The word Bitcoin became a rage in India in the year 2017. Every second person wanted to invest in it and it became a widely talked about investment avenue. It started gaining momentum in the year 2017 where it saw a one-sided upward movement and reached a peak of $20000 in late 2017. After, these people started talking about various other coins (called alt-coin) like Ripple, Etherum etc. All these fell under a broad category called cryptocurrency.

What is a Crypto Currency?

The word crypto comes from the Greek word “kryptos” which means secret/hidden. Cryptocurrency is nothing similar to your physical currency. It is digital currency/digital money which is based on cryptography. Some of the features of cryptocurrency are as below:

- It can be stored on your computer or phone and can be sent from person-to-person.

- Nobody controls the currency i.e. no central bank can print these coins.

- They are available to everyone irrespective of the nationality.

- It provides secured means, as all the transactions committed on the network are unalterable.

- All the transactions are anonymous and can be done directly between two parties without any third-party intervention.

- They are built with measures, to ensure that they will work well in both large and small scales.

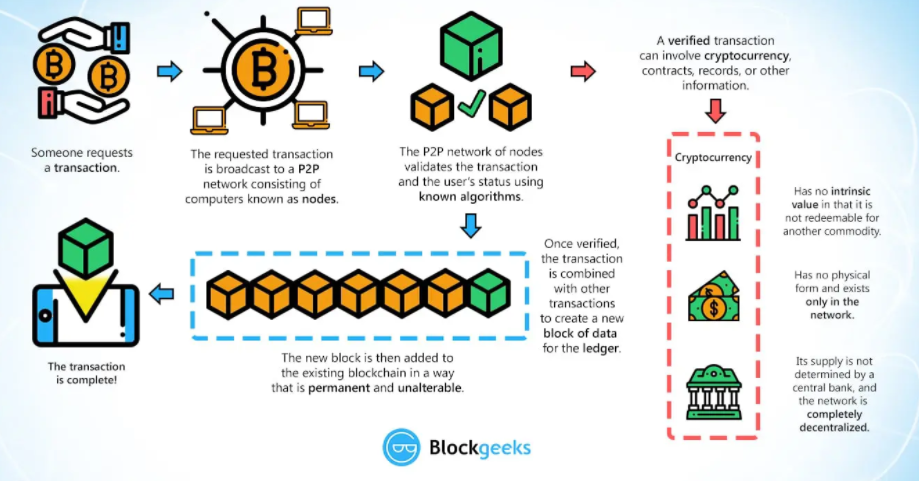

How does it work?

1) Transacting:

- Transactions are sent between peers using software called cryptocurrency wallets.

- The person creating the transaction uses the wallet software to transfer balances from one account (public address) to another. To transfer funds, knowledge of a password (private key) associated with the account is needed.

- Transactions made between peers are encrypted and then broadcasted to the cryptocurrency’s network and queued up to be added to the public ledger.

- Transactions are then recorded on the public ledger via a process called “mining”. All users of a given cryptocurrency have access to the ledger if they choose to access it, for example by downloading and running a copy of the software called a “full node” wallet.

- The transaction amounts are public, but who sent the transaction is encrypted

- Each transaction leads back to a unique set of keys. Whoever owns a set of keys, owns the amount of cryptocurrency associated with those keys. Many transactions are added to a ledger at once.

- These “blocks” of transactions are added sequentially by miners. Hence, the technology behind it is called “block” “chain.” It is a “chain” of “blocks” of transactions.

- Most cryptocurrencies are based on the above mechanism. However, some alternate coins use unique mechanics. For example, some coins offer fully private transactions and some don’t use blockchain at all.

Below image summarizes the entire working of blockchain technology:

2) Verifying the Transactions (Also called as Mining)

- Once a transaction is made, the transaction is not confirmed and goes through a verification process. Once confirmed, the transaction becomes part of a record of historical transactions stored on the blockchain.

- Cryptocurrency Miners verify the transactions and then add them to the public ledger. They use powerful computers to solve complex math problems that are the key to the verification process.

- Cryptocurrency Mining is open source, so anyone can confirm a transaction, and the first miner to solve the problem gets to add a block to their transaction ledger. This process is called the “proof-of-work system.”

- After adding a block to the ledger, the miner is given a reward in the form of a cryptocurrency for the efforts, which varies based on the cryptocurrency.

3) Public Ledger

- All confirmed transactions including the ones from the start of a cryptocurrency’s creation are stored in a public ledger.

- The identity of the coin owners is encrypted, and the system uses a cryptographic technique to ensure the authenticity of record keeping. It can also calculate the amount available for spending in the wallet.

- New transactions can be checked to ensure that each transaction uses only those coins owned by the spender.

Types of Cryptocurrency

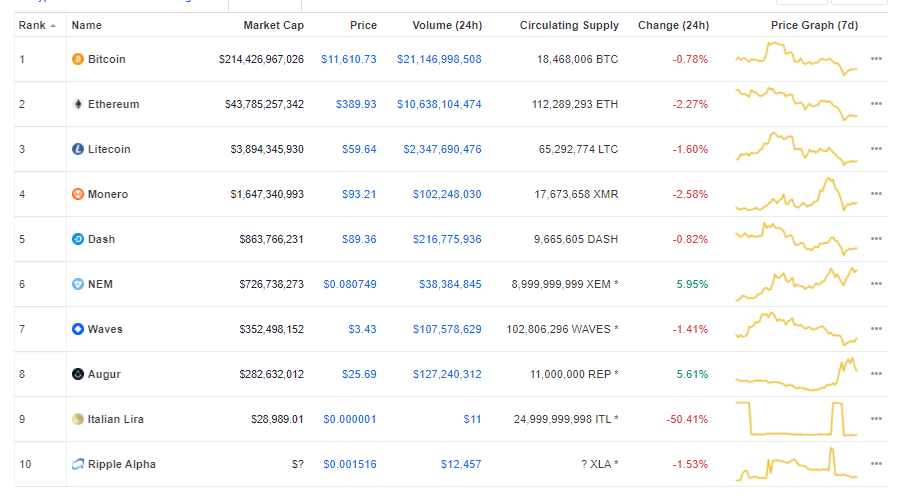

There are thousands of cryptocurrencies, and more are being developed and launched every day. Some of the most common cryptocurrency are as follows:

i. Bitcoin: Bitcoin was the first and is the most commonly traded cryptocurrency to date. The currency was developed by a Satoshi Nakamoto in 2009. (not known till now who is Santoshi Nakamoto)

ii. Ethereum: Developed in 2015, Ether is the currency token used in the Ethereum blockchain, the second most popular and valuable cryptocurrency.

iii. Ripple: Ripple is another distributed ledger system that was founded in 2012. Ripple can be used to track more kinds of transactions, not just of the cryptocurrency. The company behind it has worked with banks and financial institutions, including Santander.

iv. Litecoin:This currency is most similar in form to bitcoin, but has moved more quickly to develop innovations, including faster payments and processes to allow many more transactions.

The above is based on blockchain technology. However, other cryptocurrencies are building completely new infrastructures. Details of some of the widely used cryptocurrency are given below:

How to Buy Cryptocurrency?

- To buy, one can simply add a credit card or debit card to the exchanges and would need to go through a two-way verification or can use websites like Coinbase, Zebpay, Unocoin, Coinmama Kraken which are popular exchanges to trade in bitcoin.

- Alternatively, one can directly visit the websites of cryptocurrencies like bitcoin.org and ethereum.org and choose your wallet to trade in bitcoins specifically.

- However, before choosing an exchange, it is important to keep in mind that every exchange has its exchange fees.

Where to store:

- Cryptocurrencies can only be stored in specialised wallets due to their added security measures.

- There are online cryptocurrency wallets like Zebpay or Unocoin wallet and also there are apps on Google Play Store and Apple App Store which provides wallets for storing.

Criticism for Using CryptoCurrency:

- Due to anonymous nature, it is well suited for illegal activities such as money laundering and tax evasion.

- Market prices are depended on supply and demand, this leads to high exchange rate volatility.

- Even though the transactions are secured in a cryptocurrency there are vulnerabilities of the infrastructure underlying them such as security of exchanges and wallets which are prone to hacking.

Future of CryptoCurrency:

Cryptocurrency has soared into a $200B industry and is taking the world by storm. The entire mechanism of cryptocurrency is being widely adopted, but it remains a niche. It’s only a matter of time when this will be widely accepted both legally and as an alternate to the physical currency.

Source: Investopedia, Cryptocurrencyfacts, Blockgeeks, Genesis-mining, Telegraph

Follow Us @

Some Unrelated Stories!