The year 2021 has just begun and it has already seen some of the most bizarre events happening in the stock market. A lot of these events have occurred due to the people’s sentiments and behaviour rather than the actual fundamentals or valuations. Psychological/ Emotional trading has seen an exponential rise since the pandemic. But why has such a type of trading increased during the pandemic?

The United States of America has seen a crazy change in their investment philosophy and patterns in general. Let us see a major event associated with Behavioural trading:

GameStop (GME)

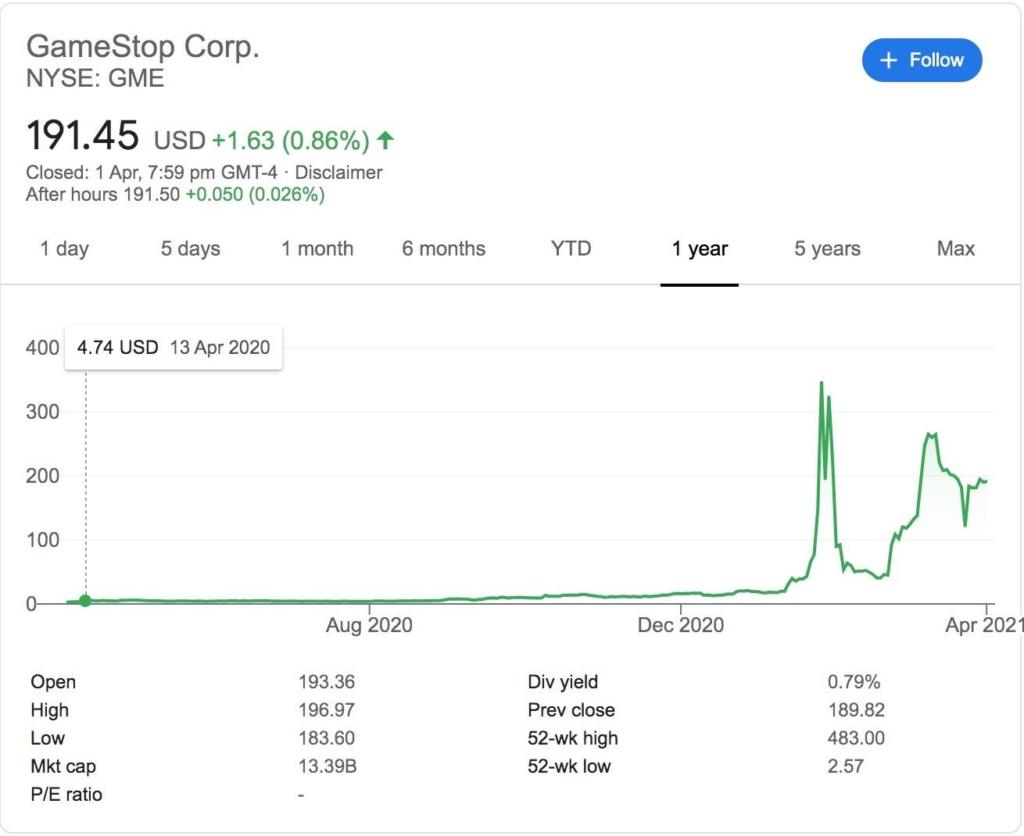

This battle can be termed as David vs Goliath where amateur traders take on professional bankers and investors. A stock which had been hovering around the range of $5 exponentially increased to around a high of $480 in less than a year. This has been an increase of 9500% which is really crazy.

To give some context, it all started when hedge funds such as Melvin Capital and Citadel announced that they had heavily shorted Gamestop because they believed that online video game downloads from sites such as Steam would triumph over video game retail shops like GameStop. A forum on Reddit called wallstreetbets (WSB) consists of around 10 million members with over 100k active on any given time. Keith Gill, known as DFV on Reddit had been making videos about GameStop on his Youtube Channel since a year. He is a firm believer of GameStop and “likes the stock”. Here is a link to his channel where he has been explaining his rationale behind investing in GameStop.

Roaring Kitty

The people on WSB along with Keith noticed the extremely high short interest (over 100% of the floating shares) in GameStop. The group started encouraging people to buy the stock so that the price soars which may lead to a short squeeze (occurs when a stock or other asset jumps sharply higher, forcing traders who had bet that its price would fall, to buy it in order to forestall even greater losses).

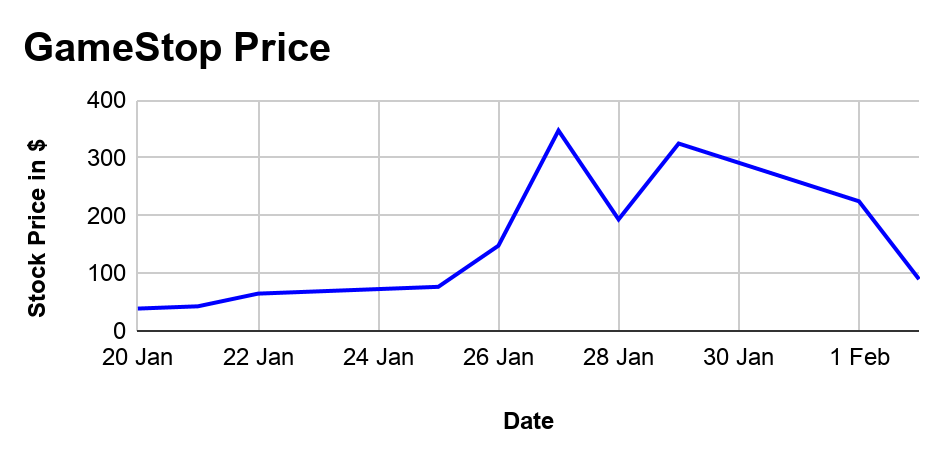

Let us look at the timeline along with GameStop price and some top posts from WSB.

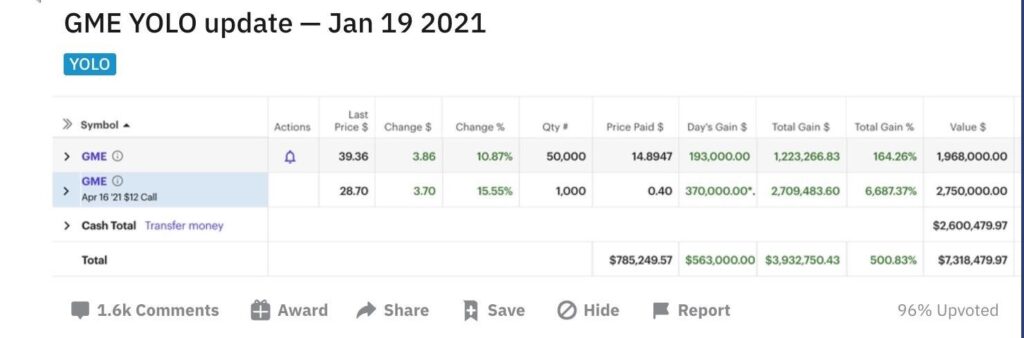

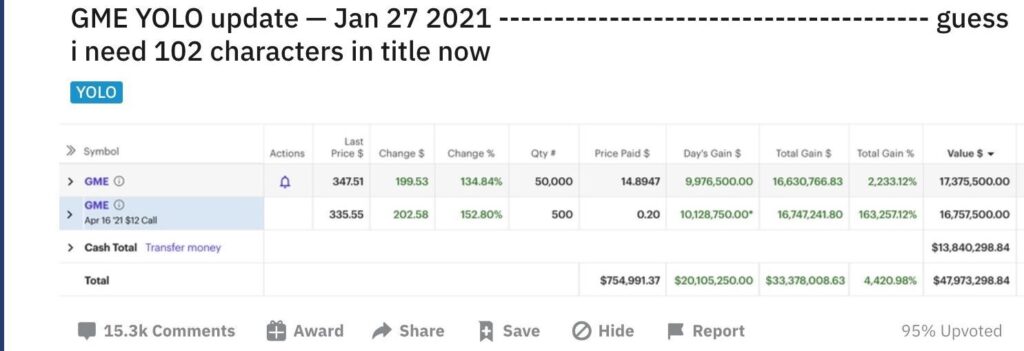

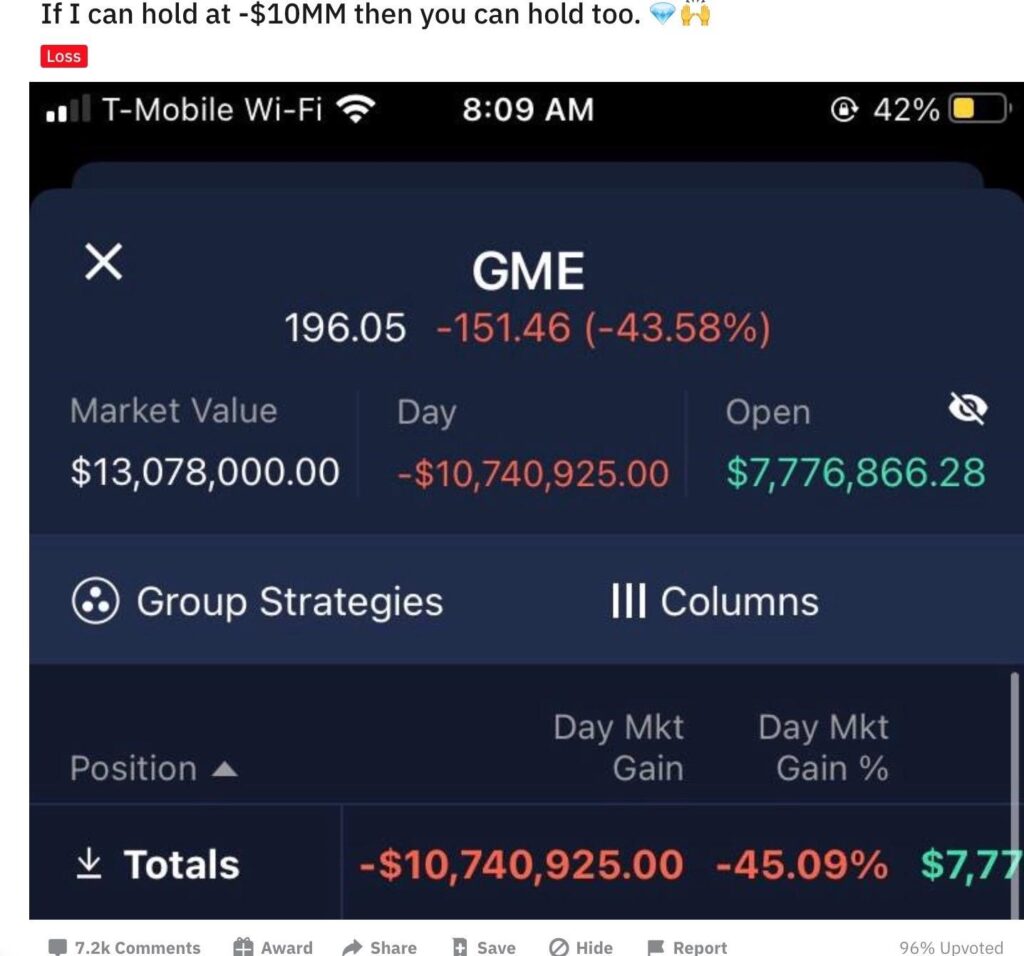

It all started around 20th January 2021 when the people on WSB started to buy the GameStop stock as well as the call options in order to drive the stock price upwards. Many people were influenced by Keith Gill who is believed to be the one who first noticed the potential in GameStop. This is how his holding was:

As of today (4th April, 2021), he still holds the position.

With the naked short selling done by the hedge funds, they would have to pay off their margins and square off someday. People started noticing about the rise in GME and began buying more and more. Due to COVID-19, millions of people were unemployed and had no source of income, thus investing in stocks would help them earn some money. Let us have a glance at the sentiments of the people and what made them unite against a common foe, the Wall Street?

i. These are people who have for years disliked Wall Street and the idea of capitalism. The resentment for Wall Street investment firms stems from the Financial crisis of 2008 which affected thousands of common people. People lost their houses and their jobs back then and now is when they believe is their time for revenge. People would invest their entire life savings in GME as it became personal for them. Here is a link to an open letter written to Melvin Capital and CNBC by a user who shared about how the 2008 Housing crisis affected them and what WSB really means to them.

Open Letter

ii. Wallstreetbets is like a family for these people. They realize that they are in this together and till the end. A comment on WSB stated that “For all those holding at $300, we are coming to rescue you”. This was said when the stock was at around $100. A rational investor would be one who would take his/her profit and invest it in other stocks or spend it. Here, it is a personal fight for the people against the hedge funds. They will buy GME back to take it to higher and higher prices. Never has such a investment philosophy seen where people look out for each other and their sole aim is to defeat the hedge fund and the system.

There are people like the one above who would never sell GME unless it reaches whatever target he/she has set (which is mostly above $1000). Phrases such as “Diamond Hands” (investor who holds on to a stock regardless of the risk/losses to reach an end goal. Often used to call a group’s collective strength to go through high tides) and “Paper Hands” (investors who sell stock at first sign of trouble) are used in WSB to encourage people to hold on to GME.

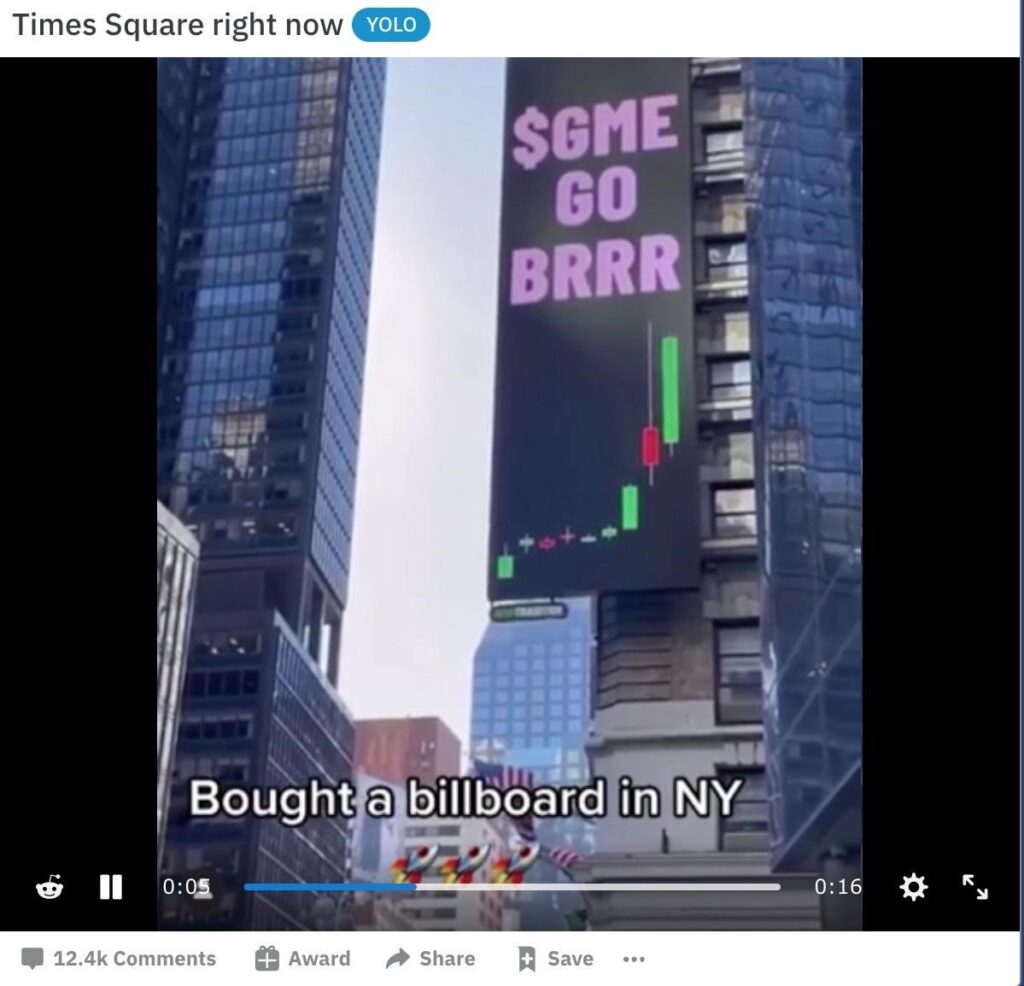

iii. People have gone out of their way to get more and more people into retail investing (mainly buying GME). “GME to the moon” is a phrase which was seen on many hoardings all over the United States. People started making memes on GameStop and this type of investing is called “Meme Investing”. A meme stock is which has seen an increase in volume not due to fundamental performance but due to hype on social media and online forums. Along with GME, WSB also targeted stocks such as AMC, NOK and BB who were also heavily shorted. Instead of looking at fundamental valuations, they would target the stocks which were shorted the most by the hedge funds and buy them to create a short squeeze.

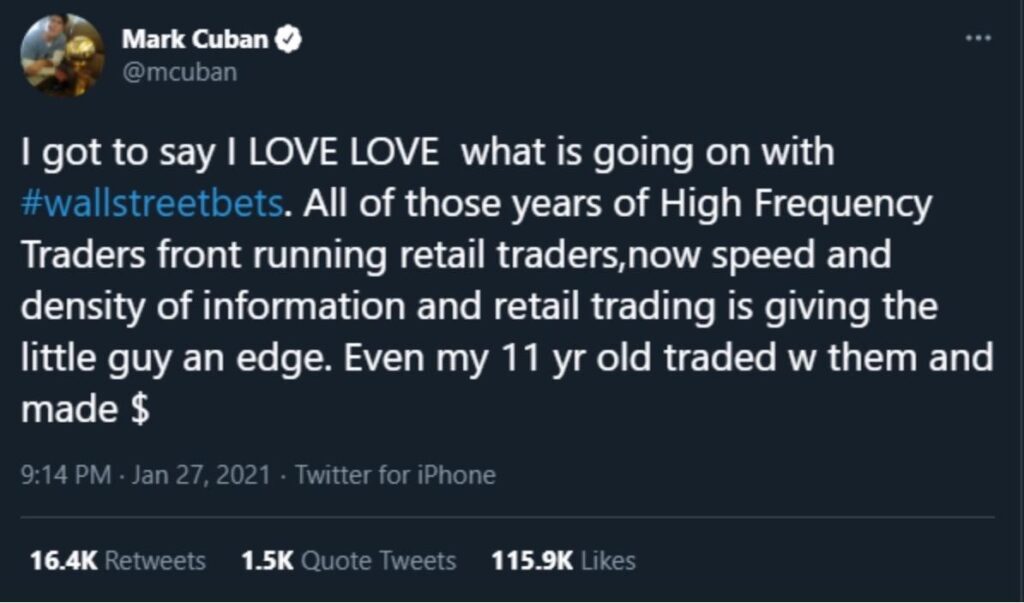

iv. There are a lot of influential people who supported the WSB in their fight. Some of them are:

Elon Musk – Shares of Gamestop jumped 60% after Musk tweeted this. The largest leap in the stock price was seen on 27th Jan, 2021 (from the graph) which was the same day Musk tweeted this. Elon Musk is known to cause an increase in assets such as Bitcoin and Dogecoin also by just tweeting. This is a classic example of psychological and behavioural trading where people just follow the influencers blindly without researching anything on their own.

Mark Cuban, an American billionaire entrepreneur and investor tweeted in support of the people and also gave an AMA session on WSB where he answered the questions of the new retail traders. Below is the link to the AMA which Mark Cuban did on WSB.

Mark Cuban – AMA

Chamath Palihapitiya, a Canadian-American venture capitalist, had invested in GameStop himself and he donated the profit earned ($500,000) to the Barstool Fund, which supports struggling businesses.

After all the above GameStop saga, it is seen that the majority of these people are amateur traders and have no knowledge of trading/investing whatsoever. They just see a meme or a trend and feel the urge to follow it. Many of them even invest all their savings to follow the fad. People have also reached a whole new level of craziness and just blind decision-making.

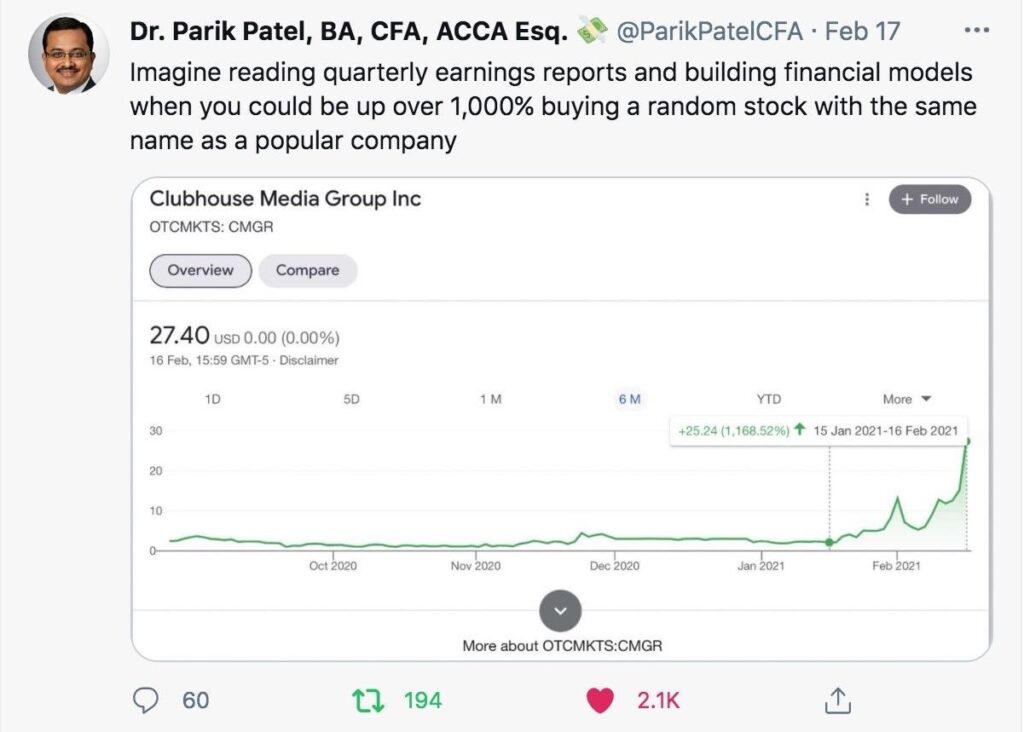

At the start of 2021, there was a lot of hype of Clubhouse where people could listen to people such as Elon Musk, Mark Zuckerberg and various other celebrities. Clubhouse was an invite only app accessible only on an IPhone whereas Clubhouse Media Group (the one in the graph above) is an marketing company whose purpose and work is completely different from the Clubhouse (invitation only audio-chat app).

People literally confused the two of them and started buying shares of Clubhouse Media Group and it rose $1 to $28 in a single month which is insane. The Clubhouse App is not even publicly listed yet. A 2800% increase due to a mistake by thousands of amateur traders. Imagine an amateur trader making more due to this than a Harvard MBA working at a Wall Street Investment Bank.

Clubhouse Confusion

Looking at the Indian markets, we definitely have less behavioural trading than the US market due to stricter regulations by SEBI regarding shorting of stocks and also having upper-circuits on the stocks. However, there are certain trends which suggest some influence of amateur trading in the stock market.

i. Over 10 million Demat accounts were opened in 2020 in India, with 6.3 million accounts opened during the period of April to September, 2020 which is a staggering 130% increase than the previous years. People sitting at home, with nothing to do can invest their time and money in the stock market. Some of them are unemployed due to the lockdown with no sources of income, so the stock market gives them a chance to earn something.

ii. These are amateur traders with no experience prior and no knowledge about fundamental or technical analysis. For someone with no knowledge about trading, they would always prefer quantity over the quality. Buying 1000 shares of ₹2 would be more preferred by an amateur trader than buying 5 shares of ₹400 as they would hope to get higher returns from a small-cap stock.

NIFTY Smallcap 100 rose from 3200 (March 2020) to 8400 (March 2021) which is a 162.5% increase. Both the smallcap and mid-cap sectors overperformed the large-cap in 2020 which can be due to the increase in the number of new traders.

iii. There were several Web series’ in 2020 which brought in new people into investing. Scam 1992 is a major example of this. Are the people just investing in stocks as a fad developed by the series?

To conclude, we need to ask some fundamental questions.

Is this type of investing the new thing? Will the behavioural and psychological trading get more returns than the fundamental valuation or is this only limited to the pandemic? Can these two methods coexist? Do let us know in the comments!

This post was written in collaboration with Asif Yahiya Sukri LLP. Asif Yahiya Sukri LLP provides unparalleled personalized financial services to a broad range of clients across different geographical locations. With a presence in the USA, India and the MENA region, they ensure that all of your financial decisions are made carefully and with your best interests in mind. They are innovators who understand what goes into building companies.

You can also reach out to them on info@aysasia.com

Follow Us @