Gaming has evolved drastically over the decades, making its debut in 1940 in the form of a giant electromechanical machine called the Nimatron allowing you to play a single game called the Nim, to arcade games in the 70s, home gaming consoles in the 80s, computer games in the 90s, online gaming at the turn of the century and now to mobile games and esports. More than most of Millenials and Gen-Zs have started off their mobile phone interactions with games such as Bounce and Snake 3D. Feeling nostalgic yet?

3, 2, 1, Blast-off!

The global gaming sector has come a long way since. Prior to the pandemic, the gaming industry was already valued higher than the global box office and music industries combined! Game developers and designers were being paid in hundreds of thousands of dollars a year – a third or more of the average salaries of their respective nations. In India alone, game developers are being paid over INR 500,000 per year, way more than the INR 145,000 national average.

What’s surprising is that while the global gaming industry is expected to grow by 10% year on year, in India, the annual growth rate is estimated to be around 45%! The surge in userbase during the pandemic has made India rise up to the position of #1 in the global gaming industry. Fueled primarily by a growing middle class, rising disposable income and, needless to say, a young population (with over 50% of the nation being under the age of 25), this rapid growth over the last few years or so seems here to stay.

Think about PUBG as an example. It took over the Indian userbase by storm since its premiere in March 2018. By including social elements such as voice chats and conducting tournaments in local languages, the game amassed nearly 13M daily active users in 2019! India alone generated a monthly income of around USD7-8M for the app. While these figures from India seem pale as compared to those from other countries, this one game alone was able to shift consumption behaviors in India to spending heavily on online gaming platforms. The success of PUBG in India shows that the gaming ecosystem here is ready to be monetized.

“Bhaiyya, we’ll do Houseparty then Ludo?”

As per a report by KPMG, the pandemic saw a shift in media and entertainment consumption patterns in India, with more people shifting away from traditional media such as TV, film and print into sectors such as digital gaming and media. Mobile users make up a whopping 85% of the industry, PC users comprise 11% with the remaining 4% being taken over by tablet users.

This ought not to startle you, for more than most of us had resorted to virtual entertainment and multiplayer mobile games like Ludo/Snakes & Ladders as a means of virtual social interaction over the past year more than we’d care to admit. Casual gaming witnessed a strong consumption uptake in 2020, and in-app purchases were also gaining momentum. Payment platforms like PhonePe and GooglePay have also contributed to this by reducing the friction in making purchases.

From IPLs to MPLs – the rise of e-sports

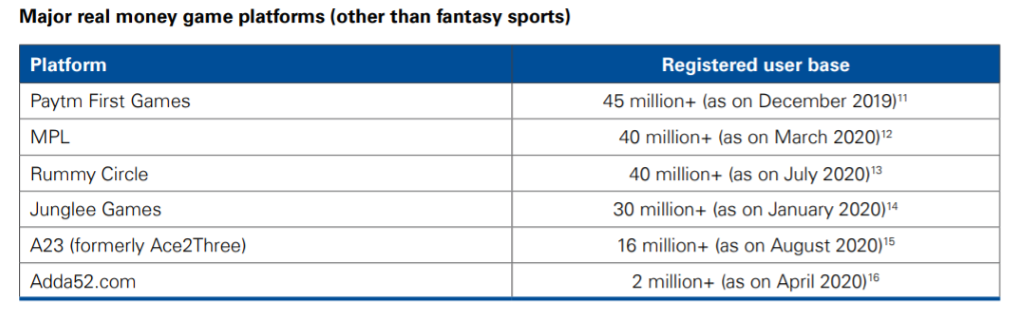

So, it must come as no surprise to you that Venture Capital investments in the gaming sector in India had risen by 2.7x times in 2020 as compared to 2019! Approximately 90% of the total INR 25 billion investment value came from 2 platforms – Dream11 and Mobile Premier Leagues (MPL) – indicating the rise in popularity of real money games as opposed to casual games. Doesn’t it seem quite uncanny that games in the esports segment continued to thrive even as many sports events were cancelled in the wake of the pandemic?

Earlier accounting for just 4% of the nation’s userbase, now e-sports is expected to grow 36% year-on-year for the next 3 years! It goes without saying that where there are players, there is a growing fanbase, and the Indian e-sports audience for gaming tournaments have already grown from just 6M in 2017 to 17M in 2020.

Fame to the dame! Even the women of India have joined in on the fun, with the female demographic displaying an impressive growth of 48% in over just a month from March to April 2020.

“Hang in there, it’s a bumpy ride ahead!”

The sea of opportunities is vast and seems to stretch out into the backdrop of a setting set. How scenic! It isn’t hard to fathom a future (what with VR based games already on the get-go) where your typical stadium sports and crowds are replicated just as easily in the online world. Even with the relaxation of lockdown norms, this sector seems resilient and ever-ready to weather all climes.

Alas, the road ahead is but filled with bumps! Online games like Rummy and Poker are still banned in several Indian states (like AP, Assam, Odisha and Gujarat), even in the wake of skill gaming gaining massive traction all over India.

Another major concern is the limited number of popular game titles from Indian studios. As mentioned earlier, 90% of VC investments were recorded in just 2 Indian companies. Even as far as the Indian userbase is concerned, amongst the top 10 mobile games downloaded in 2020, only one – Ludo King – is from India. Even consumer spend on Indian developed games is much lower.

Made in India...or nah?

One might owe this to a nascent growing market for Indian developers, but this might not be the case. For Indian based games hardly ever took off in India, let alone globally. One reason for this could be due to the ease at which Indian games are prone to piracy. Another would be that developers are concerned about consumer habits and believe they could never succeed in a country like India where the spending habits of the young crowd are primarily dictated by the older generations. Moreover, Indians are driven to products by word of mouth and it’s more often western games that are on the rise globally which penetrate into the Indian market as well.

All this has led to skilled game developers running off to other markets to develop and design gaming software, leaving India unprepared to take on the task of developing a full-fledged game with the time and money it would take for a US or Japanese company to do the same.

We have a long way to go if we are to convert this embryonic explosive market into one that makes a significant contribution to the country’s GDP. All we need would be an Indian developed game like PUBG to change consumer habits and transform the gaming game.

Follow Us @