Organizing the unorganized

Ashish, a grocery store owner in Mumbai, is new to the city, and he is not much aware of intracity logistics. He always faced challenges in getting a mini truck on time to transport the goods from stockists to his shop. Also, he often ended up paying two-way freight because of lack of options. Many other business owners like Ashish are searching for the affordable and reliable intracity logistics service provider, but are not able to get one.

On the flip side, you might have seen a group of mini truck owners standing at designated places in your city daily, waiting for the business to come to them. So, there is a clear gap (primarily due to the unorganized nature of the industry), right? – Here is how Porter was born!

Porter bridges this gap through cutting edge technology. It helps individuals and businesses to book mini-trucks for intracity logistics in few clicks. On the other side, it helps mini-truck owners in increasing truck utilization by offering frequent bookings. It has created a win-win situation for both the key stakeholders of this industry by marrying consumers and truck owners/drivers, though a simple yet highly impactful technology proposition.

Resolving critical flaws of the intracity logistics industry, underutilization, and price efficiency, with the help of technology, has helped Porter establish itself in 6 major cities – Delhi, Bangalore, Mumbai, Chennai, Hyderabad, and Ahmedabad.

The terrific trio behind Porter

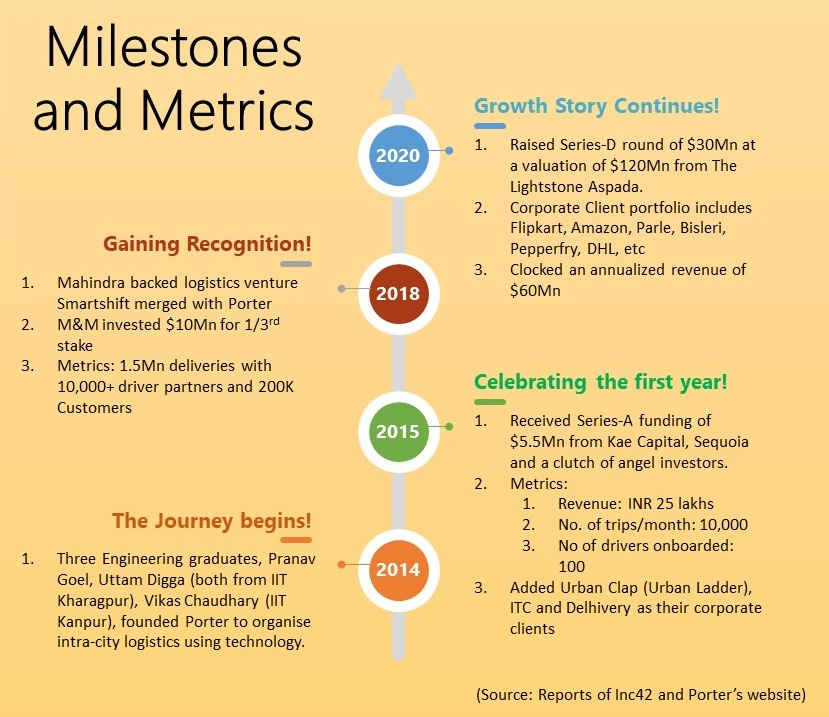

Porter is the brainchild of three young and like-minded IIT graduates – Pranav Goel, Uttam Digga, and Vikas Choudhary. Uttam, personally, felt the need to tackle the issue prevailing in the mini-trucks and light commercial vehicles (LCV) market, and Porter’s idea struck him then. He saw the opportunity through the gap in this untapped industry in 2014, which could have been filled by technology integration, and then came the disruption. Pranav and Uttam both have shared Alma mater – IIT Kharagpur and have worked together at JP Morgan. Pranav knew Vikas since they studied for JEE in Kota and knew he had thrills for such ideas. This is how the trio joined hands to start Porter in August 2014.

Since 2014, Porter has witnessed exponential growth year on year. As of 2020, it maintains a network of 70,000+ driver partners, more than 1 million customers across six major cities of India, and has clocked more than 10 million trips.

In 2018, Mahindra & Mahindra (M&M) backed logistics aggregator startup Smartshift merged with Porter to create operational synergies. Impressed with the growth trajectory and mutual objective of improving logistics facilities in India, it picked up around 1/3rd stake in Porter for USD 10 million in 2018. Till now, Porter has raised USD 32 million from a clutch of institutional investors – Kae Capital, Sequoia Capital and LGT Lightstone Aspada, M&M and Innoven Capital at a valuation of USD 120 million.

Portraying the Porter!

Porter is built on end to end technology integration that leads to process automation and minimal manual intervention. It results in near-zero process errors and helps to scale up rapidly. The mobile application comes with worthy features, which make the entire procedure hassle-free. It offers the convenience of real-time tracking of vehicles, online payments, the safety of goods, and more.

It is often said today Data is the new oil. There is substantial raw data generated in every industry, and the success of modern-day organizations rests upon how well they employ data in AI-powered technology to improve processes, prediction, and customer relationship management on an incessant basis. Porter believes in this ideology firmly and is continuously working to leverage its technical know-how to introduce maximum efficiency in their operations.

From a customer experience point of view, Porter’s mobile application is built with an excellent user interface that eases the process of searching a mini truck or LCV, booking the trip, and making payments hassle-free. To improve customer relationships, they have dedicated call-centres with a target to resolve at least 95% customer grievances. This customer-centric company culture has helped Porter amass a pool of loyal customers and have managed to position themselves as a synonym to “Uber of trucking.”

Porter does not believe in burning excessive cash on digital marketing gimmicks. They give more credence to conventional and organic marketing methods like word of mouth and the use of partnering agents. They employ gamification techniques to engage and motivate its existing driver network and to attract & on-board more drivers to the platform.

Porter has also aimed at creating a profitable definition of ‘Return Cargo’ for the drivers. Traditionally. A truck owner would return empty after completing a delivery. However, Porter provides return cargo to at least 85% of its drivers. A driver on porter gets 2.7-2.8 trips per day as against the usual number of 1-1.2. An increase in trips and incentives upsurge the revenue of drivers by 20%, which can be further passed on to customers to offer competitive pricing.

What is more in store for Porter?

A significant challenge is to educate drivers about the advantages of working on an organized platform. Porter has been quite successful in doing until now, but this will become increasingly challenging once they penetrate in Tier II and III cities. Porter competes with the likes of Lets Transport, Truckeasy, Blowhorn, etc. Startups like Moovo (backed by Yuvraj Singh), The Karrier, Truckmandi, Trucksumo, LoadKhoj failed to remain afloat in the market.

Porter has successfully placed itself as one of the leading players in the intracity trucking market in major cities. Now, they have pivoted on leveraging technology and creating a solid foot-hold pan India. The last mile logistics industry has primarily been an unorganized sector and is quite ripe to disrupt in the coming years.

The Indian startup ecosystem has witnessed supernormal growth in tech-enabled trucking logistics startups such as Rivigo and Blackbuck over the past few years, as businesses use these services more frequently than traditional ones. Also, there is a broader trend where B2B startups have raised more capital and have been valued almost at par with consumer-facing businesses. Furthermore, the consumer mindset shift from being only price-sensitive to quality-oriented will benefit budding startups like Porter.

Porter’s growth story and future seem promising as it is yet to tap the significant Tier II and III cities’ markets. Let us wait for how the story unfolds.

Follow Us @

Some Unrelated Stories!