Click here to download the entire article.

I. Introduction

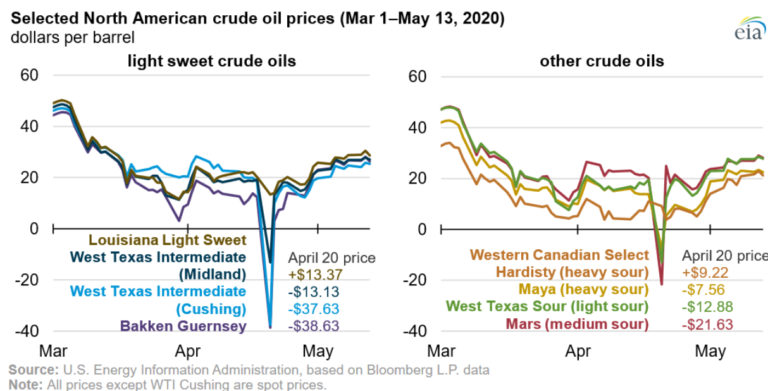

On April 20, 2020, the futures contract of West Texas Intermediate (Cushing) (“WTI”) made history as it dropped an eye-watering 310.45% in a single day, to negative $37.63 per barrel (/bbl) (Exhibit 1). A crude understanding of this dictates that the seller was willing to pay $37.73 /bbl to the buyer, to take delivery of the oil (a real commodity), from the hands of the seller (i.e. Negative Oil Futures Prices). This was in fact true, on April 20, as the futures contract almost drew to a close. Of course, considering the prices and expiry on the next day, the futures contract was hugely illiquid, and whoever held the contracts would have had to take the delivery of oil barrels.

This article is an attempt to explore the causes of the such a massive drop and the probable effect of the same on the oil & gas industry and its ancillaries, going forward. In order to do so, we have tried to explain below certain concepts which may prove useful to better understand the article.

- The subject commodity here is the Crude oil rather than gasoline, or distillates such as diesel fuel, jet fuel, etc. It’s the rawest form of oil which is literally dug out. The differential necessary to remember is between the onshore and offshore platforms to drill and extract oil: onshore drilling is digging deep holes under the earth’s surface whereas offshore drilling is drilling underneath the seabed.

- The most popular grades of oil traded are Brent North Sea Crude (Brent Crude) and the West Texas Intermediate (WTI). Brent refers to oil that is produced in the Brent oil fields and other sites in the North Sea (offshore). Brent crude’s price is the benchmark for African, European, and Middle Eastern crude oil, whereas WTI is the benchmark for North American crude oil (onshore).

- Crude oil is a real commodity and a major portion of the market is traded on live markets using futures. Futures are listed/ traded forward contracts (contracts to buy a particular asset in future at an upfront agreed upon price). Since these are futures contract of oil, unlike other futures contracts, on expiry of the contract, the holder of these contracts would ideally have to take the physical delivery of said commodity.

- Brent crude oil futures trade on the Intercontinental Exchange (ICE) and WTI futures are traded on the New York Mercantile Exchange (NYMEX) division of the Chicago Mercantile Exchange (CME). Since Brent is traded internationally, the delivery locations vary by each country, whereas delivery of WTI occurs in Cushing, Oklahoma. Important to note, it was the WTI May futures, and not the Brent crude futures, which turned negative one day before expiry of the contract.

With the above understanding, let’s attempt to understand the industry’s troubles.

II. Modern History

Marc Rich, one of the most controversial and influential commodity traders, once famously said that oil is the blood that flows through the veins of the world. It may be historically accurate to say that crude oil was the fundamental source of energy for the world’s economy. However, it is impossible to not see the plight of this industry in the 21st century.

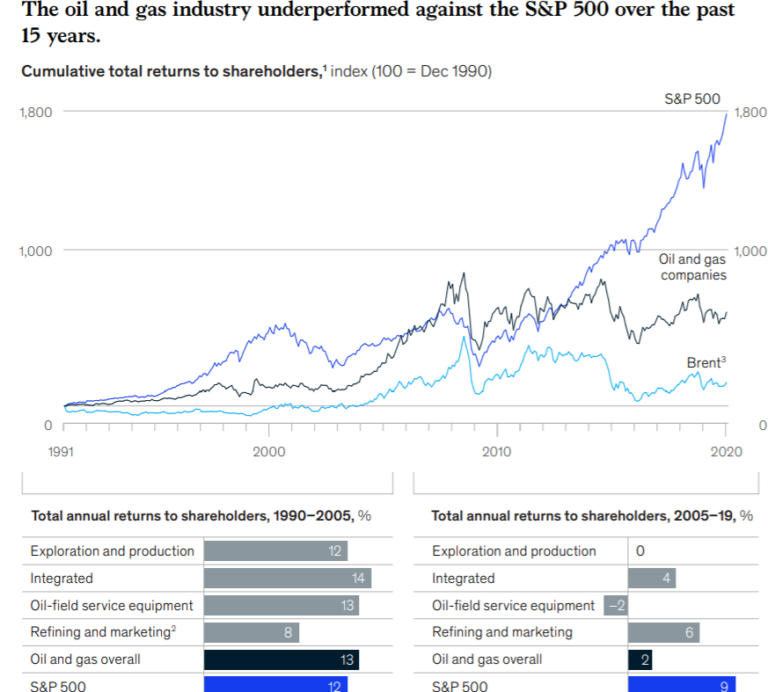

The oil and gas industry experienced their third price collapse in the past 12 years. It is no news that the industry has been in trouble for a long time. From 2005 to January 2020, even with macro support such as strong demand growth and effective supply access continued, the global industry failed to keep pace with the broader market. In this period, the average of the oil and gas industry generated annual total return to shareholder growth about eight percentage points lower than the S&P 500 (Exhibit 2).

Historically, long duration price shocks wipe out poor performers and lead to consolidation. But the capital markets were generous with the oil industry in 2009–10 and again in 2014–16. Many investors focused on volume growth funded by debt, rather than operating cash flows and capital discipline, with hope that prices would continue to rise.

III. Causes

There were three major factors/ events that occurred under the backdrop of the COVID-19 breakout, that led to a sharp decrease in demand of crude oil forcing the price to drop to historical levels, that I’m calling – “the drop trifecta”.

- Russia-OPEC oil price war

While a significant portion of the world’s oil reserves are held by the Organization of Petroleum Exporting Countries (OPEC), Russia is also a major oil producing nation. With demand falling due to the COVID-19 pandemic and a drop in Chinese demand for oil (largest consumer since 2008), OPEC, in a summit in Vienna on 5 March 2020, decided to cut oil production by 1.50 mn barrels per day through the second quarter of the year, and called on Russia and other members of OPEC+ to follow suit. On 6 March 2020, Russia rejected OPEC’s demand marking an end to the partnership and a beginning of the price war between the two. As a result, Saudi Arabia increased its oil production by 2.60 mn barrels per day and Russia increased oil production by 500,000 barrels per day. As a result of continuing excess supply with a sudden and dramatic fall in demand for oil, the prices for oil futures were seemingly in free fall. A lot of geo-political effort and negotiation was required to bring stability in the oil supply including the obvious involvement, of the US President Donald J Trump.

- The Storage problem

The most obvious issue was the storage problem. With supply that increased due the price war and with the dramatic fall in demand, the biggest issue was to store this dangerous flammable commodity, in millions of barrels or in pipelines. Here we may draw a difference between the Brent Crude and WTI. As a result of being a product of offshore drilling, Brent Crude is usually stored in massive shipping vessel containers offshore and stay offshore. This worked out well for Brent futures, which although lost massively in this whole crusade, did not venture in the negative price territory.

WTI did not share the same fortune. Being a product of onshore drilling, it had to be stored in pipelines and barrels which is infinitely more complex and expensive than offshore storage. Further, given that the delivery of WTI futures occurs in Cushing, Oklahoma which is a land locked location, the capacity of the place was already filling up a week before the expiry of the futures contracts. This meant that everyone holding the futures contracts was going to have to take physical delivery of the oil with no place to store it or incur a massive logistical and storage cost for the oil they just bought. As a result of costs shooting up than the already troubled futures prices, investors realised and started selling contracts at a negative value just to avoid incurring that extra storage cost.

- Futures derivatives and the role of Financial Institutions

As explained above, a huge portion of oil is traded live through the derivatives markets, using futures contracts. As you may be already aware most derivative contracts are simply settled financially, depending upon the price of the underlying asset at contract expiry. However as mentioned earlier, oil futures on the other hand, are physically delivered of the real commodity i.e. oil.

Now, usually the producers who want to lock in a price, would enter into a futures contract with a prospective purchaser who wants the oil at contract expiry. However, more often than not, the other end of the futures contract in the interim (from contract start till expiry), are financial institutions who are happy to make money off of the contract but are least bit interested in actually taking delivery of oil.

Now, there were a lot of barrels of oil waiting to be delivered on 21 April 2020 at expiry of the futures contract in the US, all the while Russia and OPEC are pumping out oil at absurd rates. But there is only a limited amount of storage space for oil. Due to such limited storage space and massive excess supply of oil available, the financial institutions and futures traders started realising that they need to exit this contract, or they might have to take physical delivery of oil and incur hefty storage costs. They started panic-selling the contract. The market got so desperate that these institutions started paying the counter parties to take the oil away from them, so they didn’t have to deal with the responsibilities of storing it. It is widely held today post facto that the dip in the negative price of oil was nothing, but a financial anomaly caused by fear and incurring heavy storage cost. We’re inclined to agree with this, since it is evident that the very next day prices were back up again.

However, the plight of the industry cannot be ignored since it has been in trouble for 15 of the first 20 years of this century. The industry operates through long megacycles of shifting supply and demand, accompanied by shocks along the way. Additionally, the sector’s financial and structural health is worse than in previous crises. The advent of shale gas (an alternative to crude oil), excessive supply, and generous financial markets that overlooked the limited capital discipline have all contributed to poor returns. Today, with prices touching historical lows, and accelerating societal pressure to invest more and more on renewable sources of energy, executives sense that change is inevitable.

Please note that I have not ventured in explaining the technical analysis of the oil futures prices (contango vs normal backwardation), but the same is a really interesting read on the internet. For understanding basics of these two concepts, I suggest you click here to see Khan Academy’s videos online.

IV. Short term and Long Term implications/ challenges

It would be rather foolish to discuss what would be impact of negative prices which lasted for not even one full trading cycle. Rather, it must be looked upon as an indicator; a tell on how the industry may perform in the future. And it is not a pretty picture.

- Short term

An optimist would say that because oil is the most traded commodity and has a significant bearing on global transport costs, it should lead to inflation (which is a good thing) and can lead to higher rates of economic growth. However, sometimes oil prices crash because there are fears of an economic recession. The crash in oil prices in 2020 is without a doubt, indicative of the economic recession and the prices have fallen so far that many oil firms will be forced out of business, causing job losses and falling investment. It goes without saying, that there would be differential impact of fall in oil prices, on every country, and consequently their strategies (& policies) would have to be framed accordingly.

Under most best-case scenarios, oil prices could recover in 2021 or 2022 to pre-crisis levels of $50/bbl to $60/bbl. The industry might even benefit from a modest temporary price spike, as today’s massive decline in investment results in tomorrow’s spot shortages. In a downside case, oil prices might not ever return to levels of the past. In any case, oil is in for some challenging times in the next few years. Further shale gas has unlocked abundant gas resources at lower breakeven costs vis-à-vis crude oil.

There is another obvious short term impact due to the pandemic on the industries manufacturing oil products. An immediate impact is the lowering of gas demand by 5 to 10 percent versus pre-crisis growth projections. Demand for refined products (like jet fuel) is down at least 20% and has plunged refining into crisis. McKinsey & co. estimates that it will be two years at least before demand recovers, with the outlook for jet fuel particularly bleak.

The immediate effects are already staggering. From an overall perspective, companies must figure out how to operate safely as infection spreads and how to deal with full storage, prices falling below cash costs for some operators, and capital markets closing for all but the largest players.

- Long term

Looking out beyond today’s crisis toward the late 2030s, the macro-environment is set to become even more challenging. Starting with the growth in demand for hydrocarbons, particularly oil, is set to peak in the 2030s, and then start declining. The pace of this decline today is estimated as a slow decline, however with technological advent in energy, may increase the rate of decline exponentially.

While geopolitical risks will continue to be a major factor affecting supply, new sources of low-cost, short-cycle supply will reduce the amplitude and duration of ‘up-prices’. The already hit shale oil and gas subsector will nonetheless continue to provide supply that can be rapidly brought onboard. Declining demand, driven by the energy transition, and global oversupply will make the task of OPEC and allies, harder rather than easier. Global gas and LNG will have a favourable role in the energy transition, ensuring a place in the future energy mix, supported by the continual demand growth in the coming decade. In the long term (post-2035), gas will face the same pressures as oil with peak demand and incremental economics driving decision making.

Further, the challenge of the energy transition will continue. Today, governments are intently focused on managing the COVID-19 pandemic and mitigating the effects on economies, which is deflecting attention away from the energy transition. However, the climate and environment debate are unlikely to go away. The innovation that has lowered costs for wind, solar, and batteries will continue and the decarbonization will be detrimental for the traditional industry. All in all, the industry is in grave peril.

Liked the Article you just read? Show us your support by clicking that like button and sharing it with your friends! Also don’t forget to leave your thoughts about the article in the comment section below.

You can become a part of our mailing list by clicking here

This is an excellent explantion for the fall in crude oil prices & the impacts. Looking forward to read many more such articles. Great work..!!