The cult Indian comedy film ‘Phir Hera Pheri’ revolves around a scheme proposed by one Laxmi Chit Fund. The fund promises to double any investment made by investors in 25 days, no questions asked. Too good to be true, isn’t it. Unfortunately, the motley and naive protagonists fall for that trap, and the ensuing uproar is incredibly comedic to witness.

However, never once during the entire movie do we think – “Wow, maybe I could have fallen for something like that.”

The idea is absurd, unthinkable even! We educated folk, trained to catch even the smallest scent of mischief, would never fall for such a half-baked plan.

Well what if I told you that people much smarter than you and I – Billionaires, Banks, Insurance Companies, City Councils and even people like Steven Speilberg all fell for the exact same scam. A $64 Billion Scheme – the largest investment scam in the history of financial markets.

A Ponzi Scheme. By none other than Mr. Bernard Madoff.

What is a Ponzi Scheme?

First used by Charles Ponzi, an Italian swindler, in the 1920s, a Ponzi Scheme is a plan of inviting investors to put money into a novel idea. Early investors are paid using the money bought by the later investors, and so on, until one day there aren’t enough new investors and the whole house of cards collapses. The interesting thing about such schemes is it’s all in plain sight. Anybody with even the slightest suspicion can smell the fraud a mile away. The problem is though is that nobody ever suspects it. They see a packaged box, looking pretty and fancy – but they never think to take a look inside.

Now you may think, there isn’t anything remotely similar to the 2 examples that i have given. I am here to prove you wrong.

At the bare basics, the 2 schemes were absolutely identical:

1. Both promised great returns with a credible story.

2. Both exhibited trust.

3. Both sold exclusivity.

The First:

Laxmi Chit fund said that they invest the money received in a foreign company which gives them a 4X return, and the company passes 2 times the investment to the investors. While this seems impossible , we must understand their target audience and what sounds believable to them. They also enamor their prospective investors with stories of past investor’s riches to close the deal.

Madoff’s Investment vehicle was a Hedge fund. Hedge funds are complicated entities that take investor’s money and invest it in the stock market. It is important to know that most people know the word, but very few know what they actually do. Why? They don’t care, as long as they earn the investors good returns. And Madoff earned great returns. He showed credible safe returns matching the S&P 500 with supposed clean track record, while other hedge funds appeared to sell snake oil. He attracted people with returns that sounded just about good enough that they could be true, and explained his returns with instruments called derivatives. What are derivatives? They are complicated financial instruments most people don’t understand. His investors didn’t understand either – and that was his strength.

The Second:

Anuradha, the representative of the Laxmi Chit fund was a suave woman. Her character was attractive and appeared intelligent – the perfect combination to pull wool over the eyes of 3 unsuspecting men. Her etiquette, tone and demeanor was more than enough to convince them of the surety of the plan.

The trust in Bernie Madoff did not come from his behavior or his etiquette. It came from his credentials – 3 times president of the NASDAQ, Chairman of one of the largest Brokerages on Wall Street and a long list of other accolades that would make any unsuspecting person trust the guy with their life savings.

The Third:

Laxmi Chit fund is portrayed as a ‘get rich quick scheme’ for the rich, hidden from the poor. It is the secret of how the rich get even richer. It has a very high threshold of Rs. 1 Crore minimum investment, which just added to the fund‘s credibility. Just being included in the list of investors of Laxmi Chit fund seems like a privilege to brag about.

Madoff’s fund is the same. Madoff rejected loads of prospective investors. Getting into his exclusive list of investors was an honor reserved for the inner circle of wall street. Why would anyone running a scam reject money from an investor? Logical thinking, isn’t it? Well that’s what he wanted them to think.

Also, there is an philosophy that if people much smarter than me have already invested, I’m sure my concerns are unwarranted.

There are hundreds of Ponzi schemes around the world every year, duping people of millions. Yet, we never see them coming. Why?

Our brain, like any software, has bugs

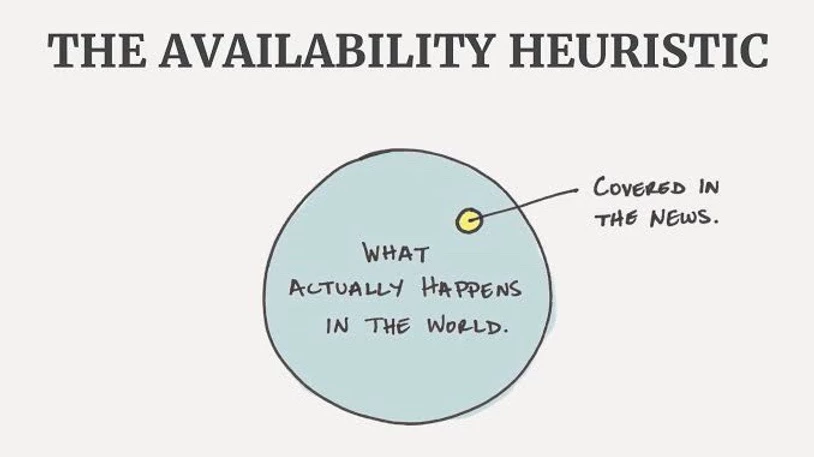

The first issue is that the human brain is a peculiar thing. We think its rational, but time and time again it proves it isn’t. For example, in both the 2 examples I’ve given, there are huge red flags all over the place – the run down office building of Laxmi Chit Fund, or the almost perfectly consistent returns of Madoff. But the people who were duped failed to notice them. Why? Because we tend to see what we’re familiar with and what comes to our mind first – when people saw Madoff, they saw the NASDAQ Chairmanship, and the credible returns. They didn’t even think of looking deeper. This is one of the wiring defects or bugs that our brain has – the Availability Bias.

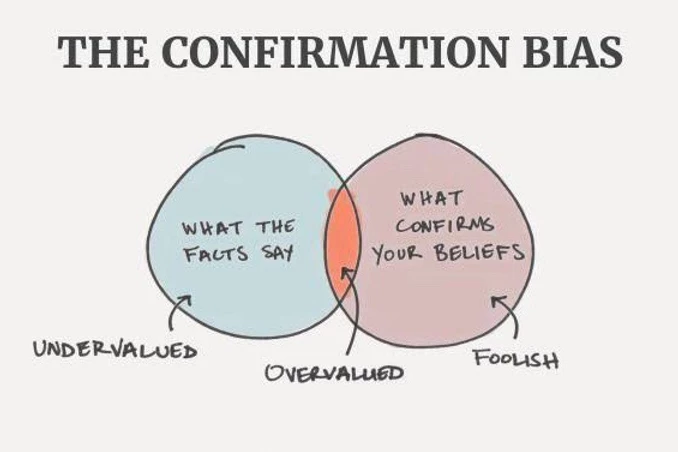

The second issue is greed – one of the 7 deadly sins, and justifiably so. Greed clouds our judgement unlike most emotions. When we have a carrot being dangled in front of us, we see only the carrot and not the monster holding it above our heads. We often ignore the most blatant contrary evidences that smack us right in the face. Why? because it is not in our interests to do so. This is called confirmation bias – we accept only those facts which align with our pre-existing conclusions.

When was the last time you readily changed your opinion on something?

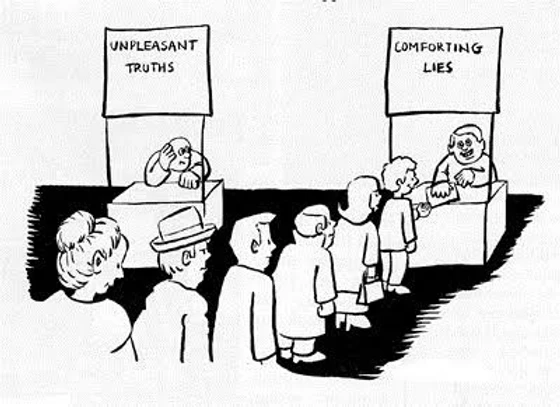

The third issue isn’t really a bias. It’s more of a conditioning that we as humans have developed over time. We tend to believe that people generally tell us the truth. It’s called the Truth Default Theory. A big reason why we exist in a default truth state is that the growth of civilisation depended on it. Society requires us to place an almost unwavering trust in our leaders, institutions and just about everybody around us. Imagine if you constantly believed everybody is lying to you – would you trust your family, friends, coworkers, or even your government?

This is why when people, especially strangers, lie to us, we tend to believe them. There may be some doubts, but the evidence in favour of the truth is given far greater importance than the evidence in favour of lies. This is exactly what happened to Raju, Shyam and Baburao as well as Bernie Madoff’s billionaire clients.

They just chose to ignore the inconvenient truths around them. Just imagine, Harry Markopolos – a forensic investigator tried for YEARS to convince the US Securities and Exchange Commission to investigate Madoff. They refused – the fraud police chose not to do their jobs. why? Because they had no inclination to suspect otherwise, even though there were a hundred reasons to do so.

Ponzi Schemes are often the oldest tricks in the book. And that’s what makes them the most difficult to catch – because they sell a dream. The dream of riches, wealth, stability – you have a dream, they sell it. They come in all shapes and sizes, but their modus operandi is always the same. You will face many such ponzi schemes in your life. But, it’s always your perception, and your threshold for the truth that determines whether you’re a victim.

The inspiration for this piece comes from Malcom Gladwell’s book ‘Talking to Strangers’. Please check it out here.

Also check out this podcast of Malcom Gladwell with Joe Rogan to know more about the book: https://youtu.be/Okg2LH6XKzY

The article first appeared at Percapita.in

Follow Us @

Some Unrelated Stories!