Affle India is one of the most scalable, asset-light, and profitable digital businesses listed on the Indian stock exchange today. Affle is a global technology company with a proprietary consumer intelligence platform that delivers consumer engagement, acquisitions, and transactions through mobile advertising.

Affle India was founded by two Anujs – Anuj Khanna Sohum and Anuj Kumar. Together, they listed Affle in 2019, which was oversubscribed by 86 times, a record for an internet company at that time. The issue price was set at 740 – 745. And as of 6th June 2021, the share price is 5,349. An astonishing seven-fold multiplication in share price.

Affle also stepped up their acquisition game as of late. They acquired two companies in 2020, appnext (mobile app discovery and recommendation) and MediaSmart (European mobile programmatic & proximity marketing). In the last three years, the company has gone ahead with five acquisitions which have helped them to build ground in various aspects from digital ad fraud detection to simplifying the omnichannel business. On 10th June 2021, the company announced that they’d acquire Jampp, a mobile marketing firm based in Latin America.

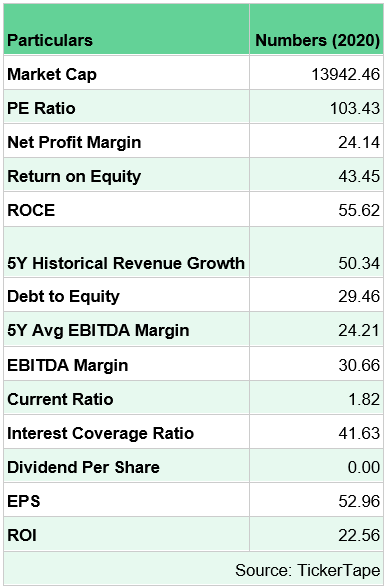

Affle’s business model is very asset-light, and the company also has good investors such as Microsoft, Bennett Coleman & Co., Centurion corp, D2C, and Itochu. The FII holding of the stock has also gone up from 8.37% in Sept 2020 to 19.87% in May 2021. This increase is because the business model has leaps of growth ahead of it. The business functions with good margins of the net profit margin of 24.14%, making it a very attractive company.

Affle focuses on two business segments –

I. Consumer Platform

II. Enterprise Platform

Consumer Platform:

The consumer platform delivers consumer acquisitions, engagements, and transactions through relevant advertising for leading B2C companies. The consumer platform provides the following services –

1. New Consumer conversions (acquisitions, engagements, and transactions)

2. Retargeting of consumers to close their transactions

3. Online to offline platforms that convert online consumer engagement into meaningful in-store walk-ins.

Enterprise Platforms:

Provide end-to-end solutions for companies to enhance their engagement with mobile users by developing apps, provide enterprise-grade analytics for more engagement.

The consumer platform contributes to 97.2% (2020) of the company’s revenues; meanwhile, the enterprise business only contributes to only 2.8% of the revenues. However, both the segments are growing in leaps and bounds; in 2019-2020, the consumer platform revenues grew, 34.1%, and the enterprise business grew 23.8% Y-O-Y.

Industry and Business Overview:

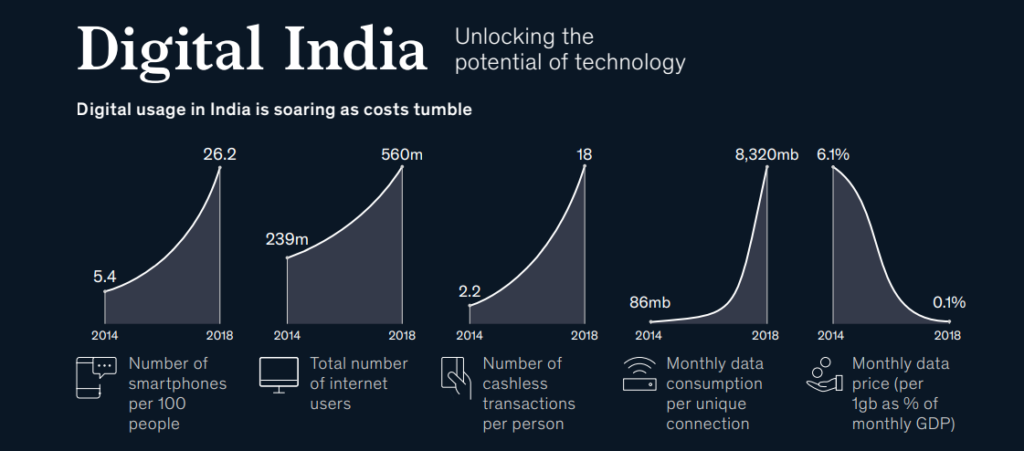

The global mobile advertising market was valued at $190.2 Billion in 2019 and is expected to grow at 13% CAGR to $450 Billion by 2026. However, the transition from offline to digital ad spend has exploded during this global pandemic. Digital ad spends across India has also grown exponentially. The Indian ecosystem of digital ad spend was forecasted to make up 30% of the entire media ad spend in the country and is expected to reach 64% of total digital ad spend by 2022.

Affle operates in a niche that doesn’t have many competitors. According to the CEO, the competition of Affle is primarily in developed countries targeting only those developed countries. However, that is strictly not the case with Affle, as it targets both developed markets and emerging markets. And the emerging markets are the bread and butter of the company.

For Affle, the primary markets include – India, South East Asia, Middle East, and secondary markets are – North America, Japan, Korea, and Australia.

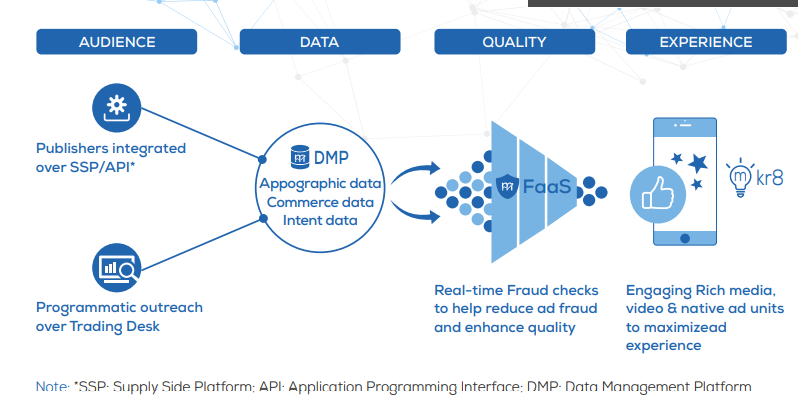

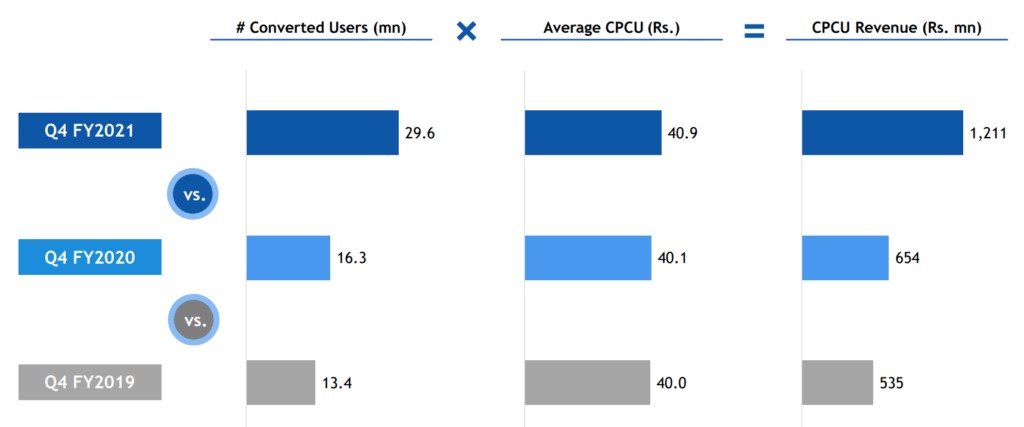

Affle’s business model is not based on standard industry practice but rather a differentiated cost per converted user (CPCU) business model. The whole industry is mainly operating on clicks, views, and impressions. However, most of Affle’s tasks start after the consumer has installed the app or clicks on an ad. The conversions that Affle pulls off are firmly integrated with a deep funnel matrix, driven by an enormous data pool. In this data pool, ad fraud detection takes place.

Digital ad fraud is when traffic is manipulated to give an impression that a particular campaign was successful. This can be done with the help of bots and malware. Affle has developed an MFaaS ad fraud detection system when the system can filter bad data and focus on the actual consumer, hence increasing the ROI of each campaign. The company has 18 patents filed, and 10 of them are related to the digital ad fraud detection system.

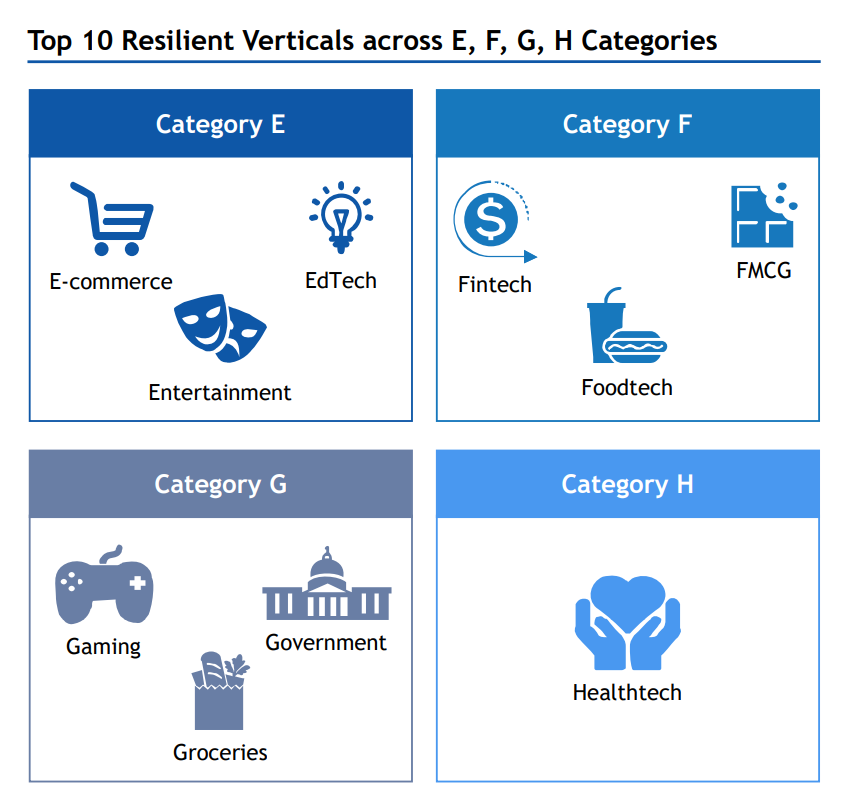

Markets have rewarded Affle for having a very resilient and diverse customer book, with the company divided into four categories E, F, G, H. According to the latest Q4 fillings, the revenue contribution by these categories has increased from 74% in FY2020 to 90+ in 2021. However, the revenue contribution from the top 10 customers has declined over the years, from 64.5% in 2019 to 42.8% in 2021.

The Q4 results of Affle were powerful; the profits jumped 282% from Rs15.29 crores to Rs 58.51 crores. The revenues increased 76.92% from Rs 80.02 crores to Rs 141.57 crores. This growth can also be seen in the technical side of the business, where the number of converted users rose from 72.3 mn to 105.3 mn. Average CPCU decreased slightly from 40.1 to 40.8, and the total CPCU revenue grew 44% from Rs 2965 mn to Rs 4294 mn.

Affle India’s client list is star-studded, and the company is serving some of the epitome business across broad categories. The industries range from Ecommerce to auto, so this depicts the scope and the scalability of the company.

Financials:

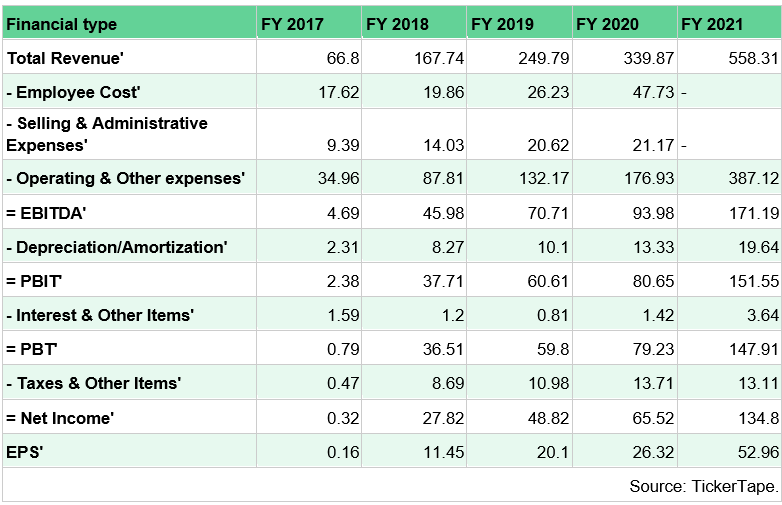

Income Statement:

Balance Sheet:

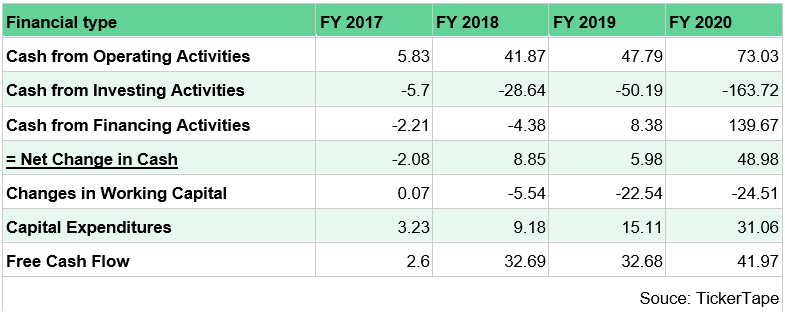

Cashflows:

Key Ratios:

Strengths:

- The digital aspect of the industry brings in more opportunities for scalability and growth;

- No reliance on a few clients, but rather the clients come from various sectors, displaying scalability and need;

- Substantial focus on R&D translating into patents that facilitate competitive moats;

- Strong fundamentals with low debt structure and healthy liquidity;

- Recent acquisitions in various geographies and different digital segments validate the company’s focus on growth and diversification.

Weakness:

- Reduction in promoters stake from 68.38% in Sept 2020 to 59.89% in May 2021;

- Crackdown on digital advertising and changing perception of privacy;

- The bulk of revenues coming from consumer platforms;

- A more significant portion of the revenue comes from emerging markets with lower purchasing power that translates into lower efficiency.

Follow Us @