Background:

Happiest Minds Technologies is a digital transformation, infrastructure, security, and product engineering services company. The company was founded by Ashok Soota In 2011. It is headquartered In Bangalore, India and has its operations in the United States, United Kingdom, Canada, Singapore, and Australia

The company received $45 million Series-A funding In November 2011. The investors were JP Morgan Asset Management, Intel Capital and Ashok Soota, Ashok soota is also cofounder of innovative IT company Mind Tree.

They opened their first office in Reading, UK as part of expansion in March 2012. At present they have offices in India (Bangalore, Noida and Pune), US, UK, Singapore and Australia with more than 170 plus customers globally.

Happiest Minds Technologies has more than quadruple its value since the launch of its IPO (Offered at INR 166 per share) in September last year.

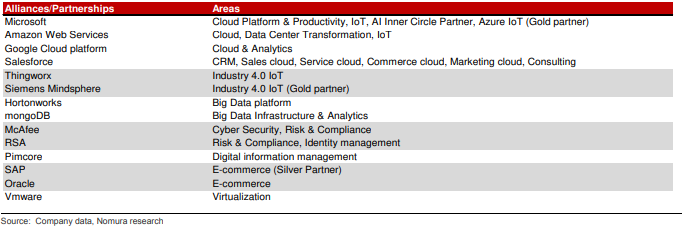

Happiest Mind has strengthened its relationship with independent software vendors (ISVs) such as Amazon AWS and Microsoft over the past 3-4 years. It has also established a platform for contacting their professional account managers for potential customers. In order to improve domain technology and increase clients, it has increased cross selling to existing Microsoft Technologies customers. In addition, co-operatives and partnerships have been its main source for the leading generation. It plans to deepen its relationship with other ISVs including Google Cloud, Salesforce, Appian and Maplesoft.

Edutech is amongst the best performing segments for the company whose revenue contribution increased from 18% in FY16 to 26.3% for 9MFY21. Also Automation as a percentage of revenue has been constantly growing from 20.7% in FY20 to 25.5% for 9MFY21.

Recently, the company acquired Pimcore Global Services (PGS) to expand its digital e-commerce and data management solutions and partnered with Ilantus Technologies to enhance next generation capability.

Industry Overview:

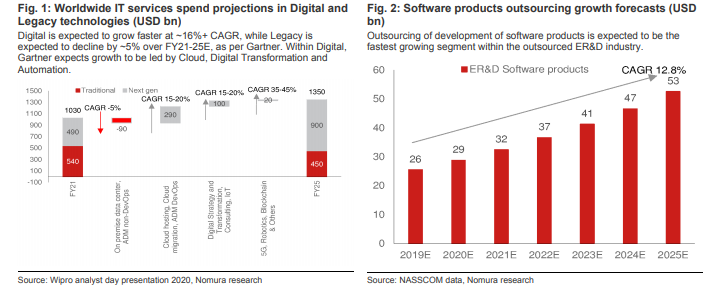

According to Gartner, digital technology is expected to reach US $ 900bn (34% of total technology spend) by FY25E, from US $ 490bn to FY21E, Digital Technology has become very important, businesses and customers looking to use emerging technologies such as IoT, cloud, analytics, and automation to increase product delivery, improve productivity, and provide a better customer experience. While many customers were on the verge of digital transformation before the epidemic, acceptance rates were slow at the time, but have now been in speed track due to COVID.

Business Overview:

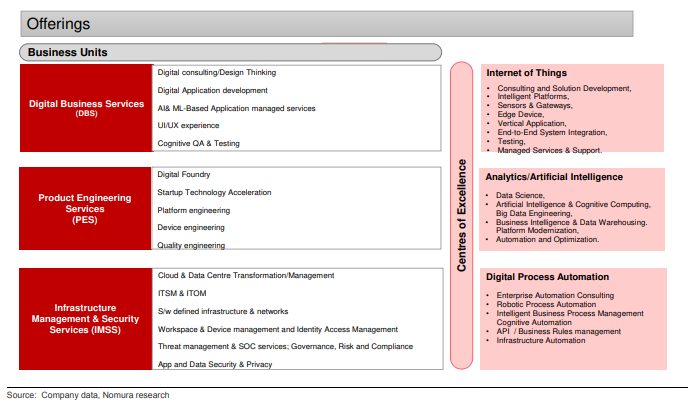

Happiest minds strength is in cloud and Enterprise SaaS (Software-as-a-Service) space, it derived 96.6% of its Q3FY21 revenues from digital technologies, with strengths in cloud and Enterprise SaaS (Software-as-a-Service) space. Segment-wise, Product Engineering Services (PES) contribute ~50% of revenue, followed by Digital Business Services (DBS) 24.5%, Infrastructure Management & Security Services (IIMS) 21.5% and the residual is attributed to Others

Key Alliances:

Happiest Minds’ has been a frontrunner in forging key alliances and partnerships in areas that have boomed during the digital era — this includes analytics, cybersecurity, information management, e-commerce and virtualisation.

Happiest minds has alliances with almost all the major independent technology vendors which will give an opportunity to dip its toe into a larger client base.

It can be a ‘one-stop shop’ to address the entire gamut of customer digital IT spends. When the company first came into existence, the focus was on expanding its customer base. Now, the impetus has shifted to upselling and cross selling.

This means doubling down on its existing customers by either offering upgrades on the services they have already signed on for with Happiest Minds or selling them products related to what they have already own, respectively.

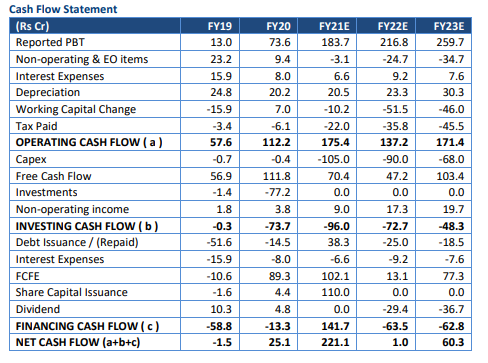

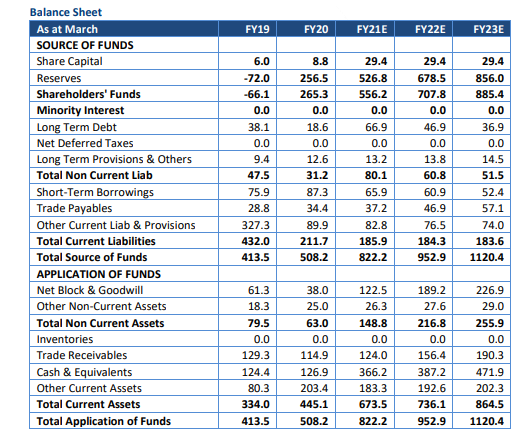

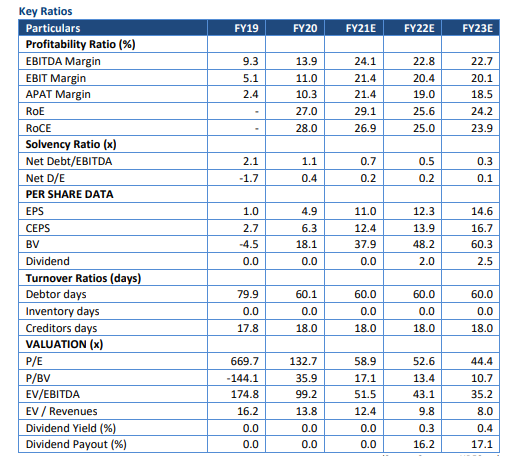

Financials:

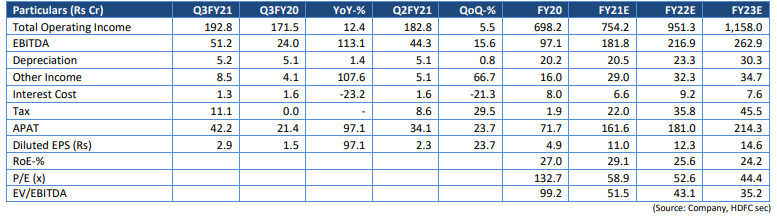

As per HDFC Sec research, total operating income is expected to grow at 24% CAGR over next couple of years and EBITDA is expected to grow at 20.31% CAGR.

Happiest Minds is expcted to continue to grow at nearly two times the pace of large caps — like Tata Consultancy Services (TCS), HCL Tech, Infosys and Wipro — and 1.5 times the pace of its mid-cap peers, owing to its digital presence.

Strengths:

- Digital acceleration and industry transformation to bring more opportunity of revenue generation.

- Recent acquisition of Pimcore Global Services to add incremental growth ahead

- Partnership with Ilantus Technologies to enhance next generation identity and Access Management Security Services

- Established and diversified client metrics across verticals and geographies

- End-to-end capabilities span the digital lifecycle from roadmap to deployment and maintenance

- Existing partnerships with Independent Software Vendors (ISVs) and strategic Acquisitions over the past

- Strong fundamentals led by healthy debt protection metrics and liquidity

Threats:

- Rupee appreciation , strict immigration norms and rising visa costs

- Grographic concenratration may hurt – Derives 72.2% reveue from US

- Revenue is not diversified – Top 10 clients contribute 49% of revenue

- Concentration in few industry verticals – Concentration in Edutech , HiTech, Retail, TME and BFSI

- Delivery and Execution risk – Due to changing customer requirements

- Lack of domain expertise – Though run by experienced management it lack the domain experise of large cap IT firms

- Lack of long term commitments with customers

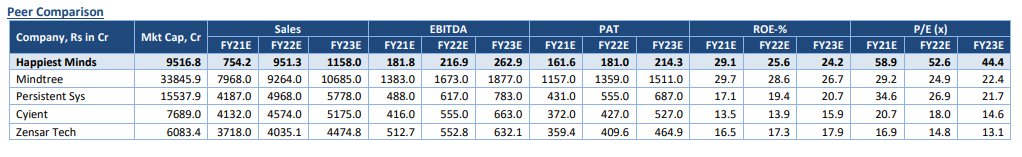

Peer comparison, Valuation & View:

Happiest minds valuation as compared to the peers is high, but it is showing excellent promise in the years to come with the excellent management team, it has a diversified mix of services, multiple longstanding client relationships spread across verticals, and healthy cash on the balance sheet. With the expectation of pursuing inorganic acquisitions (in digital e-commerce and data management solutions) company revenue is expected to grow well in the long term.

Happiest Minds deserves a premium because it could grow faster than its midcap peers and maintain margins. Since the company claims that 97% of its revenue comes from digital services the growth rates will be higher.

Happiest mind seems to be consistent compounder and one should buy and hold this stock and may be pass it to next generation.

This post was written in collaboration with Asif Yahiya Sukri LLP. Asif Yahiya Sukri LLP provides unparalleled personalized financial services to a broad range of clients across different geographical locations. With a presence in the USA, India and the MENA region, they ensure that all of your financial decisions are made carefully and with your best interests in mind. They are innovators who understand what goes into building companies.

You can also reach out to them on info@aysasia.com

Follow Us @