History of RBF

RBF is also known as royalty-based financing. This structure started in the early 20th century for large businesses in industries as diverse as oil and gas, mining and biotech. Investors then began to move to SME’s. It is gaining popularity in the US and now is a pioneering asset class in India.

The model

It is a friendly debt structure model without any hassle. The capital is given upfront at the beginning itself and is 4X of monthly revenue. The monthly repayment expected is 2-9% of gross revenue until the total repayment is received.

By Entrepreneur’s, For Entrepreneur’s

Formal education will make you a living; self-education will make you a fortune. – Jim Rohn

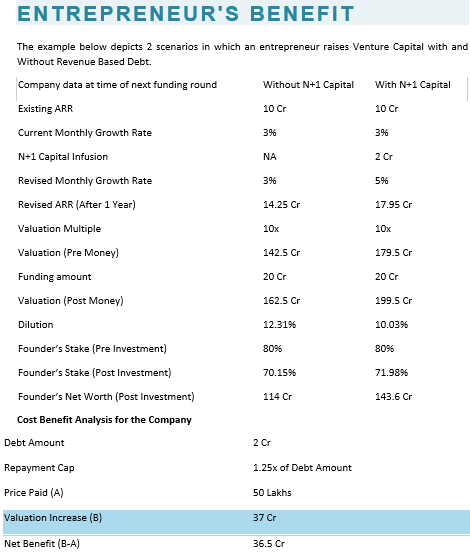

This quote is rightly said as N+1 Capital is founded by two professionals whose only aim was to develop an investment instrument that makes fundraising easy for companies. They studied the difficulties faced by companies and discovered a new way to run and support business. An approach that goes beyond the pursuit of high valuation i.e. no need to pay monthly instalments or interest or even offer equity to them. They are not here to steal your business or even be a part of it. They simply want to be the backend by pumping capital upfront in exchange of a share percentage of your future revenue in the business. They are on your side and it’s “your company to keep”.

Win-win for Entrepreneurs and Investors

Both – the entrepreneurs and investors are aligned towards revenues and growing the business. Like debts, revenue-based financing (RBF) is non-dilutive i.e., you don’t lose a stake in your business, you have 100% control over your business without anybody’s interruption. With respect to debts, you have a fixed amount to repay along with some collateral security. So ownership and control is all yours!

In RBF, your monthly payments are directly linked to the revenue performance. The payments will alter with your revenues making your finance a variable cost rather than a fixed cost to your business. Consider the hotel industry, they have maximum business during festivities and their repayments will be higher compared to other days thereby reducing the burden of principal repayment.

Ease of doing business

N+1 Capital focuses on enabling the companies to stay more in control of their business and to focus only on one thing – how to grow and build a great company. They don’t want you to halt only due to the lack of funds. N+1 acts as a catalyst and accelerates the growth of a company by completing the end-to-end investment process within 6 weeks.

Not a fancy word for “factoring”

Till now, we have understood RBF gives you unrestricted capital for growth in return for a small percentage of monthly revenues. Factoring provides working capital to the business and RBF basically is for growth. A company takes RBF initially and leverages the funds to register growth.

Companies that can approach

Companies that have a minimum monthly revenue of INR 50+ lakhs for previous three months with a moderate growth showing 25% gross margin. So it is important to note the company must be generating revenue as it will be from the revenue that payments will be made.

Ready to grow? Here, visit their site and see how they can help you. https://www.np1.in/

This post was written in collaboration with Asif Yahiya Sukri LLP. Asif Yahiya Sukri LLP provides unparalleled personalized financial services to a broad range of clients across different geographical locations. With a presence in the USA, India and the MENA region, they ensure that all of your financial decisions are made carefully and with your best interests in mind. They are innovators who understand what goes into building companies.

You can also reach out to them at info@aysasia.com

Follow Us @