How Columbus’s expeditions were financed:

“I sailed to the West southwest, and we took more water aboard than at any other time on the voyage”,

wrote Christopher Columbus, in his logbook, still yet to reach the Westward lands. Christopher Columbus’s transatlantic voyages were the first steps in the process that opened the way for European exploration and colonisation of the New World, i.e. the Americas. Overcome with doubt himself, he kept his three ships sailing through the uncharted waters, reminding his crew that they must complete the journey for which Queen Isabella and King Ferdinand, who jointly ruled Spain, had loaned them an enormous sum. Little did his crew know that Columbus did not actually owe any debt to the Spanish monarchs. Instead, Columbus’s navigation endeavours were financed with such arrangement that Queen Isabella and King Ferdinand secured 70% of the profit share on the goods and slaves that the Columbus managed to bring back, in return for financing all his expeditions. In case the voyager returned empty-handed, he would not be liable to repay the principal amount lent (although humiliation was warranted). Such an arrangement does make sense as no one would want to explore uncharted waters with debt, the interest on which will keep compounding (even if Columbus returns empty-handed) and no King or Queen would want to earn just a mere interest on loan given when there is a possibility of amassing huge profits. Also, King Ferdinand, already worried of competition from the Portuguese expeditions, would want to encourage risk-taking by guaranteeing that the repayment would be dependent only on the success of the venture and his other properties or assets would not be touched. The monarchs did, in the end, make a huge gain by entering into such a financing structure instead of conventional debt.

Before introducing sukuk to the discussion, let us first understand conventional bonds. A bond is a debt security wherein the issuer is lent certain amount of money by the investor in return for periodic payments of interest along with the return of principal amount after an agreed period. This interest, has another term in economics- Usury. The general rule is that the debt has to be repaid along with interest. If not, the issuer would face bankruptcy proceedings, wherein all his properties would be sold to repay the lender.

Concept of debt in Islamic Finance:

The Islamic Law has recognized the freedom to enter into any form of contract as long as it does not contain certain prohibited elements, which are:

i. Riba (paying and receiving interest or usury).

ii. Gharar (uncertainty) which could have been prevented.

Riba, in simplistic terms, means usury i.e. growth in value of an amount due to interest charged for passage of time. Charging Riba is prohibited under the Islamic Law and is also considered unethical.

Instead, the usual practice followed was of borrowing and lending with returns on borrowing tied to performance of specific assets purchased from the borrowing. Such practice was widely known in the Middle East and Mediterranean regions even in the pre-Islamic era. This later became the norm under the Islamic Laws.

On the other hand, Gharar (uncertainty) is to be prevented in contracts as much as possible. Without going into too much detail, we can safely say that Gharar is allowed only if both parties have symmetrical information (i.e. both parties have the same information) and there is no element of speculation. Most derivative contracts are prohibited under the Islamic Finance.

Introducing Sukuk:

The term ‘Sukuk’ (plural of sakk) is an umbrella term that includes all types of debt instruments which are compliant with the Islamic Laws, i.e. which do not contain any payment of interest on the amount borrowed.

Instead of charging interest on the amount lent, sukuk-holders would be entitled to all returns generated from the assets purchased or the activity financed from the amount lent, for a specified period of time. After the specified period of time, the asset is then transferred to the issuing company and the company in turn pays back the sukuk-holders, their principal amount. Hence, sukuk-holders share risk of the assets purchased using the amount lent.

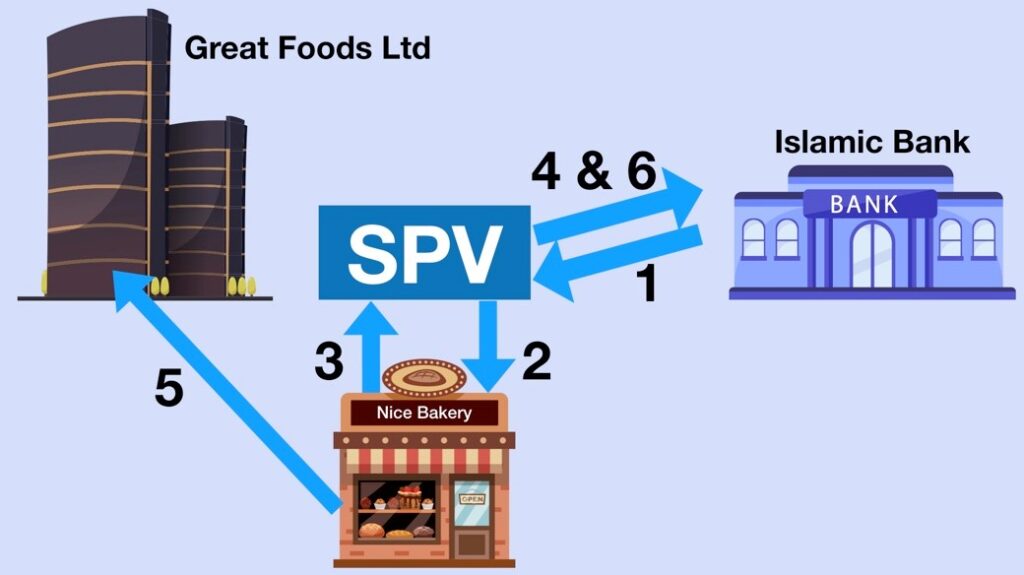

Let us use an example to explain the concept. Suppose Great Foods Ltd wants to start its own chain of bakeries under a new brand ‘Nice Bakeries’. The company approaches an Islamic Bank for borrowing the required capital. In a sukuk structure, Great Foods Ltd would set-up a separate entity (called as Special Purpose Vehicle or SPV for short). The SPV would issue sukuk securities of Rs. 50,00,000 to the Islamic Bank and use the issue proceeds to purchase Nice Bakery. The profits generated from Nice Bakery are passed through by the SPV to the Islamic Bank. After 5 years, Great Foods Ltd. pays the principal amount of Rs. 50,00,000 to the SPV for buying Nice Bakery which in turn is used by the SPV to redeem the sukuk securities. Once the sukuk are redeemed, the ownership of Bakery business is transferred to Great Foods Ltd. Note that since inception, the Islamic bank would be entitled to the bakery’s profits for only five years and may have certain protective and supervisory rights. However, Good Foods Ltd would retain the management of the bakery.

In the above pictorial illustration:

i. The Islamic Bank transfers Rs. 50,00,000 to the SPV against issue of Sukuk securities of 5 years maturity.

ii. SPV uses the issue proceeds to purchase Nice Bakery.

iii. SPV earns profits from Nice Bakery.

iv. SPV passes through the profits generated to The Islamic Bank.

v. After 5 years, Great Foods Ltd. purchases Nice Bakery from the SPV for Rs. 50,00,000.

vi. The SPV uses the sales proceeds to payback The Islamic Bank on Sukuk’s maturity.

Note that this is a simplistic example of sukuk securities. There could be many other aspects which could be added in the above arrangement. For example, Great Foods Ltd could also charge the SPV or Nice Bakery management fees for managing the affairs of Nice Bakery.

As sukuk-holders participate in returns generated from the assets purchased, sukuk are also called as participation debt securities.

Merits of Sukuk:

Earlier, sukuk were considered to be merely an arrangement for borrowing money for complying with the Islamic laws. However, there are many other benefits that sukuk structures provide apart from just compliance with Islamic laws. Though sukuk are not intended to replace conventional bonds, in certain cases, sukuk structure of borrowing could be more beneficial for both the borrower and the financier than conventional bonds.

Many financial experts and economists opine that sukuk are an ideal way of financing large infrastructure projects. Many countries have issued sukuk securities for funding such projects. This allows investors to participate in the returns generated from such projects and have a diversified portfolio of such sukuk issued by different countries, rather than merely charging fixed interest (riba). Issuing countries also get to share the risk of such projects with the investors. Large Companies can also issue sukuk for funding new ventures with benefits to the investors and issuing company being similar to those mentioned for infra projects.

Different Structures of Sukuk:

Note that sukuk includes any type of debt arrangement which complies with the Islamic laws, that is, which does not have an interest component. Therefore, apart from the example mentioned hereinbefore, there can be many other ways in which a sukuk could be structured. The most common forms of sukuk are given hereinbelow:

Mudarabah (Partnership):

In a Mudarabah Partnership, the financier provides capital for a new venture to the borrower and becomes a part-owner of the venture, along with the borrower. The financier would act as a silent partner and would be entitled to an agreed share of profit for a limited period of time after which he is repaid the principal amount. Being a silent investor, the financier does not have the right to direct the affairs of the new venture.

Therefore, in our example of Great Foods Ltd, The Islamic Bank would only be a part-owner of the SPV and Great Foods Ltd would also have a share of profit. The Islamic Bank would not have any voting rights or any other right to direct the bakery’s operations. Hence, Great Foods Ltd would have complete control over its bakery business, while sharing profits with the bank for the period of funding.

Musharakah (Profit Sharing):

In a Musharakah Sukuk arrangement, two or more parties establish a Joint Venture, wherein both the parties have not only the profit share but also right to vote and manage the affairs of the venture. Here, one party (financier) provides all the capital and the other party (entrepreneur) brings in its management and labour. However, there is an agreement that entrepreneur would buyout the financier within a particular period of time. The profit sharing and voting rights ratio would decrease and the equity share of entrepreneur would increase throughout the contract period as the entrepreneur pays back a certain portion of the amount financed at fixed intervals.

Murabahah (Markup)

Murabahah contracts govern the process of acquiring an item (say for Rs. 100) by the financier, and then reselling it (say for Rs. 105) to the borrower after charging a mark-up (Rs. 5) . The bank lets the borrower to pay the purchase price in instalments. This type of arrangement is common in working capital financing.

Ijarah wa iqtina (Hire purchase):

Ijarah wa iqtina’s literal meaning is Hire-purchase and acts just like a conventional hire-purchase agreement, wherein:

i. The possession of asset is transferred immediately for the use of the lessee.

ii. Lessee makes periodic lease payments to the lessor.

iii. The ownership of the leased asset is transferred to the lessee on payment of the last lease payment.

Though hire-purchase agreements are used as a conventional means of financing around the globe, they are included in Sukuk structures as they comply with the Islamic Laws.

The list does not end here:

There are many other structures of sukuk (Istisna, Salam, to name a few). However, we shall limit our discussion to the four most common Sukuk structures mentioned hereinabove. Know that historical records indicate that there are around 8 other types of sukuk contracts that have been traced back to the pre-Islamic era in the Middle-eastern region.

Sukuk in the Modern World:

The Sukuk Market is primarily an institutional market. Most of the countries where sukuk are issued do not have an active retail market and most of the times sukuk are issued to institutional investors only. The demand for sukuk far outweighs the supply, due to being still at a developing stage and also due to the fact that most of the sukuk-holders generally intend to hold the certificates till maturity.

Malaysia is the largest sukuk market globally with around 45-50% of the total sukuk financing around the globe issued in Malaysia. In fact, Malaysia is the first country wherein modern contemporary sukuk were issued. As on the end of 2020, sukuk certificates worth approximately USD 258 Billion are currently active in Malaysia itself. Due to the various tax incentives offered, issuing sukuk in Malaysia is also cheaper than issuing conventional bonds.

Though earlier, sukuk market was only active in countries with predominantly Islamic population, this is not the case presently, with countries like United Kingdom, Singapore and Hong Kong having issued sukuk.

Sukuk in India:

Currently, India does not have a legal framework in place for issuing sukuk or for other funding arrangements under Islamic finance. In fact, banks are not yet allowed to enter into sukuk like structures. The idea of introducing Islamic finance, (which includes sukuk) was first recommended in the year 2008, by a committee on Financial Sector Reforms which was chaired by Dr. Raghuram Rajan. The main aim of introducing Islamic Finance was not only to provide an Islamic compliant financing mechanism but also to attract investment from countries like the UAE and Malaysia. Sukuk were also considered to be an innovative approach for infrastructure financing. However, the RBI later decided not to pursue the introduction of Islamic banking in the country. However, the idea of introducing Islamic Finance was not completely scrapped but was rather deferred for a later time. There is still a growing interest in the possibility of sukuk-like financing being introduced in India.

Conclusion:

A whole new method of funding long term and risky projects has been made available by the Islamic Financial Market through sukuk structures. It must be reiterated that these securities cannot be a replacement to conventional debt instruments in all cases. However, the design of these instruments are targeted towards certain economic activities. There is worldwide recognition that the one-sided interest based debt contracting may not be suitable for certain types of financing needs such as long term infrastructure projects or projects sailing in uncharted waters, like that of Christopher Columbus. Sukuk based financing offers a better way of financing such projects by allowing a participatory lending arrangement between the sukuk-issuer and the financier. India would definitely benefit by giving legal recognising to such instruments.

Follow Us @

Atharva, found – Sukuk: Rise Of Islamic Participatory Lending – to be a very interesting & informative read. Thank you.