The world of Venture capital (VC) and start-ups has become too glamorous these days. From billion-dollar funds going forward raising one fund after the other and investing in start-ups right from Series A to Series F, the entire start-up world today is characterised by million-dollar valuations and high Customer Acquisitions Costs (CAC).

It is truly refreshing to see someone specifically diss this entire phenomenon and talk about the ‘future of capitalism’ with a focus on solving ‘real-world problems’.

Today we will talk about Chamath Palihapitiya (CP).

CP was born in Sri Lanka and moved to Canada when he was six with his family as refugees. He is today, a Canandian – American venture capitalist and the founder & CEO of Social Capital.

Social Capital aims to be a refreshing change in the world of VC. While the entire ‘tech-industry’ strives to put their best brains in to getting more clicks, Social Capital’s mission is to advance humanity by solving the world’s hardest problems.

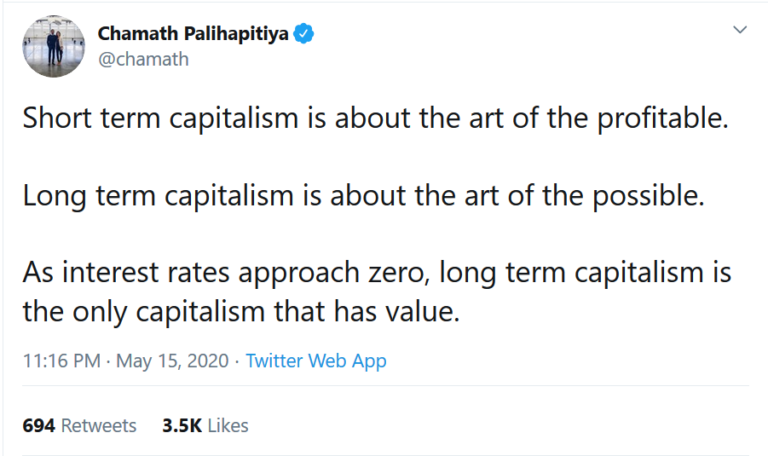

CP always has a voice which is different from what you hear from regular investors. In a tweet on 15th May, 2020 he was quoted stating:

Prior to founding Social Capital, CP was an early senior executive at Facebook in 2007 which he left at 2011. He is also a board member of the Golden State Warriors where he holds a minority stake.

Criticism of the status – quo

In 2017 CP expressed regret for having helped Facebook become the largest social media platform. He felt that the short-term dopamine driven feedback loops that have been created is destroying how society works.

He argued that social media platforms today have been used and abused in ways that their architects never imagined. It is important to see how the industry as a whole does now that ensures the impact on the society continues to be a positive one.

As early as last month, CP’s comments on allowing Airlines to fail in a conversation aired in CNBC attracted a lot of eyeballs across the world. CP argues that a lot of these companies that used money to do expensive buybacks in the past should not be handed bailouts. The companies should approach the bankruptcy code and go through the ‘rules of the game’ – protect employee pensions, get unsecured debt wiped off, so on and so forth.

The 14-page document gives tremendous insights on the history of capitalism, what according to CP today is wrong with Wall Street and what lies ahead in the future.

While the letter is detailed and quite exhaustive, we shall focus on four key areas addressed through the letter.

- Acquihiring and Greenmailing

CP argues that today, most of the STEM graduates end up working in Wall Street on quant models to generate alpha for their clients. The brightest minds today are not working on issues that affect humanity – climate change, healthcare and education.

This is primarily because big – tech and Wall Street end up paying the highest pay packages which ‘green mails’ the brightest minds in the world to work on option trading models or ad-targeting rather than working on next generation clean energy or space exploration.

- Capital Misallocation

CP makes an interesting comparison between the cost of the Apollo mission (when we sent man to Moon) in today’s dollar terms with the R&D budget of big – tech (Google, Facebook, Amazon, Microsoft and Apple).

The cost of the Apollo mission in today’s dollar terms is USD 150 Bn. The total combined R&D budget of big-tech was USD 75 Bn in 2018 terms. This essentially means that big-tech could have sent people to the moon and back using two years’ equivalent of that budget.

What big – tech has achieved by spending that money on R&D is probably too short of what could have been achieved. CP states that today, more than ever, the government, the society and the individual have to undertake a role in ensuring the misallocation of capital ends.

- Benchmarking returns with S&P and Berkshire Hathaway

At the end of the day, doing greater good for the society is noble, but does it rake in the moolah?

CP states that solving issues around climate change, healthcare and education requires patient long-term capital. As interest rates around the world now go towards 0, access to cheap capital around the world no longer is an issue.

Social Capital presently is closed and is not looking for new investors but they are ready to commit and be long term partners to businesses that solve actual problems. In a space that is characterized by frequent entries and exists to keep getting a 5x to 10x return in a short span of time, this approach is surprisingly different.

Chamath once described the fuelling of Silicon Valley start-ups with hefty valuations through multiple rounds of funding as a giant ‘Ponzi scheme’.

Social Capital, in it’s first eight years of operations (2011 – 2019), has outperformed the S&P 500 and Berkshire Hathaway (in their first eight years between 1965-1973) by 2x and 3x respectively.

- Looking Ahead

CP offers three key learnings which have been reproduced here as under –

- Be emotionally rich and available. It’s worthwhile and teaches you to have the patience to be compassionate versus harsh. Then observe what happens when you follow this advice.

- Be coherent and honest with other people. It makes life much fairer for both yourself and the person in front of you. When you practice honesty with compassion, amazing relationships will be born.

- Take the advice of others but carefully consider how it applies to you. What works for others may not work for you.

As we step in to a new era where we start the decade with a lot of uncertainty, it is refreshing to see a VC firm focused on solving hard problems that concern humanity – climate change, healthcare, education etc. Will Social Capital set the benchmark for how VC and Investing will look like in the future? We will have to wait to find out.

Liked the Profile you just read? Show us your support by clicking that like button and sharing it with your friends using #tfpprofile

Also don’t forget to leave your thoughts about the article in the comment section below.

You can become a part of our mailing list.