The face of luxury fashion was changing way before the pandemic came into the picture. Crucial aspects of the luxury business such as targeted demographics, product lines, market strategies and even leadership teams were subject to revolutionary improvements which could previously have been too ambitious for the traditional fashion community which was often deemed to be snooty and mostly with European roots. The pandemic surely did give a needed nudge to the industry for the better or for the worse.

To anyone who is following the luxury segment closely, the evolution is very evident. No longer is it limited to a handbag or the latest fall/winter collection. Like all other sectors, the experience economy has percolated deep in the spectrum of luxury. As it was aptly phrased in a recent report by McKinsey and Business of Fashion, the luxury industry was at the precipice of a seismic shift in the beginning of 2020. A major portion of the existing consumers along with new ones were choosing experiences over materialistic things. However, this does not point at the fact that the number of consumers aspiring for luxury products was decreasing. The segment did transform into something far too flexible and accepting with services like reselling and rentals which are now popular. This process led to European and American brands to shift a considerable amount of their focus on hospitality and other ancillary categories. With this, e-commerce was steadily gaining market share and, while tourism remained a significant revenue-driver for luxury brands, growing government regulation was already making local buyers more important.

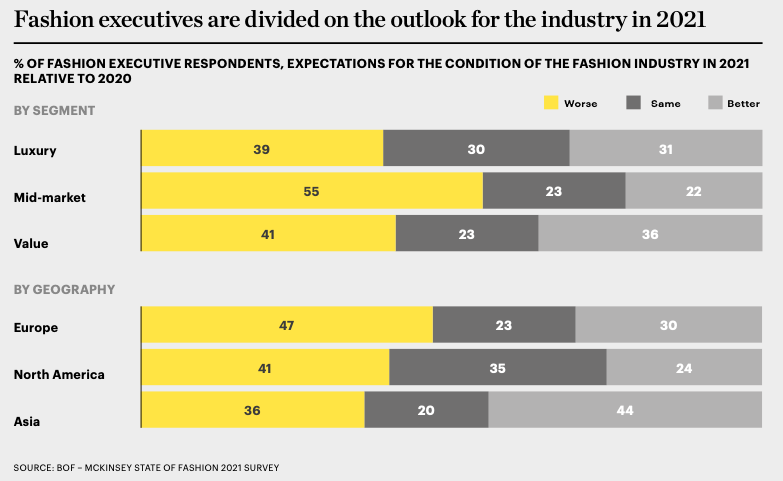

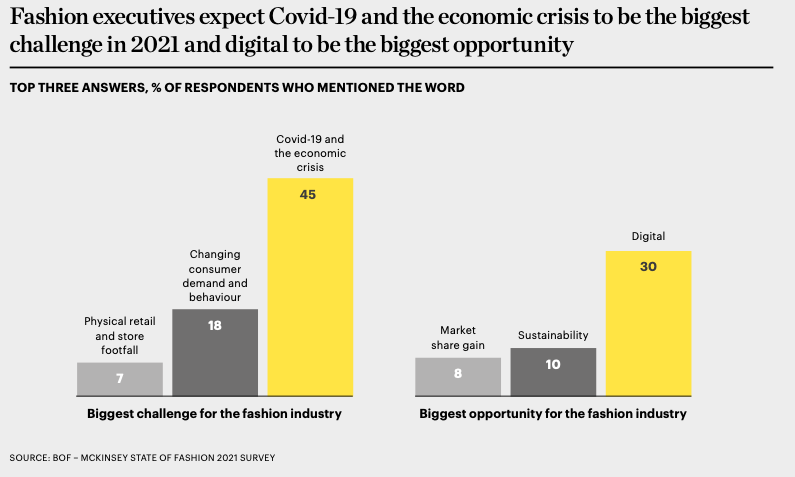

The indusrty was moving at a stable pace before Covid-19 became a literal showstopper for brands. With luxury hospitality and the shift to ecommerce, the future was slightly better for brands, but the pandemic made the future for the modern blooming era a little hazy. The initial months of the pandemic did result in a halt of sorts. In the June and July through September of 2020, the prospect of attending IRL (in-real-life) fashion shows in any great number seemed far off. The British Fashion Council was first to adopt an online format using digital tools, when it announced that its usual men’s fashion week would move forward as a co-ed, digital week. The Fédération de la Haute Couture et de la Mode (FHCM) too, held their very first couture fashion week in the July of 2020. Some larger houses even deferred their showcases in the hopes of a physical show whereas some adopted a hybrid model. In terms of sales, brands with strong APAC presence did better than the ones solely focused on their vicinity or only with a strong foothold in China. Brands that generate more than 30 % of annual sales in the Asia-Pacific region, including China, Japan, South Korea and Taiwan — achieved higher market valuations during the pandemic. With this, the luxury business was facing fundamental shifts in their style of operations as well consumer behaviour. The previously gradual shift to digital experiences had now picked up pace. Sustainability and ethical business practices turned out to be game changers as more and more customers wanted to make morally correct choices. In addition to this, companies were faced with troubled labour and supply chain disruptions with a lot of the material coming from China. So if you were to picture the industry as of today, you could perhaps, most aptly, imagine a place with traditional elite players with set rules along with new indie-modern brands taking up unconventional paths in the same play field with customers as the ticket buyers who are currently in a transitional phase with regards to their style preferences, spending habits and moral beliefs.

Innovation was at the epicentre for most of the sectors during this pandemic. Brands tried out unconventional campaigns, initiated support programmes, shifted SCM strategies and even adopted new go-to-market strategies to stay relevant. For example the secondhand, or resale, market, both Burberry and Gucci made arrangements with reseller brand The RealReal. In addition to this many department stores like Nordstrom and Macy’s M built secondhand shops inside their stores, often curated by third parties like Trove.

But anyone who is even faintly acquainted with the working of business cycles could see a recovery, perhaps post a prolonged period but still on the horizon. Soon by the Q3 of 2020, some areas of luxury were springing back up. The fashion division under LVMH, which includes the crucial leather goods category saw a 12% YoY increase, even as overall sales decreased 7% owing to the challenges faced in the duty-free area as international travel was badly hit, as well as at the global beauty store under their wing, Sephora. At Hermès, sales were up by 7% overall, with major product lines showing positive growth. At Kering, overall sales fell by 1%, beating analysts’ estimates by nearly 8%. While sales at Gucci fell almost 9%, Bottega Veneta jumped 21%.

As a sector, uncertainty is definitely in the air. Owing to its nature, the luxury business is a mix of creativity and commercialisation. Therefore, to strike the right balance post the Covid-19 era is important. The needs are changing and so is the buying pattern. Erwan Rambourg, MD and Global Co-Head of Consumer & Retail Research at HSBC believes stores are critical to the luxury experience. Luxury will “prioritize brick and mortar and physical interaction over online sales,” he writes. Rambourg believes that e-commerce in luxury is more about “storytelling rather than selling.”

Focus will be on minimalism, finding the right investment opportunities, establishing just work practices and rigorously working on gaining retail RoI. Redefinition is on the cards, there is hope that it will be a positive news for the existing ones as well give a lot of space to new ones.

For sources click here

Follow Us @

Sources:

- The State of Fashion 2021

- Digital Fashion Weeks and Virtual Shows: A Rundown of Fashion’s New Rhythm

- As Coronavirus Lockdowns Hit Supply Chains, Luxury Fashion Is Not Immune

- Global luxury market to return to pre-pandemic levels by 2022: Report

- Luxury Turns From Conspicuous To Conscientious In 2021: Challenges And Opportunities Ahead

- Luxury Goods Sales Projected To Recover To 2019 Levels This Year

- Global Powers of Luxury Goods 2020 The new age of fashion and luxury