Market Chronicles for the week ended 14th August, 2020.

Nifty had a choppy week, followed by a steep fall on Friday, finally ending the week a flat 0.32% in the red.

Our outlook is CAUTIOUSLY BULLISH, because despite Friday’s abrupt fall the trend is intact, and we see no reason to be bearish as long as the latest higher low & 200 DMA are defended. However there is enough reason to be cautious given the bearish momentum divergence on the daily charts, making a re-test of 10900 quite likely.

To the upside, the last major gap from March still remains unfilled between 11377-11630.

Please read on to understand our rationale. This article contains an analysis of technical parameters as well as open interest and derivatives data. All the information below has hints for what levels to watch out for in weekly trade. Replicating these on your charting software and keeping an eye on them can help minimize unpleasant shocks in your trading.

Moving Averages

A quick snapshot of how the major Moving Averages are placed on the daily and weekly chart.

Ichimoku (D)

Nifty intraday

Nifty spent most of the week defending Monday’s gap-up.

On Friday, it gave a sudden fall and closed the open gap from the 2nd week of August. It also held the trendline from the March lows.

Bank Nifty

Bank Nifty is still trapped in range. 21000 seems to be a good support area!

OI Analysis:

Open interest or OI is the total number of open positions in the market. A high OI indicates that there is a lot of activity in that instrument. It does not indicate buyers and sellers individually but is instead a more holistic measure, i.e. it is the number of contracts between the buyers and sellers, not the buyers and sellers on their own. One of the ways OI analysis works is that high-volume market participants would have sold strangles at strikes which leads to higher OI. This type of reading does not typically account for other types of spreads that one may trade, but the data for it is available.

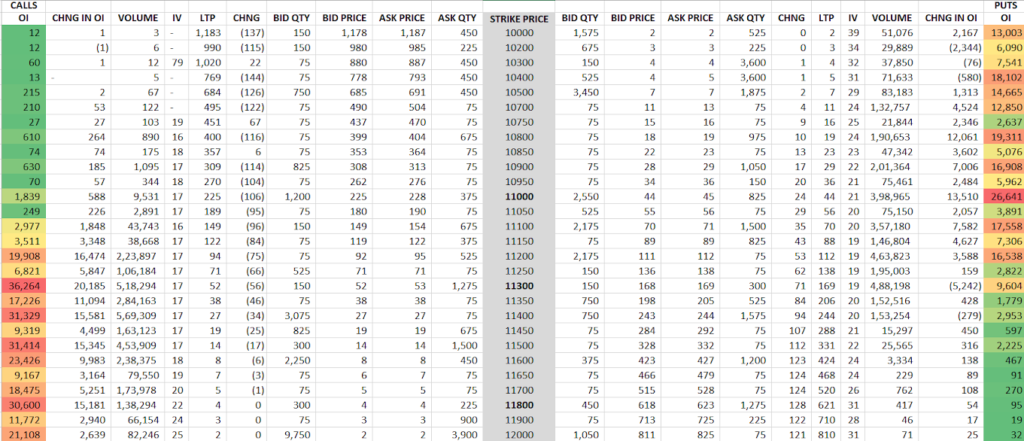

Nifty

Looking at the OI figures of 20th August 2020 expiry, we can see that the range is slated to be between 11,000 and 11,300. Call writers seem to have rolled back their strikes anticipating a bearish movement this week, possibly using 11800 as a hedge to design a spread.

Put open interest does not appear to be as high as the call’s, nor does it appear to be as spread out. This is because we can see several high OI strikes on the call side, but that isn’t the case on the put side.

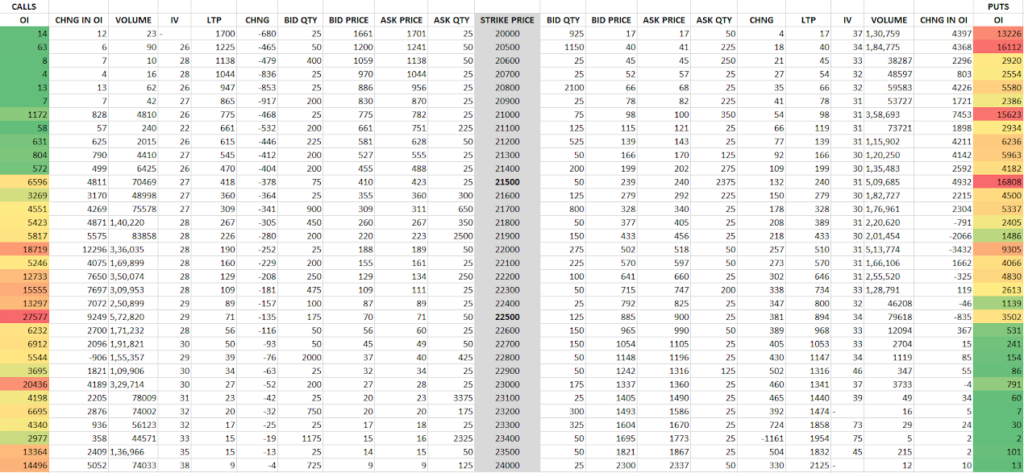

Bank Nifty

Banknifty has the tendency to move quite a bit more than Nifty which makes the OI figures we see here rather interesting. We typically discuss the range by understanding the highest OI strikes, however we can see that Banknifty’s OI tends to be spread out across several strikes.

This makes it slightly trickier to accurately estimate the range for the coming week when compared to Nifty. However, we can see that levels higher than 22500 do not have a very high OI which once again means that the larger option players expect this week to test lower levels or stay range-bound with a mildly bearish bias.

Heavyweights in the Nifty 50:

Let’s look at some important stocks in Nifty50 that collectively make up around 42.83% of NSE’s flagship broad market index. The analysis is done on both, Daily and Weekly timeframes. Charts displayed are either Daily or Weekly depending on which provides a clearer picture.

The weights used as per the most recent NSE press release available, dated July 31st 2020. Compared to the previous period’s, this period has seen some major changes including Infosys replacing HDFC for the number three spot and TCS replacing ICICI Bank for the number five spot. This is most likely due to the strong performance delivered by IT stocks in the past couple of weeks. Interestingly, the overall weightage of the top five stocks continues to increase MoM.

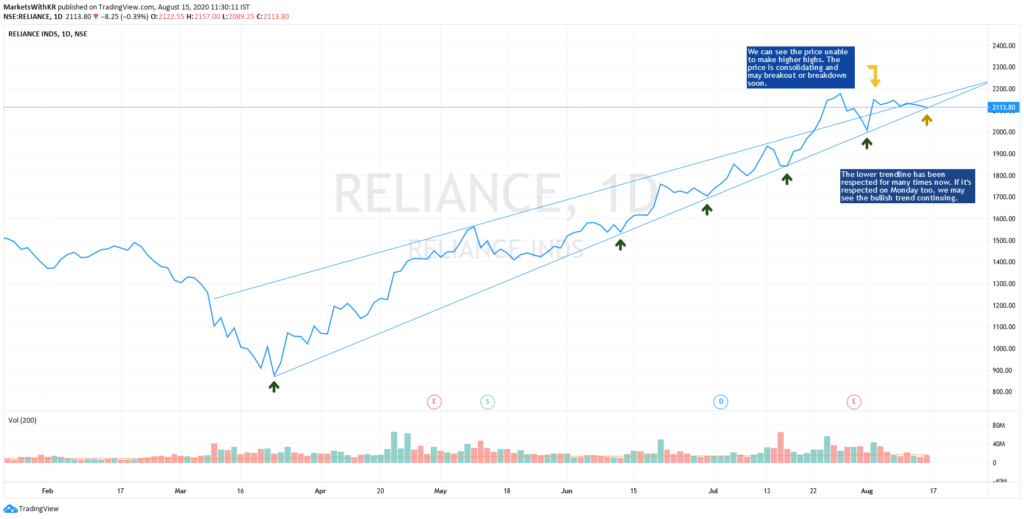

1. Reliance (14.00% weight): We looked at Reliance’s line chart last week as it shows us a more linear and cleaner picture of how the trend looks like. Up until now, Reliance has respected the trendline very well. This means that as long as it can hold the levels where it rested on Friday, we could potentially see the stock continuing the rather linear uptrend it has enjoyed so far. However, a breach of this level may signal caution for the Big Daddy of the Indian markets. In the past, RIL has given a fake out after consolidating at its ATH before retracing. While this does not appear to be very similar to those fakeouts, the possibility cannot be ruled out just yet. All this makes Reliance a key focus for the coming week, even more so because the initial AGR dues sentiment seems to be unfavourable for Jio. The uncertainty seems high as volumes have shrunk as well. (Read the Basics of Dow Theory and trend by clicking here).

2. HDFCBANK (9.56% weight): The banking heavyweight continued its laggardly performance by facing stiff resistance at 1066-1070 levels. If the market sentiment is not good and if buying does not pick up, we could see HDFC Bank below 1000 once again. Volumes seem to be drying up, too.

3. Infosys (7.56% weight): After the false breakout that we discussed last week, Infosys has underperformed quite severely, rejecting higher levels every single day. One positive point to note here is that despite rejecting higher levels, the buyers have attempted to close higher every day. This means that the bulls haven’t given up yet, which is a good sign. If volumes can pick up on Monday or perhaps if we see some strong industry or company specific news, we may see INFY doing quite well.

4. HDFC (6.59% weight): Not much has changed in HDFC since last week. It attempted to bounce from the support zone, but this was at a time when there was a fair bit of uncertainty and lack of buying confidence. This could be why we’re seeing it failing to hold higher levels. Of course, HDFC Bank not being too strong might have something to do with the underperformance, too. Many HDFC stocks including HDFCAMC haven’t been able to pick up pace since quite some time.

5. TCS (5.12%): We still stand by last week’s analysis of 2200 being an important level for TCS. Given that Infosys has managed to hold onto higher levels better than TCS, it may be a stronger stock from the market’s perspective, but TCS has the potential to show some rather large moves which may narrow the performance gap down if momentum is picked up. What is interesting is that both TCS and Infosys are seeing a steady fall in volumes which may mean it really could be an industry-specific problem rather than a stock problem.

Heavyweights in Banknifty:

Since we have started analysing Banknifty in Market Chronicles, we decided to include some top movers of Banknifty. The number one mover is HDFC Bank, which has already been spoken about in the previous section, so we will discuss two other important stocks here, namely Kotak Bank and SBI. Other banks have an impact on the index, but these along with ICICI Bank are typically the movers.

1. Kotak Bank: After a rough last week, Kotak Bank seems to be walking right into its Fibonacci retracement support level at 1285. This should be an important level to hold onto as once this is breached, we may see the stock slipping further.

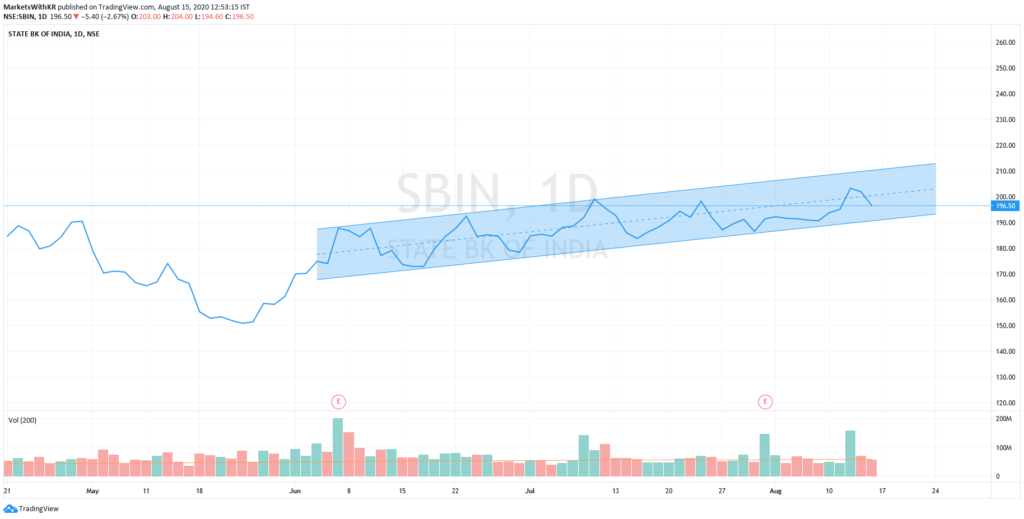

2. SBIN: The PSU heavyweight gained quite a lot of attention when it recently breached 200 levels for the first time in quite a while. However, this was possibly a fake out as it rests at 196.5 on Friday closing basis. While volume data supports the strong breach of the important psychological barrier, the momentum did not catch up and hence we saw the stock sliding. It is still contained within the parallel channel and is halfway between retracing. Whether buyers enter at this price after a 200 retest or wait for the support to be tested will more than likely depend on the broad market conditions and announcements made on the Independence Day by the PM.

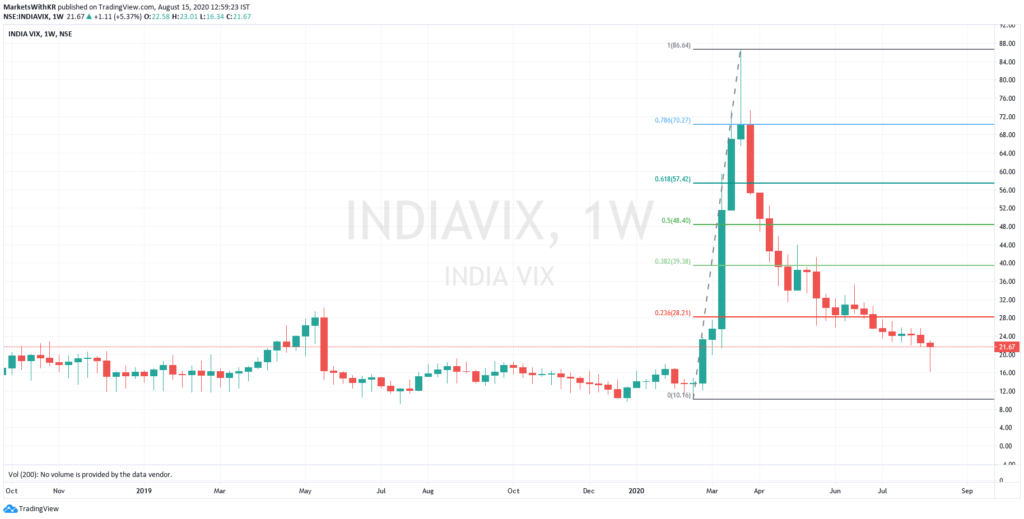

Volatility:

VIX continues to fall, but based on intraday price movements and overall sentiments, we believe that the actual price movements are not very well described by INDIA VIX this time around. If the markets continue climbing a wall of worry, we may continue seeing lower VIX levels, until it doesn’t. When VIX may just spike. This past week has been incredibly choppy in terms of price movements, with massive gap openings seen on intraday charts, too. These details are not captured by VIX which may be why we see it continuing to fall.

Friday was one of the most important days for INDIA VIX. This is because it, for the first time since COVID-19 selloff, touched sub-20 levels. And not only did it touch sub-20 levels, but the low made was just above 16 which is in the territory of pre-COVID normal VIX levels.

This is a very, very big thing. However, on a closing basis, the volatility index was quick to recover back to 20+ levels after the markets saw an extremely sharp correction towards the end of Friday.

Next levels for VIX will depend on how the broadmarket moves. Many speculate that the market is overbought and due for a correction. If that happens, VIX may rise. However, if we see buying picking up, VIX may come back to lower levels.

For your reference, a lower VIX (or lower volatility) is generally associated with price moves that are less choppier and more trending. It also results in lower option prices (due to a lower IV). But at the same time, the ATR (Average True Range) of the stock would be narrower.

If you’re new to technical analysis and would like to know how to read the charts below, here’s a quick guide!

Disclaimer:

We, Anosh Mody & Krunal Rindani shall take no responsibility for any losses occurring out of investment/trading decisions you make based on the contents of this article.

We are not SEBI registered investment advisors. This article is meant for educational purposes only, please consult your investment advisor before acting upon any information you see here.

We may or may not have open positions, kindly assume that we are biased.

Follow Us @

Some Unrelated Stories!