Background

In recent years, Mergers & Acquisitions (M&A) have been materialising at an unparalleled pace in the corporate arena. Research suggests that global M&A activity has seen tremendous growth in the last 10 years. In terms of overall value and number of deals, FY19 stood at almost $ 3,500 Bn across 20,000 transactions vis-a-vis FY09 with merely US$ 1750 Bn across 10,200 transactions. This is a definitive indication that more and more companies have accepted M&A activity as a strategic choice for organisational growth.

M&A Principle of 2 + 2 = 5

Combining or merger of two companies is undertaken as there is a perception of synergistic benefits (more so with identical business) primarily through higher revenues, lower expenses or lower cost of capital.

Additionally, M&A provides companies with an edge over its competitors through increased market share/ consumer base, diversification of portfolio risks, economies of scale and certain tax advantages.

Companies also undertake M&A activities for internal restructuring majorly with an objective of streamlining corporate structure.

Meaning of M&A

As the term suggests, ‘Merger’ is consolidating or combining two or more companies to form one company. On other hand ‘Acquisition’ is one company taking over another company.

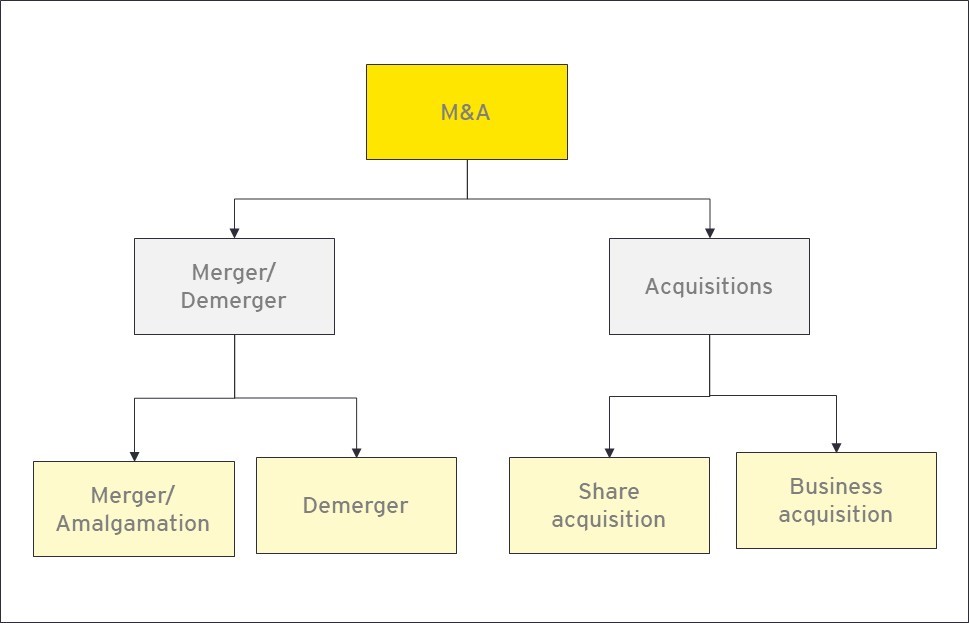

This article focuses on core M&A activities that can be broadly classified as follows:

1. Mergers/ Demerger

- Merger/ Amalgamation

- Demerger/ / Spin off / Hive off

2. Acquisition

- Share acquisition

- Business acquisition

1. Merger/ Amalgamation and Demerger / Spin off / Hive off

- Merger/ Amalgamation:

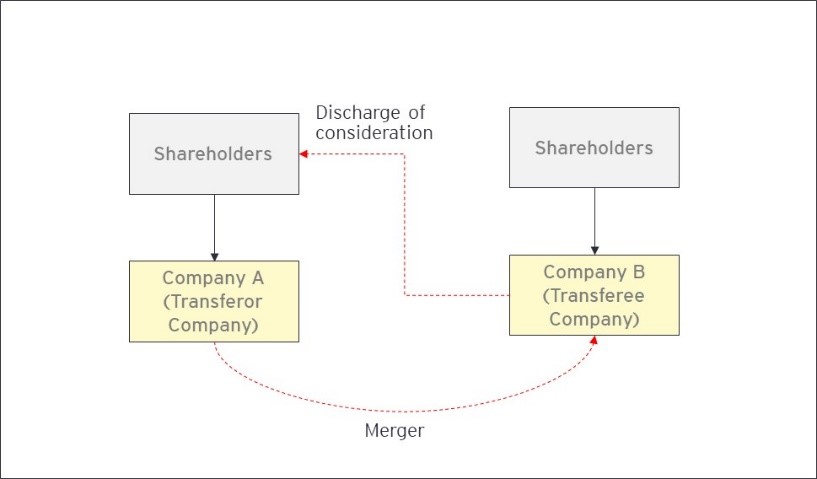

Mechanics and concept:

All assets and liabilities of one or more amalgamating/ transferor company(ies) is transferred to amalgamated/ transferee company and in return, the transferee company discharges merger consideration to the shareholders of transferor company(ies) in the form of cash or issuance of shares of the transferee company.

This is a court driven process. The jurisdiction of the court depends on the place of registration of the transferor company(ies) and transferee company. Meaning, if multiple jurisdictions are involved, approval will have to be taken from all the relevant jurisdictional courts (In this case National Company Law Tribunal (NCLT)) of the respective jurisdictions. Post completion of the merger process, the transferor company(ies) would cease to exist.

Generally, mergers are perceived as friendly and planned. Types of mergers include:

Horizontal mergers: Merger between companies that are direct competitors with each other in terms of products or markets.

Vertical mergers: Merger between companies are part of the same supply chain (Example: A retail company in manufacturing garments merges with a company that supplies cloth for manufacturing garments).

Conglomerate mergers: Merger between companies that are not in similar/ same line of business (Example: Food manufacturing company mergers with a software manufacturing company).

Concentric mergers: Merger between companies in different industries but having same/ similar customer base (Example: Mobile manufacturing company mergers with a headphones manufacturing company).

Reverse merger: Merger of a private limited company into a listed company or merger of smaller/ weaker company into a bigger company or merger of the parent into its subsidiary.

Merger as a mode of acquisition has the following advantages:

Synergies: It helps the transferee company to business synergies and expands its market share and consumer base.

Tax: It may have favourable tax implications such as exemption from capital gains, fresh life of carry forward of tax losses of transferor company(ies) to transferee company, the tax break on goodwill arising (if any) pursuant to the merger in the books of the transferee company, etc.

Value creation: Generally helps to create value for stakeholders of the transferee company.

While there are definite advantages of mergers, there can be certain drawbacks too:

Timelines: A typical merger would take approximately 6-8 months. Again, if a listed company is involved, considering approval from Securities Exchange Board of India (SEBI) or any specific industry approval such as Competition Commission of India (CCI), Exchange control approval etc., the timeline would extend further by ~ 3 months.

Approvals: The process requires approvals from various regulatory authorities (e.g. Central Government, Registrar of Companies, NCLT, Income Tax Authorities, Official Liquidator, any other relevant authorities on case to case basis)

Transaction costs: Compared to a straight-forward share acquisition, it involves higher implementation costs

- Demerger/ Spin off / Hive off:

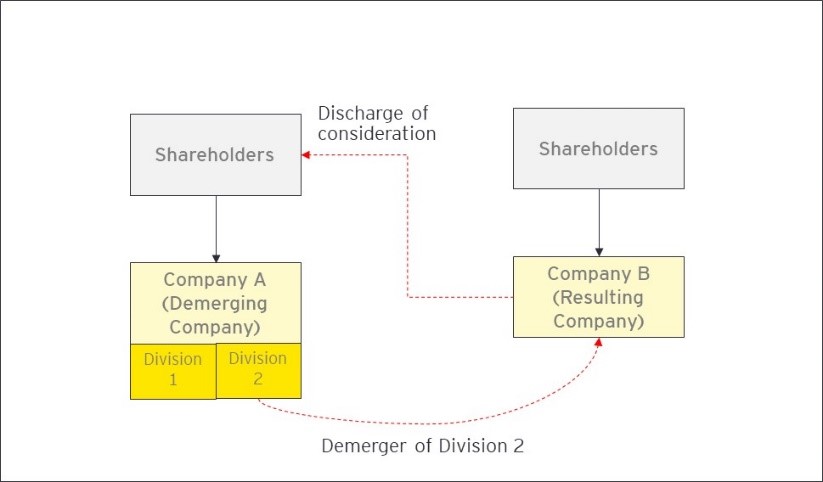

Mechanics and concept:

All assets and liabilities of an identified business undertaking from demerging company to resulting company and in return the resulting company discharges demerger consideration to the shareholders of demerging company in the form of cash or issuance of shares of the resulting company.

Identified business undertaking means any division or unit of a company that constitutes a business activity.

This is a court driven process similar to that followed during a merger.

Typically, companies having multiple divisions/business segments prefer to demerge low performing business to unlock value for its stakeholders. A demerger is also preferred where an investor is only interested to invest in a specified business undertaking of a company. Types of demerges include:

Split: Demerger of a division or line of business into a separate company.

Spin-off: Demerger of a company involved in multiple businesses into separate companies for each business.

Sell off: Demerger of identified business undertaking into a separate company with an intention to sell off the business to an investor/ third party.

Demerger as a mode of acquisition has the following advantages:

Value unlocking: Demerging a loss-making or non-core business undertaking results in value unlocking for stakeholders of demerging company. Further, demerging a profit-making business undertaking results in value unlocking for stakeholders of the resulting company.

Attracting investors: Demerger provides an opportunity to investors to invest in the desired business undertaking of a company.

Focus on core competencies: Demerging non-core business undertaking helps the management of demerging company to focus on their core competencies.

While there are definite advantages of demerger, it has the same drawbacks as mergers.

2. Acquisitions

- Share acquisition:

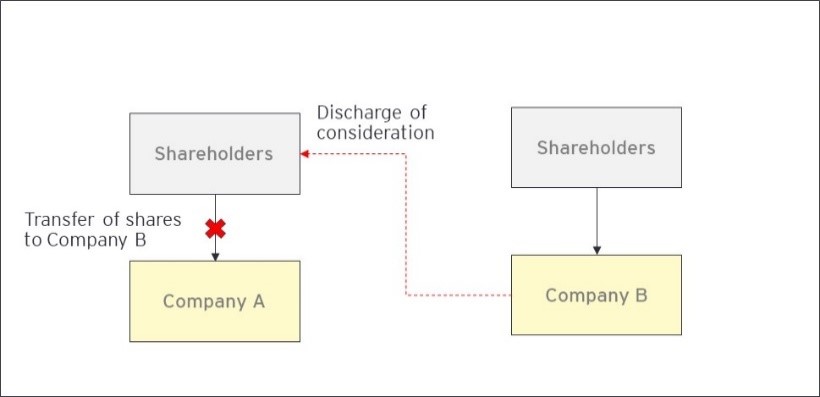

Mechanics and concept:

In share acquisitions, a company purchases stake in another company (typically controlling stake or ≥ 20% stake) for consideration payable to the sellers in cash or kind.

Post-acquisition, the acquired company comes under the name of acquiring company. Types of share acquisitions include:

Hostile acquisition: Acquisition of shares of the target company directly from its shareholders to gain control over the target.

Back flip acquisition: This is an uncommon form of acquisition where the acquirer becomes the subsidiary of the acquired company post completion of the deal.

Reverse acquisition: Acquisition of a listed company by a private limited company.

Friendly acquisition: Acquisition of shares of the target company with full knowledge and consent of target’s management.

Share acquisition as a mode of acquisition has the following advantages:

Control: It provides the acquirer control over the target’s assets and income. Further, it also provides the acquirer decision making powers.

Income: Provides a source of income in the form of dividend and capital gains (at the time of exit) for the acquirer.

Synergies: Acquisition of target in a similar line of business helps the acquirer to expand its market share and consumer base.

Limited Liability: The liability of the acquirer is limited to the extent of investment in the target. This provides protection to the acquirer against any future liability of the target that devolves upon the acquirer.

Liquidity: Shares can be easily sold off-market and/ or on market (only in case of listed shares) or through an IPO.

Ease in implementation: Compared to a merger or demerger, it is faster and requires lesser regulatory approvals.

Transaction costs: Compared to a merger or demerger, it can be achieved with lower implementation costs.

While there are definite advantages of share acquisition, certain drawbacks are:

Risk: There exists a risk on fall in share prices of the target.

Returns: Compared to a debt investment which provides fixed returns, dividends yield in case of equity investment depends on the target’s performance.

- Business acquisition:

Mechanics and concept:

A company acquires identified business or assets of another company for consideration payable in the form of cash or issuance of shares to the seller. Post business acquisition, the acquirer and the seller both remain in existence.

Unlike merger and demerger, business acquisition can be achieved without the involvement of court (i.e. by executing a business transfer agreement).

A business acquisition can be bucketed into two categories:

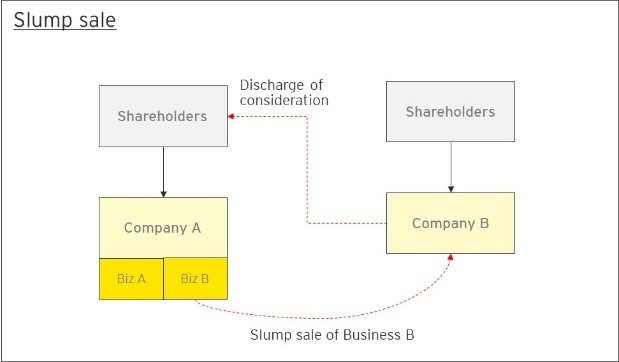

Slump Sale: Transfer of identified business undertaking on lock, stock and barrel basis for a lump sum consideration.

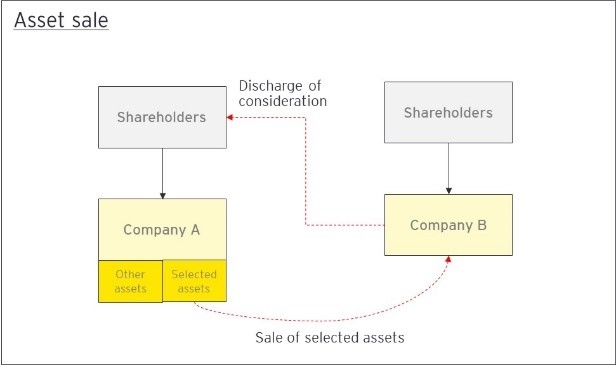

Asset Sale: Transfer of identified assets or liabilities of a company by assigning values to each class of asset.

Business acquisition as a mode of acquisition has the following advantages:

Ease in implementation: Compared to a merger or demerger, it can be implemented faster and requires lesser regulatory approvals.

Investment flexibility: It enables the acquirer to acquire specific assets/ business undertaking that may supplement its current business.

Focus on core competencies: From a seller’s perspective, sale of identified business or assets may facilitate the company to focus on its core competencies and attract strategic investors.

While there are definite advantages of business acquisition, there can be certain drawbacks also:

Tax and regulatory costs: Possible stamp duty and indirect tax (Goods and service tax – in the case of an asset sale) considerations.

Transaction costs and approvals: High implementation cost and regulatory approvals if the business acquisition is done through NCLT process.

Conclusion

James Penny, founder of JC Penny (a leading departmental store in the United States of America) has rightly quoted; “Growth is never by mere chance; it is the result of forces working together”. In today’s world, growth and expansion is the essence of a successful business. M&A act as a catalyst to this objective. Depending on the company’s needs, objectives, mission, vision and assessment of the company’s SWOT, M&A could indeed provide a much-required boost to kick start business expansion.

Happy reading…Stay safe!

Source for M&A statistics:

https://www.etftrends.com/core-equity-channel/dont-expect-to-see-another-strong-year-for-ma-in-2020/

Follow Us @

Some Unrelated Stories!