Hello Avid Readers,

I was wondering lately that it is very easy to invest small, irregular amounts in crypto currencies, small and mid cap equities, and flex those high returns which the current bullish markets lately offered!

But, I personally feel teenage investors don’t like me somewhere lack that long tem planning.

We all condemn FDs but somehow invest in them only when in 30s as either we may be uncertain of playing long term game in the equities market or may be unaware of the alternative options available to us which have zero to little risk of default and provide better returns than FDs! Most importantly, you don’t have to rush your adrenaline while investing in these for long term like you might do when investing in Small Cap Stocks or Crypto Currencies!

So this blog is meant to bring in front of you the 10 alternative investment options excluding the ‘Futile FD’! I will just tell you the motive of using the word futile shortly!

One disclaimer, Crypto Currency or any equity market stock category is not included in the list! Its just about the minimum risk and stable returns which investors like you and me wish to achieve in the long term without becoming “Khatron ke khiladi” unnecessarily and tracking our heart beats as well as our investments because of those 20-30% downs and ups in fraction of minutes and also due to the small size of the market which makes it really unstable.

Also, neither are we going to consider PPF i.e. Public Provident Fund or NPS i.e. National Pension Scheme as they have high lock in periods.

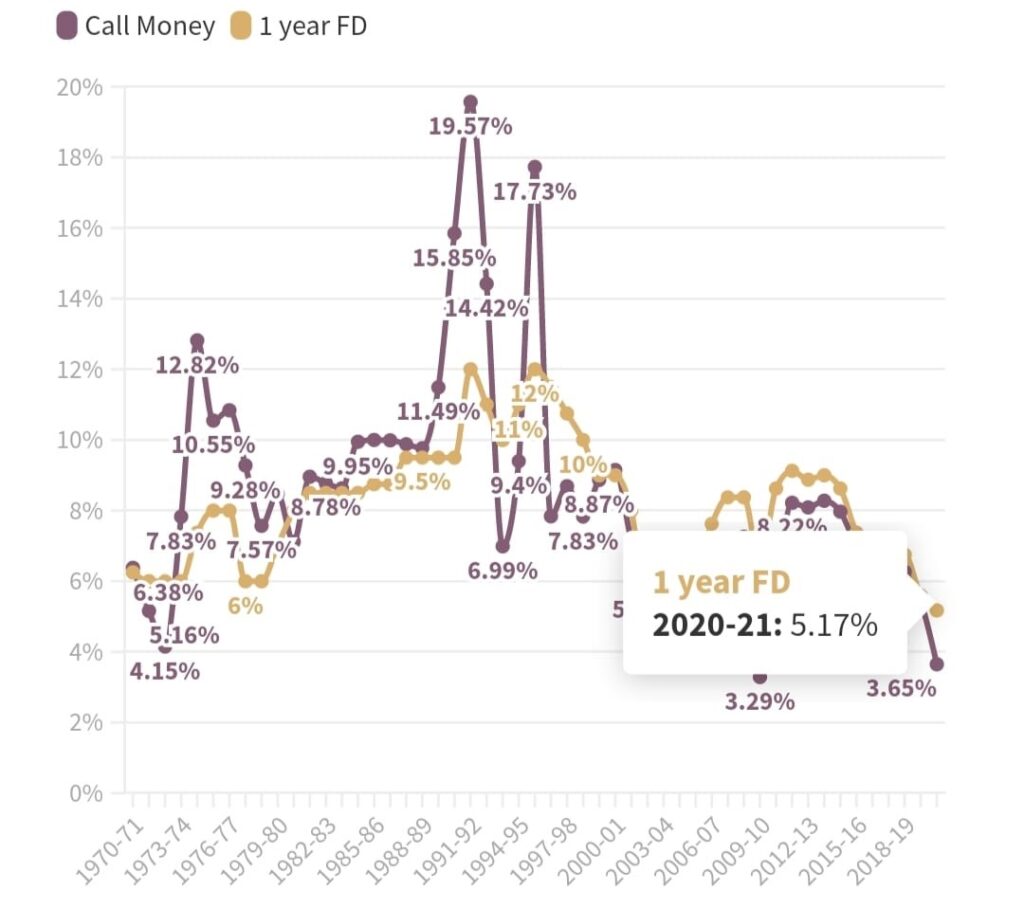

Now, Talking about the uselessness of investing in FD’s can be easily explained considering the following figures. Interest rates on FD’s with nationalised banks are around 5%! The following chart also depicts the falling interest rates from 12% in 1995 to even less than half of it in 2020-2021.

Now,5% may have seen reasonable but the inflation rate in India currently is 6.26%!

The cherries on the cake being the triple digit returns which the equity markets have provided in last couple of months and the taxation which is applicable on this 5% FD return!

Now, one can definitely say that the returns provided by equity markets were in exceptional situations and the long term returns NIFTY and SENSEX returns are somewhere between 12 to 13%.

No doubt on it!

But these are still able to beat the inflation rate! Moreover, people falling under 30% Tax slab are highly vulnerable and can only expect 3.5% returns from FD as post tax return, ultimately reducing the value of money they shall have in the future! And we have not yet considered the Education Cess which shall be levied on the returns next:)

So, without any further ado, let’s find out the FD killer options with stable returns over a long term horizon! All the alternatives are depicted below before we learn about each one of them in detail.

So the first on our list is-

1) Corporate FD:

In layman’s language, it is the FD or Fixed Deposit from the corporate houses and NBFCs. Now, generally returns from corporate FDs are 1-4% higher than the returns offered by Fixed Deposits.

One must ensure that they only buy high rated corporate FD by checking the rating of the company. Past repayment history is also recommended to check once.

I feel, two of the biggest advantages of investing in Corporate FDs are that at the very same risk which you take while investing in Bank FDs which is negligible, Corporate FDs also carry negligible risk and provide guaranteed returns which are better than FDs.

Also, investor knows at the beginning the amount he will be making after the tenure of investment ends,thus he can make his financial decisions accordingly. This is not the case with Bank FDs!

Now, to ensure that you enjoy the first advantage, it is very important to check the FAAA credit rating from CRISIL and MAAA credit rating from ICRA.

Triple A’s ensure highest safety!

FAA ensure high safety.

FA suggests adequate safety.

Of course, you cannot expect exceptional returns since you playing at almost no risk when investing in these high safety securities!

Corporate FDs from HDFC, Bajaj Finance are highly secured.

Also, these securities are also taxable as per your income tax slab. This means, if you fall under the 30% tax bracket, you pay 30% tax on interest earned in corporate deposits.

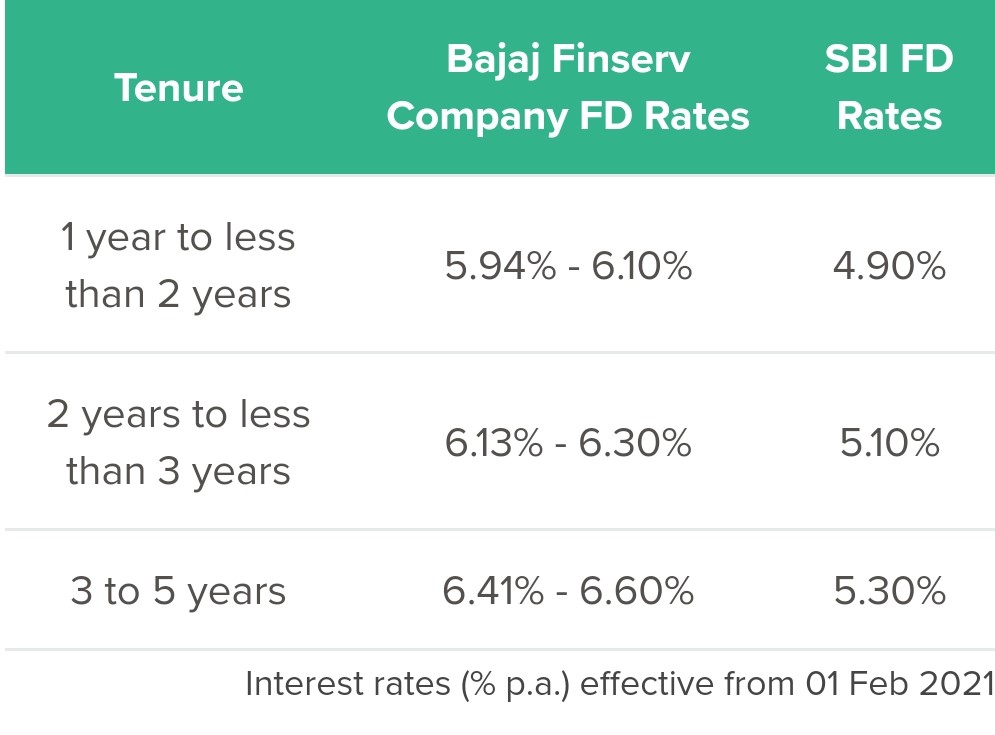

The below table shows the difference in the FD and Corporate rates when compared to Bank FD rates when seen in different time zones.

Also, one more thing, Over and above these interest rates, senior citizens can take benefit of an additional benefit of 0.25%. So, say, if an individual invests with Bajaj Finserv for less than 5 years, and say he will earn an interest rate of 6.60%, for a senior citizen, the interest rate in this case would be 6.35%.

The top performing Corporate FDs right now in India considering the credit rating and the returns they offer are:-

- Shriram Transport Finance FD(upto 7.95% for individuals when invested for 5 years)

- PNB Housing Finance(upto 6.70% for individuals when invested for 5 years)

- ICICI Home Finance Ltd.(upto 6.65% for individuals when invested for 5 years)

There are many of them offering somewhat similar returns, please do your own due diligence before investing in any of them!

2) Non-Convertible Debentures(NCD):

Alright, one of the best thing about this asset class is that these debentures can be bought/sold in the secondary market.

Moreover, NCD are of two types–

Secured NCD wherein in case of bankruptcy, the investor would be compensated first after selling the assets of the company.

For Unsecured NCD, needless to say, it is not the case i.e. these are not backed by the company assets and only based on the creditworthiness of the issuer. Also, undoubtedly, Unsecured NCD carry higher returns since they are more risky to invest in when compared to Secured NCD.

Like corporate FDs, it becomes really important to check the credit ratings of these debentures.

So, how to purchase them?

They are listed on the stock exchange and one can buy them through one’s respective registered broker.

It becomes very important for the investors to thoroughly check the company’s background as well as the credit rating(by ICRA, CRISIL, etc.) to ensure that they park their money in the right NCD!

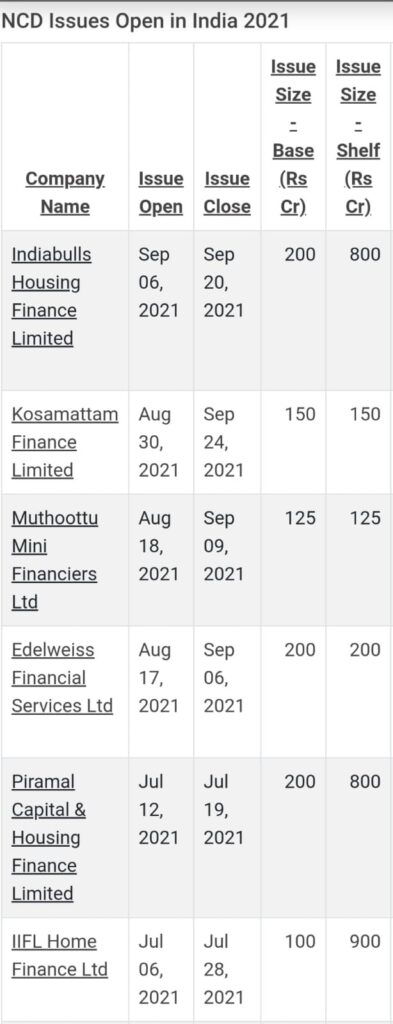

Below,are the recent NCDs being listed on the stock exchange.

3) RBI Bonds:

I am sure most of us have at least heard this name before in our school economics textbook! So, as by the name, these are the bonds issued by the Government of our country.

They are one of the securest options to invest in, until and unless the government defaults! Which cannot be the case, because the entire economy will crash in that case:)

Alright, remember, this interest rate is floating and keeps on changing every six months. The interest earned would again be taxable as per your income tax slab. One of the drawbacks of the RBI bonds can be that they have a lock in period of 7 years. The current interest rate on RBI Bonds for period July 1, 2021 to December 31, 2021 and payable on January 1, 2022 remains at 7.15%, unchanged from the previous half-year.

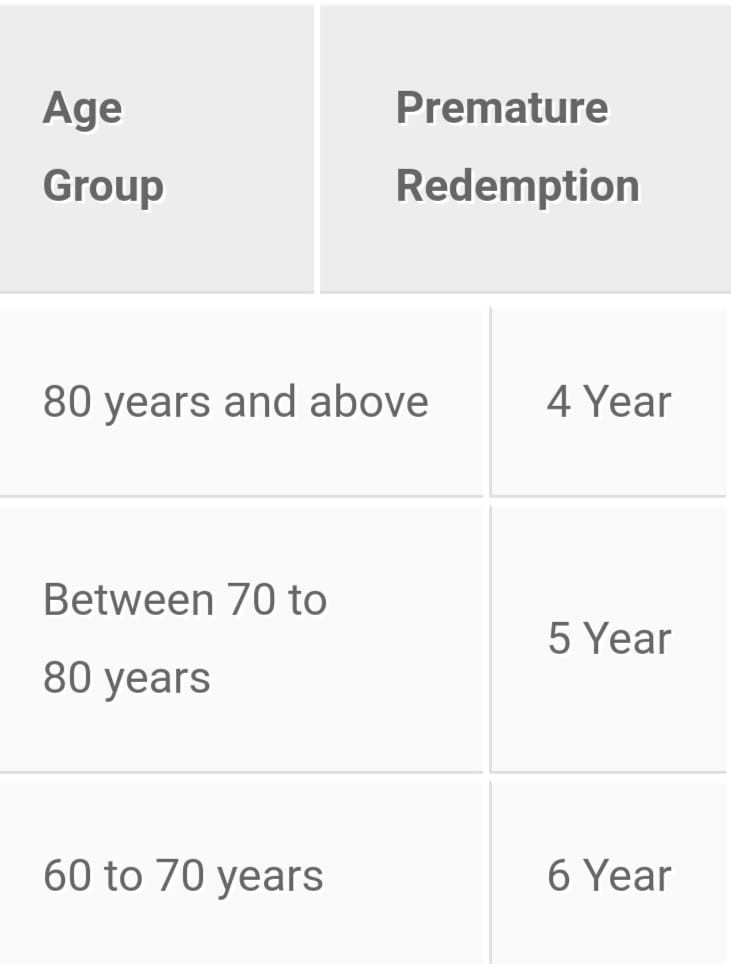

Before purchasing these bonds from any Nationalised bank, Private Bank or Stock holding corporation of India, do remember that RBI bonds are not eligible for trading in the secondary market in India and can’t be used as a guarantee for loans from banks or other financial institutions. Here,as well, there are special privileges for the old age people. The privilege is not by promising extra return but by promising early redemption i.e. Senior citizens may take a premature exit after 4, 5 and 6 years from these holdings based on age group.

4) Savings Account of Small Finance Bank:

As by the name, instead of investing your fund in the top private or public banks, consider small savings bank account by small finance banks also as an option!

Like, AU small finance bank, gives an interest rate of 6%, when investing any amount between 10 lakhs to 25 lakhs. It offers 7% interest if the balance is between 25 lakhs to 2 crores. The best part is that all the small finance banks are registered under deposit protection scheme and money upto Rs.5 lakhs is insured. And this was when you are investing in only one small finance bank, the more banks you pick up to invest in the protection limit shall increase in multiples of 5.

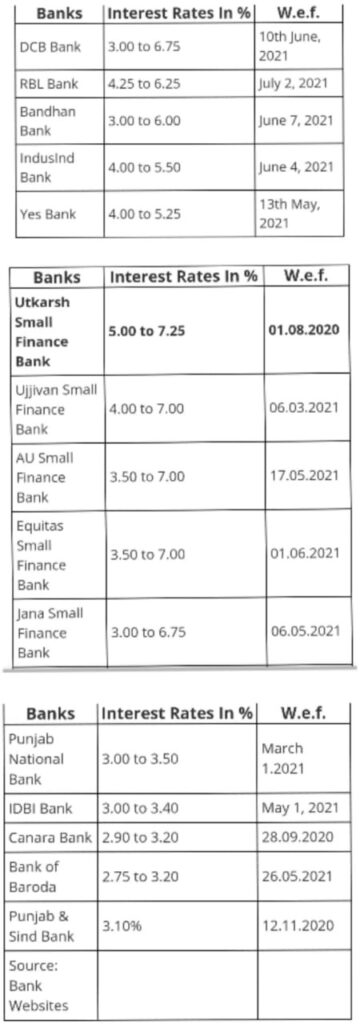

Thus, interest rates offered by small finance banks on savings account are much higher when compared to leading private and large public sector banks. Seeing the numbers, HDFC Bank, ICICI Bank and Axis Bank offer 3%-5% interest. The Kotak Mahindra Bank is offering somewhere up to 4%. The State Bank of India (SBI) is offering 2.70% interest and Bank of Baroda is offering up to 3.20% interest respectively.

The picture below the shows the saving accounts interest offered by small finance,private and public sector banks and the dates from which they came into effect!

Your task is to identify the category of banks by yourself from the tables:)

5) National Savings Certificate:

Alright, so I guess many of you must have heard of it as well!

National savings certificate schemes are part of the post office savings scheme offered by the government. The current guaranteed return offered by the scheme is 6.8%. The best part here ,this investment can be used to reduce our taxable income by Rs.1.5 lakhs under Section 80C of the Income Tax,1961. But again, a drawback for some may be the lock in period which is 5 years. One can invest in these either via the post office or via the nationalised banks both online and offline.

One can invest as low as Rs.1,000 as an initial investment, and increase the amount when feasible.

Unlike RBI bonds, Banks and NBFCs accept NSC as collateral or security for offering secured loans.

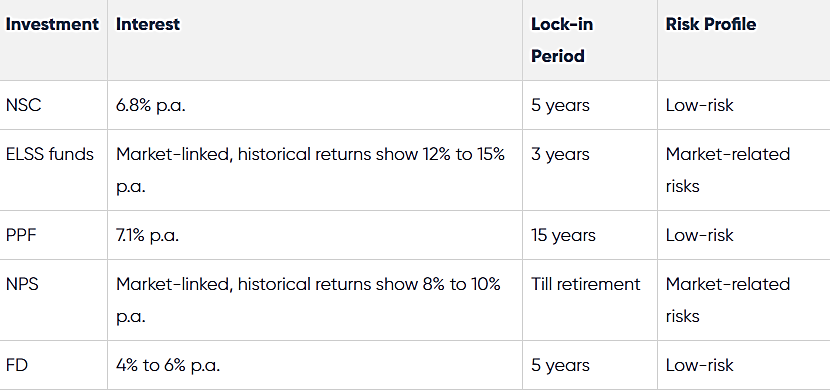

Section 80C,1961 also has other investment options under it. The other popular options available are Equity Linked Savings Schemes (ELSS), National Pension System (NPS), Public Provident Fund (PPF) and Tax-Saving Fixed Deposits (FD). The table in the picture below compares NSC with other tax-saving investments:

Alright readers, we are done half way! The next 5 options cater to the Debt Mutual Fund and ETF category!

Alright so before diving in to know the names of the schemes under this category, it is important to know the benefits they offer overall!

Liquidity and Lower tax rate with indexation benefits(if invested for more than three years)are the benefits one can get! Post tax returns prove out to be a game changer due to indexation benefits.

The Short term capital gain tax(STCG) stands at 30%.

The Long term capital gain tax(LTCG) stands at 20% with indexation benefits.

One catch is that the returns here are not stable and infact change each and every day.

So, now let’s see on the last five options quickly.

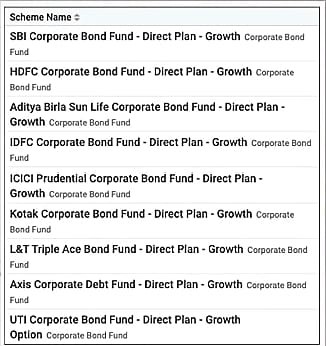

6) Corporate Bond fund:

This is a mutual fund category where the mutual fund invests more than 80% of their total resources in corporate bonds which offer returns ranging between 6% to 8%. The volatility is around 1%-2%. Now, it goes without saying that top rated bonds must only be considered. They are ideal for risk-averse people looking for high returns. The time period of the top rated corporate bond funds generally ranges between 1 and 4 years. Corporate bonds generally offer higher interest rates as they carry higher credit risk whereas Government bonds are more stable, as they have negligible default risks.

Corporate bond mutual funds operate in the stock market just like any other normal mutual fund. An increase in the value of a corporate bond carried in the portfolio of the mutual fund increases the NAV of the fund, thereby leading to profit creation. On the other hand, a fall in NAV value has a contrary effect on the aggregate value of the mutual fund resulting in losses. Some of the best Corporate Bond fund schemes are depicted below.

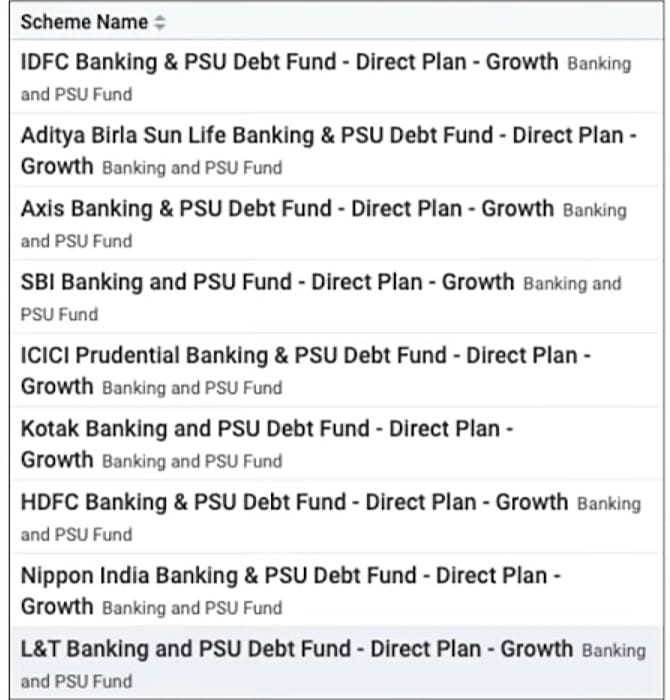

7) Banking & PSU Debt Fund:

They invest 80% of their corpus in PSUs of banks, PSUs and other government bodies. Again, they also offer returns ranging between 6% to 8%. The volatility is around 1%-2%.Companies issuing banking and PSU funds have a minimum of AAA- credit rating from the best agencies of India. For this category, Fund managers target the Maharatna and Navratna companies to build an ideal portfolio, as they have a history of yielding substantial gains. The best banking and PSU debt funds comprise public sector companies and top-performing banking organisations. Hence, the risks associated with such investment are minimal, as the amount is secured by central government backing. Moreover, debt funds by nature have lesser risk. In times of unforeseen downtrend in the stock markets, money deposited in top rated debt mutual funds can provide considerable returns to compensate for lower returns from the risky assets during tough times. Some of the best Banking & PSU Debt Fund schemes are depicted below.

8) Money Market Funds:

Just Three more to go!

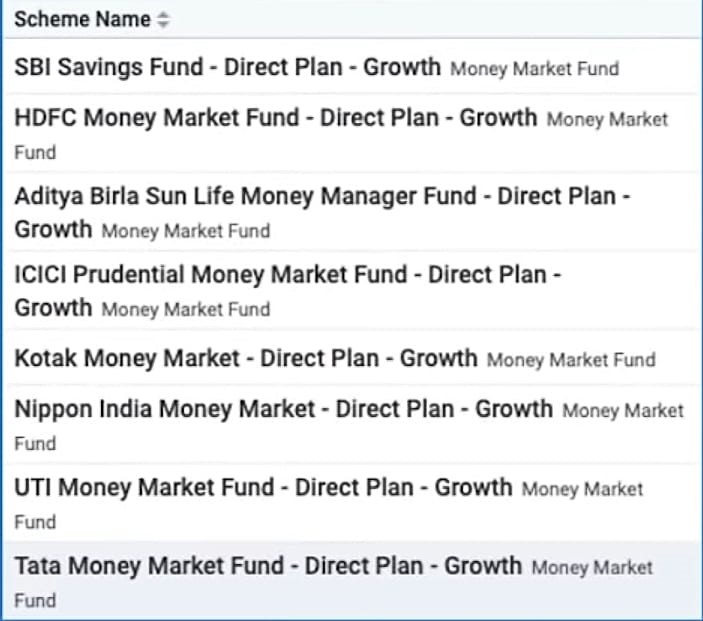

Remember the 12th class BST booklet, commerce people! The NCERT page explaining the various money market instruments in brief. Commercial Paper, Treasury Bills, Certificate of Deposit etc. To recall, Money Market is basically an exchange where the trade of cash and cash-equivalent instruments takes place regularly. The instruments that are traded in the money markets have maturities which can vary from overnight to 365 days i.e. one year.

Alright, So, Money Market funds invest in funds with maturity of less than 12 months. It is a comparatively less volatile debt fund category with return ranging from 4%-6%.As taught even during school days, investors with idle cash lying in their savings account can earn better returns by investing in these funds. Money market funds are recommended to investors with an ideal investment horizon of 90-365 days. These schemes can help one diversify his/her portfolio and help invest surplus cash and on the same time maintaining liquidity. Some of the best Money Market Funds schemes are depicted below.

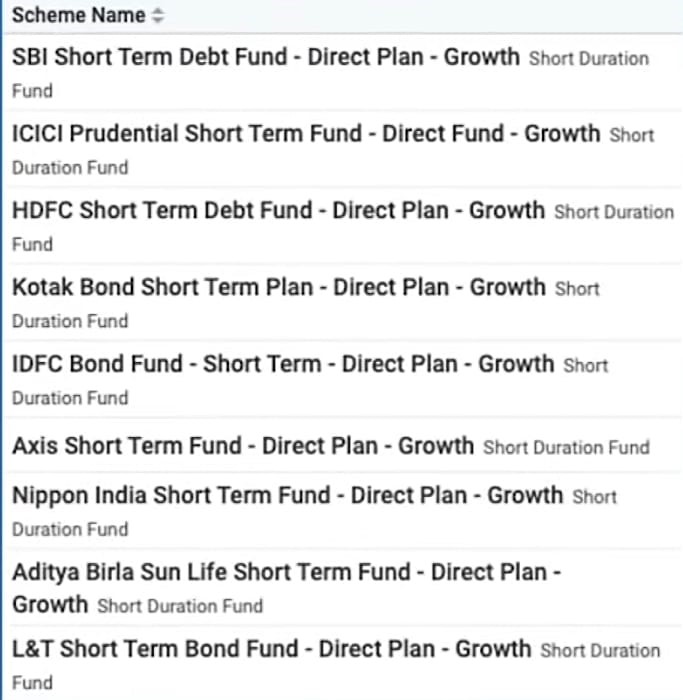

9) Short Duration Funds:

These funds invest in bonds with maturity between 1-3 years. Like the corporate bonds and Banking and PSU bonds, these funds are slightly volatile and provide investors with returns ranging from 6-8%.

In terms of risk associated with interest rate , short duration funds are positioned at the lower end i.e. higher than liquid, ultra-short duration funds and low duration funds but lower than medium duration funds and long duration funds. Some fund managers invest in the highest quality bonds, while others may allocate a significant part of the corpus to AA and lower-rated debt bonds in order to boost returns for the investors. However, it must be noted that short duration bonds usually have lower default risk.

First time Investors who want to start building a portfolio of debt funds can start by investing in these funds. These funds offer decent returns along with moderate risk. Their returns are generally higher than that earned by investing in liquid or overnight funds, while the volatility of fund value is lower as compared to longer duration funds. Some of the best Short Duration Funds schemes are depicted below.

10) Bharat Bond ETF:

Those of you not aware of the ETFs, they carry properties of both the mutual funds as well as stocks. They generate stable returns and carry NAV(Net Asset Value) just like mutual funds while they can also be traded actively on the stock exchange just like stocks.

Also, you need a demat account to trade ETFs which is not the case with mutual funds.

So, Bharat bond ETF invest money in bonds of public sector companies. Now, there are various bonds available under this category which are Bharat bond ETF 2023,Bharat Bond ETF 2025,Bharat Bond ETF 2030.

The key difference between these are that each ETF invest in bonds with different maturities.

What it means is, Bharat Bond ETF 2023 invest in bonds with medium term maturity. Bharat Bond ETF 2030 invest in bonds with long term maturity. Longer the time horizon, better the yield from the ETF. But, needless to say, higher the duration higher the chances of volatility. Also, there are four different fixed maturity time periods ranging from 2 years to 10 years (the maturity for the Bharat Bond issue will happen in 2023, 2025, 2030 and 2031)

You must be wondering which company/government taking bonds do they invest in? This ETF invest in bonds issued by Central Public Sector Enterprises (CPSEs), Central Public Sector Undertakings (CPSUs), Central Public Finance Institutions (CPFIs) and other government organisations of AAA credit rating. Very clearly, The ETF does not carry credit risk. The Bharat Bond ETF-April 2031 comes with an indicative yield of approximately 6.82%.

As per NSE’s website, Bharat Bond ETF-April 2030’s YTM is around 6.69%. The best part is, there is no lock in period and the expense ratio of the bond is also low, at 0.0005%. And yes taxation benefits as benefits with indexation for long term investors.

For retail investors like you and me, the minimum amount of investment required is Rs.1000, and in multiples of Rs.1000 thereafter during the NFO i.e. New Fund Offer period. And there is an upper limit of Rs.2 lacs.

Alright, a lot too digest!!

Thankyou so much everybody who have made it till here. So, this was the complete list of the alternatives to FD with little to no risk! All these alternatives are explained in brief here to just make the readers aware of the asset classes which exist and they might be unaware of, just like I was once:)

Please do your due diligence and patiently read about all these alternatives in detail since there comes a time in everybody’s life where taking risk with the hard-earnt money doesn’t sound like a good option. So, this was all for this blog. Before leaving I would definitely quote a saying from one of the legendary investors to conclude it all on a complacent note.

“The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioural discipline that are likely to get you where you want to go.”

-Benjamin Graham

Follow Us @