Using currency exposure can be an effective method of mitigating currency risk for an entity. The fundamental difference between options and forwards is that options provide the entity with participation in the gains if the currency pair favors the option buyer for an upfront cost (called option premium). A potential increase in favorable movement in the currency pair can be of immense value to operating in a fiercely competitive market. The entities can pass on the benefit of such a promising market movement to their final consumers. Let us look at how entities mitigate their currency exposure using different option structures.

An entity is far more likely to use a currency forward rather than a currency option. According to a report published by Bank for International Settlements published in 2019, the daily average OTC turnover adjusted for local and cross-border double-counting for currency forwards is approximately USD 1 billion compared to approximately USD 300 million for currency options. This ratio is more skewed in a developing financial market such as India.

Current RBI regulations prohibit speculation on the over-the-counter market in India. According to RBI’s master direction on Risk Management and Inter-Bank Dealings, exposure can be either Contracted (already entered into) or Anticipated (expected to be entered into in the future).

As a risk management tool, options can be purchased as vanilla calls (for importers) or put opportunities (for exporters). For the sake of convenience, all the forthcoming examples are from an importer’s perspective for a European option on the USD/INR currency pair. Payoff tables are excluding the premium amount.

In addition to buying a call, an importer can also sell a call or put into reducing the upfront cost of the option.

Range Forward

When an importer sells a put and buys a call, this strategy is a risk reversal or a range forward. For example, an importer would buy a call at 75 and simultaneously sell a put at 72.

The strategy can create a synthetic forward contract by buying a call and selling a put at the same strike price. (selling the put for a lower notional than the call option leg.) instead of completely letting go of the benefit of rupee depreciation, an entity can enter into a participatory forward.

Call Spread:

Another strategy involves buying a call option and simultaneously selling a call option at a higher strike price. This strategy is recognized as a call spread. It can be created by buying a call option at 75 and selling a call option at 76. Through this strategy, instead of fixing an upper or lower bound on the final price, the entity selects a benefit on the spot by such exercised options. For example, if the spot price on expiry turns out to be 80, the final price at which the entity purchases USD would be 79, i.e., spot minus the difference between the call option strikes.

Seagull:

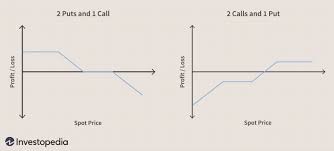

A more complex extension is when an entity

1. Buys a call option

2. Sells a put at a lower strike

3. Sells a call at a higher strike.

This strategy would be created by buying a call at 75, selling a put at 72, and selling a call at 76. This strategy is recognized as a seagull due to its wing-shaped payoff diagram (as illustrated below). In this strategy, the entity forgoes its benefit in rupee depreciation by selling a put while increasing its cost in case of rupee appreciation. The most sought-after iteration of this strategy is a zero-cost seagull, i.e., the entity does not pay any upfront premia while entering into this strategy.

The new RBI master direction allows non-retail users to enter into any derivative structure which the Authorised Dealer can price and value independently. However, the same should be approved by the board of the Authorised Dealer. Another condition is that the potential loss from the derivative transaction to the user, in any scenario, does not exceed the loss that the user would face if he had left the position unhedged.

This opens up many alternatives, such as using a barrier in any of the legs of a structured option. It is a positive step in the direction of evolving the currency derivative market in India.

The views expressed in this article are personal and are in no way an investment recommendation.

Follow Us @