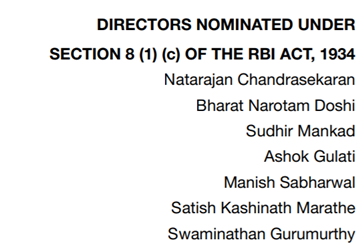

N Chandrasekaran, the Chairman of Tata Sons which controls 28 enterprises listed on exchanges having close to USD 111 billion dollar in market capitalization and Manish Sabharwal, the Chairman of TeamLease services (a USD 0.6 billion dollar enterprise) sit on the RBI Board.

Unexpected tryst with this company

I was once at a Reliance fresh store and while I was checking out with my purchase, I arrived at a checkout counter which looked something like this.

All I could see written was “Teamlease Services” and the logo looked something like this.

The only thing I could remember was the company had had its IPO around a year back and a friend of mine had made good amount of money in it. This was again the year 2017 and I was not very active in reading or doing research.

The RBI Angle

After the Bimal Jalan committee had recommended the transfer of a one time special dividend from the RBI to the Government of India in August, 2019, I was curious to read the RBI’s annual report. Although I was thoroughly well versed with the members of the Monetary Policy Committee (MPC), I was curious to know about the members of the RBI board.

The Reserve Bank’s affairs are governed by a central board of directors. The board is appointed by the government of India. Besides the RBI Governor, there cannot be more than four Deputy Governors as full-time official directors of the central bank.

There can be ten non-official directors from various fields and two government officials.

This made me rekindle the name of this company when I had first spotted it back in 2017.

What does TeamLease do?

Here’s the short description of the company from Page 2 of their annual report.

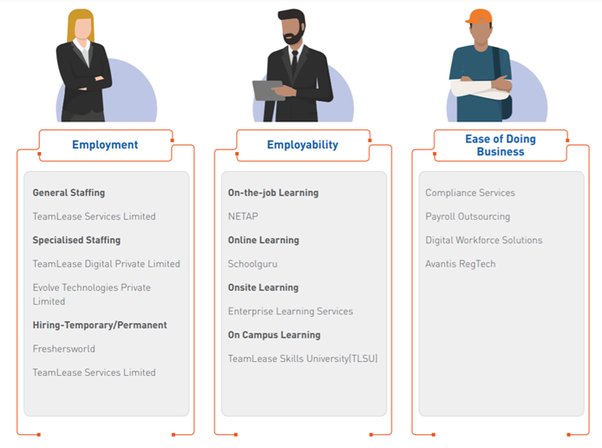

“TeamLease Services is one of India’s leading human resource companies offering a range of solutions to 3500+ employers for their hiring, productivity and scale requirements. A Fortune India 500 company listed on the NSE & BSE, TeamLease has hired 17 lakh people over the last 17 years and has 2 lakh+ open jobs every day. One of India’s fastest growing employers, TeamLease also operates India’s first Vocational University and fastest growing PPP National Apprenticeship Program. The company offers solutions to large, medium and small clients across the 3Es of Employment (1.5 lakh+ associates), Employability (2 lakh+ students/trainees) and Ease-of-doing Business (55,000+ compliances).”

Let’s take an example. In short, consider Reliance Retail wants to setup a new Reliance Trends store in a new high street retail location. It needs close to 200 people to run that big store it opens (relating it with the tryst above). It can put a few HR managers, take interviews, shortlist or it could call up TeamLease and say “Hey, I need 10 managers at 18,000 per month, 50 Sorters and Attendants at 14,000 per month and 140 Associates at 10,000 per month” – TeamLease would immediately supply them with this pool of people at a cost of 16k, 12k and 8.5k respectively for the manager, attendant and associate respectively and continue earning this recurring cash flow over the period of the contract (assuming it to go from anywhere from a year to till the store is in existence).

As per their latest investor presentation, TeamLease earns 739 per associate in General Staffing.

General Staffing, as discussed above is one of the services that TeamLease offers. It’s entire range is as under:

Their entire gamut of services can be further distilled into the following three categories.

Manish Sabharwal (Co-founder and the Executive Chairman)

The reason I got interested in knowing about TeamLease and Mr. Sabharwal was mainly because N. Chandrasekaran, chairman of Tata Sons has close to 28 Tata companies listed valuing the group at about 111+ billion dollars compared to TeamLease’s market cap barely being more than half a billion dollars (~4,300 cr.).

Here are the credentials of Mr. Sabharwal as laid out in the Annual Report.

- Bachelor’s degree in Commerce from the Shri Ram College of Commerce, Delhi University and Master’s degree in management from The Wharton School, University of Pennsylvania

- Co-founded India Life Pension Services Limited in ‘96, a payroll and pension services company that was acquired by Hewitt associates in 2002.

- Serves on various state and central government committees on education, employment and employability

- Currently a nominated member of the Central Advisory Board of Education – the highest advisory body to advise the Central and State Governments in the field of education

- Serves on the executive committee of the chief minister’s advisory council, planning department of the Government of Rajasthan

- Part of the expert committee on Innovation (Niti Aayog).

- Part time non–official director on RBI’s Central Board, appointed for a 4-year term w.e.f. February 09, 2017 (as discussed above).

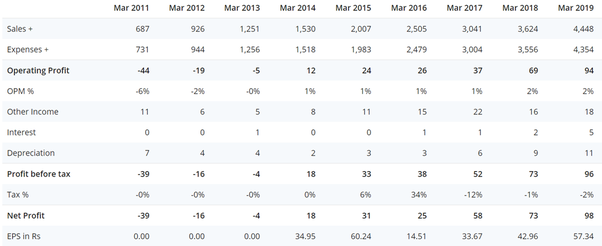

Financials

Notice that while the firm was initially incurring losses, (2011–2013) Net Profits have grown 5x between 2014 and 2019. The company has a very thin operating margin of 2% but in relative terms it has doubled from 1% in 2014 to 2% in 2018 and beyond.

ROCE (dhandha’s return) has consistently improved from 3% back in 2013 to 20% in 2019.

The road ahead & Final thoughts

While the company reports it’s results in three operating segments i.e.

a) General Staffing and Allied Services – Comprises of Staffing Operations, Temporary Recruitment and Payroll & NETAPP (90%)

b) Other HR Services – Comprises of Permanent Recruitment, Regulatory Compliance,Training Operations and Job Portal & (2%)

c) Specialized Staffing Services – Comprises of IT Staffing and Telecom Staffing Operations (8%)

(Figures in brackets represent the revenue share mix)

There seems to be enough headroom that the company enjoys.

We all remember a while back the controversy and chatter that was around us with respect to the unemployment numbers being officially released by the NSSO. Even if we were to discredit all thoughts and say everything is perfect, there is one theme that we can’t deny.

India has a big unemployment problem. There are people who join the both formal and informal workforce and there are limited number of opportunities that are created.

There’s a central theme evolving in our country with respect to formalization – GST, Digital Payments, tax compliance etc. The Company acknowledges the fact that 93% of the employment occurs in the informal segment making the case stronger for an addressable formal market.

As more and more MNCs come to India and also various companies are getting their back-office functions automated or outsourced, there is again big headroom for companies like TeamLease to grow.

Amazon’s recent interest in Quess Corp (a similar company) should serve as an example to substantiate this.

Also, if the low margin of 2% makes you feel unsafe, do remember India as a country adds close to 1.5 cr. people to it’s roster every year making almost no issues both on the supply side and on the demand side as discussed above.

Latest Update

Recently, Mr. Sabharwal was a part of the panel along with Info Edge CEO and Aon India head discussing about the “Job Loss Scare”. The video can be accessed here.

When asked the question about how does a 20 year old who’s just starting out, a 30 year old who is in the middle of his career and a 50 year old who has peaked address this situation?

Quoting Dumbledore from Harry Potter he mentioned “It is our choices, that show what we truly are, far more than our abilities.”

The article first appeared at Saketmehrotra.com

Follow Us @

Some Unrelated Stories!