You can download the entire Biocon Limited: Research Report here.

Industry Overview

The pharma sector is well poised to take an important position in the world markets. India being the largest generic medicines provider, supplies over 50% of the world demand for various vaccines and over 40% of generic demand in the US. This basically points to a simple conclusion, that India has an enormous advantage or conducive environment to produce generic medicines because India being one of the largest producers of STEM graduates.

Indian pharma sector is expected to be a $100 Billion opportunity by 2025. The export pharma sector is expected to be $25 Billion opportunity, with the main export of bulk drugs, intermediates, drug formulations, biologicals, Ayush and herbal products and surgical devices.

Now, we will go deeper and talk about the biotechnology space in India. The sector mainly comprises of biopharmaceuticals, bio-services, bio-agriculture, bio-industry and bio-informatics. The majority of revenue is generated in biopharma.

India is among the fastest-growing markets for the biotech sector, having the second-highest USFDA approvals. India is also a favoured destination for clinical research, clinical trials and contracts research services due to the growing bio-services sector.

Global Trends

i. Growing and ageing population: The population is still rising with most of the world population becoming ‘older’. The spread of non-communicable diseases commonly found in the elderly, like cancer and other cardiovascular diseases opens up opportunities for novel healthcare products and therapies.

ii. Pricing Pressure: With the rising population and increased life expectancy, the demand for novel and complex healthcare products is going to rise and hence consumers will have to pay more ‘out of the pocket expenses’ (exceeding health insurance claims), resulting in pressure from governments to fix prices for some products

iii. Technological Advancements: With the expanding scope of AI and data analytics in healthcare, there is a big scope for companies in this space to use more of the digital platforms to build on their increased efficiencies. This will translate into more research and development expenses, but over long term, it may pan out to be a competitive advantage.

iv. More Collaboration: Increasing scope for strategic partnerships is another definitive trend. This will be more advantageous for well-established firms working in emerging countries, who now want to geographically diversify. They will move toward global players and might indulge in joint ventures to enable a win-win situation.

v. More resilient healthcare systems: This is a crucial point that we see emerging post the COVID scenario. The lack of consensus, political mismanagement, inadequate health infrastructure to tackle the virus, has led to growing dissent among the public and a question mark on the pharma and healthcare sector as a whole discounting the political clout. This also gives an opportunity for key infrastructure and organizational/ strategic players to create a functioning & efficient healthcare system.

The Indian pharmaceutical sector has been growing at 15% CAGR since 2015. There is a big overhang, which is the COVID outbreak (PwC). It is also estimated that the sector will register a 10-13% growth in FY21 (ICRA)

The major issue going forward is pricing pressure. The growth of both the US GDP and the pharma sector (being a major importer from India) manufacturing issues, US-FDA drug approvals and the vaccines developed for COVID will increase competition causing a downward pressure on pricing

The Indian biotech sector has been growing at ~ 10-12% annually. The main regulator in India for this sector is Department of Biotechnology (DBT). Moreover, the medical devices and diagnostics sector is seen as a growing area for the industry. Another special trend seen in India is that lot of startups (2700+) are in the biotech space and it is expected that there will be 10000+ biotech sectors by 2024.

Additionally, due to 100% FDI allowed under automatic route for greenfield pharma and manufacturing of medical devices, there is a big possibility of increase in competitive intensity in the sector

Now, we will go deeper and look at the company, Biocon Limited.

Company Overview

History:

Biocon Limited is the largest biopharmaceutical company of India. It was incorporated in 1978 as a joint venture between Biocon Biochemicals Limited and an Indian entrepreneur, Kiran Mazumdar Shah. The company started as an enzyme manufacturer and was soon exporting to US and Europe.

- In 1989, Biocon Biochemicals got acquired and soon Biocon Limited became an independent company based in India in 1998. The company’s management soon started investing in research services as well as developing fermentation technology. They also started leveraging this technology and soon started investing in biopharmaceuticals and statin.

- In 1994, Biocon also established Syngene Internation Private Limited as a custom research organization (CRO). This was done mainly as there was a growing demand for pharma related R&D and Indian companies were finding it difficult to invest in in-house R&D programs.

- In 2001, Biocon became the first Indian company to receive US FDA approval to manufacture lovastine, a molecule that is used in reducing cholesterol. Also, the company received a patent for its bioreactor, PlaFractor.

- In 2003, the company became the first one in the world, to devlop human insulin on a Pichia expression system.

- In 2004, the company was listed on Indian bourses. In 2005, the company also signed a commercial agreement for supply of Insulin API to Asia, Africa and Middle East.

- In 2006, Biocon inaugurates Biocon Biopharmaceuticals which is India’s largest multi-product biologics facility. The company also inaugurated Biocon park, which is the largest integrated biotechnological park encompassing manufacturing and research labs.

- In 2010, Biocon and Optimer Pharmaceuticals started manufacturing and had a supply agreement for a novel API, first in class anti-inefective. They also announced a strategic FDI in Malaysia

- In 2013, Biocon received marketing authorization from Drug Controller of India, for its novel biologics Itolizumab, anti-CD6 molecule for the treatment of Psoriasis. The company also entered into a strategic partnership with Mylan for their insulin products.

- In 2014, Biocon introduced Trastuzumab (CANMAB) for the treatment of breast cancer in India.

- In 2015, Biocon also expanded its presence in Mexico when it received approval for Insulin Glargine, through its partner PiSA Frmaceutica. Biocon also started expanding its biosimilar portfolio.

- In 2016, Biocon also started supplying Insulin Glargine in Japan, a major milestone for the company. Biocon also got its first approval from EU for its generic formulation.

- In 2017, Biocon and Mylan became the first companies to have received a US FDA approval for their biosimilar Trastuzumab. The company also became the first Indian company to have received the FDA approval for a biosimilar.

- In 2018, they commercialized their biosimilar, a major milestone for their biosimilar business, US being the largest consumer market for pharmaceuticals.

- 2019 market the year, when Biocon set up an Independent subsidiary to design and manufacture its biosimilar business. The Trastuzumab biosimilar was also approved in Canada and Australia. Bicara Therapeutics was also established as a wholly owned subsidiary in Boston, US that will be focusing on bifunctional antibodies.

Recently the company announced that the biosimilar, Itolizumab could be used for the treatment of COVID 19. GoI has not included this in their COVID 19 treatment list due to lack of evidence as they tested the medicine on 30 patients only.

Biocon has also partnered with Voluntis to develop digital therapies for diabetes. This is a major diversification shift for the business. This will make the company the first in getting US FDA approval for digital therapies for Type 2 diabetes.

Biocon’s business:

Biocon is India’s largest integrated biopharmaceutical pure play company listed both on NSE and BSE. Since its operational inception back in 1978, Biocon had been engaged in the manufacturing of enzymes. In 1999, Biocon leveraging on its fermentation technology derived from 21 years of experience in enzymes business, forayed into the pharmaceutical business. The pharmaceutical companies have been engaged in the generic formulation business, due to cheap imports of APIs (the core raw material) from China and lower cost due to the ‘generic’ nature of the medicines, which translated to low R&D expenses.

Biocon started its pharma business not in ‘generic’ space but started targeting manufacturing of APIs, biosimilars, novel biologics etc. The company also started tackling diabetes by venturing into therapeutic business. This is important because it showed a differentiated approach adopted by the company. This approach also brought in considerable advantages like high barriers to entry, first mover advantage, high cost of R&D expenses and setting up of clinical trials and research.

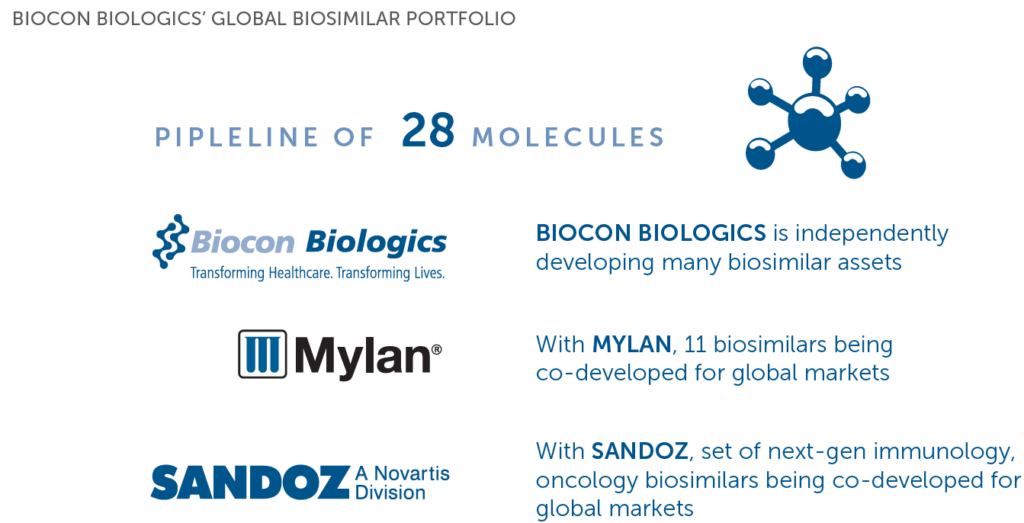

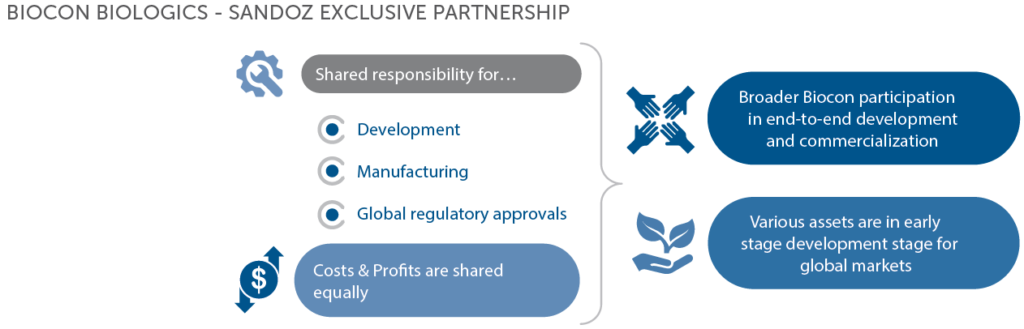

In FY18, when the competition invested in businesses generating predictable ROCE, Biocon decided to further develop their biologics portfolio by drugs based on recombinant DNA. This was a big risk and quite a difficult endeavor to undertake. To hedge this risk, they partnered with the global leader Mylan in the generic business, who were willing to share the risk and mutually develop these drugs. The company also fostered a relationship with Sandoz for its biosimilar business, particularly: portfolios of immunology and oncology (considered future of human biology). In the novel assets, Biocon has a relationship with Quark Pharma for siRNA (small interfering RNA) therapeutics and with JDRF for their novel oral insulin Tregopil.

Biocon works on a hybrid business model wherein the company undertakes these high-risk projects and also supports the stakeholders with more predictable businesses like small molecules and APIs (mature portfolios).

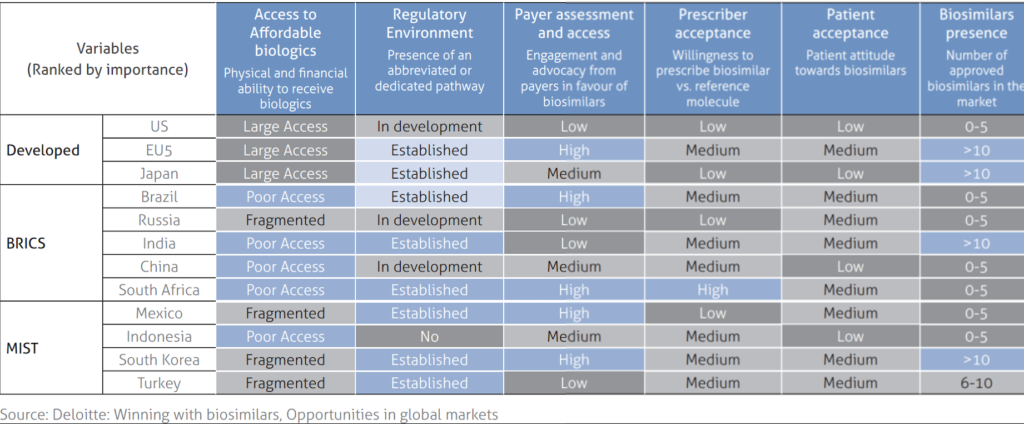

The company’s robust focus on its biosimilar business, in the long term is assumed to provide stable growth and increased market share, due to the increasing biosimilar markets in Europe and USA, resulting from better access and affordability of the patients.

The company also believes bi-specific antibodies to be the next major opportunity. These antibodies offer an advanced therapy treatment against cancer.

The company also recently stated that they have reached an inflection point in their biosimilar business and have consolidated the whole value-chain into a wholly owned subsidiary, Biocon Biologics headed by Dr. Christiane Hamacher.

The company also initially used to partner with global pharma companies that used to commercialize their formulations from their APIs but Biocon has also started forward integrating their operations and they plan to commercialize their formulations themselves to getter a better slice of the pie instead of only making a licensing fee earlier.

Biocon’s insulin manufacturing and R&D setup in Malaysia is the largest integrated insulin facility in Asia with an investment of ~ $300 Million. This sits well and shows that management is firm on its promises of delivering the lowest cost insulin to its diabetes patients, the ambitious goal of 10 cents per pen.

Biocon also holds more than 50% market share as the leading producer of Olistat API. Biocon entered back in 2003, being one of the first movers, in the mammalian cell culture technology. They are used in developing complex molecules which helps in repressing tumor.

The company also believes that oncology market to be the major dominant market in the therapies industry, projected sales to be ~US $129 billion over 2017 to 2024. The company’s partnership with Volantis in digital therapies is a step in this direction.

Management & General Information

The company is led by Siddharth Mittal, CEO and Joint MD along with Kiran Shaw, the chairperson and the MD of the company. Recently, Dr. Arun Chadavarkar retired as CEO & Joint MD of Biocon on 30th November 2019 after spending 29 years at the company.

Here, we will be only talking about Kiran Mazumdar Shaw, as she is the majority shareholder in Biocon, close to ~ 40% and is the chairperson of the board. She also became the executive chairperson of the company. She started this company as a joint venture with Biocon Biochemicals Limited with a startup capital of Rs. 10,000 as an enzyme’s manufacturer.

She was born on 23rd March 1953 in Bangalore, became the India’s richest self-made woman billionaire with a net-worth of around $4.1 Billion according to Forbes. Under her leadership, Biocon became the first company to receive US FDA approvals for its two biosimilar products for the treatment of cancer. She was the one responsible for making Biocon taking a different approach from the copy-cat generic business to a high-end R&D company. Back when she was a young student, she wanted to become a doctor but couldn’t and when such an opportunity arose, she jumped to it and became an entrepreneur, which was not at all a famous career option for a woman back in the Indian society of 1970s. She completed her Bachelor’s in science degree from Bangalore University and did her Masters from Melbourne University. She has received accolades from the GoI such as Padma Bhushan in 2005 and Padma Shri in 1989. She holds a lot of international awards and honorary degrees from international universities. She also holds board memberships in Infosys and Narayan Health.

Corporate Governance

The corporate governance of Biocon has been quite robust in its 40+ years of existence. Led by good management and dedicated policies of related party transactions, the company has always been following the adhered policies and guidelines of SEBI. At times, when lot of well reputed corporate houses are being questioned for their corporate governance standards, Biocon hasn’t shown any glimpse of ‘a miss’. There are lot of RPAs as studied from the annual reports by the author between the company and its subsidiaries, but no red flag has been observed. Going ahead, the situation should be monitored.

RPAs like loans or some exchange of goods or services etc. between Biocon Ltd and its subsidiaries. The loans should be monitored but the interest rates are quite reasonable

Key metrics that the author looks at good practices of corporate governance:

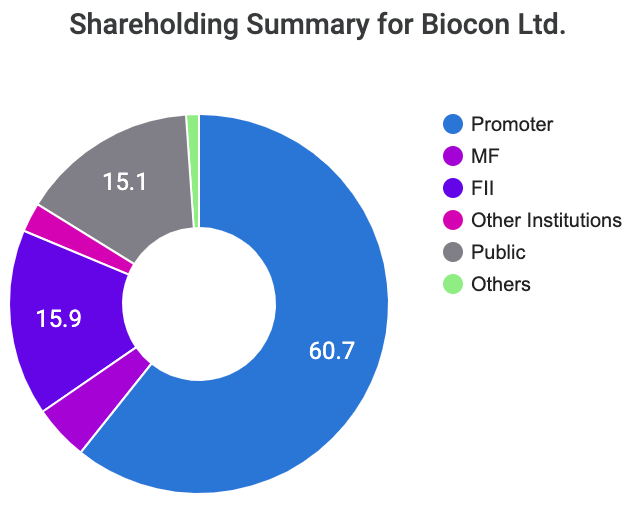

- Stake of Promoters and change over the years:

There hasn’t been any substantial change in promoter holdings in the company. A healthy stake of 60.67% and this has been more or less consistent over the years.

The rationale at looking at promoters’ stake in the company is it shows that the promoters’ interests are also aligned towards the long-term viability of the company. Also, Ms. Shaw’s substantial personal net-worth is in the Biocon stock which is a good positive for the retail investors.

- Shares Pledged by the company or promoters:

There aren’t any shares that are pledged by the company’s promoters.

Rationale for checking this is because if the shares are pledged by any ‘big’ shareholder to any third party and the share price starts falling, then the such shareholder has to deposit more shares, some other financial instruments (safe or moderately risky) or cash. If they can’t pledge additional assets, then those shares could be transferred to that third party.

This is risky when a big block of stake is pledged because it may hamper the stability of the company’s promoters or management.

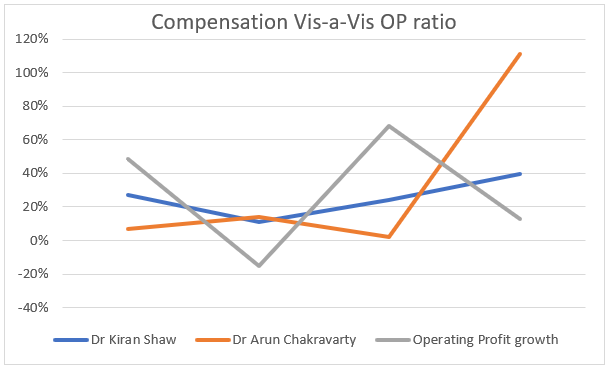

- Compensation of Key Management Personnel

Compensation of Key Management Personnel vis-a-vis Net profit growth = Operating Profitability: This ratio should be closely monitored. However, it is pertinent to note that stock options and other perquisites and benefits that are included in the compensation. Also, net profit is a little distorted figure due to the other non-business/ non-recurring income and expenses getting added and subtracted.

So, according the author’s best judgement, operating profit plays a better role in judging this particular metric, due to the ‘core’ business being evaluated here but here too there are lot of factors to be considered.

This is a red flag that we see here. We don’t see the numbers being aligned here if we take a 5 year view of the compensation structure of the ex-CEO and MD of the company vs the operating profit growth. Here too, one has to interpret the numbers carefully.

- The compensation structure of the company is according to SEBI guidelines, and the component shown here is the culmination of the whole ‘compensation’ structure of the key management

- The components are mainly fixed and variable including ESOPS, which can fluctuate widely and particularly forms the basis for Dr. Shaw’s compensation

- In the last year covered, Dr Arun retired and hence the compensation shot up due to the bonus and benefits accrued and paid to him

So, an analyst can interpret these figures and form his own judgement. The author has given the benefit of doubt and has taken into consideration the disclaimers studied from the annual report and provided to best of his knowledge, accurate information to the readers.

- Management actions vs words:

The company stated that they will move towards therapies and in FY20-21, Biocon formed a strategic partnership with Volantis for digital therapy business.

The company also followed through its promise, of spending its capex on Biologics and Biosimilar business and spent $200 Million in FY20 on further developing the Biosimilar business and setting up of an R&D centre in Chennai. For its small molecule business, they set up a green field facility in Vishakhapatnam. The management commentary in earlier years, were that they will focus on its ‘mature’ portfolio of Small Molecules and their growing business of Biosimilars.

- Capital Allocation:

Capital Allocation is the most important job of the top management. They have full control of how the capital/ money generated by the business will be utilised in the business. So, the investors or potential investors should closely monitor how the management is allocating the capital.

The company in FY19 stated that the company’s focus will be spending its capex on its biosimilar and small molecule businesses; in FY20 they reported that they have spent ~ $200 Million on a manufacturing facility (greenfield in Vishakhapatnam) to build more robust portfolio for their small molecule business. In Biosimilar business, their spends were largely on account for a greenfield facility in Bangalore and R&D infrastructure unit in Chennai.

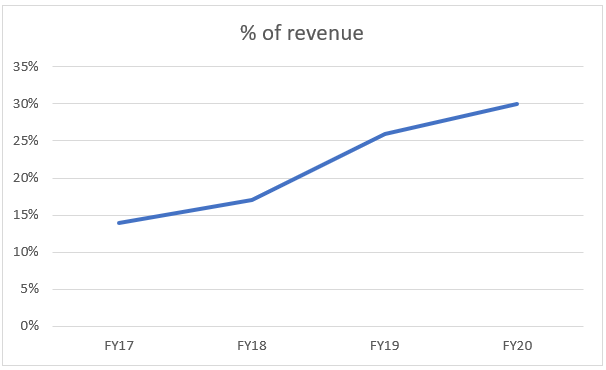

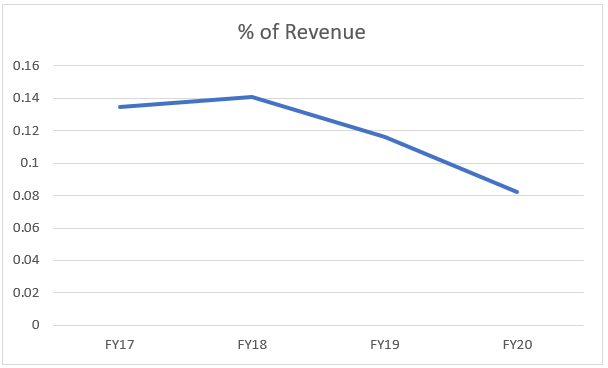

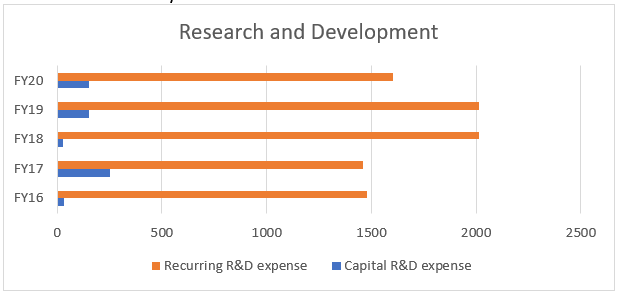

Kiran Mazumdar Shaw also stated in one of the interviews, about the need to evaluate the company and management’s efficacy over the long term. She also stated that one of the key metrics that the company should be judged over is the R&D expense which has been quite consistent with the increased revenue level Y-o-Y of about 14-15% of the revenue. The management’s vision to be the pure play biopharma company, sits well, when the company has integrated itself over the whole value chain of the bio-pharma business – from API manufacturing facility in Mangalore, biotech parks in Bangalore, factories in Malaysia, Andhra Pradesh and Bangalore, to US FDA approvals for its biosimilars, spending money on therapies for chronic diseases, immunology and oncology.

- Company’s operation:

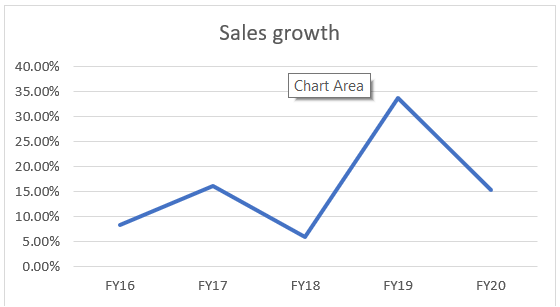

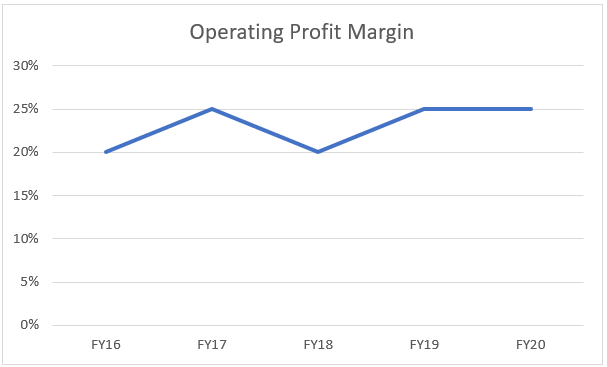

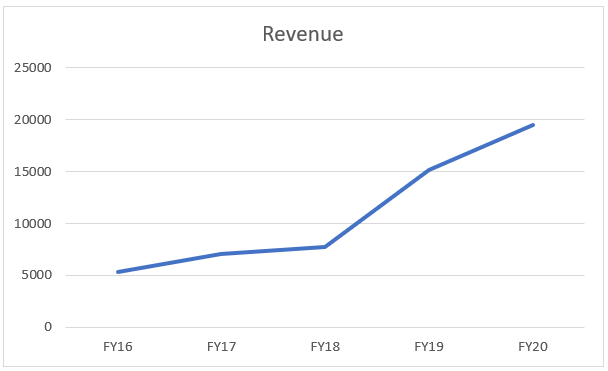

Core revenue growth and core operations profitability: The 5 year data is analysed and is viewed along with the stock price returns in CAGR terms because the author believes it capture the true potential of a company and management’s commentary of looking at the stock/company for at-least 5 years.

The observation of the sales growth, Y-o-Y CAGR for a 5 year tenure is approx. 15.56%, which sits well instead when we increase this holding period to 10 years, at 10.4%. If we look at the 3 year sale growth of the company, it sits much better at 17.84% CAGR. These numbers should be taken into consideration with regards to the industry (quite volatile and defensive in nature) and a mature company which still finds good growth opportunities, which is again captured in the ROCE ~13%. The ROCE of Biocon in among the top 4 in the pharma industry.

The graph beautifully (?) captures the volatile nature of the sales the company has delivered even though the operating profitability being quite stable.

On average ~22-23% operating margin. This comes in one of the top-most in the pharma industry.

The company also delivered a 19% CAGR in operation profits.

There is one important point to study here, that in a 5 year period which the management says the company should be judged upon, the stock returns in CAGR terms is astounding: 39.35% CAGR and again paradoxically, if investors tend to increase their holding period to 10 years then it is 22.72% CAGR.

- Directors composition:

Strict guidelines are being followed as mandated by SEBI. Following has been taken directly from the company’s FY20 annual report:

None of the Directors serve as a Director in more than seven listed companies. Further, none of the Directors serves as an Independent Director in more than seven listed companies or three listed companies in case he/she serves as an Executive Director in any listed company. None of the Directors on the Board are a member of more than 10 committees and a chairperson of more than 5 committees, across all public limited companies in which he/she is a Director. Further, none of our IDs serve as Non-Independent Director of any company on the board of which any of our Non-Independent Director is an ID. Ms. Mary Harney is an Independent Woman Director on the Board of Directors of the Company.

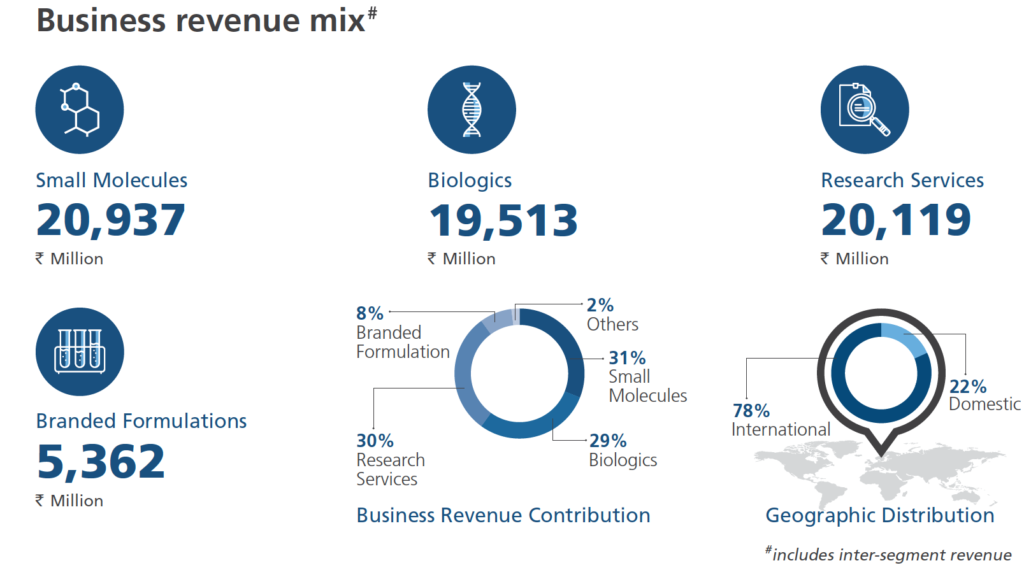

Deep Dive into Biocon’s Business

Now, we will take a granular look at the company’s business, which is divided into 4 parts. Here, we will be talking about the three dimensions, barring the research division because that is housed in Syngene International Limited, which is a public listed company having its own business and financial information.

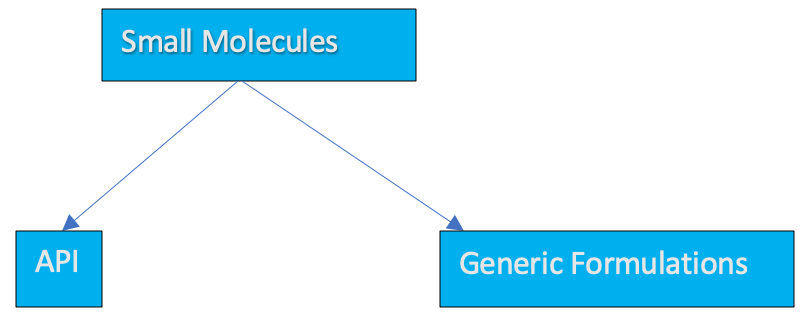

So, Biocon’s business is divided into three divisions namely; Small Molecules, Biologics and Branded Formulations.

- Small Molecules:

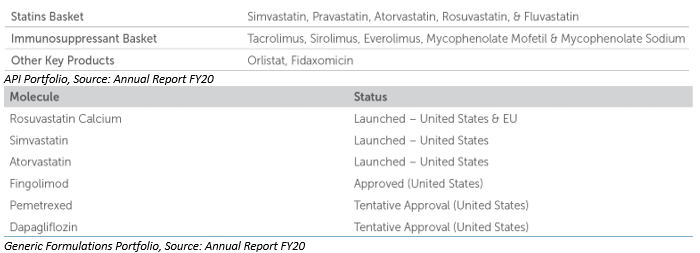

Biocon has a complex portfolio of small molecule APIs in the domain of cardiovascular, anti-obesity, immunosuppressants and narrow spectrum antibodies/antifungals.

The business is defined by technical barriers to entry due to strong foundation in fermentation-based technology and chronic therapies (company specific advantage).

To increase the scope of immunosuppressants, the company has also built a plant in Visakhapatnam, Andhra Pradesh to support the growing demand of the products.

The company has a good market position in APIs, an important/ core raw material for pharma companies but it will also increase its focus on the generic formulation business. This seems strange because there is intense competition in the generic space though the company states this strictly aligns to its policy of becoming a fully integrated bio-pharma company. So, it started its generic formulation business back in FY17. It adopted a niche place in the generic business too, such as that of therapeutic area like oncology, auto-immune diseases, diabetes etc. Initially, the company focused on its reliable supply chain (due to foundation of vertical integration) and chose the chronic space.

Going forward, it plans to use its fermentation technology and characterization technique, so that it can commercialize a solid pipeline of – difficult to make, technological intensive – generic portfolio in global markets including the US.

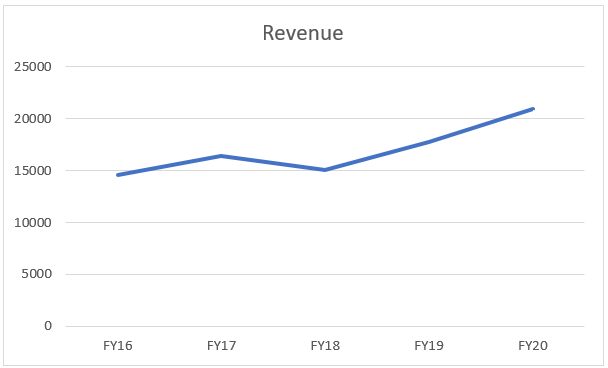

The Small Molecules business has done really well and is the biggest contributor to the revenue. Growing at a rate of 7.5% CAGR, the company in a 5-year period has shown one ‘down’ year.

This was mainly due to pricing pressure and channel consolidation in US in the generic space. The revenue declined by ~ 8%.

The company also expects to have limited competition in the generic niche space that it is working in. The company has extensively focused on developed markets and had a good record, in FY17 it registered growth of 12% by supplying Rosuvastatin API to its US customers, on the other hand it got approval in its generic formulation business for Rosuvastatin Calcium ANDA from USFDA and EU.

In FY19, the company also filed several Drug Master Files (DMFs) in developed markets and emerging markets

The company also started diversifying to China through a license and supply agreement for its 3 generic formulation products. This will allow the company to enter the 2nd largest pharma market and also supply US FDA approved generic formulations to patients in China.

In FY20, the company also started working on a greenfield fermentation-based manufacturing facility in Vishakhapatnam, Andhra Pradesh. This is expected to increase the volume growth in the small molecule API business. This will help the company on its vision of becoming vertically integrated. The expected outlay for this project is Rs. 600 crores.

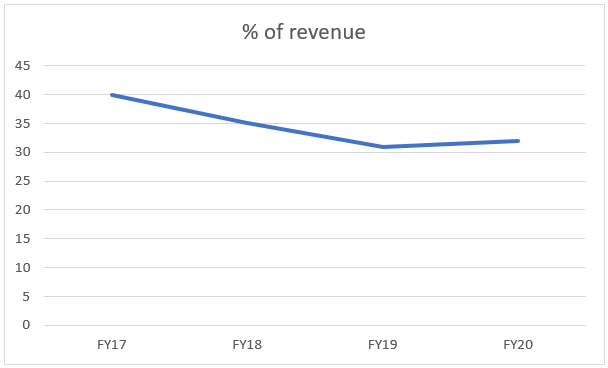

The above graph depicts that the company’s Small Molecule division’s % of total revenue, has been decreasing. This actually aligns with the management’s commentary of focusing more on biosimilar business. Moreover, the author also believes that the biosimilar business is a growing area for the company and the small molecule is more or less a ‘mature’ business.

The risk which the author still feels is the extreme competition in the generic space. Instead, the company can focus more of its resources on its API business which is expected to increase in volume due to China-India standoff and India’s call on ‘self-reliance’. The company has a huge growth market in API due to Indian pharma companies importing 70% of its API requirements.

- Biologics:

Biocon has been betting big on biologics business with a focus on novel process engineering of drug substances and products, predictive toxicology, adaptive clinical trial design and data analytics. The company’s investment strategy in manufacturing has been to build capacity in a modular manner.

The antibodies that are included in the portfolio include BIOMab- EGFR (nimotuzumab for neck and head cancer), ALZUMab (itolizumab, for treating psoriasis). These foundations have also led the company to get approvals of CANMab (an affordable for a biosimilar for treating of breast cancer), large scale development of insulins and insulin analogs and device systems.

The company sees it as a major driver of growth for a foreseeable future, having the first mover advantage and a strong base.

- Biosimilar Portfolio:

The company has one of the largest biosimilar portfolios in the world; spanning insulins, antibodies and other biologics. A pain point however, is huge cost of R&D, large gestation period, technical know-how, global scale infrastructure investments and strong focus on commercialization. Therefore, the company has partnered in their biosimilar portfolio with Mylan and Sandoz.

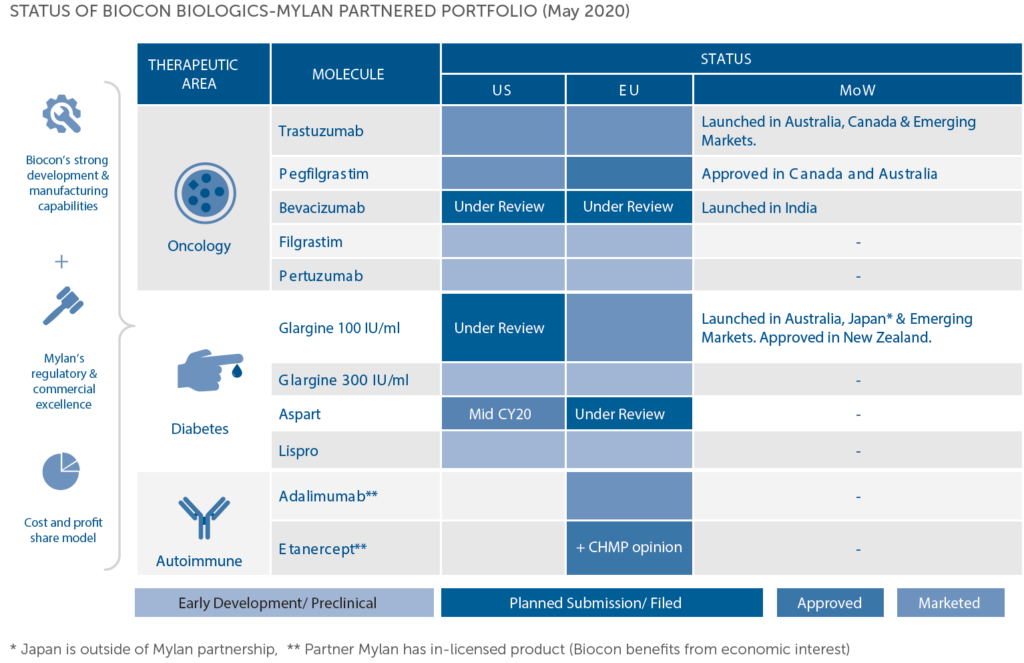

The company received its first developed market approval for its Insulin Glargin from Japan where it was working with a partner. Though, the market is small as compared to rest of the world, but it gives confidence to the company about its capability. The company also received a MYR 300 Million contract from the Malaysian Govt for supplying RHI cartridges and re-usable insulin pens. Biocon has a large scale (company’s first foreign) manufacturing facility based in Malaysia supplies this order and conduct exporting business from there starting from FY17. Semglee, the company’s biosimilar insulin Glargine also got approval and started selling in Europe during FY19.

The company also sees Trastuzumab biosimilar as a growing area going ahead. The company reported this in FY17 and got approval for this in FY18 from US FDA for Ogivri, a biosimilar trastuzumab co-developed by Biocon and Mylan. This is a milestone for the company, being the first Indian company to get an approval for a biosimilar in the US. This is mainly used to treat stomach and breast cancer. In the emerging market of Brazil too, this got approved, which is one of the top-3 growing markets globally in terms of breast cancer. The drug also got approvals in the European and Australian markets in FY19.

The company’s insulin Glargine also got approved in Australia, Europe, Russia and South Korea.

A setback faced in FY18: The company had to refile the approval application for Trastuzumab and Pegfilgrastim dossiers in EU. This was an unexpected event but is not bound to affect the revenue materially in Europe. This happened because of some observations that the company received on its sterile injectable fill-finish facility. US FDA also had the same observations in case of Pegfilgrastin but there were no scientific observations- a positive sign.

The company moved on its promise in FY19, got approval (US FDA) for its Pegfilgrastin biosimilar: Fulphila and started commercializing it in US. It also got approvals from Australia, Europe and Canada. Through support programs, it garnered mid-teen market share in the syringe market till Feb 2019.

The company’s brand Insurgen is a major player in Malysia in the rh-Insulin market, holding 75% market share. During FY19, the company also launched Insulin Glargine in South Korea with a local partner.

The company also entered into a partnership with Mylan and a third party (Lupin) to gain market share in Europe and certain select markets, for advanced stage Etanercept asset.

In FY20, the company set up a subsidiary, Biocon Biologics which will hold the company’s Biosimilar business (95%+ stake). Biocon Biologics plans to touch 5 million patients lives by 2022 and reach a revenue of around $1 Billion. Biocon Biologics also plan to launch products in developed markets like EU, Australia, US, Canada and Japan every year over the next few years.

The company also launched its mission of launching human insulin for 10 cents.

In FY20, the company saw Ogivri launched in US and Europe.

There was also a law change in US, in which insulins will now be regulated under Biologics. This would have caused problems for generic insulin developers who had filed for the application before the law change date, including Biocon. But a legislation was passed which exempted the company and it is expected that Semglee will be approved and launched in US, in CY’20.

Biocon Biologics also gained from third party partnerships that Mylan formed with Fujifilm Kyowa Kirin Biologics, for an in-licensed brand Hulio in Europe which is expected to drive more market share and increased profits.

Mylan also filed a Biologics License Application (BLA) for the biosimilar, Bevacizumab which the company (Biocon Biologics) plans to launch in US and Europe.

Nepexto, a brand under the etanercept biosimilar assets got launched in Europe, where Biocon Biologics retain the economic collaboration arrangement with Mylan.

For the company’s independent portfolio, Biocon Biologics also started developing recombinant human insulin in US. Biocon Biologics also is in the process of developing, manufacturing and commercializing a biosimilar asset with Just – Evotec Biologics, a subsidiary of Evotech SE. (risk factor but innovative approach)

In November 2019, the BLAs that were filed by Mylan for Pegfilgrastim drug substance to be manufactured at Biocon’s facility in Bengaluru was also approved by US FDA. This will help address the developed markets of US and other global markets.

In late FY20, the new Drug Substance Facility has been commissioned in Biocon Park, Bengaluru. The commercial operations are expected to start in late FY21.

The company in FY20, also increased its R&D capital base by acquiring Pfizer Healthcare India Ltd’s R&D capital assets. This will help the company’s biosimilar product launches.

Biocon Biologics also received an equity infusion by Activ Pine LLP, valuing the company at $3 Billion and enterprise valuation of ~ $3.5 Billion. This amount will go towards capex and R&D investments.

- Novel Biologics:

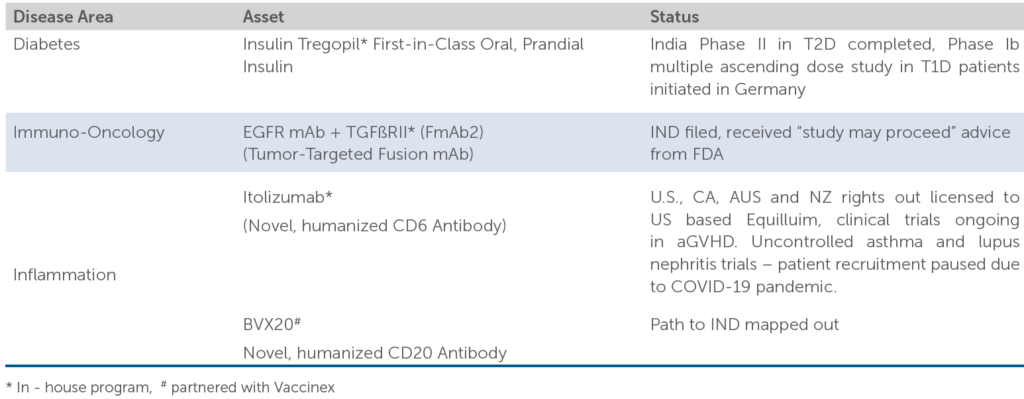

The company’s novel biologics portfolio is mainly comprised of therapeutics focusing on diabetes, immune-oncology and auto-immune diseases. These encompass a wide range of platforms including monoclonal antibodies (MAbs), novel fusion MAbs, small interfering RNA (SiRNA) etc.

- Under diabetes, Biocon’s main program is Insulin Tregopil. The company’s Phase II study in Diabetes type-2 was completed in FY18. Biocon has submitted the relevant proofs to DCGI, India and filed a market authorization application.

- Also, the company had a partnership with US based firm JDRF for treatment of Type 1 diabetes for research and advocacy, which began in Germany in FY20. This will be important for the company because on the basis of this research the company may capitalize on Tregopil’s efficacy worldwide

- Under autoimmune diseases, Biocon’s main program is Itolizumab – humanized monoclonal CD6 anti-body that was approved in India for treating psoriasis.

- A novel small interfering RNA molecule, QPI–1007 is in licensed in India, based on the Quark Pharm’s SiRNA technology platform for treating non-arteritic ischemic optic neuropathy

- In Immuno-Oncology, FmAb2 is Biocon’ lead program, a fusion protein of EFGR mAb/TGb RII ECD. The company also formed another subsidiary Bicara Therapeutics, that is focusing on fusion antibodies. FmAb2, is ready to initiate Phase I trials in US and Canada. The company is also working on more fusion anti-body platforms to produce other novel bi-functional anti-bodies.

The above-mentioned assets include both early and advanced stage programs.

In FY18, the company launched antibodies like BIOMAb-EGFR, which was India’s first indigenously produced anti-body for the treatment of neck and stomach cancer.

Biocon also became the first global company to validate (scientifically) CD6 antibody for the treatment of autoimmune diseases. The company also launched under its novel biologics portfolio, ALZUMAb, an anti-CD6 monoclonal antibody in India in FY18.

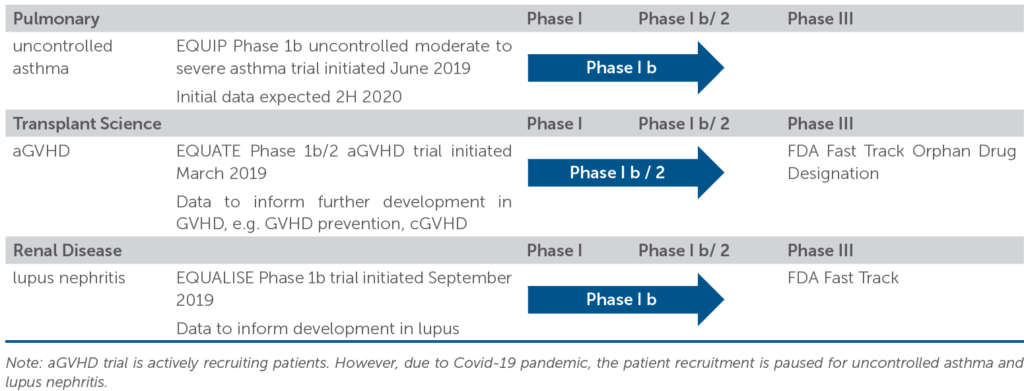

In FY19, the company also licensed Itolizumab to a US based company, Equillium for the US and Canadian markets, which the company expects, leads to developing of the molecule for the treatment of severe autoimmune and inflammatory diseases. Equillium received an approval for IND particle from the US FDA.

To fund the clinical trials, this company ‘IPOed’ in October 2018 and Biocon holds ~13.5% stake in the company. This is expected to generate licensing fee as well as dividends generated from the shares held.

The table below shows Equillium’s development status summary:

Biocon also expanded the licensing agreement with Equillium for Itolizumab to include more countries: Australia and New Zealand.

The company’s Biologics division is a growing for the company, which the company acknowledges. The 5 years CAGR is ~ 30%. The company has been able to deliver such an impressive growth because of yearly new launches and a robust pipeline of products. Moreover, the company has also been delivering improved profit margin, because of the company’s focus on biosimilar, which are high value products.

The company’s risk point in this division is mainly that the top line growth is not necessarily translating into improved profits because of high cost of operations and the division demanding higher R&D cost.

The company’s management is also delivering on its words of increasing the % of revenue of the biologics business. This is a good sign for the company’s economics, on being well run by the top management. Also, this also shows that the company is shifting its focus to a growing business.

A business when mature can either use its free cash on acquisitions, returning the money to the shareholders or focus on new growth opportunities.

Taking cue from the above statement, the company has actually returned money consistently to its shareholders (in the form of dividends for the past 5 years) and also pursued growth opportunities which shows judicious capital allocation

Re-iterating, the company’s top management also guides that this business is tough to be in and will hamper short term profitability. This will demand investments both capex, opex and R&D. The development cycle is also long. So, it is advisable to look at this as a business that you can own rather than a stock you can flip and make money in short term.

- Branded Formulations:

The company’s brand formulation business caters to Indian and UAE markets. It is a regional business, which produces specialty drugs in the chronic therapy areas of diabetes, cancer, nephrology, immunology etc.

The risks surrounding this business is increased competition from low cost biosiliars mAbs and price caps introduced by the governments. The company is trying to solve these problems by diversifying in adjacent markets of Sri Lanka, reaching out to Key Opinion Leaders (KOLs) and increased digital communication. The company also strives for increased licensing for its complex products.

The key products to look out for, in this business segment are Insugen®, Basalog®, Erypro™, Tacrograf™ and Psorid™

In the Indian business, the company’s top 10 brands account ~ 70% of the revenue (this segment). In FY18, the company launched a new brand KRABEVA®, a biosimilar Bevacizumab, an important addition to oncology portfolio. Biocon’s brand CANMAB™, Trastuzumab brand continues to rank No.1 in the local market, garnering ~ 27% market share.

The UAE business is quite well diversified has around +40 brands, top 10 contributing 69% of sales. The company operates in areas of Acute, Cardiovascular, Diabetes, Respiratory and Gastrointestinal therapy in the UAE market. In FY18, the company launched Glaricon™, a brand under Insulin Glargine- the company’s first biosimilar launched in the local market. The company, as promised focused on licensing, innovator brands from Novartis Imprida and ImpridaHCT- for the cardiovascular market, which currently the company ranks in top 10.

During FY19, the company also launched Canhera, a Trastuzumab brand, another affordable biosimilar. Canhera, has performed exceptionally well in a year of it being launched (FY20), garnering ~ 30% volume share in the retail market. The company’s diabetes segement- Jalra and Glaricon, has shown stupendous growth ~ 30% y-o-y.

The Branded Formulations portfolio was expected to perform the worst in the quarter (January – March 2020) due to COVID-19, but the impact was subdued.

Financially speaking, the branded formulations business has performed the worst, due to headwinds as already spoken about but also due to some supply disruptions in the Malaysian facility. The company’s revenue CAGR for past 5 years ~ 4%.

The company’s branded formulation’s revenue to % of total revenue has also been consistently falling, which again shows the management’s focus shift. From ~ 14% in FY17 to ~ 8% in FY20. This according to the author is a good strategy because considerable risks present and low risk-reward ratio.

There is one consideration that the author found, that the company spoke in its FY17 report, that the company will try to diversify into adjacent markets like Sri Lanka and other emerging markets but there was no sign of this in the next 3 years of annual reports.

The company recognizes the problems and in its guidance of FY21 and subsequent years, the company will spend its capex on its performers: Small Molecules and Biologics (split equally).

Some Financial Analysis

Note: We will be doing relative analysis by taking some competitors in the pharma sector. Now, pharma and bio-pharma are two well defined industries on their own, in India. In many countries, they are not well defined and more or less treated the same. But logically speaking, they are different and please heed to the same in our analysis. Don’t make any judgements as its not an ‘accurate’ comparison. This is being done because no other similar size comparable competitor of Biocon exists in India.

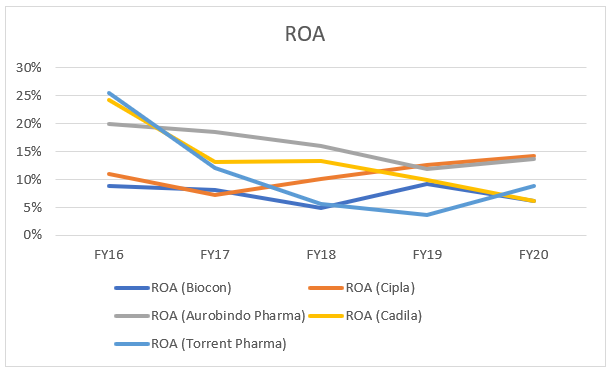

- Return on Total Assets:

This is one of the most important ratios that we are using in our analysis. This is being done to gauge how efficiently the company has invested in its assets, and what income the company has been able to drive from this investment.

We will try to take the industry view and see how Biocon performed in the last 3-5 years. We might also do some adjustments which we feel seem reasonable.

We will try to exclude assets which we feel don’t support the justifiable nature, like cash and trade receivables. We will be including Capital- WIP to be more conservative in our calculations.

The industry being capital intensive, we will expect low ratios in absolute terms. The idiosyncratic nature of the company of focusing more on innovation driven businesses and not focusing on 1-2 years but 4-5 years also drives the analysis.

Also, one of the important things to note here is that the analysis should be done between similar sized firms and of the same industry. Somewhat arbitrary definition of similar sized firms is being used: market capitalization.

The company has performed ‘not good’ (one of the lowest in comparison) in terms of ROA analysis, when we have a ‘compare’ with the above-mentioned pharma companies in the industry. They are comparable because of more or less similar market capitalization and business mix.

This is a cause of worry for investors, as observed in the graph, the numbers are bleak in comparison to Cipla, Torrent Pharma (latest FY years) and Cadila. This can be due to huge amount of CWIP and recurring R&D expenditure. The company is also capitalizing its Development expenditure which it believes would provide economic benefits in the future.

In FY20, the company has delivered ~ 6% ROA in comparison to ~ 10% shown on average by its competitors.

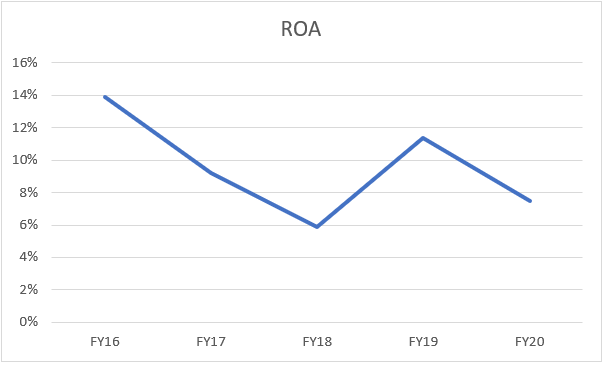

To get a better picture, we will be talking about ROA over the years:

The company’s ROA figure over the 5-year duration has ‘z’ figure. If we go deeper, in the down years the company has actually invested in greenfield projects in Bengaluru, Malaysia, Vishakhapatnam (like in FY20) and the up years have actually shown improvement because subsequent economic benefits as well as realizing of low investments.

Looking at absolute analysis, actually gives a perfect picture and reinforces the beliefs of the management.

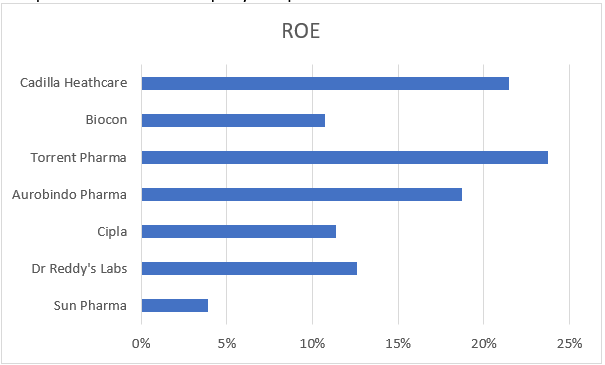

- Return on Equity:

This is the most important ratio that determines the return that is generated by the company on its shareholders equity. This shows the true earning potential on the capital the company possess.

Here, first we will take a 5-year duration and analyze with the competitors how the company has performed.

Biocon has been coming in the lower ring of the above spectrum in terms of 5-year ROE, only beating Sun Pharmaceuticals, which is the largest firm in the industry. Interestingly, Biocon has the largest share capital out of all the competitors, with additional Rs. 300 crores recently infused last FY. This was the ESOPs and other equity issued by the company to attract the top talent.

To give a better picture, we will use the Du-Pont Analysis and look at Biocon’s performance over the years.

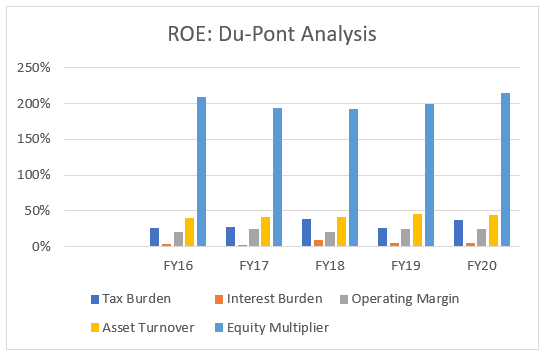

Du-Pont 5 step analysis will give us a comprehensive picture behind the simple ratio of ROE. The ratio will have 5 components namely: Operation margin, asset turnover, equity multiplier, interest burden and tax burden. The analysis will cover a 5-year time period.

If we go deeper, in the above graph, tax burden seems to be way off in FY18 and FY20, reaching close to ~ 40% in both the cases.

The interest burden seems to be stable throughout the time period, increasing in one particular year FY18 to 9% from the 3% in FY17. The subsequent years see fall due to the debt repayment.

The operating margin seems to be stable throughout at ~ 25% which shows good efficiency in the company’s operations.

The company’s equity multiplier is a slight cause for concern as it was decreasing in recent years but in FY20 it has once again exceeded the ratio of 2 which basically means the company seems to be using more debt to finance its assets.

- Return on Capital Employed:

In a recent analyst conference call held by the company’s management, Siddharth Mittal spoke about ROCE of various divisions of the company.

- Small Molecule ROCE is expected to be around 25-30%

- Branded Formulation ROCE is around 60-70%

- Syngene continues to be around 25-30%

- He further went on to mention that the Biologics ROCE are relatively subdued, which actually provides them with an opportunity with clinical findings and facilities/ infrastructure being created, to augur the company’s growth going forward

- In continuing to defend Biologics ROCE, he assured that the ratio would definitely grow going forward, once developed markets are penetrated and given the advantage of being in the first 3 players to launch in these markets.

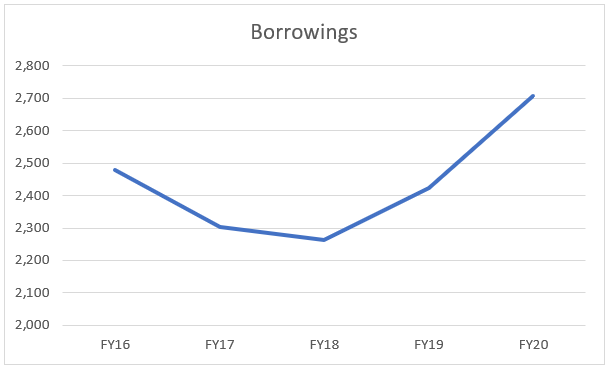

- Borrowings:

Now, we will delve deeper into the debt part of the company and analyze how much total long-term obligations the company is carrying and the nature of the same (and if it a cause of concern):

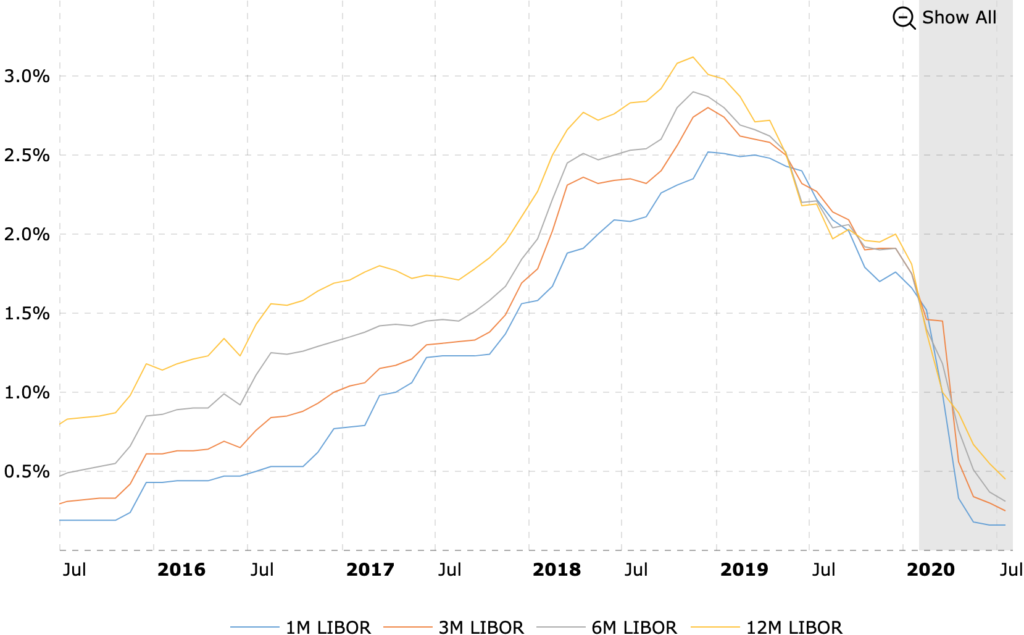

The company in FY16 had an external term borrowing (unsecured) of $9 million, carrying interest rate of LIBOR + 0.20% p.a. which was repaid in FY17. The company also had other external unsecured borrowings of $25 million as well as another $9 million which were all repaid in the same FY, carrying interest of LIBOR + 0.1% and LIBOR + 0.35% respectively. The company’s equity multiplier increased on account of increased trade payables (long term), payable to mainly the MSME sector by 14%.

During FY18, the company took an external commercial borrowing to the tune of $20 million from a bank, charged against plant and machinery to be paid back in 4 equal installments carrying interest of LIBOR + 0.95% p.a. The company entered into an interest rate swap to convert this facility into a fixed rate payer swap. The company also took a financial assistance from CSIR of Rs. 3crore to be payable in 10 installments carrying interest rate of 3% p.a.

DSIR also sanctioned a financial assistance to the company to the tune of Rs. 17crore for one of its research projects to be payable in 5 installments in 3 years post commercialization. (to be repaid in royalty)

DST also sanctioned a financial assistance for one of the company’s research projects to be paid in 10 installments to the tune of Rs 70crores carrying interest of 3% p.a. The company’s pension liabilities and some other provisions were also increased. The fair value of hedging instruments (under liabilities) also increased.

During FY19, the liabilities increased on account for payables for capital goods, book overdraft increase, increase in employee gratuity obligations and also increase in current payments of long-term borrowings.

During FY20, the company paid back one of the installments of the DST assistance that it availed in FY10. It also repaid another external commercial borrowing to the tune of $20 million that it took in FY16. The non-current provisions of the gratuity component fell, and other liabilities decreased.

The debt is going higher on account of multiple financial assistance being received from the government departments carrying interest of 3% p.a. and external commercial borrowings with a relatively lower interest rate, which as seen from its track record, the company will be able to service.

The debt is rising also on account of rising capex and research and independent research projects being undertaken by the company.

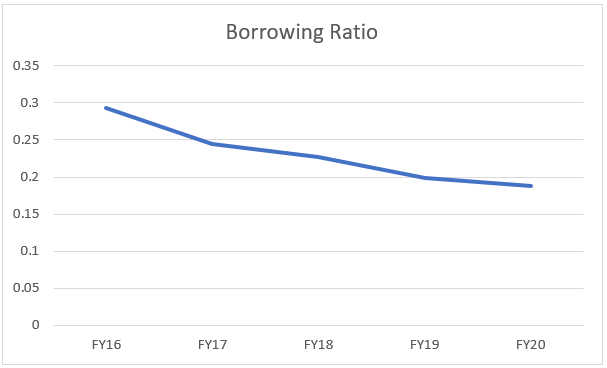

This is a positive sign for the company overall, the long term borrowing as a % of total assets have been consistently falling which reinforces our belief of the company being able to service its obligations comfortably.

Moreover, one of the favorable points that we are missing here is that the company has been able to tap external capital markets and has borrowed at low rates of interest.

As we can see in the above graph, the LIBOR rate 3 months have been consistently on decline which is expected to reach near 0 limits, a big positive for the company. It can borrow virtually ‘free’ money until the company can be expected to tap external markets, which is a direct function of its reputation and size (simplifying here, but you get the point)

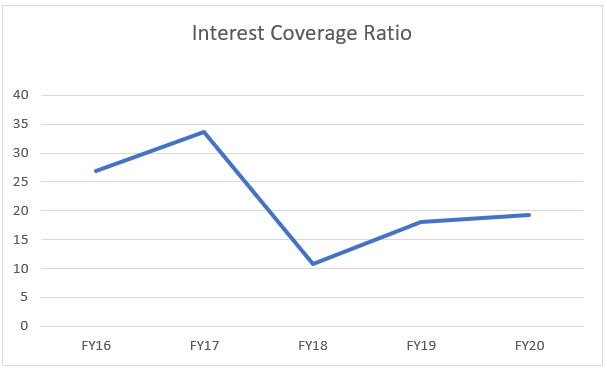

In FY18 to FY20, the interest coverage ratio has actually decreased. This is on account of increased multiple debt obligations taken by the company in FY18, due to the increased Capex and R&D projects.

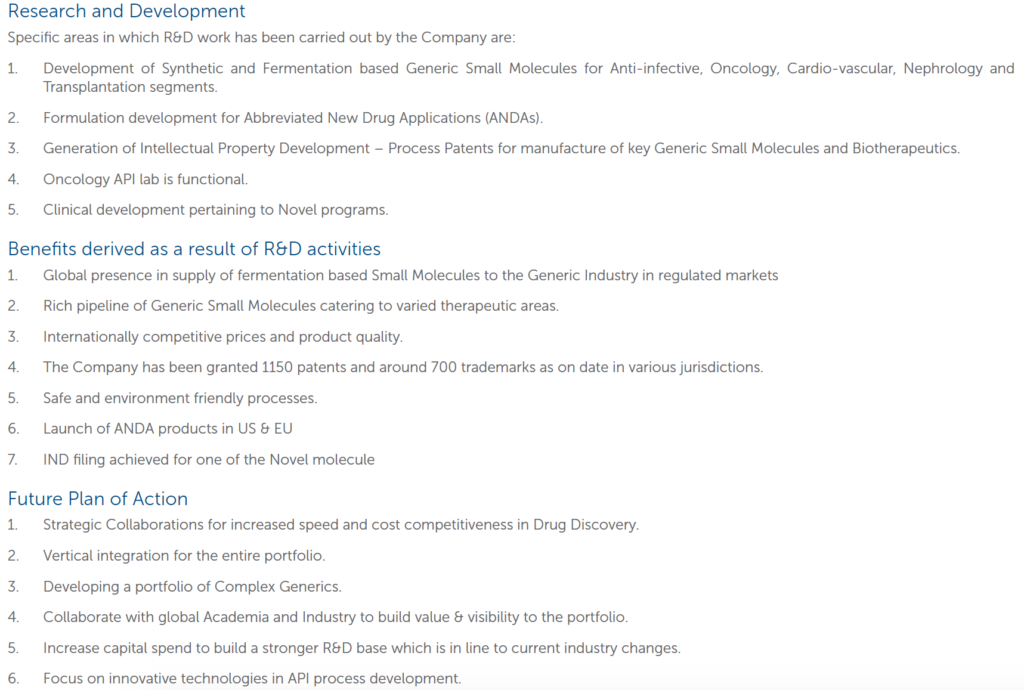

- Research and Development:

One of the major components of the company is the R&D wing. The company’s ex-CFO Siddharth Mittal, he gave a guideline that the R&D should be quite intensive in the next few years in the range of 12-15% of the revenue ex-Syngene. (in FY17). The company capitalizes the R&D cost for some products. The rationale as dictated by the management is:

i. It is accordance with IND As- 38, Intangible Assets. The company expects technical and commercial feasibility of the products and hence finds it feasible to accrue the cost and show it as an asset.

ii. The development cost can be measured reliably. As the company calculated development cost on a product basis, the cost can be measured reliably.

Valuation Brief

We believe that the price that you buy a part business will not matter as it tends to average out in the long term. It is a good practice to buy good businesses at fair prices rather than bad businesses at bargain prices. (credits: Warren Buffet in one of Berkshire Hathaway’s AGMs)

Moreover, please remember that we will be focusing less on valuation here as the industry and the business itself is quite unpredictable.

To go in the investment literature, even the legendary investor Warren Buffett says that if the business economics are not good, a competent management also can’t run the business profitably.

We also believe that the times are different now and it makes sense to buy volatile businesses if one finds a good business rather than looking at a ‘stable’ prices.

It is an internationally accepted practice to value businesses by discounting the free cash flow that the company has been generating. But we also believe that for such an industry if the company is generating ‘free’ cash flows, then it implies that the company is not find good growth opportunities which we don’t look for in our investments.

We are hard core value investors, average time holding is 13 years, spanning to 20+ years in some cases but we also look at growing businesses who can find opportunities or take risks to pursue other endeavors.

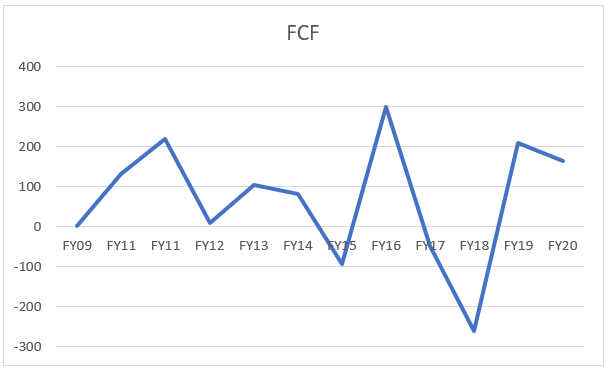

Now, if we look at Biocon’s operations and delve deeper into free cash flow the company generates, its abysmally low and quite volatile in nature, as seen in the following graph (taking an 11 year time period)

Interestingly, the CAGR for 12 years for FCF comes out to be ~ 44% which is the result of ‘silly’ mathematical calculation but a fact.

Thus, this also cannot be denied that the company also had negative FCF which might trouble lot of investors. Nonetheless, we will try to value the company and see what might be a fair value of the stock that an investor is supposed to buy.

Now, there are pitfalls to this:

- Taking assumptions for certain values like growth rate, discount rate and other variables that are important for company valuation

- Overconfidence bias, in terms of through research and the analyst feels that the analysis could not go wrong

- Lot of emphasis on the numbers, instead of looking at the underlying business which a prudent businessman will be seduced to own

- Using traditional valuation models to value growing-volatile businesses that don’t generate as much as FCF that is required for valuation (like in the above case)

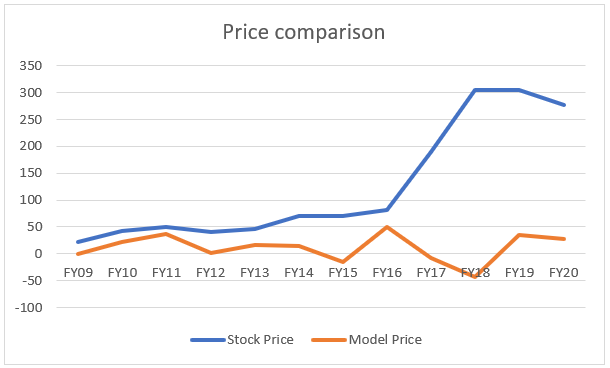

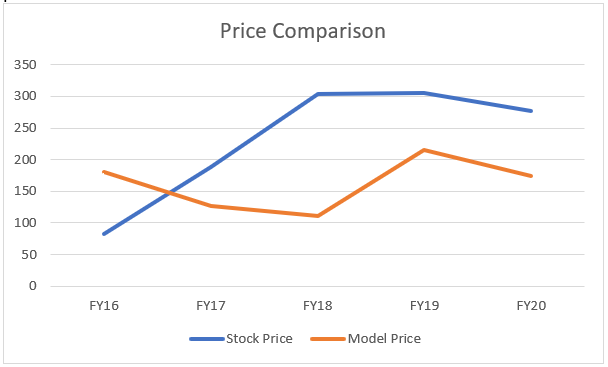

Nevertheless, we will show the readers how much ‘wrong’ the valuation can be. The word wrong is under quotes because the stock price will eventually revert to its fair value over a considerable time period i.e. 12 years! But the price calculated by our model seems something else:

If we look at this chart alone, our model says that the stock price have been consistently wrong since 2009. This can be the case, no doubt but we don’t believe it is correct simply because most of the value has not been captured by the FCF model. We deducted the R&D spending and hence, the accrued value has been left behind by only considering the cash flow generated. Moreover, the distance between the ‘true fair value’ calculated by our model seems to be too off from the price.

This is a 12-year time period and the business as a whole has performed well and we don’t believe that the markets are such grossly ‘inefficient’. On the contrary, we believe that the markets are reasonably efficient most of the times, barring some black swan events.

So, we will try to include the accrued benefit arising from R&D expenditure. We will assume here that the economic benefit will be 40%, a conservative figure because there is a 50% probability of the ‘project’ getting successful and give much more benefit than the ‘cost’ component.

We have used a proprietary model and assumed double digit growth rate of 15-20% p.a. for 5 years and assumed that the shareholders for the ‘volatile’ nature of the business have demanded the stock market index + 10% p.a. as the return. These are the assumptions that have gone in the model. We also take +/- 20% to make our assumptions as flexible as possible.

Looking at this model, the prices seems to be a little over valued unless we take a margin of error. (20% both up and downside)

If we become flexible (of course, we have to!), then we perceive then the share prices to be reasonably priced as on 7th August 2020, at ~ Rs. Rs 320-480.

Different approach: We have also taken a conservative approach and assumed an indefinite growth of 5% and our value for the business per share comes out to be ~Rs. 60 with +/- 20% to keep at a conservative style. (if it is a stable business). The assumptions are too ‘foolish’ to heed to but nevertheless, this is how the picture looks like?

We are not making any investment advice and we are against looming over stock prices. Hard fact is that we need to buy public securities at market prices and hence have been provided with such models.

We will refrain from looking at the comparative PE ratio for the company because of differences in the industries.

Still, the trailing PE of the company seems to be ~ 49 which is perceived as too high but once again this is bound by what assumptions made by the analyst (provided PE ratio should be forward looking).

Conclusion:

This report has tried to encompass the business dynamics and some number crunching with regards to the company, Biocon Limited.

We will not be speaking whether you should trade this security or not (please see disclaimer below) but we like the business going forward, provided close monitoring and new projects are looked for by the competent management.

Disclaimer:

The Author(s) shall take no responsibility for any losses occurring out of investment/trading decisions you make based on the contents of this article.

We are not SEBI registered investment advisors. This article is meant for educational purposes only, please consult your investment advisor before acting upon any information you see here.

We may or may not have open positions, kindly assume that we are biased.

Sources:

https://www.ibef.org/industry/biotechnology-india.aspx

http://intelligentinvestor8.blogspot.com/2014/05/5-step-dupont-equation.html

CFA Level 2 book: Equity

Screener.in and Money control

Annual Reports FY16-20

Follow Us @

Some Unrelated Stories!

Loved the flow of the report…Detailed yet crisp.

Very well researched!