Greensill(y) Capital

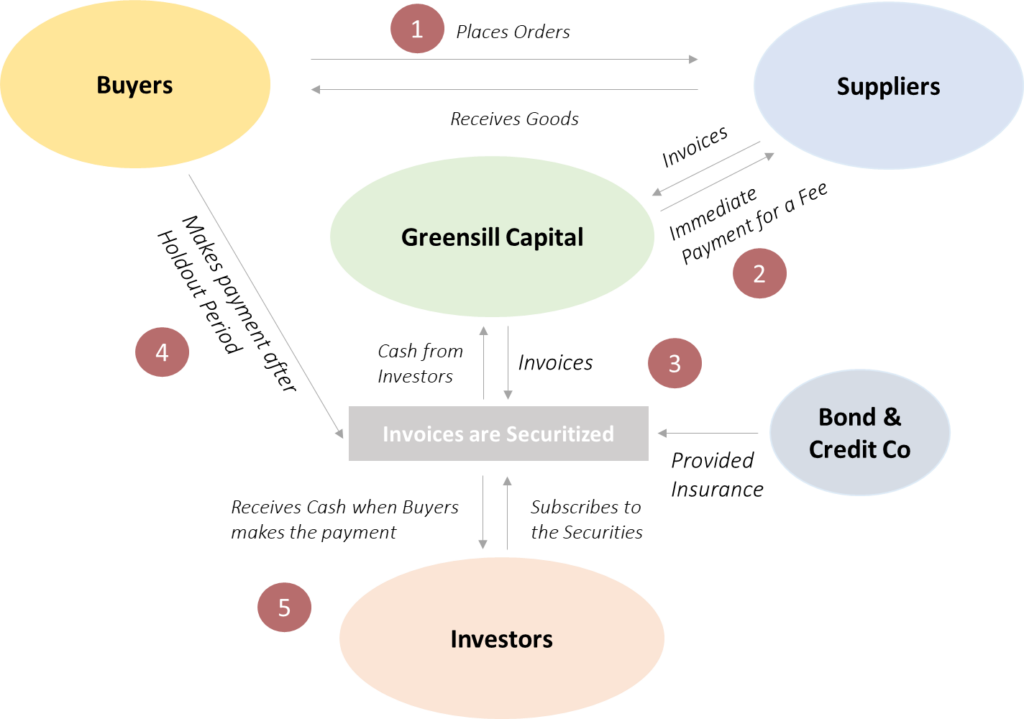

Greensill Capital was started in 2011 in London by Lex Greensill, an ex-Citigroup and Morgan Stanley Banker, an ex-farmer and now an ex-Billionaire. Greensill Capital was in the business of “Supply Chain Financing”. It helped resolve the evergreen (pun intended!) problem of Buyers wanting to hold out their payments to their supplier for as long as possible while the suppliers wanting to be paid immediately. Greensill Capital acted as a middleman that would pay the suppliers immediately by charging them a small percentage of their invoice value and then give time to the buyers to pay them back later.

Lex Greensill in 2019 received “Commander of Order of the British Empire” for “service to the British Economy”

This is how traditionally Supply chain financing is done. However, Greensill Capital added few more steps, they took these invoices and converted them into short-term assets and sold them to Investors. This is called “Securitization of assets”. These assets were sold to various investors through Credit Suisse and a Swiss asset management firm called GAM. The money from investors helped Greensill to further finance new invoices which in turn were again pooled and converted into these securitized assets and sold to investors and the cycle continued. They were also insuring these securities through Bond & Credit Company, the Sydney unit of insurance behemoth Tokio Marine Holdings Inc.

It was a sweet business

To be honest it’s was a very sweet business to be in…..until it wasn’t.

Let’s meet the Musicians

For Greensill the waters started to get muddy in 2018. It started with the blowup of GAM’s bond funds, where 9 of its Bond funds carrying $7.3 Bn of these Securitized assets had to be liquidated. This was allegedly because of a single portfolio manager named Tim Heywood who was responsible for purchasing the Securitized assets originated by Greensill. The issue aroused when GAM noticed these 9 funds’ high exposure to Mr. Sanjeev Gupta and its GFG Alliance, an international conglomerate that operates primarily in the steel and mining industries. Mr. Gupta shared “friendly” relationship with Tim Haywood and Greensill was the largest financial backer of GFG Alliance. And when Greensill filed for administration, it said explicitly in court that GFG has started to default on its obligations. Greensill has about $5 billion of exposure to GFG.

Then there’s Credit Suisse, who was co-managing these supply chain funds and like GAM was also purchasing these securitized loans from Greensill and selling it to more than thousands of its wealthy clients. Their share was in fact much higher than GAMs (a $10 Bn line) and they didn’t stop after the GAM debacle.

We also have David Cameron who during his term as the Prime Minister of UK appointed Lex Greensill as an unpaid adviser and allowed him to develop a policy that would ensure small firms were paid more quickly and guess whose business would’ve benefited from this policy. After leaving his post, the ex-PM was appointed by Greensill Capital as a “Special Advisor” who tried to lobby with the government to give the firm more access to government-backed loans.

Major Sponsors – Softbank, Credit Suisse & GAM

Other sponsors – General Atlantic and the UK Government

Special Advisors – David Cameron, Ex-PM of UK and Julie Bishop, Australia’s former foreign minister

The orchestra isn’t complete yet, in 2019, Softbank entered the picture by infusing $3 Bn directly into Greensill ($1.5 Bn each from Softbank and its Vision Fund) becoming the largest investor ahead of General Atlantic (another musician in this orchestra). However, this was not lunch money as it was used by Greensill to lend to affiliates of Softbank and GA.

For instance, in 2020 Greensills’ German Bank subsidiary had lent $435 Million to Softbank’s portfolio company Katerra, a construction startup, however soon after the company ran in to “Financial troubles” and was on the verge of Bankruptcy, so Softbank provided Katerra with a $200 Million rescue capital. But what makes it interesting is part of the deal involved Greensill converting its $435 Million Senior Debt secured by receivables into just 5% Equity, giving an almost bankrupt company a valuation of a whopping $9 Bn. And the most ludicrous part of it? the subsidiary bank didn’t make any provision in its balance sheet for this and valued its stake at face value of $435 Million.

Another chorus in this Symphony – Softbank had put in $500 Mn in a Credit Suisse fund that invests in technology startups and guess who Credit Suisse had lent from that capital.

Now back to the present, the final few nails in this all-encompassing coffin was hammered by the German financial regulator – BaFin and their insurer – the Bond and Credit Company.

BaFin had started investigation of the German Bank subsidiary of Greensill due to irregular transactions, opaque accounting practices and it’s high exposure to none other than Mr. Sanjeev Gupta’s GFG alliance. It said to have uncovered evidence that assets linked to Mr. Gupta listed on the bank’s balance sheet DID NOT EXIST.

The German Subsidiary bank had bought four Jets and leased back all of them to Lex Greensill

And Bond and Credit Company, the one who was insuring these securitized loans, well they decided not to renew the insurance policies citing its concern on the loans underwritten by Greensill and had fired a manager who had a key role in signing off on this business previously.

Consequences

Well, the list is long and quite interesting

So, with no insurance cover now, the investors started to question the credit quality of these securities and Credit Suisse pulled the plug on its $10 Bn line of Greensill Funds and is now liquidating the same. It is looking at a loss of $ 3 Bn.

BaFin shut Greensill Subsidiary Bank to save money for depositors and creditors. German municipalities that parked funds with the Subsidiary bank are at risk of losing their funds. And a judge in Germany has granted BaFin’s request to begin insolvency proceedings for Greensill Bank.

The National Health Service, which manages the publicly funded healthcare system of the United Kingdom had to pay the pharmacies directly as it couldn’t use the supply chain finance it was availing from Greensill, creating major financial burden.

Softbank had already written down it’s investment in Greensill in 2020 but it came to light only recently.

And now the interesting part, since GFG Alliance was so dependent on Greensill for its financials needs, imagine what the insolvency of Greensill did to its business. Well, their businesses are now capital starved and the Court documents show GFG warning that if it lost Greensill financing, then it would collapse into insolvency too!! Now just to make the impact of this clear, GFG owns businesses across the Globe, employing 35,000 people across 30 countries, it owns a BANK in England, the Wyelands Bank. The Bank of England is worried of the consequences of this failed orchestra on the retail deposits of Wyelands Bank and has asked Mr. Gupta to deposit 75 million pounds immediately.

Accountancy firm Grant Thornton has been appointed Administrator (meaning they’ll control the operations going forward) of Greensill’s two core UK companies, which oversaw its business of purchasing invoices and converting it into securities for sale to investors. Grant Thornton has agreed in principle to sell Greensill’s intellectual property and technology platform for processing client payments to U.S. based Apollo Global.

Time and again we have seen such a gargantuan orchestra involving collapse of a Financial lender creating some extraordinary symphony and a Movie being made later!

This post was written in collaboration with Asif Yahiya Sukri LLP. Asif Yahiya Sukri LLP provides unparalleled personalized financial services to a broad range of clients across different geographical locations. With a presence in the USA, India and the MENA region, they ensure that all of your financial decisions are made carefully and with your best interests in mind. They are innovators who understand what goes into building companies.

You can also reach out to them on info@aysasia.com

Follow Us @