Humans have been leaving footprints on the moon for nearly half a century, and the enterprise has piqued the interest of numerous billionaires. High amounts of private finance, technological advancements, and increased public-sector involvement are all shifting the industry’s trajectory.

The investments in space call for a more accessible, less expensive reach into space, with enormous potential prospects appearing in industries like satellite broadband, high-speed product delivery, and possibly even human space travel.

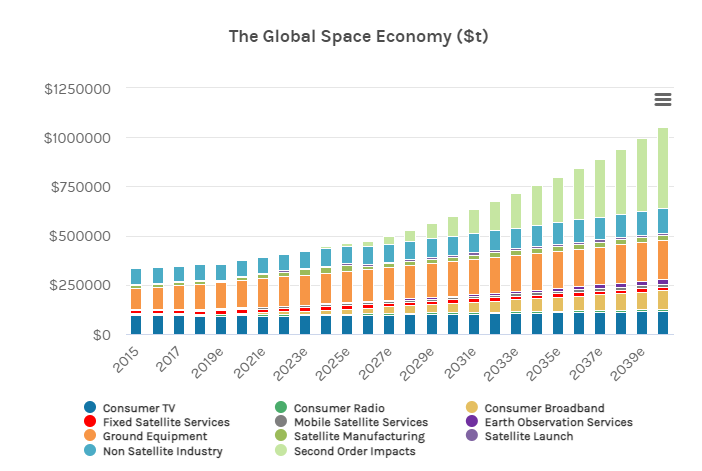

In the short term, space is considered as an investment opportunity that will have an impact on a variety of businesses outside of aerospace and defence, such as the IT hardware and telecommunications sectors. According to Morgan Stanley, the global space business might generate more than $1 trillion in income by 2040, up from $350 billion today.

There has been a shift in the industry’s goals and ambitions as the number of entrepreneurial space enterprises has grown. The business has piqued the interest of Silicon Valley’s billionaire space explorers, who want to disrupt the traditional aerospace industry through entrepreneurship and new manufacturing processes.

Reusable rockets, mass-production of satellites, and the development of satellite technology are all used by companies like SpaceX, Blue Origin, and others to help bring costs down. Currently, the cost of launching a satellite via reusable rockets has dropped to around $60 million, down from $200 million, with a possible drop to as low as $5 million, and satellite mass manufacturing might reduce the cost from $500 million to $500,000. Many other businesses are similarly ambitious and forward-thinking, with some even aiming to extract extra-terrestrial bodies rich in resources from space.

For a long time, the space industry has been dominated by state-owned companies that were used for research, communication services, and defence. However, American private firms have begun to enter the industry and are gaining traction: about $19 billion in private capital is presently invested in hundreds of such companies that wish to reach the industry and make significant strides.

What are the biggest investors up to?

Elon Musk’s plan of Starlink:

Launching satellites that provide broadband Internet access would assist to lower the cost of data at a time when demand for it is increasing. “Data demand is increasing at an exponential rate, while the cost of access to space (and, by extension, data) is reducing by orders of magnitude,” Jonas argues. “We feel that providing Internet access to underserved and unserved populations presents the greatest opportunity” Indeed, Morgan Stanley predicts that as data consumption rises—a trend fuelled in part by driverless vehicles—the cost of wireless data will be less than $1 per megabyte.

Jeff Bezos and his plans for Blue Origin:

Blue Origin, based in Kent, Washington, is an American aerospace manufacturer and spaceflight firm. It is presently led by CEO Bob Smith and is owned by Jeff Bezos. Blue Origin was launched by Jeff Bezos, the world’s second richest man, in September 2000 with the purpose of making space travel more affordable, regular, and accessible through automatic guided technologies. Blue Origin received a $1 billion grant from NASA in May to develop preliminary concepts for a human-landing system for NASA’s Artemis 3 mission, which seeks to land humans on the moon in 2024.

Microsoft co-founder Paul Allen and British tycoon Richard Branson

are taking a different approach. In June 2015, Allen’s Vulcan Aerospace unveiled the world’s largest plane – the Strat launcher. With a 385 feet (107 meters) wingspan, it can carry 1,000lb (454kg) satellites to high altitude and launch them into low Earth orbit.

Branson’s Virgin Galactic:

launched in 2004, promoting short suborbital flights to civilians in the hopes of creating a space tourism industry. More than 700 passengers have already paid around $250,000 for advance tickets for Virgin Galactic’s Space Ship Two, reportedly including Tom Hanks, Ashton Kutcher and Leonardo DiCaprio, though the date of the first commercial flight has not been announced. Using the same carrier aircraft, it also plans to deliver small, 200lb (91kg) satellites. The cost is around $10m, or one-sixth the cost of a SpaceX flight, but it has not announced when either service will be available.

“Azure Space and AWS Space:

are removing complexity across the value chain, making a global network of space-based communication and data collection infrastructure accessible to the tech community to innovate upon,” Anderson wrote. “In the same way that every company today is a technology company, the companies of tomorrow will all be space companies,” he added.

As per tweets from SpaceX founder and CEO Elon Musk,

the company has deployed 100,000 Starlink terminals and is already serving 14 countries with licence applications pending in others. According to Musk, SpaceX has recruited 10,000 new Starlink internet service subscribers in the last three weeks.

Future aspects, technology? How will it impact technology?

As private companies help with operations related to satellite channels, ISS, moon and Mars, government space agencies can redirect their focus to deep space exploration and conduct more operations like the Hubble telescope, which might still be difficult to commercialise, because of their scale and complexity. Private space companies and public agencies need to work hand in hand so that the space industry can continue to expand and grow.

Follow Us @