What is Behavioural Finance

Behavioural Finance is the study of the psychology of investors and market participants in general.

Over the past 100 years, traditional finance theory has assumed that investors are rational and have no difficulty in making well informed financial decisions. The traditional side of the coin also portrays that investors don’t confuse how the information is presented to them and emotions don’t guide their decision making. However, this is different from the reality that we live in.

In the words of Meir Statman, “Standard finance people are modelled as “rational,” whereas behavioural finance people are modelled as “normal.”

Normal people have their reservations and biases and we as humans can get too attached to things, information or our beliefs. These biases are embedded in our psyche and may help us at certain times.

To put it simply, behavioural finance suggests that investors can display overconfidence when making gains and can be oversensitive to loses.

Various biases can impact investors and advisors in making key decisions –

Overconfidence:

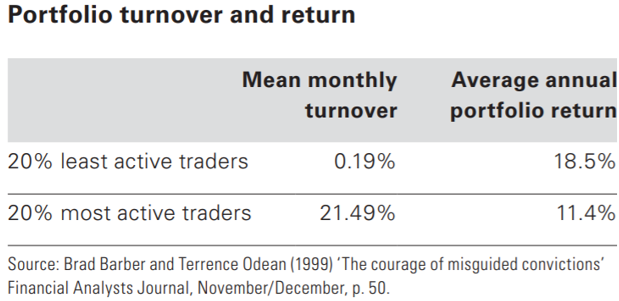

Overconfidence in one’s decision making is a universal trait and affects most aspects of our lives. Research on this attribute has yielded that individuals tend to inflate their ability and overate their views of the future. Overconfident investors overestimate their ability to analyse their bets and to build a winning portfolio. Overconfidence is also linked with over-trading. Professors Brad Barber and Terry Odean’s research with retail brokerages found that most active traders earned lower returns.

People always conflate their skill with luck. Luck plays a pretty healthy part in a person’s lives and investors conflate this luck with skill. For example, Masa Son’s incredible investment in Alibaba which turned $20 million to $50 billion. How much was this investment skill and not luck?

Loss Aversion:

The traditional theory is all about the trade-off between risk and reward. The assumption, according to traditional theory is that investor should seek a higher level of return for higher levels of risk. However, behavioural finance suggests that investors are more sensitive to risk. The deposition effect comes into play here. Simply put, it states that investors tend to sell a winner and hold on to losers, in the hope that losers will eventually turn into winners.

Constructing Portfolios:

Traditional financial theory recommends that investors treat all their investments as a pool or a portfolio and always consider how the risk of each investment offsets the risk of other investment in the portfolio. It further sums, that an investor should think of his/ her wealth comprehensively. This means including stocks, bonds or alternative investments.

However, human behaviour doesn’t treat our portfolio as compressively as traditional theory wants us. Investors tend to single out poor performing securities/ investments in a portfolio.

Managing Diversification:

According to behavioural finance research findings, investors struggle to apply the concepts of diversification and portfolio building. Traditional theory recommends that investors should allocate funds according to recognized approaches of portfolio building. Even though investors might understand the relevance of such different frameworks, they either don’t know how to put such approaches in practice or have a bias for familiar assets classes. An investor has the tendency of investing in familiar assets classes as these classes are known to her and hence perceived as low risk.

Managing These Biases

Hiring Advisors:

Hiring advisors to do due diligence and fact-finding for the clients.

Clients can guide their advisor on the level of risk they want to take, and the returns can be generated based on that.

Effectively, advisors will help the client in building their investment policy statement, a document containing all the relevant information required to perform the work by the former.

Building a Framework:

Most of the top investors have a framework in place, which guide their investment decision. Frameworks help investors to differentiate winners from losers and practice their investment philosophy. These frameworks can be divided into different investment criteria considering long term goals or short-term needs. These frameworks help to offset the tendency of being loss averse.

Follow Us @