The Coronavirus pandemic was unparalleled, because never before have we witnessed a shock that paralysed both the supply and demand side of the economy! Most funds were caught unaware, grappling with losses and trying to gauge the extent of losses. But one class of funds actually stood to gain from the chaos. Tail Hedge funds, the best example of it being Universa Capital.

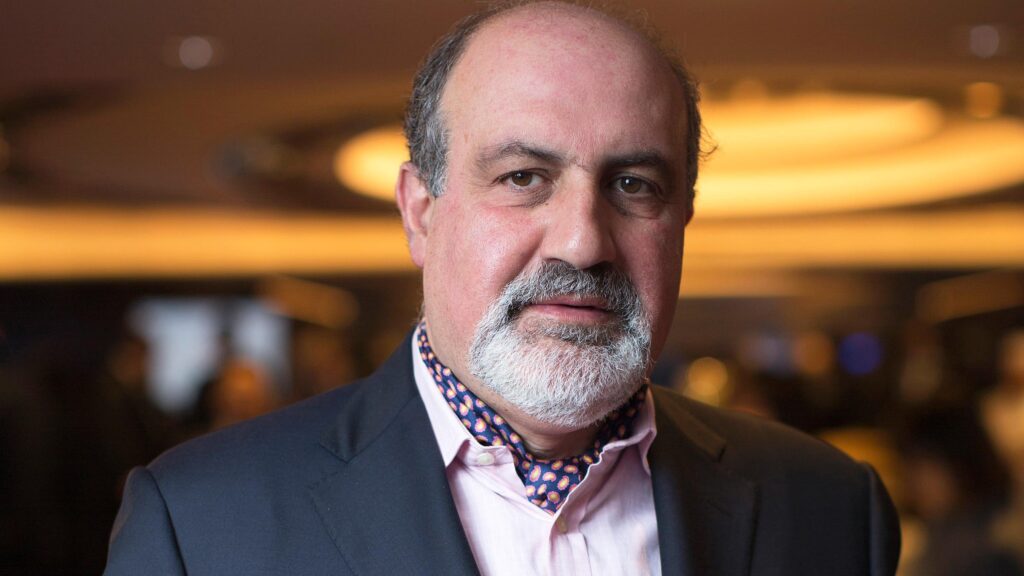

Universa Capital is the fund started by Nassim Nicholas Taleb, the man who is seldom caught surprised. Taleb’s fund saw 4144% return YTD in April. Yes, you read that right. The fund made 40 times the profit when globally markets came crashing down with a clang.

Taleb, a Lebanese-American author, and former trader, doesn’t just talk the talk, but walks it too and with panache. His most popular work, Black Swan, is the term that is being used to depict the current events. And before you ask if he could’ve predicted a health related pandemic impacting global markets, no! But Taleb did know, from his experience in dealing with chaos and statistics, that the new found investor confidence and buoyancy was heading towards a roadblock soon. And not the one to be “Fooled by Randomness” he positioned his bets to help him reap rewards when the pandemic did eventually hit us.

So what exactly is the investing strategy of Taleb?

A tail risk hedge fund focuses on 3 sigma events on side of the normal curve, i.e. the left tail 3 sigma. It relies on asymmetry in demand and supply in the equity market. Besides, you also need significant investor confidence that the markets are better positioned, that they have better information than they did when the previous crisis arrived. While most of these conditions were satisfied, there was no way to predict that a global health pandemic would cause the market crash. That is, there is no sure shot way of timing the markets. And so, to be able to reap the benefits of being a tail hedge fund, you need to have sufficient funds to cover your margin in the good times.

The current market downturn saw investors first flee to safer markets, i.e. US market. Then as the Fed announced rate cuts, investors tried to find other asset classes. And finally they decided that cash is king. At each event turn, a tail hedge fund stood to make significant profits.

Liked the Profile you just read? Show us your support by clicking that like button and sharing it with your friends using #tfpprofile

Also don’t forget to leave your thoughts about the article in the comment section below.

You can also subscribe to our mailing list by filling the form below.