As some of us may have studied in our economics class, that to run any business, you require 4 ‘Ms’. Those are the Machine, Material, Man-power and the most important of all – Money. Though all the 4 resources are vital for the operations & sustainability of business, a greater importance is attached to Money since it has the ability to pay for the other three resources. There are various means to source the capital at the nascent stage of the business like the crowd funding, seed funding, angel funding, venture capital, etc. (since the requirement is less in absolute terms), but as the business grows, only a few options are available to raise the dry powder.

The two most common means of capital raising is – one on the debt side of the balance sheet and the other on the Equity side. Let’s understand in little detail about both these means of Capital Raising.

Bank Loans

Bank Loans are the most common form of capital raising which is grouped on the liability / debt side of the Balance Sheet. The Bank loans generally consists of the Working Capital and the term liabilities. Working capital includes Cash Credit, Overdraft (OD), WCDL, PCFC, Letter of Credit (LC), Bill Discounting, Bank Guarantees, etc. whereas under Term Liabilities you have options like Construction Loan, General Corporate Loans, Loan Against Property / Shares (LAP / S), Lease Rental Discounting (LRD), etc. Different products can be chosen by the Firms depending upon the suitability and the costing of the Products.

Bank Loans are generally advanced against security given by the Entity. This may include Margin Money, Collateral Security and Personal and Corporate Guarantees. Though it is famously said that taking debt is highway to hell, there are some merits in taking debt as well:

Low Cost of Capital

Raising Bank Loans is the cheapest way to raise capital for expansion. In a country where the interest payments to the banks are tax deductible, the net cost of debt (post tax deduction) is even lower. This is beneficial for Companies since Preference Dividends and Equity dividends are not tax deductible and carries higher cost as compared to the Cost of Debt. The Costing may differ from Firm to Firm depending upon factors such as External Credit Ratings of the Company, Security Coverage, Internal Credit Assessment by the Lending Bank, lending banker’s internal Credit rating, past relationship with the lenders, etc. A Company having positive debt metrices and an excellent track record of repaying the debt can raise debt with the least spread.

Financial Leverage

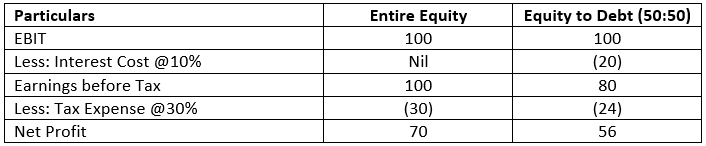

Bank Loans also acts as a catalyst to increase the Shareholders Returns. Consider a scenario where a project is entirely funded through Equity versus a project which is funded partially by equity and debt (50:50). Let’s assume that a Company is undertaking a project for Rs. 400 Crores on which it has an EBIT of Rs. 100 Crores.

In the first scenario, the Company has a RoE of 17.5% (70/400*100) and in the second scenario, the Company has a RoE of 28% (56/200*100). Thus, it may seem that in absolute terms, the Company earns more, but in terms of RoE, the 2nd scenario is well off.

Dilution of Ownership

While advancing loans, the bank takes charge only on the assets of the Company. The raised funds are not considered a part of the Company’s Equity. The ownership of the Company is not diluted. This means the shareholders of the Company can earn higher RoE even without their share in the profits getting diluted. The Bank is only concerned with the timely repayment of debt taken by the Company.

Private Equity

Companies which are averse to taking debt on their balance sheet or Companies which are unable to raise any additional debt due to over-leveraged position resort to raising capital through Private Equity. Private Equity is one of the preferred sources of Capital for large expansion plans. PE Funds are backed by Institutional Investors, Pension Funds, HNIs and other larger PE Funds. Different PE funds have different mandates as to the size of Investments, the stake that they acquire, Sector and Industry preference, Stage of investments, etc. As against bank loans, PE funds does not take any charge on the assets but acquire the ownership of the Company with a seat on the Board of the Company.

Even though the majority shareholders of the Company have to dilute their stake in the Company to raise Private Equity, they would be willing to do so having regards to the below merits of raising Private Equity.

Operational Expertise and Network

The PE Funds and Managers come with vast experience and expertise related to the Company’s operations. The Company can in-turn leverage the network through the Fund Managers. They can get access to the other PE Fund’s investee Companies and can target for international expansion as well. In some cases, the PE Funds can also facilitate strategic acquisition, target buy-outs and possible M&A opportunity.

Outflow of Funds

Generally, a Company raising Private Equity does not have to worry about the capital repayments. In case of Equity, the Fund may seek an exit through a secondary transaction or IPO. Only in case of buy backs does the Company have to return the Capital raised earlier with some % return on the investments. However, that would be at the end of the project life cycle.

In case of Preference Shares, the Company has to pay annual dividends to the shareholders. The rate of dividend is generally the minimum IRR that the Fund expects to earn from its investments. The Preference Shares are then redeemed at premium at the end of the instrument tenure. Considering the re-investment of cash-flow and earning a good multiple at exit, PE Funds prefer secondary exits and thereby limiting cash outflow during the project life-cycle.

Existing Leveraged Balance Sheet

Companies with existing leveraged Balance Sheet are either not in a position to raise additional debt or can raise debt at exorbitant high coupons. This scenario is the perfect fit for raising further capital through Private Equity. It would enable the Company to strengthen its Balance Sheet and leverage Equity fund raise though additional debt. This is a pertinent trait seen in the new-age NBFC Companies.

Better Valuations during IPO/ Subsequent Fund Raise

An IPO backed by strong / global PE Funds often hit the market with better valuations and subscribed multiple times. This becomes a good opportunity for the Fund as well as the promoters to partially sell off their holdings attracting good returns. In case of subsequent fund raise as well, the Company is able to attract investors by leveraging the names of the existing PE investors on the Cap-table.

Thus, choosing between the Bank Funds and Private Equity, is subjective based on the preference of the existing shareholders, their financing strategies, preferred capital structure, risk averseness towards raising Debt, expansion plans and project life cycle, etc. Intermediaries such as transaction advisors and Investment Bankers evaluate all such conditions and positions of the Company and may advise for the most suitable capital structure and assist in capital raising via Bank Loans or Private Equity.

This post was written in collaboration with Asif Yahiya Sukri LLP. Asif Yahiya Sukri LLP provides unparalleled personalized financial services to a broad range of clients across different geographical locations. With a presence in the USA, India and the MENA region, they ensure that all of your financial decisions are made carefully and with your best interests in mind. They are innovators who understand what goes into building companies.

You can also reach out to them on info@aysasia.com

Follow Us @