NCC Ltd is engaged in the infrastructure sector, primarily in the construction of industrial and commercial buildings, housing, roads, bridges and flyovers, water supply and environment projects, railways, mining, power transmission lines, irrigation, and hydrothermal power projects, real estate development, etc.

Market Trends

Foreign Direct Investment (FDI) in the Construction Development sector (townships, housing, built-up infrastructure, and construction development projects) stood at US$ 25.66 billion from April 2000 to March 2020, according to the Department for Promotion of Industry and Internal Trade (DPIIT).

The logistics sector in India is growing at a CAGR of 10.5% annually and is expected to reach US$ 215 billion in 2020.

India is expected to become the world’s third-largest construction market by 2022.

Government Initiatives

Government plans to invest about INR 102 Lakh Crs. in infrastructure projects by 2024-25. The five-year-long National Infrastructure Pipeline (NIP) will enter its second year in FY21, during which INR 19,50,397 crores are to be invested. About INR 19.5 lakh crore has been budgeted during FY21 as part of the NIP. Urban infrastructure, road transport, energy, and Railways account for about 70% of allocation this 2020.

About 42% of the projects in the NIP are under implementation, which means construction work is already going on. Another 19% is under the development stage, while a mind-boggling 31% of the projects are still in the conceptual stage.

Investment thesis

As soon as the pandemic is over (or rather, brought to controlled levels), the government will need to revive the economy and the infrastructure sector is going to play an important role in that. Infrastructure is one sector that has an impact on almost all other sectors due to its capability of providing wide-spread employment, which induces consumption.

Finance Minister Nirmala Sitharaman said the Union Budget for 2021-22 would have an emphasis on sustaining high public expenditure on infrastructure to revive the economy which contracted in the first two quarters of the current financial year.

“Something that certainly will feature is we shall definitely sustain the momentum on public spending on infrastructure because that is the one way we are sure that multipliers will work and the economic revival will be sustainable.”

In the past, company has undertaken various government projects like Nagpur metro, NBCC Kidwai Nagar, Agra Lucknow express highway etc., and has worked with numerous government agencies. So, this initiative by the government can help in higher profits and overall growth.

Even at the time of the pandemic, NCC has an order book of INR 29,362 cr (as of September 30, 2020), and an order book to sales ratio of 3x provides strong cash flow visibility for the foreseeable future. This particular aspect provides certainty that over the period of 3 years, the company is going to earn decent profits.

This with more government projects expected in the next few years for economic revival and NIP initiative will do nothing but help NCC grow at an exponential rate.

Financials

Any company’s financial strength can be understood from the fact that even during a pandemic, the company didn’t avail the moratorium granted by the RBI.

The book value per share even at the time of pandemic has increased as seen in the graph below.

The company was able to reduce its Debt/Equity ratio to 0.37x. The WCL (working capital loan) rates have reduced significantly which helped bring the overall interest cost down for the company.

Cash flow from operations has improved significantly in the last few years.

Even though only 8% of revenue generated are contributed by subsidiaries companies, they are also doing well enough. This can be noted from the fact that they have re-paid ~100cr loan to its parent company during the year.

Buildings – the major vertical for NCC contributes 46% of the order books i.e. ~13,625 Crs. which makes them at par with L&T (the market leader right now).

Company strategy

- Focus on a core competency of the company i.e. Construction Business (EPC and item rate contracts) with asset-light strategy

- Monetize BOT and Real Estate Assets exposure on a case to case basis

- With the impetus of the Government on infrastructure development and housing for all in India, focus on bidding for construction projects

Catalyst (Triggers that make it a compelling buy)

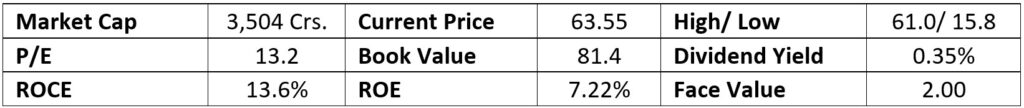

- Company is trading below book value

- Government initiative in the infrastructure sector

- Rakesh Jhunjhunwala has increased his holding in the company

Follow Us @