Background:

Route Mobile Ltd (Route), established in 2004, is a provider of cloud communication technology for OTT, Mobile network operators, and enterprises. They provide SMS, email, voice filtering, solutions in messaging, and providing analytics solutions. The main segment in which the company is a world leader is CPaas (cloud communication platform as a service). Route has more than 300 employees and has served more than 30,000 clients since the company’s inception. They have more than 800 networks. They have more than 250 direct connections to Telecom operators and have more than 3,000 monthly paid customers.

Route Mobile has provided 86.82% return from its listing, while from the IPO price, it has given 400% returns.

Industry Outlook:

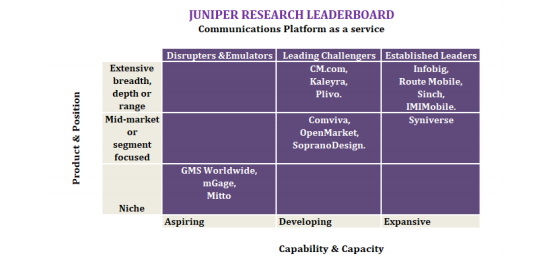

Below is a dashboard which shows the positioning of the company amongst its competitor in the CPaas segment. CPaas platform allows various enterprises to communicate to their customers through different mobile channels, including messaging applications, Rich communication services, and OTT applications.

Route Mobile does not have a competitor in India, but internationally, some players offer these services; below is the matrix that shows the positioning of the players.

Route Mobile is the established leader with an extensive breadth and depth.

Business verticals of route mobile:

- Enterprise (contributed 83% of total revenue): A cloud-based communication platform for OTT-business messaging, enterprise email, 2way messaging, etc.

- Mobile Operator (14% of total revenue): The primary service is SMS analytics, firewall, filtering, monetization, Capas, etc.

- Business Process Outsourcing (3% of total revenue): This vertical supports various client issues

Competitive Advantage:

- Robust Business Model

- The company’s delivery platform is scalable which is supported by robust infrastructure.

- By utilizing the in-house CPaas platform and BPO expertise, they are providing remote contact center solutions.

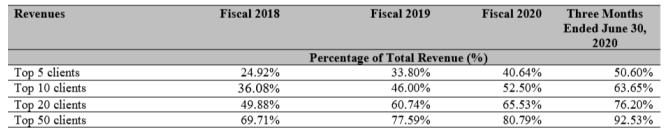

- The client base is diversified across the globe, and hence there is less concentration risk

5. Consistent financial track record

Geographical Breakup:

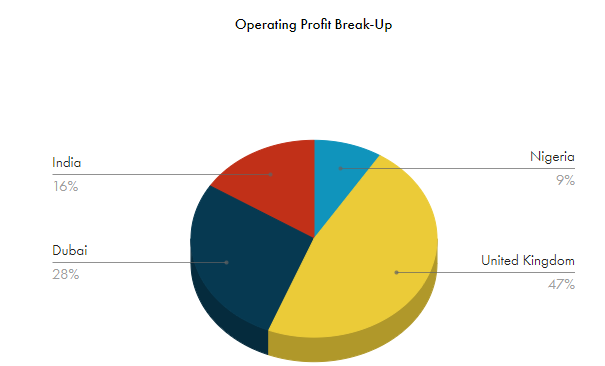

Most of the operating profit of the company comes from UK and Dubai.

Financials:

The company has consistently shown growth in sales with a CAGR of approx—30% in the last five years.

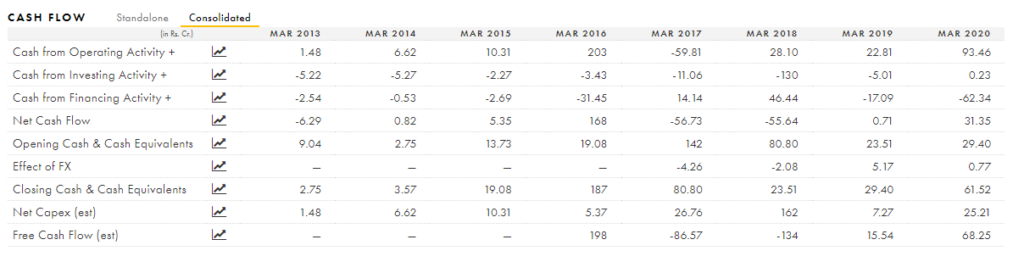

Recently the company has started generating a positive cash flow despite high CAPEX in the past three years.

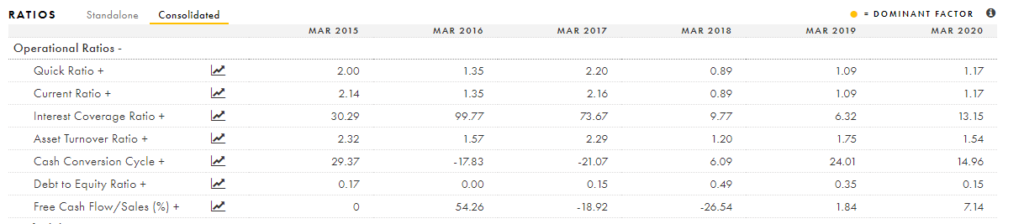

The company has significantly reduced its debt in the past three years with excellent operational ratios.

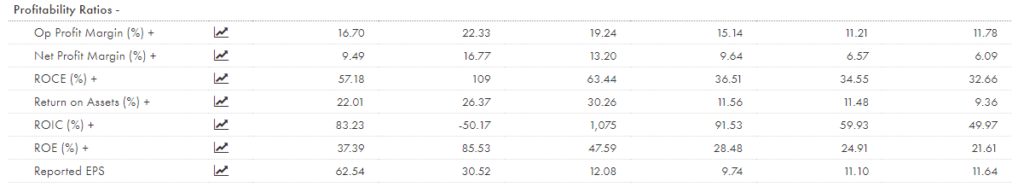

There is margin pressure in the past couple of years as EBITDA realization per transaction is showing pressure.

Key Risk:

- Company success depends upon the relationship with the mobile network operators (MNO). If the company cannot maintain such robust relationships in the future, there is a risk.

- Failure of the technology system through which the company provides the solutions is a significant risk.

- If the MNO started establishing in-house services that the route mobile provides, there is a risk.

- As most of the business is in a different country, the company faces foreign exchange risk.

Valuation and View:

Route mobile is trading at approx. 75 P/E.

Follow Us @