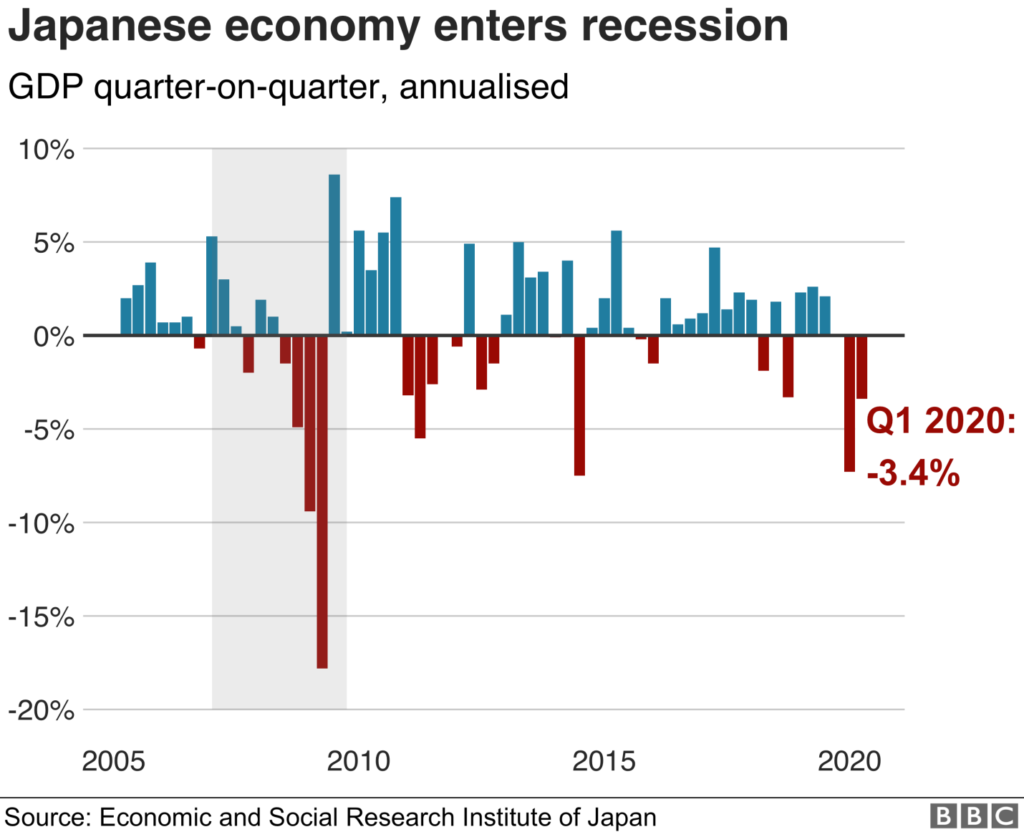

Japan, the world’s third-largest economy (as per GDP) after the USA and China, falls into recession for the first time after 2015. Japan’s economy has entered a recession – defined as two consecutive quarters of negative economic growth.

Its economy shrank by an annualized rate of 3.4% in the first quarter of 2020 (Exhibit 1). The country entered the coronavirus shock in a very weak position.

The two main reasons are:

1. Japan’s economy had faltered due to the imposition of a higher national sales tax in October 2019. The tax rate had increased from 8% to 10%, and consumer spending had surged in anticipation of the increase in tax rate. The new rate applies to all goods and services, though most are food items. In Q4FY2019, the Japanese Govt. reported a fall in real GDP of ~ 6.3% (annualized rate) from the previous quarter. The export numbers have fallen steadily in 2019 on slowing global demand and the fallout from the U.S.- China trade war.

2. Japan’s economy was already facing significant headwinds before the coronavirus outbreak. Due to the coronavirus, consumer demand fell drastically. Private consumption, which contributes to more than half of Japan’s economy, slipped 0.7% in January-March quarter of FY20. The outbreak indeed led to the uncertainty that affected manufacturing supply chains. Japan also relies heavily on exporting its goods, which have been severely impacted due to the pandemic. Many of its biggest brands such as Toyota and Honda have never seen such a huge slump in their sales.

Let’s see this in the form of an equation:

GDP = C + I + G + (X-M)

C = Consumer Spending

I = Investments

G = Government spending

X = Exports

M = Imports

In Japan, the consumer spending (C) has slumped 0.7% due to the hike in sales tax and the coronavirus pandemic. Business investments (I) have lessened since the government had capped them. There was no government expenditure (G) i.e. public expenditure made by the government. Japan was also facing a trade deficit due to which the overall GDP was going down.

Now you know how Japan entered into a recession!

Mr. Abe, the Prime Minister of Japan declared a national state of emergency (due to COVID-19 outbreak) that led many people to work from home. Grappling with this situation, the government announced a US$ 1.1 trillion economic stimulus package that focused on cash payouts to households and loans to small businesses hurt by the pandemic. Later on, the emergency was lifted and a second supplementary budget was also announced of around US $ 296 billion. (What would you have done if your country was in recession? Do let us know in the comments below)

Impact

Tourism: Tourism has always been a boost to the Japanese economy which has been hit hard as the pandemic keeps foreign visitors away. Visitors in Japan dropped by 93% year-on-year (YoY). Its initial target was to draw almost 40 million visitors this year. They eased visa requirements and an immense marketing push overseas has also helped them to fuel a huge influx of arrivals in the past decade. But the coronavirus pandemic has turned that boom to bust. The 2020 Tokyo Olympics attracted US $3.1 billion of investment, making them the most heavily sponsored games to date. However, the same is postponed to July 2021.

Automobile industry: They will need to keep adjusting production, amid a projected slump in demand. The Japanese carmakers Toyota, Nissan, and Honda suspended production at several plants in Europe to tackle coronavirus. These companies have also temporarily halted North American factories. Toyota has cut its domestic vehicle production by 122,000 units in June 2020 due to a lack of demand. The automaker expects a 80% drop in full-year operational profits. The chairman of Toyota added, “At this point, we can’t foresee what’s ahead for automakers.”

Exports: Machinery, electronics, and chemicals have a major share in Japan’s trade with the rest of the world. Exports make up 16% of Japan’s economy which shrank by 6%. The coronavirus impact on China and other countries that are dependent on China for trade resulted in a further fall in Japanese trade in 2020. China accounts for half of Japan’s exports and imports. Lower production due to factory shutdowns and reduced demand affected Japan’s trade in Asia. This resulted in a trade deficit.

Hotel Industry: The pandemic has pushed 51 Japanese companies into bankruptcy. The bankruptcies were mostly in the hotel and restaurant industries. Japan’s hotel occupancy rate tumbled to 30.5%. Japanese hotel developers and operators had been counting on a surge in demand for accommodation in the run-up to the Tokyo 2020 Olympic Games, ramping up construction projects. The number of hotel rooms in Tokyo increased by 31.3%. But the spread of the coronavirus derailed business hopes.

There were certain key steps taken by the Bank of Japan (BoJ):

The BoJ started buying commercial paper and corporate bonds for a combined amount of US$ 186 billion. They also extended the maturity of the corporate bonds from three years to five years. BoJ tweaked a rule on the maximum amount of securities held per entity by raising the ceiling to 50% for commercial paper and 30% for corporate bonds. And lastly BoJ lifted the cap on its buying of government bonds.

BoJ undertook corporate funding measures where they would extend a loan to the firms which were hit by the pandemic, at 0% up to one year. This move is aimed at encouraging commercial banks to boost lending. The BOJ will now pay a 0.1% interest to financial institutions that tap the loan program.

It has also decided to double its annual capacity to purchase exchange-traded funds and real estate investment funds.

Let’s have a look at how the world’s largest economy i.e. USA got out of recession in 2008:

The tumultuous events of 2008 were caused due to the popping of the housing bubble and the ensuing financial crisis. In a matter of months, trillions of dollars of household wealth was destroyed, setting off a rapid decline in consumer spending. The collapse of Lehman Brothers and the runs on money market mutual funds and other financial institutions caused credit spreads to skyrocket and key sources of credit to dry up. The entire financial system was in a state of anxiety and paralysis.

Catching up had been difficult. (Don’t you think?)

USA passed the American Recovery and Reinvestment Act. The Recovery Act was the boldest countercyclical fiscal stimulus in American history. It included US$ 787 billion of tax cuts and spending, with the total split roughly one-third tax cuts, one-third government investments and one-third aid to the people most directly harmed by the recession and to troubled state and local governments.

The Treasury worked with the Federal Reserve to help reduce mortgage interest rates, resulting in lower payments for the millions of Americans who refinanced their homes. They also set up a program that helped responsible homeowners facing foreclosure to get more manageable mortgage payments.

The USA developed a plan which consisted of buying troubled assets from the banter to minimize uncertainty in the market. This program was entitled to the Troubled Asset Relief Program (TARP), having a US$ 700 billion budget.

The loss of output and jobs in the recession had been so severe that it took several years of robust growth and job creation to restore the economy to full health and full employment.

The USA passed the recovery act that saved or created almost 2½ million jobs. The Act provided over US$ 2 billion in state fiscal relief to Ohio.

This tax relief and income support did not only help families to get through hard times but also put money in people’s pockets to support demand, and make the recession less severe and the recovery stronger.

The stimulus efforts passed by the government were payments to large financial services firms (to stabilize at-risk businesses), tax credits to qualifying families, funding for capital improvement projects (such as bridges, roads, and the nation’s electrical grid), an US$ 8,000 tax credit for first-time homebuyers etc.

There are several ways Japan can overcome recession. Let’s have a look at it.

Keynesian theory: States that government should increase demand to boost economic growth. As we have seen in Japan, consumer demand is the primary driving force in its economy, it should adopt policies like expansionary fiscal policy, government spending on unemployment benefits etc.

Quantitative easing (QE): The central bank can electronically create money and use this money to buy long-dated securities. This indeed increases the bank reserves and also encourages bank lending. It reduces the interest rate on bonds which thus encourages spending and investment.

Infrastructure investment: Will go a long way in solving challenges during a crisis. In short term, building infrastructure can boost aggregate demand through construction activity and employment. It’s also beneficial for long term as it can boost economic growth by increasing the potential supply capacity of an economy.

Helicopter money: Japan can print large sum of new money and distribute that among the public. It’s an unconventional method aimed at boosting consumer spending and increase inflation. It increases the monetary supply. This is different from QE (as QE focuses on increasing money supply through purchase of financial securities).

Do you think Japan’s economy is likely to recover in 2020?

Follow Us @

Very well written