“To be a good investor all one has to do is dream”

The most revered value investor of India, Late. Shri Chandrakant Sampat (1929-2015), regarded by many as the Indian Warren Buffett started investing in Indian markets at the age of 26 after quitting his family business in 1955. He was a man of resolute and rigorous discipline, this made him one of the greatest investors of India.

He amassed enormous wealth with his multibaggers, after the introduction of Foreign Exchange Regulation Act (FERA) in 1970s, by picking up multinationals even before other investors could realise the true value of the companies which diluted equity at prices lower than their intrinsic values.

He is said to have inspired and mentored many marquee Indian investors including the founder and owner of D-Mart retail chain and value Investor Mr. Radhakishan Damani.

Towards the latter part of his investment journey, he was unhappy with deteriorating corporate governance standards of Indian firms and grew critical of the policies followed by global central banks that had led to the rise in asset prices. And he took a bearish stance in the markets and converted most of his investments into cash and cash equivalents.

Sampat believed in self-education and condemned the conventional education and social system, which he felt restricted the mind. He was an avid follower of the Bhagwad Gita, and often quoted shlokas from the great Indian epic.

He was a fitness freak, for him physical fitness was one of the top priorities. He was a regular jogger and extremely health conscious human. Moreover, he followed a very simple diet and avoided sugar and fatty foods.

His Investment Philosophy

Sampat’s investment philosophy is simple; identify great businesses and let the power of compounding do the rest

He was one of the first investors in India who realized the powerful impact of compounding on portfolio. He had a knack of holding stocks for decades, believing that investors should pick shares of companies with good managements, when share prices are at an eight-year or 10-year low and invest only in a few companies.

He was a great endorser of the FMCG stocks and advised investors to pick stocks with least capital expenditure, where the return on capital employed (RoCE) should not be less than 25 per cent.

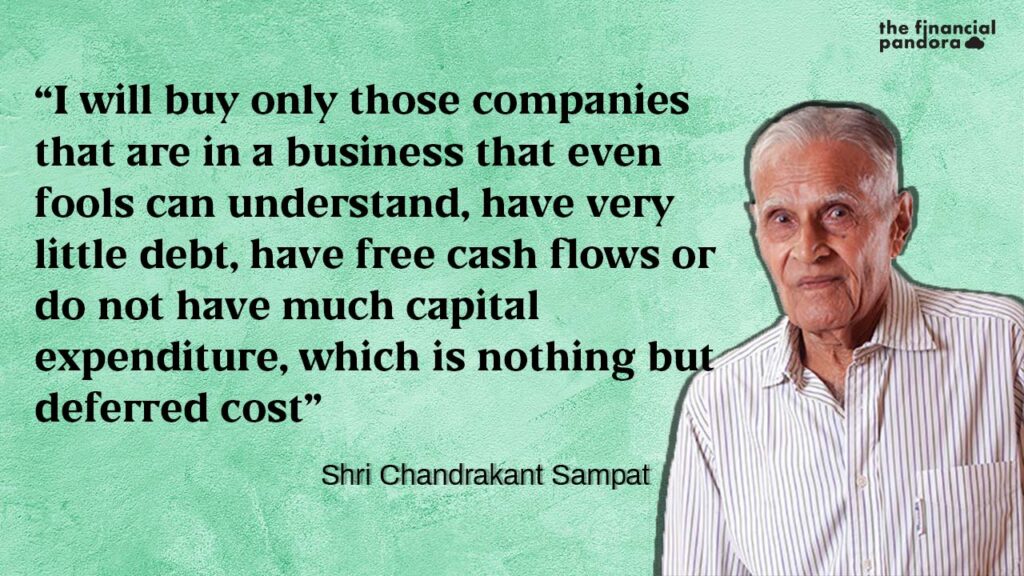

He once said:

“I will buy only those companies that are in a business that even fools can understand, have very little debt, have free cash flows or do not have much capital expenditure, which is nothing but deferred cost”

His Top Picks

Sampat gave importance to free cash flow and longevity of a business for wealth creation. He was a big bull on FMCG and accumulated shares of blue chips, some of his top picks during mid 70’s were

- Hindustan Unilever (then Hindustan Lever)

- Procter & Gamble (initially Richardson Hindustan)

- Gillette (then Indian Shaving Products)

- Nestle

- Colgate

Sampat’s Success Mantras

Capital Allocation – According to him, capital allocation is the most important aspect of a business. He believed capital and innovation gives value to the company, and a good business should be able to grow with minimum cash.

Portfolio Concentration – He believed in keeping only 8-10 great companies in portfolio, he never covered more than ten companies in his investment portfolio. According to him, in a spread-out portfolio, many companies will go wrong and very few will come right. While in a portfolio of only eight-ten companies, even one great performer will cover the wealth.

Significance Of Innovation – He was a proponent of innovation and resonated with the Ideas of Management theorist Peter F. Drucker. He believed technological innovation was resulting in shorter business cycles, which were leading to shorter life spans for companies. Before investing in a stock, he would weigh it on a rigorous scale of productivity and innovation.

Valuations – He never believed in valuation, he had his ability to visualise the future and assign value to the company accordingly, he once said

“Twin blades constitute mere 10% of the Indian market. Bangladesh has 33% penetration. If India catches up with Bangladesh, Gillette will be a Rs.15,000 crores company having a net profit of Rs.2200 crores. At 40 times discounting, that is Rs.27,000 per share”

He called his valuation approach ‘migration path for the companies’ this helped him get multi-fold returns on his portfolio of stocks.

Other Facts

Sampat was a zealous person and loved the markets. He proposed the de-bureaucratization of the whole process of Foreign Direct Investments (FDIs) with a condition that multinationals seeking entry into this country must get themselves listed on the Indian bourses. Imagine Microsoft India Ltd., Coca Cola India Ltd., Intel India Ltd., Apple India Ltd., Netflix India Ltd., being traded here!

He is also said to have suggested BSE that instead of a flat listing fee, the bourse should charge a fee linked to the number of shares the company was planning to issue. Every time the companies announced a bonus issue or raised capital through fresh issue of shares, the BSE would earn additional income.

His deep understanding of businesses, ability to envision the impact of innovations, futuristic thinking and rigorous method of stock selection are timeless and are still inspiring and guiding some of the most seasoned investors.

Follow Us @

This article is really a beautiful message to me for this year to invest in the stock market.