You all must have come across the pop-ups with a statement by an individual saying “I’ve invested “x” penny and earned this much”. Well, these are not only fake rather, a very luring advertisement to attract low-pocket investors towards something, those are popularly known as penny stocks.

Penny Stocks are those shares which generally have a share price lower than Rs. 10 also referred to as single-digit stocks.

They are famous for its small investment amount requirement, yielding good return pattern, subject to the company’s growth and management. Penny Stocks mostly have lower market capitalisation*, also called as nano-cap stocks or micro-cap stocks

*Market cap is a result of no. of shares traded multiplied by its share price.

An investor may allocate 1% of his total portfolio value to penny stocks as in case of downfall the loss could be balanced through other stocks in the basket. Since these stocks are offered by smaller companies which are start-ups or fully held by promoters, the area of manipulation is huge here.

And not every penny stock may yield high returns or give the over-hyped 1000% returns! Investors should consider multiple parameters before investing anywhere and for something as volatile as the stock market, investment due diligence should be based on numerous factors.

Followings considerations may help in better decision making:

i. Analysts say that penny stock works best in debt-free companies, as these entities can re-invest a bigger share of profit in their operations leading to a higher stock price. So, an eye should be kept on the debt-equity ratio.

ii. The holding pattern of the company can be one of the parameters, an important question to be considered here: what is the business holding % of the promotor, generally >50% shows the promoters trust the company to make profits in the long-term. It can also mean centralised ownership and control, without an external overview which can be dangerous for retail investors particularly.

iii. Profit and loss trends or Sale trends of the past 5 years can be one of the parameters which will reflect core business operations.

iv. Investors should also consider the ROCE & ROE, which will show the return generated by the company on the capital invested and on equity respectively.

v. If the company is covered by analysts, who have gauged the business and its operations and after that formed a strong opinion about the company.

The High

There are successful penny stocks (but have high risk) like DishTV India Ltd closing at Rs.10.93 from 4.28, being the recent lowest in May 2020.

Compucom Software Ltd closing at Rs.8.9 with 62% rise from April, 20, Bajaj Hindustan Sugar Ltd closing at Rs.6.05 from 2.37 on March, 20 and JMT Auto Ltd rising to Rs. 6.89 in July from Rs.0.99 in 4 months.

The stock price of Birla Tyres Ltd was 2.56 on 26th March 2020 which has raised to 55.35 as of July 2020 with a 95% swing!

Few penny stocks have raised as good as 2700% in the last 5 years as per the research article by moneycontrol.com which is based on analysis of 10 penny stocks jumping big hoops.

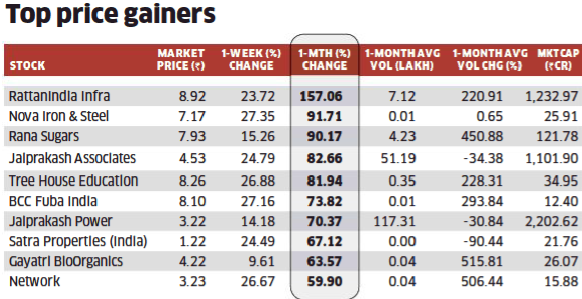

Top Penny Stocks for August which are popular are :

The Low

It as conventional belief that huge returns come with huge risks. Penny stocks are none the less a solid example of this belief.

One has to be very careful before investing, you can lose 100% of your investment while dabbling in these ‘unproven’ companies!

Also, the emerging number of robin-hood investors who aren’t aware of the traditional trade practices are making blind site investments into such stocks which might be fruitful in short-term but can take the share price from upwards floating to a negative state for such investors. Therefore, careful consideration is a must.

There is always a risk of scams like the one pulled by Harshad Mehta by buying weaker company stocks and inflating the prices, which is not an unknown story.

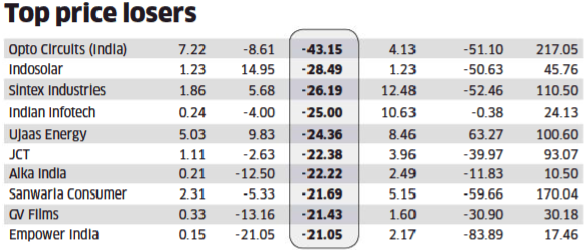

Some of the Penny stocks which faced a downfall in August 2020:

Smaller companies having limited control are more likely to become a part of the manipulation as the promoters own the company and can find multiple ways to chisel the news around the corner by the spread of rumours, which happened with Shree Ashtavinayak Cine Vision Ltd, a production house which suffered big hit around the same as stock prices rose haywire and declined like no one’s business, within a matter of few weeks. Thereby, investors suffered huge losses!

If an investor is big on pockets, a minor set-back won’t damage the wealth but small or retail investors which invest their hard-earned money can suffer by getting addicted to such stocks, as greed takes people to next level and therefore, many of the robin-hood investors face a hole in their pocket owing to the minimal amount of direction and knowledge of the market.

An investor should not focus on the no. of shares to buy, rather the focus should be on what value the investment can bring in the long run.

So, it is always better to invest in a company with a strong history/ track record with foundational values because there is a definite set of practice followed over years and these companies have a strong base. Their better asset base as well as capital allocation policies, due to years of experience, give them an edge over their small counterparts.

Although nothing comes with a guarantee, penny stocks may seem tempting in short-term but it may or may not yield the expected returns. And on a conclusive note, an investor should always consciously invest in any asset and should not get swayed away with sham schemes.

Follow Us @

Some Unrelated Stories!