From a small food delivery firm in 2011, Delhivery today has expanded to over 20 automated sort centers, 85+ fulfillment centers, 75+ hubs, 3,000+ direct delivery centers, 7,500+ partner centers, 15,000+ vehicles, and 40,000+ team members who make it possible to deliver over 1.5 million packages a day. Now, these may seem just random figures to you, but in the world of the supply chain, this is what makes Delhivery one of India’s most prominent independent e-commerce logistics startups.

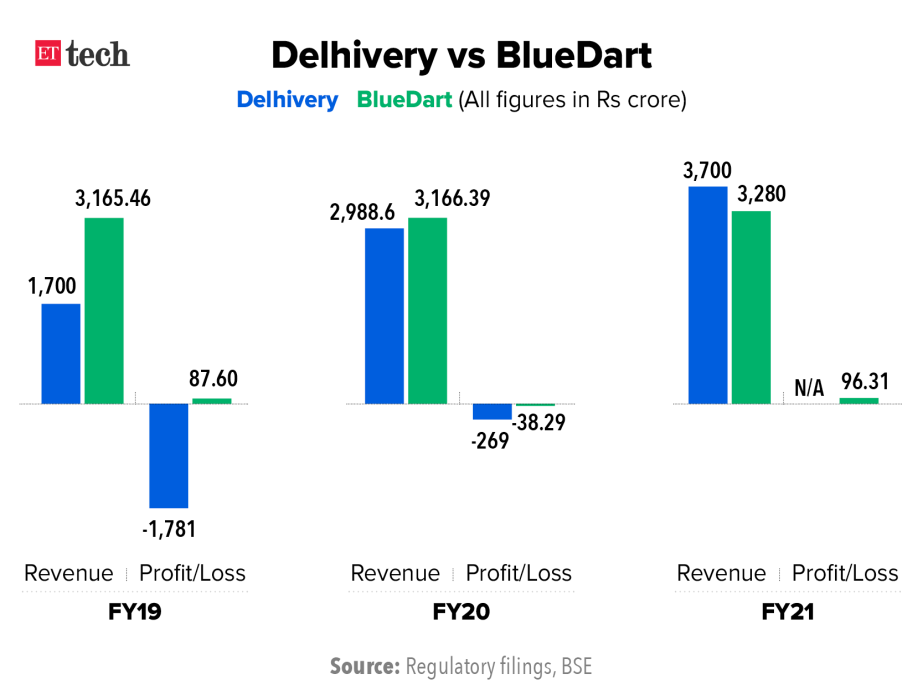

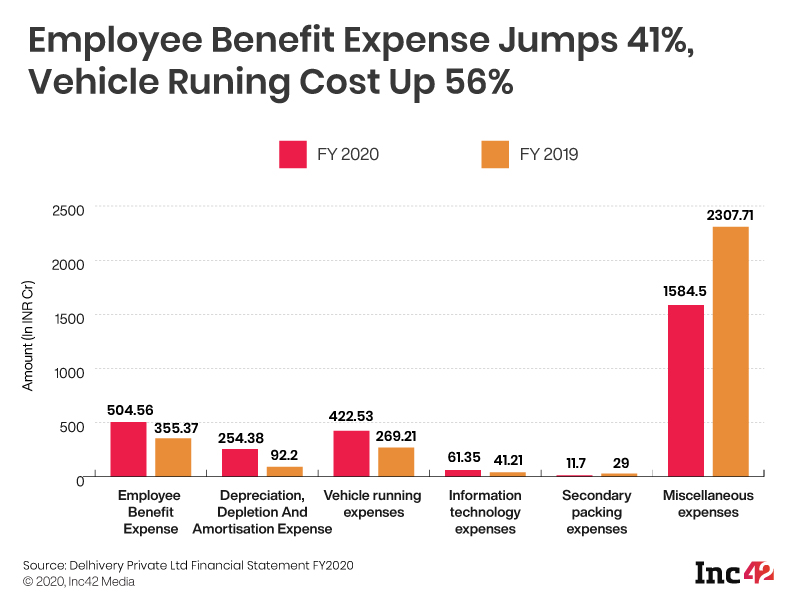

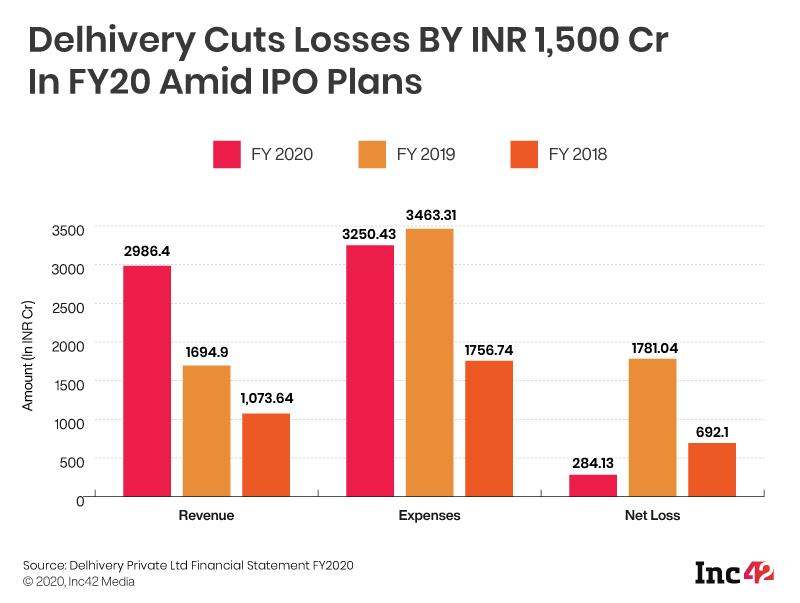

In FY21, Delhivery recorded a revenue of approximately Rs. 3700 Crores, leaving behind its main competitor, Blue Dart. The company also accepted a $277 million funding in late May 2021, deriving a valuation of $3 billion. This funding would make the total funding for Delhivery, since inception, close to a billion dollars. FY20 was a good ride for the company as well; Delhivery saw an 84% cut in losses compared to FY19. It recorded a net loss of Rs. 284.13 Crore, representing a 6.8x drop from Rs. 1,781.04 Crore in 2019. This promising result was combined with another vantage point of being a highly liquid company at present. Today, this logistical giant is sitting with a kitty of $550 million in cash without significant burning out. According to the company, they expect annual growth of 50% in the coming few years.

In today’s time, when one has a product like that of Delhivery, it hardly goes unnoticed in the investor pool. Delhivery, as of today, is supported by some of the marquee investors, both domestic and international. The six significant investors include Softbank, Carlyle, Fidelity, GIC (Singaporean sovereign wealth fund), Tiger Global, and CPPIB (Canada Pension Plan Investment Board). The latest funding led by GIC and Fidelity resulted in a 50% jump in valuation to $3 billion, as previously mentioned.

An anticipated IPO

With promising prospects and a team full of zeal, the company has finally planned to issue an IPO after a decade of its inception. It plans to go public in India anytime between December this year and March 2022, said co-founder and chief executive Sahil Barua. Though the specificities are yet to be out, the issue is anticipated to be around $400-500 million. This is the very first time the company has hinted at such a definite timeline for the problem. However, it had these plans brewing in the past two years, after it appointed a board sub-committee for its IPO and mergers and acquisitions in January this year. There is a possibility that the proceeds could be utilized for potential investments in the future. However, it is worth noting that two of the co-founders (Mohit Tandon & Bhavesh Manglani) exited the company but only after retaining their stakes as non-active members.

What does Delhivery do?

But how exactly does the company achieve these figures? It did not start with the very idea of developing into a massive supply chain brand. Delhivery’s team had their fair share of failures and successes as well. They began with the term “hyper local,” having established a local restaurant delivery network and fulfilling their orders for them in under half an hour. One would be surprised to know that Pankaj Chaddah and Deepinder Goyal (co-founders, Zomato) were involved in the initial process. With around 4-5 delivery men and a small office in Gurgaon, Delhivery started clocking in a good number of orders. They later moved to the e-commerce space, and then there was no turning back. Their clients, presently, hail from verticals like consumer durables, auto, FMCG (fast-moving consumer goods), and industrial goods. Delhivery plans to venture out in neighboring nations like Sri Lanka and Bangladesh.

Today, Delhivery has expanded its product and services pool extensively. They disrupt India’s logistics industry through our proprietary network design, infrastructure, partnerships, and engineering and technology capabilities. There are five primary services which Delhivery has to offer, these include-

- Delhivery Express, an express parcel transportation network with fully integrated and self-owned pickup, mid-mile, and delivery operations.

- Delhivery Fulfillment, a proprietary warehouse management system, inclusive of 80+ centers with 6 million sq. ft of storage

- Delhivery Freight focuses on freight requirements at the lowest costs, with a combination of owned fleet and a network of pan-India professional truckload partners.

- Delhivery Cross Border provides multiple transport solutions for sea and air cargo, express fulfillment, consolidation centers, and free trade warehousing infrastructures.

- Delhivery E2E, i.e., End-to-End Supply Chain, provides custom solutions for enterprises using in-house technology products.

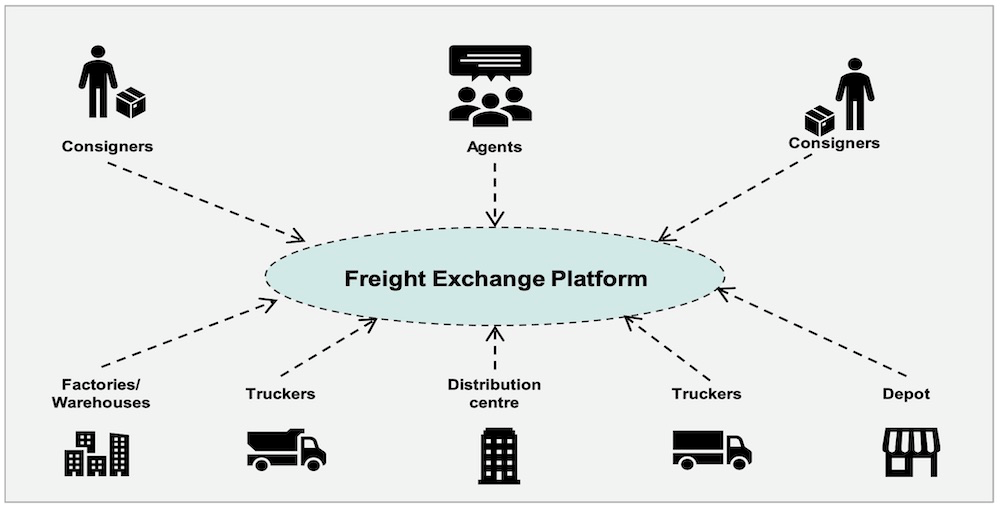

Delhivery heavily depends on the in-built tech platform used to connect consignors, agents, and truckers offering road transport solutions. The common element in these services is digitization. Poor planning and forecasting of demand and supply increase the costs, theft, damages, and delays in India’s logistics market, analysts at Bernstein wrote in a report. Advanced solutions integrated with digital tools have helped bridge this gap in India’s unorganized logistics industry.

With the onslaught of the Covid-19 pandemic, the importance and efficiency in the logistics and supply chain industry has demanded a much-needed refocus. To some extent, Delhivery has been successful in this period by delivering much needed ‘last mile services’. Its competitors, including Blue Dart, FedEx, and DHL, had their fair share of increased operations vowing to the pandemic. The post-pandemic phase will result in a scenario favorable to companies like Delhivery; the main challenges post an IPO for the company would remain in effectively mobilizing the proceeds and maintaining specific stability on the bourse.

The people behind the scenes

Sahil Burau (CEO), an IIM-B alumnus, and Mohit Tandon, hailing from IIT Kanpur, worked as consultants for Bain & Co. For both of them, they realized consulting had only so much to offer and grow. They had the drive to start something of their own; they started this journey with a sabbatical for six months and a tiny clue. Today’s team includes thousands of employees and the rest of the co-founders- Kapil Bharti, Suraj Saharan, and Bhavesh Manglani. Tandon and Manglani exited earlier this year. Sandeep Barasia currently serves as the CBO, with Ajith Pai as the COO and Amit Agarwal as CFO.

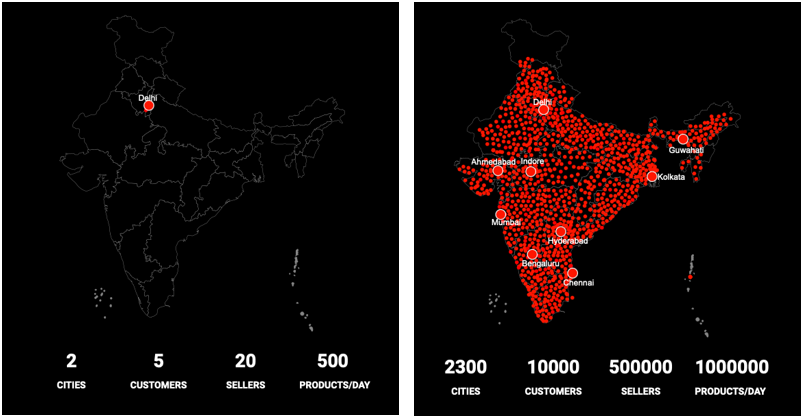

Delivery in 2011& 2021, respectively

Revenue Growth Compared to Blue Dart

Working of the business

Recording of Losses, FY20 vs. FY19 vs. FY18

For sources click here

Follow Us @

Sources:

These Entrepreneurs Started One Midnight on a Hungry Stomach: There’s Been No Turning Back Since Story: Journey of Founders’ Logistics company

https://nextbigwhat.com/delhivery-startup-journey/

Delhivery Official Webpage

Delhivery’s IPO and why it matters, The Economic Times Newsletter

Delhivery eyes Q4 IPO at $4 bn value, Livemint

https://www.livemint.com/market/ipo/delhivery-eyes-q4-ipo-at-4-bn-value-11623180904876.html

Indian Logistics Giant Delhivery raises $277 million ahead of IPO, TechCrunch

https://techcrunch.com/2021/05/30/indian-logistics-giant-delhivery-raises-277-million-ahead-of-ipo/

Delhivery to list in 6-8 months, expects to raise $500 million via IPO, The Economic Times

Delhivery Cuts Losses By INR 1,500 Cr In FY20 Amid IPO Plans, Inc42

Exclusive: IPO-bound Delhivery raises $277 Mn led by Fidelity, Entrackr

https://entrackr.com/2021/05/exclusive-ipo-bound-delhivery-raises-277-mn-led-by-fidelity/