Out of 141 countries surveyed by the World Economic Forum as a part of the Global Competitiveness Report 20191, India ranks 70th in basic infrastructure. A staggering 51.1% population is exposed to unsafe drinking water. Almost 18% of the electricity supplied is lost or stolen during transmission. Average life expectancy is still at 59.4 years. Only 34.5% of the adult population are internet users. India’s average yearly spend per capita on infrastructure is estimated to be only 1/10th of what the Top Six countries (US, UK, Japan, Germany, Canada and France) invest2.

One thing is clear – India’s infrastructure in most cases is of poor quality by world standards and in short supply, further stretched to limits by the growing population and increasing regional and rural-urban disparities.

Before we dive deeper, let us understand some traits of infrastructure

Typically, infrastructure projects are characterised by the following:

i. High capital intensity, i.e., require large amounts of investment upfront, majorly in fixed assets.

ii. Long gestation periods, i.e., a prolonged construction period wherein no cash-flow is generated.

Funding constraints are quite common – Central and State Governments have large debt and deficit burdens while capacity of private players is limited. Equity markets are typically not favourable because of uncertainties involved in execution and returns.

Further, there are also some peculiar challenges faced during implementation of projects in India. Land acquisition has been the single largest roadblock, leading to stalled or delayed projects. Requirement of approvals from multiple layers of the government at the central, state and local levels leads to unnecessary hassle and red tape for the project executioners, thus disincentivising them.

Though challenging, why is India focusing on infrastructure?

Economists, industrialists and politicians have time and again believed that infrastructure is the foundation upon which economic growth is built. Contrary to popular belief, there is a two-way relationship. The famed Indian economist Dr V. K. R. V. Rao3 has noted that it is a continuous process wherein progress in development has to be preceded, accompanied and followed by progress in infrastructure to achieve a self-accelerating process of economic development.

Infrastructure spending is expected to have a multiplier effect on overall economic growth, primarily based on the Keynesian theory that aggregate demand can be reactivated by increasing public expenditure. In addition, improved infrastructure will enhance the overall productive capacity of the economy and its global competitiveness, at the same time facilitating lower input costs for manufacturing, boosting aggregate demand through jobs and income generation.

While physical infrastructure is an important determinant of domestic production, good social infrastructure is vital for human development as well as economic progress through better educated, better skilled and healthier citizens.

What has India planned for the next few years to achieve its target?

Policy changes

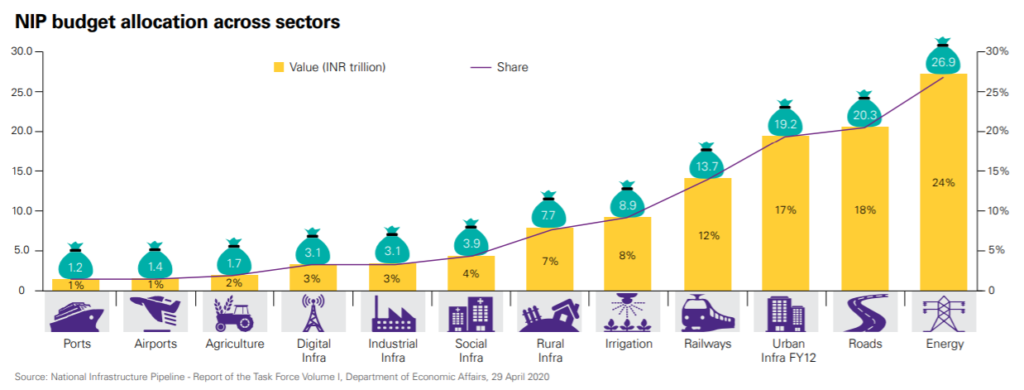

i. GoI launched the National Infrastructure Pipeline (NIP) for FY 2020-25 based on the Infrastructure Vision 2025. The projected investment would be INR 111 trillion, jointly funded by the Central Government (39%), State Government (40%) and the private sector (21%). 7,400 projects are proposed to be covered under this plan.

ii. National Hydrogen Mission has been launched to facilitate generation of hydrogen from green power sources.

iii. Public Private Partnership Appraisal Committee (PPPAC) has been set-up for the speedy appraisal of PPP projects in the Central sector. PPPAC has already approved 7 projects in FY21 with total project cost of INR 66,600 crore.

iv. The revamped Infrastructure Viability Gap Funding (VGF) scheme has been continued till 2024-25 to attract more PPP projects and facilitate the private investment in the social sectors (Health, Education, Waste Water, Solid Waste Management, Water Supply etc.).

Overhauling the credit ecosystem

i. National Bank for Financing Infrastructure and Development has been set-up, which will receive initial government funding of INR 200 billion. The aim is to have a lending portfolio of at least INR 5 trillion in three years’ time, and would provide the much-needed long-term debt financing at competitive rates.

ii. Enabling infrastructure debt funds to raise finance by issuing tax-efficient zero-coupon bonds, which will help in raising and channelling public funding.

Attracting private participation

i. New innovative PPP models such as Hybrid-Annuity-Model (HAM) and Toll-Operate-Transfer (TOT) models are being formulated, to match risk outlook and investor appetite, and so that project implementation risk remains with the government.

ii. 100% tax exemption granted to foreign sovereign wealth funds4 in respect of their interest, dividend and capital gains income from investments made in infrastructure before March 21, 2024.

iii. Monetisation of de-risked brownfield assets, i.e., operationalised projects with stable income sources. It would enable raising funds in foreign exchange, which would be further used to finance fresh infrastructure projects. Such projects are quite attractive to foreign investors since they provide stable rate of returns over a long tenure5.

iv. The National Highways Authority of India and Power Grid Corporation of India will each sponsor an infrastructure investment trust (InvIT) to attract international and domestic institutional investors. An InvIT is a special holding vehicle created to hold a portfolio of varied infrastructure assets. It would allow developers to monetise revenue-generating infrastructure assets, while enabling investors to invest in these assets without actually owning them. InvITs also enjoy favourable tax treatment leading to better returns, making it a lucrative investment opportunity.

v. Amendment of the Arbitration and Conciliation Act 1996 to make dispute resolution more cost-effective and timelier.

Reality check

Majority of the government expenditure is targeted towards improving roads, railways and energy. Being a developing country with a vast population, humongous monies would still be needed for water and sewage, sanitation, logistics, and renewables.

Further, the shock of Covid-19 pandemic has disrupted the plans and the focus of the government has shifted to ‘lives’ from ‘livelihoods’. The efforts of the government have meandered from growth led investments to actions aimed at containing the pandemic and to support the flagging economy.

While the policy directives are commendable, the government is yet to draw up granular plans detailing the sources of funds for the investment. Private and foreign players have become jittery due to the uncertainty of the pandemic looming over.

No doubt that unleashing the capex cycle and leveraging the multiplier effect of investing can propel economic growth and help India achieve its lofty targets. But, will the aforesaid measures be enough and opportune? Only time will tell……

For Sources click here

This post was written in collaboration with Asif Yahiya Sukri LLP. Asif Yahiya Sukri LLP provides unparalleled personalized financial services to a broad range of clients across different geographical locations. With a presence in the USA, India and the MENA region, they ensure that all of your financial decisions are made carefully and with your best interests in mind. They are innovators who understand what goes into building companies.

You can also reach out to them on info@aysasia.com

Follow Us @

Sources

- http://www3.weforum.org/docs/WEF_TheGlobalCompetitivenessReport2019.pdf

- https://www.dnb.co.in/perspective/thought-leadership/india-in-worlds-infrastructure-map

- https://en.wikipedia.org/wiki/V._K._R._V._Rao

- https://timesofindia.indiatimes.com/business/india-business/sovereign-wealth-funds-look-at-infra-sector/articleshow/74361643.cms

- https://www.dfat.gov.au/geo/india/ies/chapter-9.html