Is the world ready for a ‘100% Organic Vegan KitKat’?

A revolutionary change indeed by one of the biggest Fast Moving Consumer Goods (‘FMCG’) player Nestle to introduce a healthier alternative to its iconic brand Kitkat.

Realizing the untapped potential ?

The reformations seen in the FMCG sector are the powerful tailwinds from the woke consumers shifting towards healthier and nutritious products in their daily routine.

Dating back to 1977, the controversial case of Nestle, where the brand was boycotted for almost two decades from the US for promoting bottle feeding/ formula milk feeding with misleading nutritional claims and discouraging breast feeding which ultimately led to infant deaths and illness.

This was 1977 and the incident was an eye-opener for the biggest FMCGs in the world to adopt practices in healthy interest of consumers.

Fast forwarding to 2021.

While today’s problem is not limited to milk feeding to infants, we are commonly faced with issues including obesity, diabetes, heart disease etc.

As per a report by Deloitte, consumers are segmented as ‘Forwards’, ‘Followers’ and ‘Neutrals’, in the order of their commitment towards health and wellness. The study highlights that 78% of the crowd fall under the forwards and followers i.e. displaying above average interest towards healthy and sustainable products.

Realizing that healthier alternatives are not a trade-off, the FMCG industry has ventured deeper towards offering products not dosed with excessive salt or laced with excessive sugar or brimmed with chemicals, in order to avoid the ugly outcomes.

Another classic transformation is by Reckitt, introducing an alcohol free hand sanitizer using bio-renewable active ingredients, under the brand name ‘Dettol’.

Afterall, a healthy lifestyle is a choice for the future and is not limited to foods but encompasses every personal care product.

Labelling Gimmick vs Organic Certification

Organic refers to any product made without synthetic pesticides, fertilizers, herbicides and other chemicals.

Selling propositions like ‘non-toxic’ or ‘safe’ or ‘paraben free’ have been a great marketing plank for many popular global brands, but the question is whether in essence, is the product organic or it is just a labelling gimmick?

Well, when the words can be so loosely used, an ‘organic certification’ from renowned certification body comes to rescue.

In India, National Programme for Organic Production (‘NPOP’) has begun certification for AYUSH products by affixing the trademark ‘India Organic’. Globally, there are certifications such as Ecocert which are well recognized and accepted.

Talking numbers

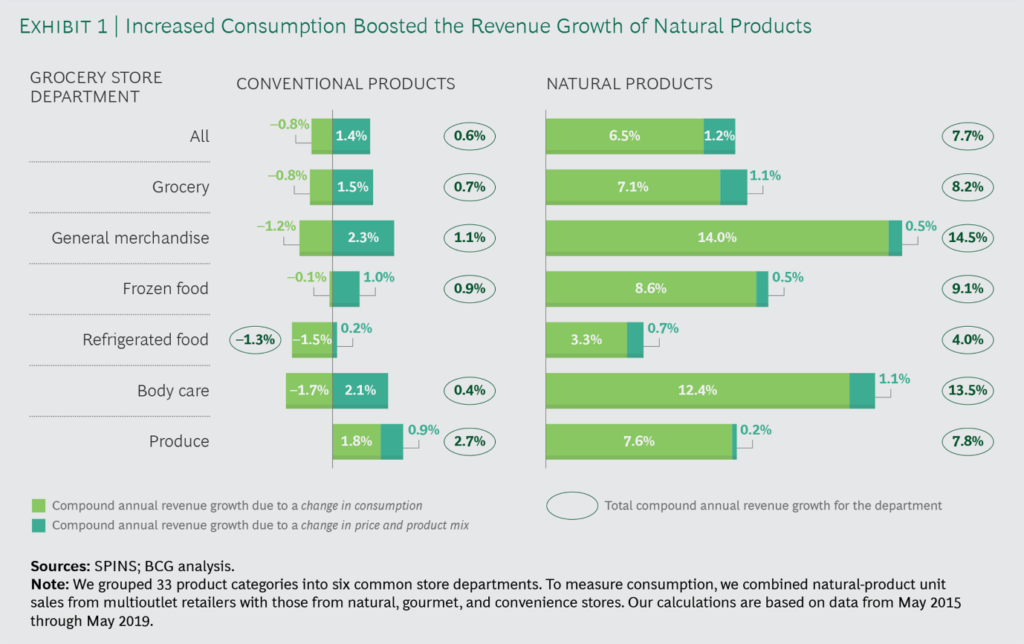

A study from Boston Consulting Group highlights that in the US, from mid-2015 through mid-2019, natural-product revenue grew by 25%, from $51 billion to $64 billion.

Also, the study accentuates the shift in sales from conventional products to more organic and natural products. (Refer image below)

As per the joint market research of Confederation of Indian Industry (‘CII’) and PricewaterhouseCoopers (‘PwC’), the Indian Ayurveda market is all set to register 16 per cent growth (CAGR) till 2025. At present, the size of the domestic market is INR 30,000 Cr ($ 4.4 billion), and Ayurveda’s market penetration is increasing in both rural and urban areas. The report highlights an increase in the number of people using Ayurvedic products.

Endnote

This is just the beginning of proliferation of ‘natural and organic’ variants in the niche market and there is so much more to expect. It is worth analyzing how in the next 5 years, this powerful small segment would have grown and how much it would have outpaced the conventional products segment.

Follow Us @