The Past

Jawaharlal Nehru once famously said – “Hindi-Chini Bhai-Bhai”, and how the narrative around that statement has since changed with border disputes and cross firing leading to loss of lives on both sides. The dragon has always been hungry for more. From Depsang and Doklam to Galwan Valley.

Consequently, the relationship between India and China is now at a very sensitive phase.

This is not the first time. A similar situation arose way back in 2016, where the Swadeshi Jagran Manch, who has always been on the forefront. SJM started a campaign to boycott ‘Made in China’ goods triggered by China’s latest provocation – blocking India’s bid to sanction the Pakistani terrorist Masood Azhar as a global terrorist.

Even before the clash of India and China, SJM had raised their voice and urged people to ban chinese products such as Paytm, when the company had raised funds from Chinese investors (Alibaba and its affiliate Ant Financial held close to 40% stake in the company, back in 2015). This time these same people want the government to get involved to shun the Chinese companies from participating in any tender given by them and to make the anti-dumping laws stringent and to impose higher tariff barriers like the US, which has imposed 6,500 barriers on China.

The Present

With Prime Minister Modi advocating ‘Aatma Nirbhar Bharat’ and ‘Make in India’ during the unprecedented crisis, various trade associations in India have started a national campaign by the name of “Indian Goods – Our Pride” to support the movement. This will not only motivate ‘not marketing of Chinese goods’ but also fructify the Prime Minister’s ‘Vocal for Local’ campaign by encouraging merchants to sell more home-grown goods made in India.

After the violent clash with the Chinese forces killing twenty of our soldiers, the direct and immediate reaction from the people has been – “Boycott Chinese Products”, but is this economically feasible and sensible? We try to see these decisions through the eyes of an economist.

In a famous theorem by renowned economist Abba Lerner which says a ‘no import’ policy is also a ‘no export’ policy. Which in laymen terms mean, if you stop the inflow of goods from one country it will affect the outflow of your own goods as the entire trade system is one vast cycle.

Trade Deficit

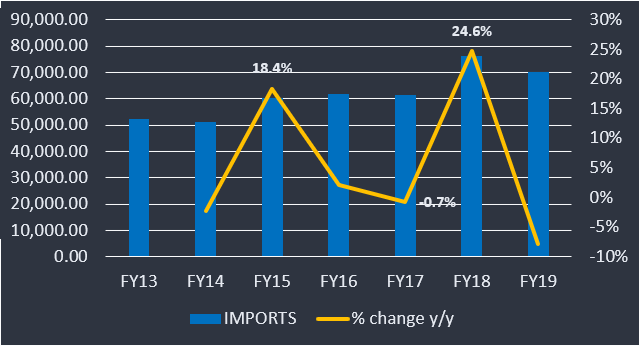

India has been importing various goods from China at a staggering level. While in 2019, the imports were $70.32 billion which was nearly 7% less than the imports in the previous financial year. The imports have been high because many of the MSMEs of India are reliant on the cheap goods coming from China. Experts have said that the input costs of MSMEs could increase by 10-40% if there are higher tariffs on raw materials or a complete ban on Chinese goods is announced.

Recently Adani Power received the approval for an 8 GW solar project which will be the biggest project in the world. The company plans to use solar cells and modules produced in India as the government has introduced a 20% levy on solar imports. Analyst predict, they could have saved up to 30% if they had imported these cells and modules from China which makes them at exorbitantly cheap prices. Nearly 40% of capital goods are imported from China as the cost of raw materials and labor is lower due to government offered subsidies and economies of scale. It is no surprise that China has a relative advantage to other countries when it comes to manufacturing capital goods.

According to the famous economist, Tim Harford – “A country ought to produce goods and services not by asking what it does more cheaply than India but by focusing on what the country does best”. A country like India should not focus on producing more capital goods and rather focus on goods which it has a ‘relative advantage’ in, compared to its peers.

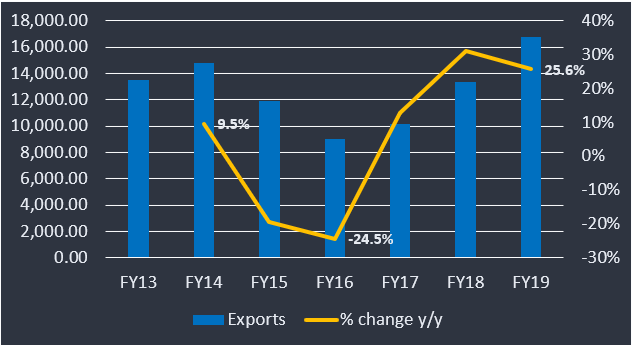

While India imports in the range of $65 to 70 billion, its exports to China are substantially low. This figure stood at $16.75 billion for 2019, which albeit being a ~25% year-to-year growth from the previous, it is still far less of a value vis-à-vis imports. This means that India’s trade deficit with China was close to $54 billion.

The diamond industry is another industry which could face the wrath of the restrictions the Chinese are expected to initiate if India starts banning Chinese products. Around 29% of the total jewelry consumption is contributed by India being one of the largest exporters in the world. Hong Kong and China are the largest importers of our Cut and Polished Diamonds with around 40% of the total diamond imports.

INDUSTRY SPECIFIC ANALYSIS

Telecom Sector

Telecomm Industry is one of the biggest contributors to the economy with contribution nearly 6.5% of the entire GDP of the country. This sector is heavily dependent on resources from outside the mainland.

The Telecoms Ministry has ordered all Chinese transactions to be barred by BSNL, MTNL and private companies. They have also asked the telecom departments to abandon all the earlier tenders or deals. The telecom industry in India may become consolidated which could lead to exuberant data and call pricing. Restrictions on Chinese products will just help in making this consolidation faster. Vodafone-Idea and Airtel already have huge AGR dues that they need to pay the government, if restrictions are imposed these both could be forced to an additional $650 million and $300 million respectively in Chinese vendor dues.

Vodafone Idea’s payables to ZTE, a Chinese telecom giant, are around $150-200 million, while it owes Huawei ~$450 million. Similarly, Airtel owes Huawei around $300 million for network gear purchases. With both of them already struggling to pay the Indian government, this added burden could well play in the hands of Jio making it the biggest service provider which will be harmful for the citizens of this country. Private telecom operators are not the only ones who owe to Chinese vendors, state run-BSNL also reportedly owes ZTE INR 1,300 crores and Huawei around INR 100 crores.

Further, in relation to hand-held devices, cheap Chinese smartphones have dominated the market for the last two years, due to consumers preferring price over the quality of the product. Last week, Xiaomi’s smartphone sold off in a few minutes which was a new record for the company for its sales in India. These cheap smartphones have helped people from poor backgrounds to have access to internet, and also for people who are living in remote areas to have better connectivity.

All the ambitious plans of the Modi government to digitize every individual cannot happen without these smartphones that come from China. India’s path to digitizing the economy with everyone using UPI cannot be achieved without smartphones, which need to be cheap so that even the poorest of the sections of the society can afford it.

While these mobiles cannot be ignored at once, the applications on it can be. The government acting on the same lines have banned 59 mobile applications which predominantly run on these Chinese smartphones notably Xiaomi. These bans will not have any major effect on the economy or the people of this country as we have perfect substitutes for these applications.

Agriculture Sector

India is known as one of the leaders in the agriculture space and every government which comes into power emphasizes polices and funds aimed at this sector showing how important this sector is to our country and economy.

Agricultural sector contributes to ~15% of the India’s GDP.

India exported agricultural and food processed goods worth $38.49Bn in FY19 of which goods worth $2Bn were exported to China, making it the largest stakeholder. There is a retaliation expected from the Chinese and this could lead to losses for our farmers as they might lose one of its most profitable market.

The other important aspect are fertilizers; nearly 35% of the Indian fertilizer market is owned by China. Banning the pesticide would put an additional burden on farmers as the pesticide which right now costs around INR 350-400 per liter would shoot up to INR 1200-2000 if the alternatives are imported. A ban will have two simultaneous effect one being the cost of agriculture which will shoot up and the sector will lose out on one of its biggest markets.

Pharmaceutical Sector

India was recently in the COVID-19 news because of its potential to manufacture hydroxychloroquine (HCQ), which was touted as a possible cure for the virus. The manufacturing of HCQ entirely depends on the Active Pharmaceutical Ingredients (“APIs”) which is imported from China. It is also reported that India imports nearly 68% of its bulk drugs – the chemicals used to make a finished product. And for some familiar drugs like paracetamol and ibuprofen, India is almost 100% dependent on China. The ban could really hamper the growth of this industry which could help in the prevention of diseases in India.

The Indian Pharmaceutical Industry is known to be the third largest in terms of volume and fourteenth largest in terms of value. But then again, with close to $6 billion of raw materials for these bulk drugs coming from China we can expect a rise in the prices, as a direct consequence of the ban.

Railway Sector

Railway sector being completely state owned and thus have been leading the charge in banning Chinese products. Railways have been reducing their dependence on China for some years now. The Dedicated Freight Corridor Corporation of India (DFCCIL) decided to terminate a INR 471 crore contracts awarded to Beijing National Railway Research and Design Institute of Signal and Communication Group Co. Ltd on the grounds of non-availability of engineers, passivity in material procurement and a slow progress rate of only 20%. The Indian Railways said if the World Bank does not find India’s move to terminate the contract with the Chinese firm agreeable, it is ready to fund the project itself.

The town planning authority Mumbai Metropolitan Region Development Authority (MMRDA) has cancelled the bidding of Rs. 500 crores for the design, manufacture, testing, supply & commissioning of ten monorail rakes received from Chinese manufacturers. The contract will now be given to Indian manufacturers thus succeeding in the “Make in India” mission.

The government has been trying to gather more profits from the railway sector for quite some now with even allowing some private players in the market. Currently India gains 53 paisa per km per passenger which is quite low compared to other developing countries. Although the shift to Indian manufacturers might delay the process of recouping profits from the industry, but it will not disrupt it.

Chemical Sector (Industry)

India contributes nearly 5% of the entire chemical demands of the world making it a pretty attractive market for investors. The only problem with the fact is that most of the substances required to produce these chemicals are imported. In the recent years, India has been trying to cut on chemicals due to the toxic gases that release due to its production causing many pre-mature deaths.

Nearly 75% of the entire organic chemicals are exported from China. Chinese producers have government subsidies which enables them to produce goods at a mass scale with limited restrictions, one of them being ignoring environmental production laws. Chinese firms have been known for being notorious when it comes to following environmental regulations. Due to this, wearing mask had become a standard practice in China well before the coronavirus.

These notorious laws help them to produce chemicals and dye at historic low prices which they export to countries like us. If we do decide to go ahead with the restrictions, it will be on our hand to face the brunt the environmental damages that will be caused. The quality of air which has already been deteriorating will further deteriorate, which could lead to more premature deaths in our country.

Automotive Tyre Manufacturing Sector

The raw materials with key natural and synthetic rubber required for manufacturing tyres account for almost 75% of the production costs. The fall in crude oil prices directly affects the price of synthetic rubber, additionally any movement in the price of synthetic rubber subsequently affects natural rubber. Even with the fall in crude oil prices along with the excessive production of natural rubber, China has still managed to keep the rubber prices in an economic range.

ICRA has already reported that the profile of the Indian tyre industry is likely to weaken in FY2020 with rise in the raw material price basket.

Automotive Tyre Manufacturers Association (ATMA) held most of the imports from China account for 40% of Truck and Bus Radial tyres. ATMA said restrictions on import of tyres will pave the way for increased domestic production while accelerating exports besides unlocking job creation potential.

To protect the domestic manufacturers, the government-imposed curbs on imports of certain pneumatic tyres used in motor cars, buses, lorries and motorcycles.

Start-up Sphere

India is third largest startup hub in the world with over 50,000 startups under the start-up initiative.

Growth: Annual Y-O-Y Growth of around 12-15%.

India has become the third largest startup hub with over 50,000 startups because of the enormous market it has to offer.

In the last 20 years, China has just accounted for 0.51% of the foreign direct investment in India but these investments have shifted from infrastructure to technology as India continues its push to digitization.

We have had many billion-dollar start-ups in the last three to five years. These start-ups have investors from all over the world including India. According to a report published by Gateway House, China nearly has $4 billion dollars invested in Indian start-ups. Alibaba and Tencent Holdings being the leader in this space with investments in nearly all the famous start-ups ranging from Paytm to Zomato to Dream11. Tencent also has a substantial holding in Oyo and Swiggy. In some of these companies, they have enough equity to make decisions making the task of boycotting Chinese products and even harder thing to achieve.

Another set of investors in these startups are the Chinese VC (Venture Capital) firms, 41 of them have invested into these start-ups. In all, these Chinese companies have invested in just 104 out of the 6,114 that received funding in the last five years. Unlike trade, investments in India from China might be significant in some companies but overall, it is still a small space.

Conclusion

While some sectors might have it good with the ban, others might have dire consequences. Make no mistake – India needs to become more competitive in its own right because no barrier can be high enough to protect it from China’s trade prowess. To curb this India needs to adopt a more stringent policy when it comes to goods coming from China as it cannot just wipe out the trade deficit of $54 billion for years to come. Rather than banning Chinese products, India should focus on producing goods which it has a relative advantage compared to China and even the other countries. This will be a better ‘AatmaNirbhar’ than boycotting Chinese goods entirely.

Follow Us @