-income instrument, they are corporate debt securities that yield interest but can be converted into a per-determined number of Equity Shares.

Conversion on the bond can only be done when the company opens the window but the decision lies in the hands of the investor.

The yield on the bond is subject to underlying stock price and the credit rating of the company. Usually, the yield is lower than that of traditional bonds as the investor gets the privilege of conversion and priority during repayment. A Zero Yield Convertible Bond can be considered as buying long term Call option without worrying about the premium decaying as the upside is unlimited if converted at a good rate.

If the stock goes down the investor has the right to be repaid the principal and interest, if they succeed and the stock goes up they can convert it into shares.

Some of the best examples of Convertible Bonds

Back in 2008, Warren Buffet made headlines on The New York Times “BUY American, I am”

His statement was quite clear that there’s blood on the street, go out and Buy. But there was a hidden message.

Goldman Sachs announced a private offering to Berkshire Hathaway whereby Berkshire Hathaway would purchase US$5 billion in special preferred shares that would pay a 10% annual dividend. Buffett stipulated that Goldman Sachs’ top executives pledge not to sell their own shares before Buffett sold his. Berkshire Hathaway would also acquire warrants to buy an additional US$5 billion of common stock at US$115 per share. The 2008 investment was made in preferred stock, so Goldman Sachs had the ability to redeem the shares, which it did in 2011. In the three years Berkshire Hathaway held the stock, it earned $3.7 billion, of which $1.27 billion was dividends. In 2013, Buffett exercised the warrants, receiving $2 billion in cash and 13.1 million shares of Goldman Sachs stock.

Let’s take some recent example

Chamath Palihapitiya, the founder of hedge fund Social Capital found the perfect way to invest in Tesla is to go long on Tesla 2022 convertible Tesla bonds. He presented his thoughts at the Sohn Conference in New York City back in 2017.

“They pay a reasonable coupon, they have a reasonable conversion price. To the average investor, this means that we can buy these converts and we are guaranteed not to lose money as long as Tesla is worth at least $15 billion. Even if the equity goes to zero, we’re protected, because as long as someone is willing to pay $15 billion … we get all our money back. At the same time, bondholders would get 95% or more of the upside if Tesla’s Elon Musk pulls “this off,” Palihapitiya said. The bond yield around 5% when Chamath proposed to hedge fund managers and the yield dropped close to zero after that. But the stock price in May 2017 was $325 which then made a lifetime high of $1,027 in June 2020.

Let’s take an example in Indian Markets

HDFC Ltd the biggest housing financing company of India and the pioneers to make the mortgage markets in more accessible in India came out with a unique way of raising money.

They came out Non-Convertible Debentures (NCD’s) of 5,000cr which were attached to warrants. The warrant gives the right to the investor to buy the shares of underlying at a fixed price (strike price). The debentures had a coupon rate as low as 1.43% per annum as compared to the market rate of 8.54%. The reason being they had the right to convert the shares in future. So, after listing the bond started to trade at a discount and warrant traded on premium.

But what if they had issued NCD’s at 8.54% and then lend the money to home loan borrowers at 9.54%, therefore, showing the spread of 1%. But by issuing these bonds at 1.43% they are effectively showing the spread of more than 8%. If these were not detachable the money received on the warrants would be written as “Equity reserves-Premium received” but now the 8% spread goes directly to the P/L account. So even if we consider 7% spread on 5,000cr issue, HDFC Ltd was able to write extra 350cr as profit in their books and all of this was legal.

Reliance Petroleum Limited

The Ambani’s have had a history of coming up with such issues to raise money. It was always easy for them as India believes in the story of Reliance Industries. Reliance Petroleum Limited (RPL), a part of the Reliance Group came up with an initial public offering (IPO) in September 1993 to partly finance its refinery project. The issue was the largest during that time in India and was made available to the public through an innovative financial instrument in the form of Triple Option Convertible Debentures (TOCDs). The TOCD was not structured as a conventional debt instrument. Each TOCD was issued for a face value of Rs.60. This included two equity shares allotted to the investors at a face value for Rs 10 each. The remaining Rs 40 comprised of a non-convertible accompanied by two detachable warrants. The TOCD holders could exercise the option to convert their instrument into equity shares in September 1997. Later the script lost its value because of the fourth option being offered on its TOCDs. It is making the non-convertible debenture (NCD) portion also convertible by receiving three equity shares for each optionally convertible debenture held. In May 1997, the TOCD holders were issued two warrants which could be converted into two equity shares at a price of Rs 20 each.

In Present Times

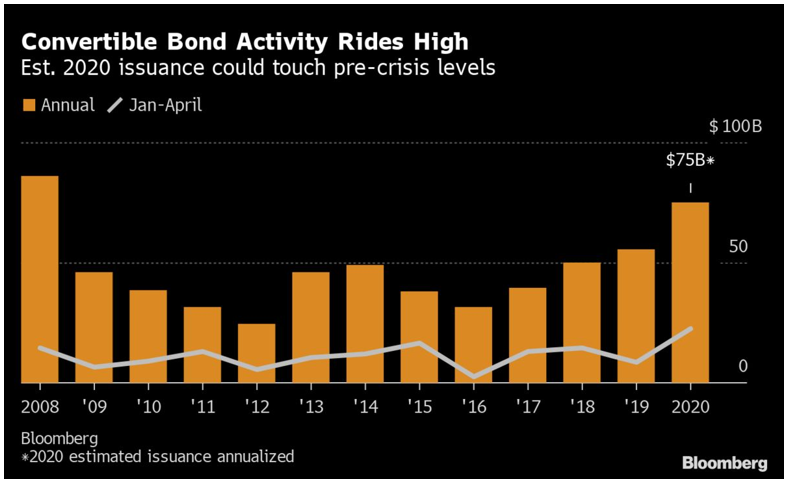

Talking about the unprecedented times we are in, it has been reported that the issuance of such instruments has seen a spike rise and reaching the levels of 2008. As businesses were shut for months and they need the fuel to run them which can only come by raising more cash. CFOs like convertibles because they’re simple and quick to get to market. Usually, an issue doesn’t require a rating from a credit rating agency; private placements can be done very easily.

Although one might think that these products give the best of both the worlds, you the upside of equity without facing risk. Each time a company issues additional shares or equity, it adds to the number of shares outstanding and dilutes existing investor ownership. There have been cases when the shares prices are inflated before the announcement of such issues so as to increase the positive sentiment in the market about the company and later haven’t really done well for the investors to get the upside. The sad part about this amazing investment avenue is that they are very rare in nature and often not accessible to retail investors. They are now are only issued by new startups with innovative ideas who want to raise capital.

Sources: Goldman Sachs, CNBC, Yahoo Finance, The New York Times, Business Standard, Bloomberg

Follow Us @