Grey Market Premium as on 07th Mar 2021 – INR 175

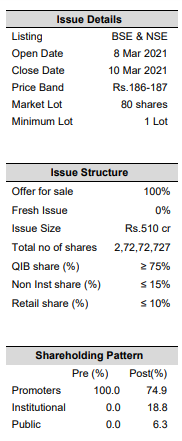

Price Band : INR 186-187

Background

Ease My Trip, established in 2008 provides investors with a unique opportunity to invest in the fast-growing online travel agency industry. Being bootstrapped, the management of the company has tended to be extremely cost conscious and this has enabled them to be profitable since inception. Their primary driver of business is that they do not charge a convenience fee and this is what sets them apart from their peers like Make My Trip, Yatra and Clear Trip.

This strategy of the company has paid off handsomely during the pandemic. and has ensured that they gained market share. The company has come up with industry first technological solutions in customer service like a chat box on the website which can give details about the cheapest priced tickets and its price movements.

The ‘let go’ of convenience fee coupled with the strong customer connect should enable them to continue to gain market share and ensure sustenance of the high growth trajectory.

However, there are several red flags related to corporate governance and high industry competition in OTA space.

Strength

i. One of the leading online travel agencies in India with a customer focused approach, including the option of no-convenience fee with lean and cost-efficient operations.

ii. In-house advanced technology and analytics capabilities

iii. Wide distribution network supported by a hybrid platform.

iv. Well-recognized brand with a targeted marketing strategy

v. Experienced management team with an established track record

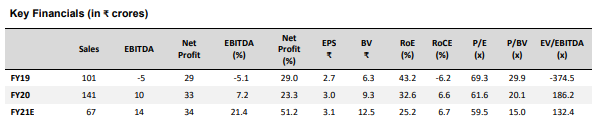

Financials

Revenue has gone up by 40% from FY 19 to FY 20 while the revenue of 9 month ended FY 21 was impacted due to pendamic.

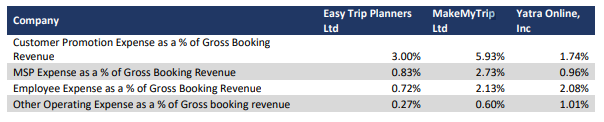

Company has one of the lowest cost as a % of revenue in the sector, their promotional expense cost, Employee cost and operating cost is lower than the peers.

The company has increased its market share form 3.1% in FY18 to 4.6% in FY20 and has been ranked 2nd among key OTAs in India based on booking volumes for 9MFY21. It is the only player among the key online travel agencies (OTA) in India which has been consistently earning profits. Being 100% bootstrapped, cost efficiency is in the DNA of the company and that has enabled them to manage profitability better than peers

Red Flags

i. High promotor salary – During FY20, two of the promoters drew an annual salary of ₹7 crore (excluding other benefits like provisions for gratuity and leave benefits, sitting fess). For 9 month december ended quarter this is 12.5% of revenue from operations.

ii. Diversification into unrelated business and high related party transcations – The company has a history of diversifying into unconnected business like coal, movies and share-trading business. The company has made huge advances to related parties and has even had to make write-offs for such advances.

iii. Serious delays in GST payments since last 3 years.

iv. High contigent liability of 126 cr related to litigiation which can wipe out almost all the equity.

Key Risks and Concern

i. As travel and tourism sector has been one of the most affected sectors due to the pandemic. the time frame for complete recovery from COVID remains uncertain.

ii. The company is heavily dependent on its airline ticket booking segment. This segment formed around 98 per cent of the company’s gross booking revenue in FY20. Further, this segment is low margin in nature and has a lot of competition.

iii. The company is facing several litigations which together amount to around Rs 140 crore. One of the serious ones is by a company’s ticketing partner, alleging that the company manipulated records and has claimed Rs 37 crore in damages. The matter is currently pending in courts.

iv. The OTA market is highly competitive. MakeMyTrip, with a strong presence across air tickets, hotels, car rentals and others is the biggest player in the industry with a market share of around 50 per cent. The industry is also witnessing the entrance of several big players now, such as Paytm, Amazon and others. High competitive intensity, coupled with a small market share, can deteriorate the company’s profitability.

Based on above company is one of the few OTA operators who are profitable and has a lot of room to grow, however due to cutthroat competition and several red flags one should be wary of investing for long term, however looking at Grey market premium and the bull run in market one can apply for this IPO for listing gains.

References:

- DHRP

- Various Sources

Follow Us @