Introduction

Retail investors in India are adding fuel to the fire with their enthusiasm for crypto. The market is thriving as it has seen steady growth. Over 10 million crypto investors live in India, with the number increasing daily.

Even though many Indians are enthusiastic about crypto currencies, one misperception is preventing millions from adopting them. Often, crypto currencies are confused with their illegality because of their unregulated nature.

An announcement earlier this year that the Crypto currency and Regulation of Official Digital Currency Bill, 2021, would be presented in the Legislature’s budget session sent another shockwave throughout India’s financial sector. There are already rumors that the bill is likely to be unfavorable to crypto currencies before it is even presented.

While it may not be possible to confirm the speculation, it is essential to ensure cryptocurrency regulation.

Why should crypto currencies be regulated?

Backing the Crypto Ban, Rakesh Jhunjhunwala states, “Don’t want to join every party in town.”

Though the Finance Minister has outlined the government’s plans to take a “calibrated” approach towards crypto currencies, Indian crypto players and platforms are fearing a complete ban on crypto trading. A ban would kill all future innovations in the space, but a regulatory framework is undoubtedly necessary to protect the interests of investors. The following lists down the significant legal and regulatory risks:

1. Absence of well-defined laws:

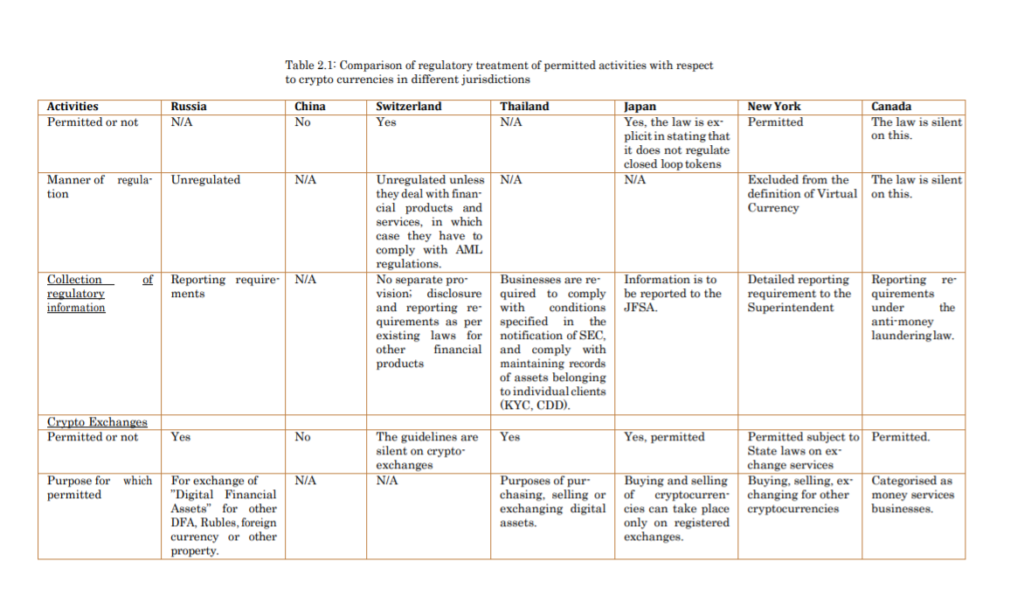

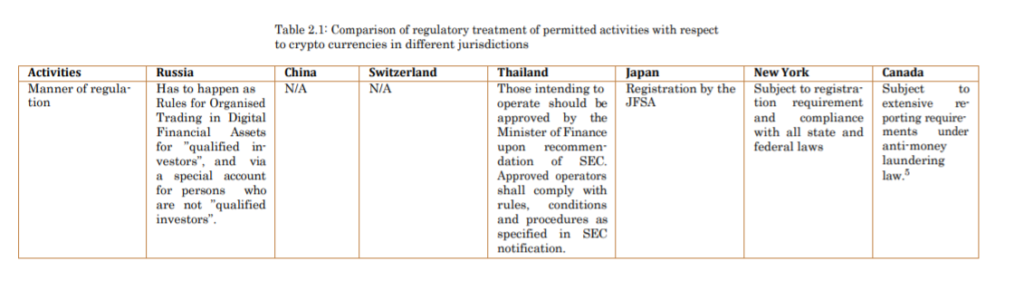

For any new technology to be put forward for mass adoption, regulatory vetting and development of industry standards are imperative. As block chain’s distributed ledger technology is still in a developing stage, regulators worldwide are studying the implication of the technology. While countries like the US and Japan have been on the front foot for developing a regulatory framework, there is no crisp framework to look up to today.

2. Lack of clarity about ownership and jurisdictions:

Distributed technology relies on the notion that there is no way to pinpoint the Ledger’s actual location. Therefore, transactions executed on a block chain tend to offer greater privacy as compared to traditional platforms. There is, however, a complex jurisdictional issue involved if one wishes to take advantage of this feature.

A crypto transaction may be governed by conflicting legal frameworks if the two parties, i.e., block chain nodes, are located in different jurisdictions. Due to the Ledger’s lack of a physical location, the “residence country” for crypto currency software cannot be determined. Additionally, since block chains can be transnational, it is challenging to determine the relevant laws and jurisdictions in international disputes. Thus due to block chain’s cross-border appeal, any national regulator faces a daunting task in enforcing laws among its users, transactions, or projects.

3. No fixed classification of crypto currencies:

In terms of how the countries intend to treat crypto, no official stance has been taken. Amongst the various classifications are asset, currency, commodity, etc. An unverified report states that the Indian Govt. might classify crypto currency as an asset class. However, there has been no clear indication from the Indian government confirming the same. This further leads to the issue of the taxation of crypto currencies.

4. Money Laundering Issues:

Several commentators argue that crypto currencies are a new conduit for fraud, money laundering, and other financial crimes. A primary reason for criticism is the crypto currency trader’s ability to remain anonymous. Crypto currencies have been used to facilitate trade on “dark-market” sites, on which criminals can purchase and sell illicit goods without being detected. Governmental agencies have labeled drug dealers that trade drugs for crypto currency as “new generation criminals.”

5. Data theft

Crypto currencies are also susceptible to data theft and financial fraud, which are pressing legal concerns. Due to gaps in block chain system code and its inherent ability to keep its user anonymous, many users, particularly those disenfranchised or involved in illegal pursuits, have embraced crypto currency as a method for financing their illicit activities.

Researchers at Cornell University found a severe security vulnerability in Ethereum’s block chain last year that could have cost $250 million in stolen funds. In a similar vein, a data breach at crypto currency wallet maker Ledger exposed 1 million email addresses. Furthermore, Ledger’s 9500 customers’ information-such as full names, addresses, and phone numbers were stolen. It is unclear whether existing data protocols can address data theft and financial fraud associated with crypto currencies.

6. Investor’s Concerns

Several developed countries such as the United Kingdom, Japan, Canada, and the United States have legalized crypto currencies like Bitcoin since February 2020. Although the IRS has considered some crypto currencies legal, a transaction’s legal validity across nations remains in question.

Unlike gold or silver, crypto currency values are not determined by any centralized authority and are not backed by any tangible assets. Their value depends entirely on how others appraise them. Due to the lack of centralized regulation, investors may have few legal options for a dispute over their crypto transactions.

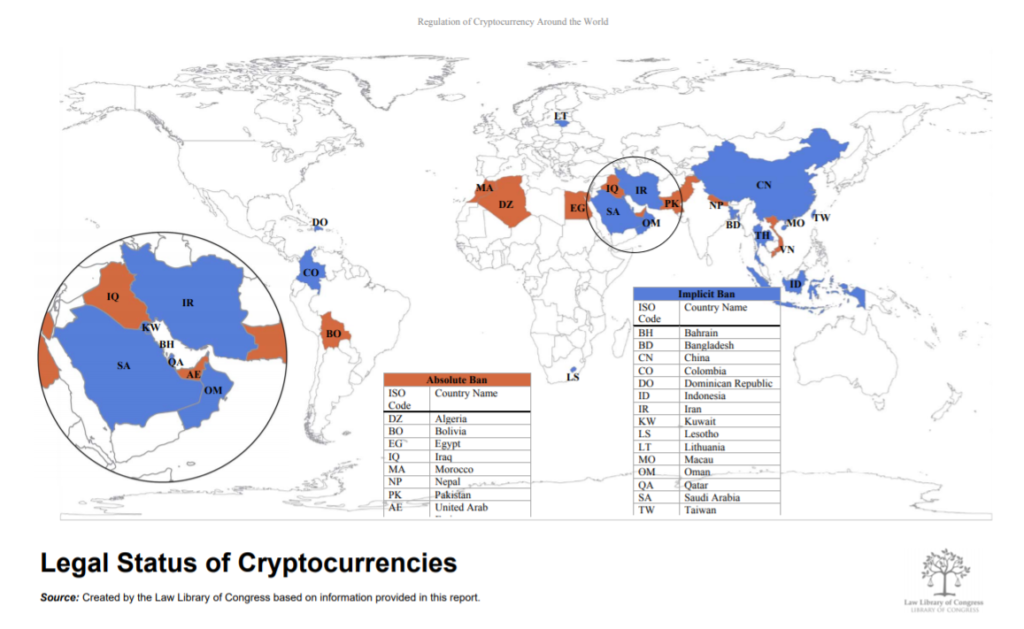

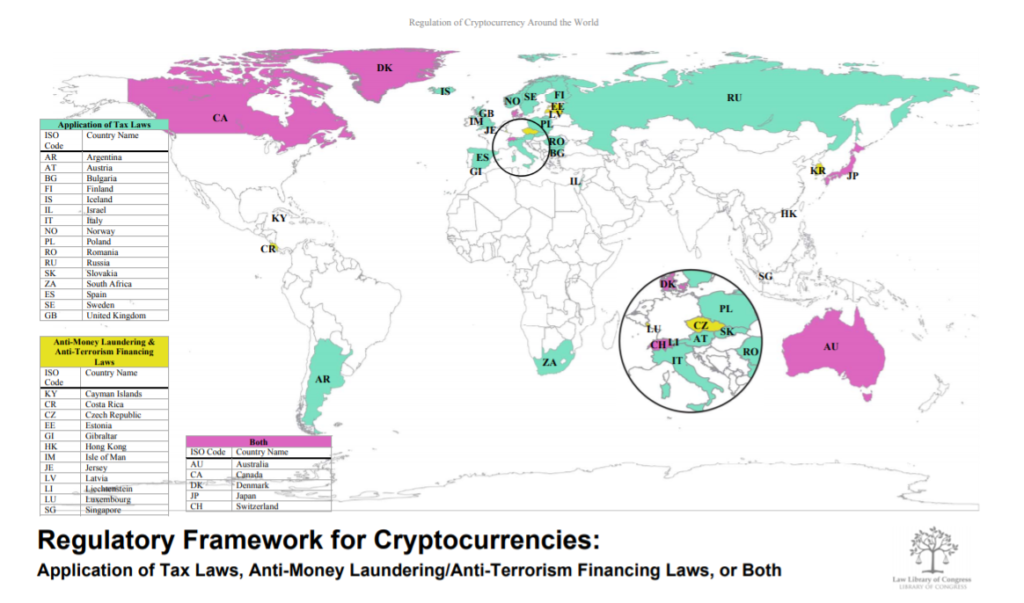

Regulations around the world

Crypto currency legality in India

Under the legal framework, there isn’t an explicit law that prohibits an investor from investing/trading in crypto currencies. In 2018 RBI issued its first circular banning all banks and financial institutions from trading with any form of crypto currency. Subsequently, the honorable Supreme Court suspended this circular, citing the principle of proportionality in “India Internet and Mobile Association of India v. Reserve Bank of India.”

Additionally, in 2019 the committee on virtual currencies under the Finance Ministry proposed a draft bill, “Banning of Crypto currency & Regulation of Official Digital Currency Bill, 2019”. This bill prohibited the issue or trade for any crypto currency business transaction or its use from storing value. It was also seeking a provision of a Digital Currency issuance by the RBI. This was to form the basis for a central bank digital currency (CBDC).

On 22nd July 2021, RBI deputy Governor T. Rabi Sankar highlighted RBI is considering the introduction of central bank digital currency (CBDC) in a phased manner while observing its implication on the monetary policies. While real-world retail and wholesale use also being a possibility shortly.

As of present-day, the honorable Finance Minister of India intends to introduce ‘Crypto currency and Regulation of Official Digital Currency Bill, 2021’ on the floor of the parliament. This bill aims to prohibit all private crypto currencies and lay down the framework of CBDC under the supervision of the RBI. But the exact timeline for the bill’s introduction and its subsequent debate remains unclear.

Conclusion

In the current system, the path of crypto currency adoption can go down two pathways. On the first path, India could choose to accept and regulate crypto currencies as one of the first countries. This will enable India to have a say when industry norms and standards are being established. Or, on the second path, it can wait and see how other economies try to integrate crypto currencies and learn from their mistakes. As for how every major economy and financial institution is thinking to incorporate crypto currencies, the question now is not why but how?

For sources click here

Follow Us @

Sources:

- https://forkast.news/cryptocurrency-law-india-economy-legal-ban/

- https://www.financialexpress.com/market/decrypting-cryptocurrencies-for-india-what-could-proposed-regulations-hold-for-the-new-age-currency/2266678/

- https://prsindia.org/billtrack/draft-banning-of-cryptocurrency-regulation-of-official-digital-currency-bill-2019

- https://www.livemint.com/market/cryptocurrency/rbi-eyeing-phased-roll-out-of-central-bank-digital-currency-deputy-governor-11626960118560.html

- https://main.sci.gov.in/supremecourt/2018/19230/19230_2018_4_1501_21151_Judgement_04-Mar-2020.pdf