Background

It was during the Earth Summit in Rio do Janeiro in 1992, that a group of visionary leaders witnessed immense possibility in redefining the financial system to achieve sustainable development. Later on, the United Nations Environment Programme Finance Initiative (UNEPFI) was formed, which acted as a catalyst to assist financial institutions to move towards sustainable development.

Later in 2000, the UN Millennial Development Goals provided a clearer picture of the role of finance to speed up the transition to a sustainable economy.

What is Sustainable Finance?

In broad terms, “Green financing” or “Sustainable Financing” refers to the financing of investments in companies or projects that integrate environmental, social and governance (ESG) criteria into their investment decisions to steer the economy towards sustainability. There are various instruments to finance green projects and platforms to track the performance of these sustainability targeting companies which are covered elaborately later in this article.

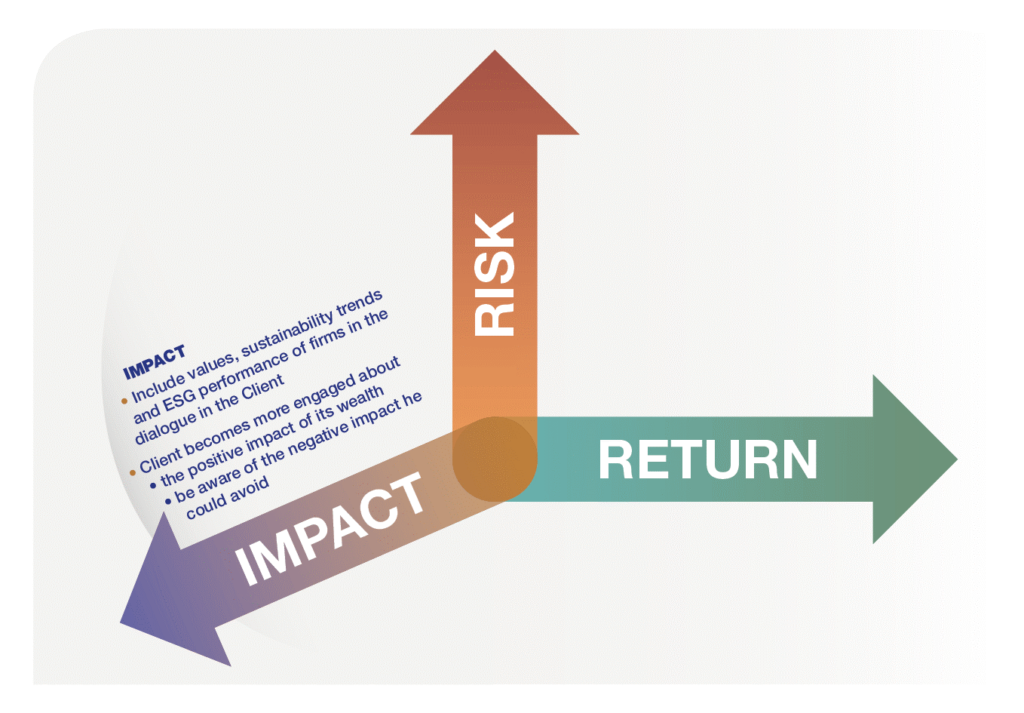

The Third Dimension

Sustainable Finance represents the third dimension of investment analysis which traditionally has been limited to the risk and return trade-off. Investors now look forward to give the impact criteria significant importance while investing their money in a company.

To construct a diversified impact investment portfolio, it is essential to first negatively screen companies and opt out of such investments and then positively screen to identify companies which add value and manage their ESG risks.

How can we filter “positively” impacting companies?

The role of Sustainability Indices (ESG):

Sustainability Indices are stock market indices that list companies based on their sustainability and long term ESG criteria. These indices periodically review and update the companies listed thereon, based on their sustainable performances. It helps investors to filter out which companies are “socially responsible investments” and thus make informed investment decisions.

The first ESG index, the MSCI KLD 400 Social Index (earlier, the Domini 400 Social Index), was launched by KLD Research & Analytics in 1990. After that, The Dow Jones Sustainability World Index was launched in 1999 as the first global sustainability benchmark representing top 10% of the biggest 2500 companies in the S&P Global Broad Market Index based on their sustainability and long term ESG criteria.

As of June 30, 2020, some of the DJSI’s top 10 constituents by weight included Microsoft Corp, Nestle, Bank of America, Alphabet Inc, and United Health Group Inc. (Source: Investopedia)

Indian ESG Indices:

i. S&P ESG India Index, launched in January 2008, depicts the performance of sustainability companies to help guide investments decisions. It consists of 50 Indian companies that meet ESG criteria which are taken from the largest 500 companies listed on NSE through a two-stage screening process.

ii. The S&P BSE CARBONEX, launched in November 2012, takes a strategic view of the organisation’s commitment to climate mitigation. It constitutes companies from S&P BSE 100 selected based on their carbon performance as measured by their level of Green House Gas (GHG) emissions.

iii. The MSCI India ESG Index lists companies with good ESG performance in comparison to their sectoral peers. Launched in 2013, the index is designed for investors who seek diversified sustainable portfolio with relatively low tracking error to the underlying market.

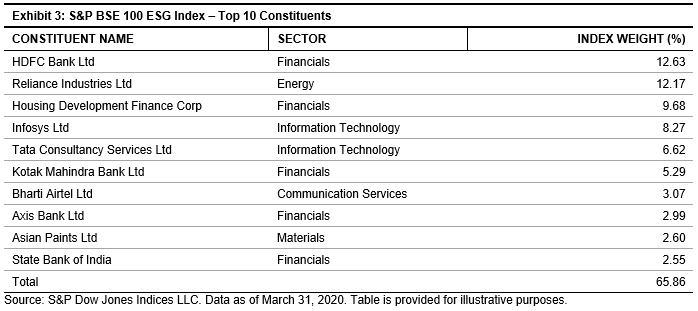

As of March 31, 2020, the S&P BSE 100 ESG Index had 64 constituents. Exhibit 3 shows the top 10 constituents in the index, which made up nearly 66% of the total index weight. HDFC Bank Ltd and Reliance Industries Ltd. had the highest weights at 12.63% and 12.17%, respectively.

Arguably, governance plays an important factor in India in determining the performance of a firm on ESG metrics. However, going forward, the effects of climate change and how businesses are tackling this issue will expectedly gain significance.

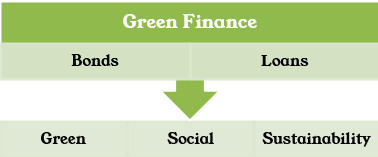

So, what are these sustainable finance instruments?

The sustainable finance market consists of bonds and loans. While there is not much difference in the application of the funds, the only difference lies in how the fund is raised. The funds for bonds comes from the investor’s market while for the loans, it comes from the banks.

Bonds:

The bonds are broadly classified based on their application, however, all the bonds serve one common purpose of funding sustainable projects. Let’s glance over some of the most commonly issued bonds in the sustainable finance market:

- Green bonds-

Green bonds are the bonds whose proceeds are earmarked for funding climate and environmentally friendly projects. In just over a decade, annual green bond issuance has grown over 100 times in terms of total value: from USD 1.5 billion in 2007 to USD 167 billion in 2018.

- Sustainability bonds-

The International Capital Market Association (ICMA) defines sustainability bonds as bonds whose proceeds are applied exclusively to finance or re-finance a combination of green and social projects, i.e. projects with clear environmental and socio-economic benefits.

- Social Bonds-

Social Bonds are yet another sustainable-debt finance instrument defined by ICMA as bonds whose proceeds are used exclusively to finance or re-finance social projects, i.e. projects with clear socio-economic benefits.

Loans:

- Green Loans-

These loans are exclusively committed to environmentally beneficial activities such as reducing the carbon footprint. These loans follow a similar structure as green bonds.

- Social Loans-

These loans are committed to funding companies or projects working on benefitting society, such as educating the underprivileged kids.

- Sustainability Linked Loans-

These loans are committed to the environment and social impact projects but follow a different procedure for issuance. These loans tie up specific sustainability metrics with the interest paid by the borrower, typically working like revolving credit facilities. This way, the borrower has a constant financial motivation to outperform their set ESG targets.

How big is the sustainable finance market?

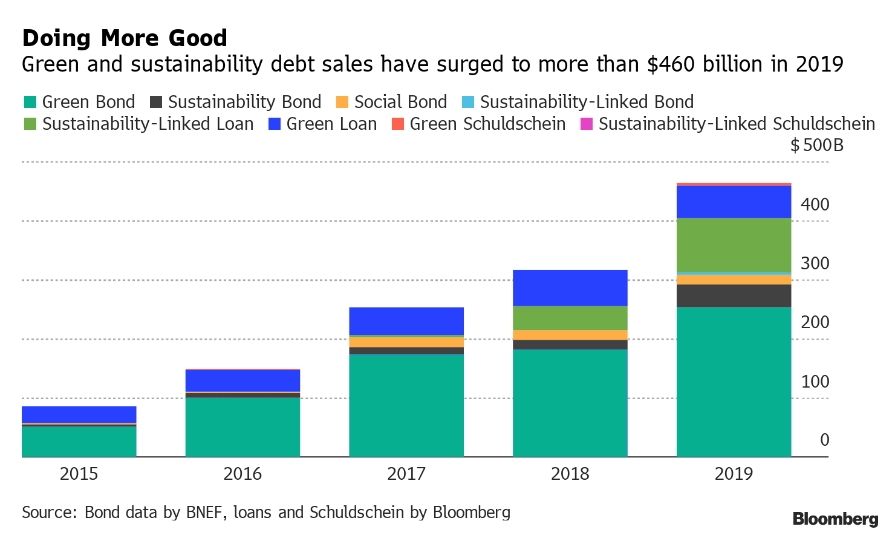

The sustainable finance market surged 26% in 2018, with a record USD 247 billion worth of sustainability-themed debt instruments raised during the year, according to BloombergNEF‘s research.

The growth of the sustainable finance market can be analysed from the graph above. Green bonds continue to dominate the market. Several reasons can be sighted for the same. The regulatory environment for green bonds is the most developed compared to other sustainable finance instruments, and the sustainable-effects of green bonds are easier to verify. Also, green bonds issuance dates back to 2007, whereas the first sustainability bond was only issued in 2014, the first social bond in 2015, the first green loan in 2016, and sustainability-linked loan in 2017.

Overview of Sustainable Finance Market in India:

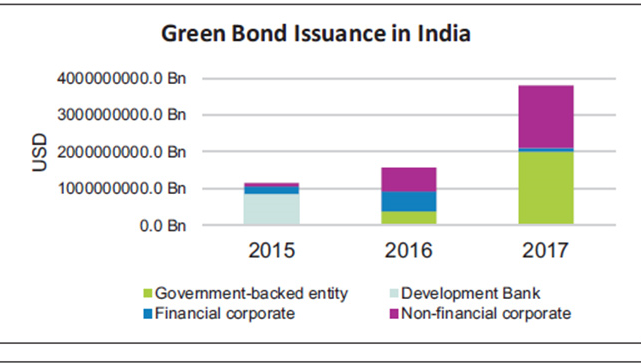

The Indian green bond market had its first green issuance in 2015 and 20 green issuances have happened since. To scale up the green bond market, the Securities Exchange Board of India (SEBI) in 2017 issued national-level regulatory guidelines for issuance and listing of green bonds. As of November 2018, India had issued green bonds valued at US$ 7.15 billion. The amount is minuscule, given the size of India’s economy and when compared to the vastness of green bond issuances by the US (US$ 34 billion) and China (US$ 31 billion).

From the graph above, we can witness the growth in the issuance of green bonds in India. Also, most of the green bonds are issued by the government, followed by non-financial corporates. Issuing institutions include public sector backed entities like IREDA (Indian Renewable Energy Development Authority), Indian Railways Finance Corporation, non-financial corporates like Greenko and private banks like Yes bank (now maybe considered public with SBI being their largest shareholder).

Yes bank marked the beginning of green bonds in India by issuing the first green bond in February 2015 to finance renewable energy projects.

What needs to be done?

India has become the second-largest emerging green bond market after China with USD 10.3 billion worth of transactions in the second half of 2019. However, the amount of investments as compared to China is minuscule. This can be seen as a sign of long runaway of growth left in this space and shows a lot of hope for the future of the green bonds market in India.

- Encouraging retail participation:

Green finance is not just limited to large scale projects such as renewable energy, recycling etc. but also smaller projects such as combating pollution or control systems. Retail banks can support the adoption of smaller projects that are rooted locally. These retail banks can effectively act as an intermediary by spreading awareness about opportunities in green finance and seeking investments for sustainability targeting companies from retail customers.

- A gap between supply-demand:

Less than 10% of asset managers use data available on ESG indices which depicts a gap between demand and supply of such information. The supply of the data needs to be accompanied by greater awareness and better policies to bring coherence.

- Development of Green Bank:

A green bank is a financial institution whose primary objective is to help accelerate the flow of green funds and the growth of sustainable finance market. Globally countries like the UK, Japan and Australia have created nationalised banks to leverage private investments in green technologies. In India, IREDA promotes renewable energy investments. In 2016, it announced plans to start exploring the idea of becoming India’s first Green Bank. This move will coordinate public and private investments and enhance the sustainable lending and borrowing process.

- Change in approach from red light to “green” light:

The policies and advocacy is concurrently focused on what should not be done, adopting strict rules and ensuring adherence of them, in other words, a “red lights approach”, However, hardly do we see measures undertaken, to encourage companies to innovate and solve the existing problems through their business practices. The system needs to be complemented with a “green lights approach” where the government works on creating an atmosphere where long term factors such as ESG performance is as important for companies as quarterly financial statements.

Summing it up

Sustainable finance plays a significant role in tackling environmental and social issues. The changing perception of investors and hence their buying pattern especially for the millennials show huge growth potential for companies and institutions that have a good ESG performance. As a socially responsible investor, your first step towards sustainable finance starts with understanding the bond market and the financial instruments that are offered and then choosing to invest in the companies that help you achieve your non-financial objectives along with the financial returns.

The green lights approach to Sustainable Finance has been covered extensively in the article by The Economist. Please check it out here:

https://www.economist.com/open-future/2019/12/12/how-to-rethink-environmental-policies-from-no-to-go

Thank you and Stay Safe!

Follow Us @

Some Unrelated Stories!