“You must know the big ideas in the big disciplines, and use them routinely — all of them, not just a few. Most people are trained in one model — economics, for example — and try to solve all problems in one way. You know the old saying: to the man with a hammer, the world looks like a nail. This is a dumb way of handling problems”

Charlie Munger

Mr. Munger is talking about mental models, that is a representation of how something works. It is a view that helps you interpret everything around you and establish a relationship between different things.

Consider this – while evaluating a company, an analyst will evaluate its business, a banker would determine its credit profile while a value investor will try to find its intrinsic value. A bond manager or an LBO artist might focus on other aspects. None of them are wrong, but neither of them are able to present a complete picture either.

The challenges and situations that we face cannot be explained entirely by one single aspect (just like in the above scenario). We need different mental models that would lead to well-rounded understanding, better decision-making and effective solutions. In addition, we cannot keep all of the details around us in our brains, and hence we use models to simplify complex data into understandable and organized chunks.

Mental Models from various fields (Physics, Biology, Economics, Military, Anthropology, etc.) can be used for decision-making. Today, we will start with a very easy but important & effective mental model – “Checklist”.

CHECKLIST – A simple but efficient mental model

A checklist is a tool that can be used to outline a set of things that needs to be completed. It is far from obvious that something as simple as a checklist could be of substantial help. However, because humans have a very limited memory and attention span, checklists help us accomplish complex or error prone tasks. Quoting Charlie Munger here, “I’m a great believer in solving hard problems by using a checklist. You need to get all the likely and unlikely answers before you; otherwise it’s easy to miss something important.”

CHECKLIST – In Investing

When we find a prospective investment opportunity that could make us good money, it often triggers the human emotion of greed. Guy Spier calls this the ‘cocaine brain’ and quotes, “You go into the greed mode. Neuroscientists have found that the prospect of making money stimulates the same primitive reward circuits in the brain as cocaine.” It makes us irrational about our decision-making. Discipline is very important, and a checklist helps you achieve it. Munger emphasizes on checklists saying, “If you are trying to analyze a company without using an adequate checklist, you may make a very bad investment”.

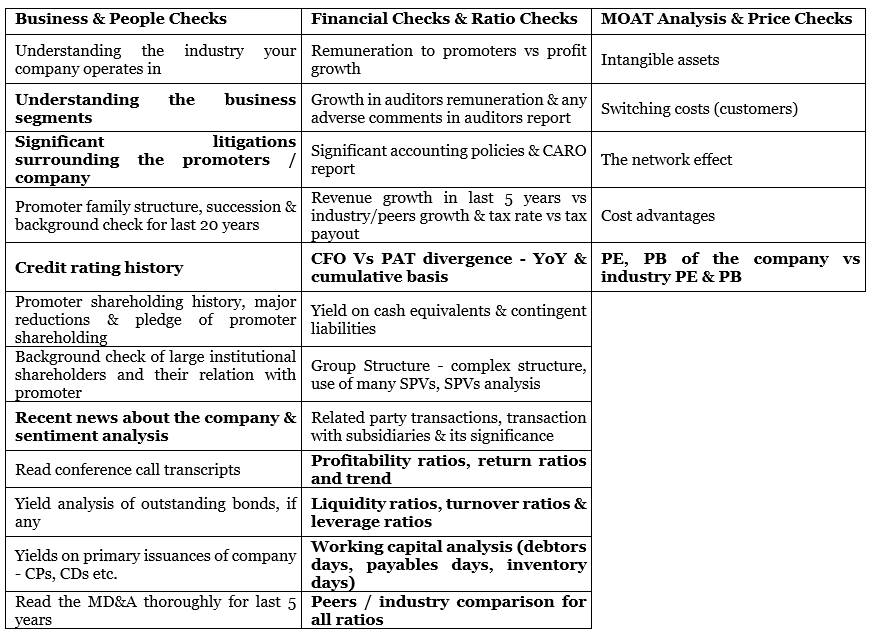

Drawing the importance of a checklist and taking inspiration from the likes of Warren Buffet, Charlie Munger, Peter Lynch, Benjamin Graham and based on our personal experience, we have made an attempt to prepare a comprehensive checklist for investing. As Prof. Sanjay Bakshi says, “The checklist for a small investor who focuses on buying good companies with durable moats would revolve around three factors – business, people and price”. Based on these factors, our checklist looks something like this!

Though the checklist is largely self-explanatory, below is a very brief explanation on some of the crucial points from the list. Remember, this is just a tool and should be used only in consonance with other tools.

Business & People Checks

Before jumping onto any company, it is of utmost importance to understand the key facts of that particular industry. For instance, while evaluating a company in the EPC sector, ideally you should give more importance to receivables than to sales, and to accounting policies and individual SPV analysis than to ‘on paper margins’. Knowing the critical facts of an industry beforehand would surely give you an upper hand while analyzing any company in that industry.

Find answers to questions like how the company is making money. This simple analysis would help you understand the business and its segments better. “Only invest in simple businesses that you understand,” says Mr. Buffet.

Corporate governance is highly undermined by retail investors; give it its due share of respect.

Apart from checking the share price of the company, check how the company is performing in the debt market. If your company is raising debt instruments (CPs & NCDs) at a rate higher than its competitor of a similar size and credit rating, you have a good reason to delve deeper.

Financial Checks & Ratios Checks

From DHFL to IL&FS, the common link between almost every financial fraud is “diverting money through different group companies/ SPVs”. Hence, when you see that a company has a very complex group structure, lots of related party transactions or huge investment in loss-making group companies, make sure you do a detailed due diligence on all the SPVs and transactions. This might take some time but it is worth it.

In investing, peer group analysis plays an important role in establishing valuation and moat of a particular stock. It will help you spot valuation or multiples anomalies and ultimately determine whether it is justified or not. Compare all the critical ratios. If there is a huge deviation in any ratio, try to find the reason for the same.

People often forget to check off-balance sheet items like contingent liabilities. One should try and ascertain that if a contingent event crystallises, whether the company will be in a position to oblige it? A classic example in recent times is Vodafone Idea Ltd post the Supreme Court judgement on AGR.

Moat Analysis & Price Checks

Warren Buffet coined the term “economic moat” which refers to the sustainable advantages that protect a company against its competitors – the same way a moat protects a castle. There are four sources of economic moats outlined in ‘The Little Book that Builds Wealth’ authored by Pat Dorsey, which are explained here. These are traits which endow companies with truly sustainable competitive advantage.

If the ROE or ROCE of your company is consistently higher than the industry average (and cost of capital), and the margins are expanding, this indicates a moat. Which moat? Let’s check:

- Switching costs

Let us explain this by taking the example of Adobe. Many people who carry out image editing are trained in using Photoshop. They are now comfortable using this software and it is difficult to switch to some other software. This is precisely the reason why Adobe can charge a higher price for Photoshop.

- Intangible Assets

We have an inherent trust on some brands like – Asian Paints, HDFC, Reliance, etc. We have a strong evidence of a moat if the customers are willing to pay more for their products. It is a kind of mini-monopoly, which allows them to extract a lot of value from its customers. Also, who would not be keen to invest in the IPO of HDB Financial Services (backed by HDFC) or Reliance JIO? This is the power of brand.

- The Network Effect

We probably have that one friend who seems to have met everyone in creation. These people create a huge network of contacts, which makes them desirable acquaintances. Their social value increases. Same is the case with HUL and ITC, who made an unparalleled network through backward integration, which in turn increased their enterprise value. To produce cigarettes and FMCG goods, ITC sources raw materials it needs through its e-Choupal network of over 4 million farmers. They have built an enviable network.

- Cost Advantages

Continuing with the above example of ITC, it sources its raw material requirements for cigarettes and FMCG products through its E-Choupal network, for Classmate notebooks through their paper plant and for the chocolates and biscuits segments through their dairy sourcing capabilities. You can see that it has its major RM requirements covered through their own networks and thus the cost is always under its check. The impact is also less during the times of rising input costs.

Coming to price checks, we should normally avoid companies who have a PE way higher than the industry average. Although a high PE is justified by high growth, sound business model and strong brand image, there is no ball-park figure here. The true test for the price is in determining the intrinsic value of the company through an appropriate and effective valuation model.

For Retail Investors

You may wonder why some of the points in the checklist are bold and the others are not. (Oh wait, you’re checking again now, aren’t you?). Retail investors generally do not wish to undertake a detailed analysis (though we suggest otherwise). For them, we’ve highlighted in bold those points that are necessary for a bare minimum check, to identify some obvious red flags.

PS: Investors should bear in mind that no checklist could ever be exhaustive for stock analysis and investing. Hence, one should not restrict themselves to the parameters mentioned above. However, an investor can be reasonably certain that those stocks which pass the above checks will have sound fundamentals.

CHECKLIST – In Life

Just as checklists are important in investing, so are they in life. Just like a checklist bears a positive outcome to our investments, it also has a bearing in the positive outcome of our life. We often compare our achievements to that of others. I got good grades compared to my friends. My salary is higher than my colleague’s salary. I have the latest smartphone available in the market. It seems as if the sole purpose of our lives is to outdo others, to race ahead of others. We compare our lives and our achievements with the scale of others.

Dalai Lama, when asked what surprised him the most about the humanity, said —

“MAN. Because he sacrifices health in order to make money. Then, he sacrifices money to recuperate his health, and then he is so anxious about the future that he does not enjoy the present. The result being that he does not live in the present or the future. He lives as if he is never going to die, and then he dies having never really lived.”

Thus, it is very important to have some checks in life and ask ourselves a few questions:

- Are we doing something we love?

- Are we enjoying what we are doing?

- Are we able to spend enough time with our loved ones?

- Are we taking good care of our health?

- Are we actually living our lives?

We should constantly answer to our conscience, add more such questions and answer them as well.

Academically or professionally too, we come to cross roads where we are shooting arrows aimlessly. Be it taking new courses to look at par with our peers or taking up high paying jobs to maintain a societal status–quo. We tend to lose ourselves in the process and take up courses, roles and jobs which are not meant for us or which do not define us. Our focus should always be on the long game and we must always thrive for it. The courses that we take up are only ‘tools’ to achieve the long-term vision. The job gives you an early exposure. Salary is only a by-product. Indicative checks and thorough process would look something like this:

- Identify your end game/ goal

- List down the tools to achieve it

- Start working in that direction

- Improvise as required

- Constantly evaluate

Just as actions succeed words, the checklist is not just to be read but to be followed with actions. To sum this up, a particular shloka from the Shrimad Bhagavad Gita comes to our mind – where Shri Krishna advices us to bring out the best in us in the present so that the future takes care of itself. The actions must be focused upon and not the results. Perform the actions diligently and the results shall take care of itself.

कर्मण्येवाधिकारस्ते मा फलेषु कदाचन ।

मा कर्मफलहेतुः भूः मा ते सङ्गः अस्त्वकर्मणि ॥ ॥२.४७॥

karmanyevaadhikaaraste maa phaleshu kadaachana

maa karmaphalahetur bhoor maa te sango’stwakarmani //2.47//

Liked the Article you just read? Show us your support by clicking that like button and sharing it with your friends. Also don’t forget to leave your thoughts about the article in the comment section below.

You can become a part of our mailing list by clicking here

Very well written guys

Quite interesting and relevant. Also well explained.. thanks alot

Well written and we’ll analysed

Well written!

Nicely written!! 💪

Wooh.. very well written with proper analogies and examples… Great work guys.

Well written,ekdum mast