Hello Risk takers and Volatility lovers,

I will start with recent take on my crypto portfolio! I invested in Bitcoin 2 weeks back after making a firm decision to enter this glorious market, and you know what, my first 200 are currently trading close to Rs.285 within just 7 days, while my mutual fund carrying the same amount couldn’t even make half of the crypto returns in 6 months!

But wait, again neutralizing my story, does it mean to join the top 1% investors who are betting on the huge potential Cryptoverse has to offer and enjoy hefty returns since the cryptos are available at quite discounted prices after the May Blunder! Always remember, higher the risk appetite you have, higher can be the returns.

So, yes, may be if you are in your initial earning years, then I would say, yes this market can be really promising in the long term.

See, My perception of not investing before in any of the crypto coins was just because I didn’t know how to Fundamentally analyze cryptos. I was aware of the technical charts but my main concern was what actually backs CRYTO COINS or how do people choose these so-called unreliable coins for long term! There may be many investors just like me who love to trade equities and just wish to invest in 8-10 cryptos in expectation to generate huge returns over the next few months or years, right?

And this can only be achieved by fundamentally analyzing them.

So, in this blog i will delve into 2 major segments which are to suggest ways on how to diversify your crypto portfolio with Rs.1000 as initial investment and select the right currencies out of humongous collection of 8000+ coins! In the second segment I shall assist you with all the FREE tools available which you can use to carry out your fundamental analysis and take wise investment decisions for medium as well as long term investment into this exciting asset class:)

And yes the best part is, unlike the equity screening, you don’t have to glare at those long balance sheets, income statements,cash flows and ratios,do the maths and come to conclusions:)

Alright, so first of all starting with how to invest your first Rs.1000. Just like the equity portfolio, the crypto portfolio too has different categories of classes to choose from! I shall provide you with the percentage allotment into various classes in accordance with my investment of Rs.1000 and you may allocate the similar percentages as per your investment amount.

Please remember these rules and give them a space to stay forever in your mind:-

- Don’t panic and Learn to HODL( as ‘Hold’ is spoken out in the crypto universe:)),since the markets are highly volatile here!

- Always remember to DYOR and also KYC, i.e. Do Your Own Research and Know Your Coin:)

- Never put all your eggs in one basket!

- Never try to time the market, prefer Dollar cost averaging!

For those of you who are unaware about Dollar cost averaging, kindly see the picture below and i hope this will help you to understand how the person who made lump sum investment by trying to time the market made no returns while the opposite happened for the person who practiced DCA!

Amazing, now let’s dive into where all to invest!

So,it goes without saying that maximum exposure should definitely go towards the king of the cryto market,i.e. Bitcoin, close to 40% is what shall be reasonable i.e. Rs.400. Now say you are investing around 10,000, so try to practice dollar cost averaging by investing every fortnight or every month.

Now, again, the next investment coin without any hesitation must be Etherium with allocation close to 15%.Etherium is decentralizing the whole Internet and has a lot of Dapps(Decentralized apps) running on its platform.

Let us also wait for Etherium 2.0 to be released in the markets and then we shall divest some of the allocation from Etherium towards Etherium 2.0,since it is again predicted to be revolutionizing the internet space with much more efficiency than Etherium!

Next we will allocate towards ‘Defi Projects’ or the Decentralised Finance projects where you do not require any middle person(especially a bank or a lending institution) to approve or disapprove a loan or carry out any financial transactions.

Now here the categorization goes as follows-

1)Lending projects like Aave,Compound

2)DEX Projects(Decentralised Exchange Projects) like Uniswap,Pancakeswap

Does that mean i am promoting these altcoins, NO! My main motive is to put forth the categories and motivate you to explore to the core before you put in your hard-earned money into them! The allocation towards these projects can be around 15% of your entire portfolio.

Now, for the mainstream adoption of the cryptocurrency, especially after distrust due to the May incident; it is vital for the centralized exchanges like Binance, Huobi, FTX to perform well. Here you shall again allocate 10% of the portfolio value.

And yes, some contribution towards the ‘smart contract projects’ which are the projects which are directly competing against the Etherium platform. Here you shall again allocate 10% of the portfolio value.Some of them are Cardano, Polkadot and Solana and investors are betting high on their future potential.

Now the last 10%!

Now, this is the amount young investors like you and me look for gambling or investing in shitcoins and memcoins. This category is very famous with names like Dogecoin, Shibainu etc.But before this let us allocate 5% towards ‘NFT projects’ as well like Mana, Chiliz, Axie Infinity. Non Fungible Tokens have gained huge popularity recently! Even Marvel has decided to launch NFTs for its all time popular character like Ironman and Spiderman! Yeah, i am too excited but they will cost way beyond my entire returns i may be able to generate from cryptos:/

NOW, the very last 5%, please use it to explore the Cryptoverse and invest only 1% towards any shit coins or meme coins! Yes,you can easily by any coin for Rs.10 or even lower on the crypto platforms:)

After finishing this first segment, let us quickly venture into tools one can use to successfully conduct his/her fundamental research on all the coins available out there and invest in the ones which have the potential to make them millionaires over time!

The deeper you research, the deeper will you be able to fill up your pockets:)

The first two financial tools you must use together are hands down

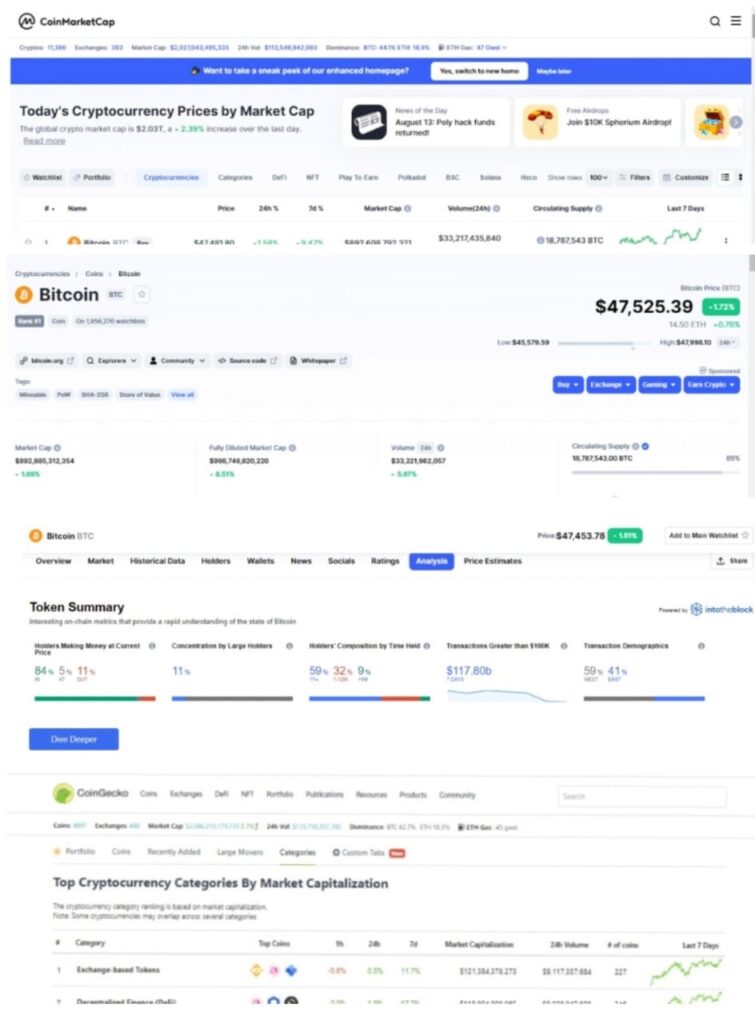

1) Coin Market Cap and CoinGecko:-

These platforms are truly ‘MoneyControlPRO’ of the CryptoVerse!

Do remember to look on these following indicators for every coin you carry your research for!.

The Circulating supply which is the actual supply in circulation

The Total supply which will indicate the nature of asset, i.e. whether it is deflationary or inflationary when considered along with the circulating supply

Market capitalization, try to have maximum allocation in the top 100 coins

Community activeness, the bigger and active the community, the better it is

The Latest news to know how is the coin being perceived by the investors

The White paper, the most important in the lot, it is like the annual report of any stock market comapny

The Percentage holding with top 100 members, which again signifies the influence those 100 members can have on the price of the coin

The number of exchanges the coin is listed on, the more the exchanges the better credibility the coin gets

All time high of the crypto coin, just to have an idea how much upside potential does the coin have

Social Media Handles which indicates how active is the currency’s social media handle

Initial Coin Offering(ICO) to know about the token distribution i.e. the holding with the seed investors, early supporters etc.

These are only some of the few indicators, the stage is all yours, research as deep as you can.

You can learn about the recently added products,lend your cryptocurrencies and much much more!

UHHH,a lot to take in,i know:)

Now, will just name the others and just give a one-two liner description!

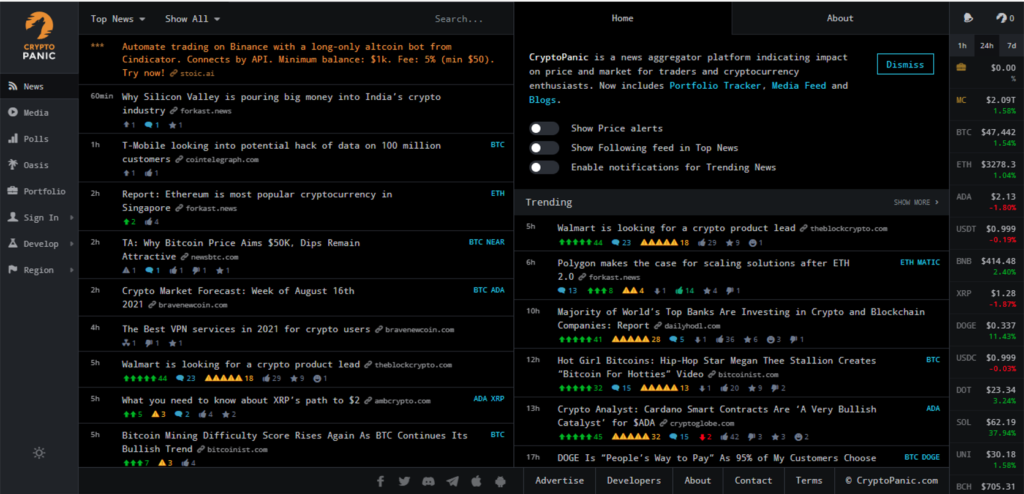

2)Cryptopanic:-

If you are panicking on to get all the news revolving on the Cryptoverse, this is the platform for you!

It is a news aggregator platform which combines all the news revolving around the crypto world and presents it on the tab.

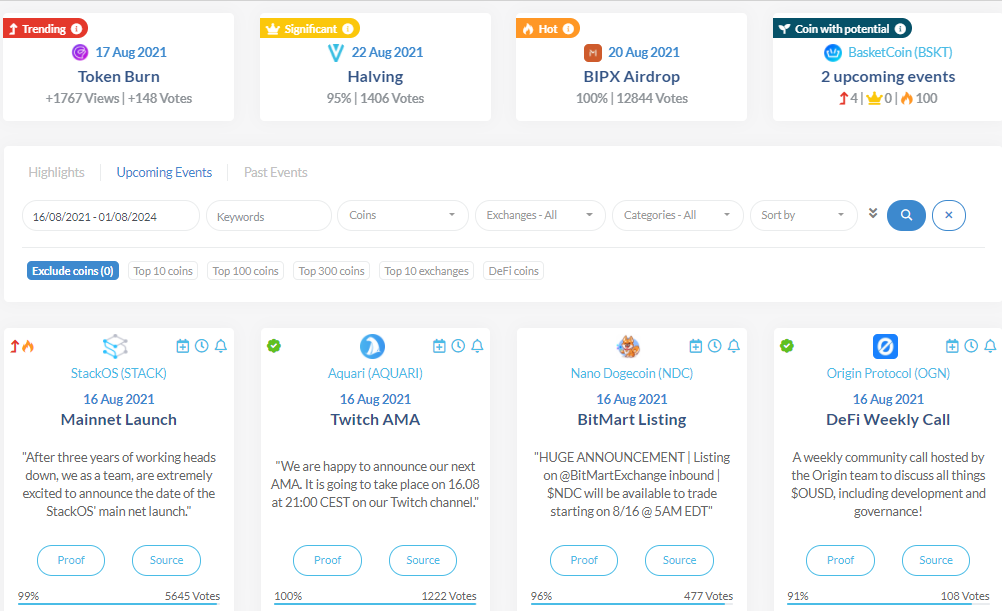

3)Coinmarketcal:-

Focus! Its not cap but cal:)So, wishing to know about all the upcoming events catering to various cryptocurrencies, this is an amazing site to visit and explore.

Like the mega event of Etherium ‘LondonHardFork’ is scheduled for 4October,2021.

People with Short term memory loss like me can even set alerts for the same through the site:)

The last 5% you were left with, you remember, you can use that to ‘Buy the news and sell the rumours’:)

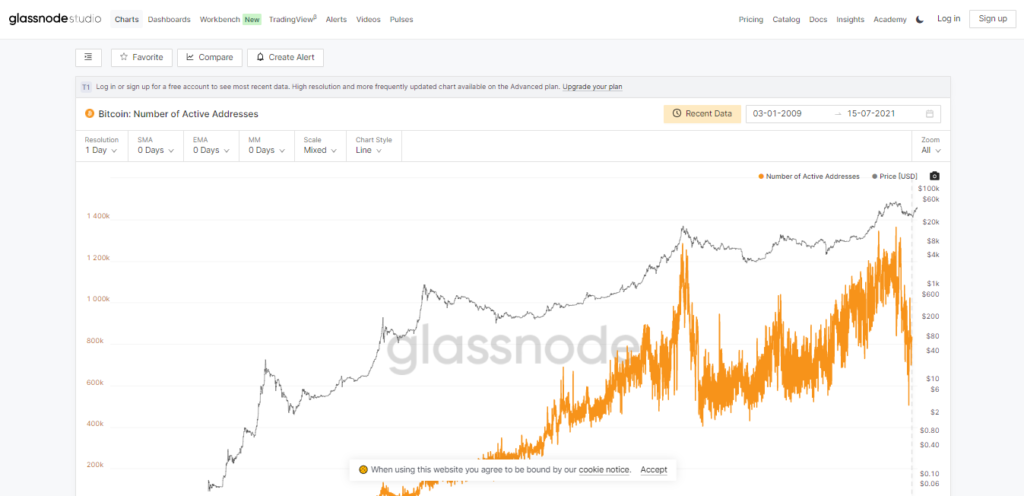

4)Glassnode:-

This platform helps to conduct on chain market analysis, to know how many new addresses have joined the space, to know how much currency is moving in and out of the exchange.

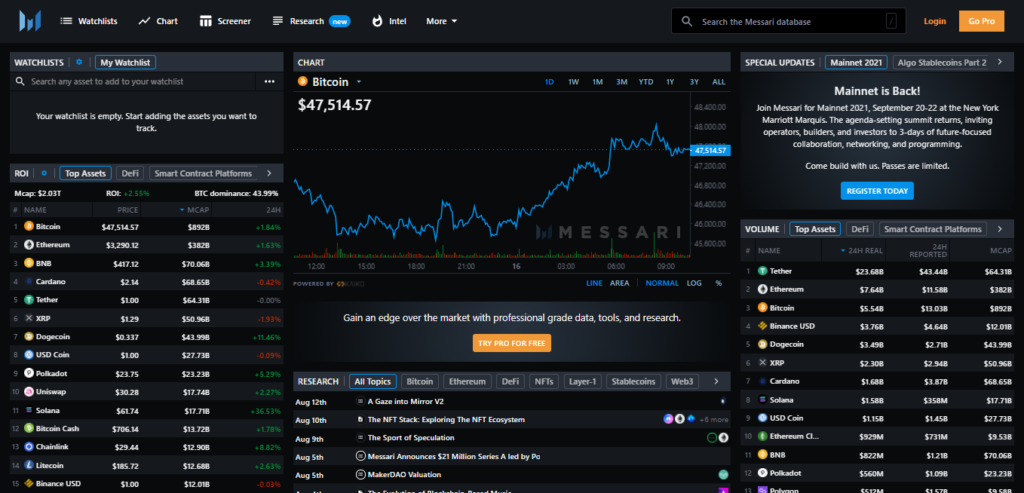

5)Messari:-

Now, the people who like to sort everything into various categories, it is the right space for them to sort cryptos as per their market capitalization, their addresses and so much more.

And the very last platform which is indispensable for all the budding investors out there.

Our very own,

6)Trading View:-

Technical analysis is incomplete without Trading View and people looking for medium term investment goals must carry out adequate technical analysis to make good returns on their crypto picks!

So, yes, that was all. I know it is a lot too much to digest in one go! But i hope this blog may help you to at least take your first few confident steps towards Cryto research and be in the top 1% investors in the entire country! Also, just a disclaimer readers, I am not any financial advisor! I just want you to build a system of investing for yourself rather than investing based on your feelings or any sort of tips or recommendations. Generating money over money needs just a bit hardwork and a bit smartwork!

Follow Us @